Ultrasound Devices Market Size, Share, Trends, & Industry Analysis Report

By Product Type, By Portability (Compact/Handheld Devices, Cart/Trolley Devices), By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM1126

- Base Year: 2024

- Historical Data: 2020-2023

What is Ultrasound Devices Market Size?

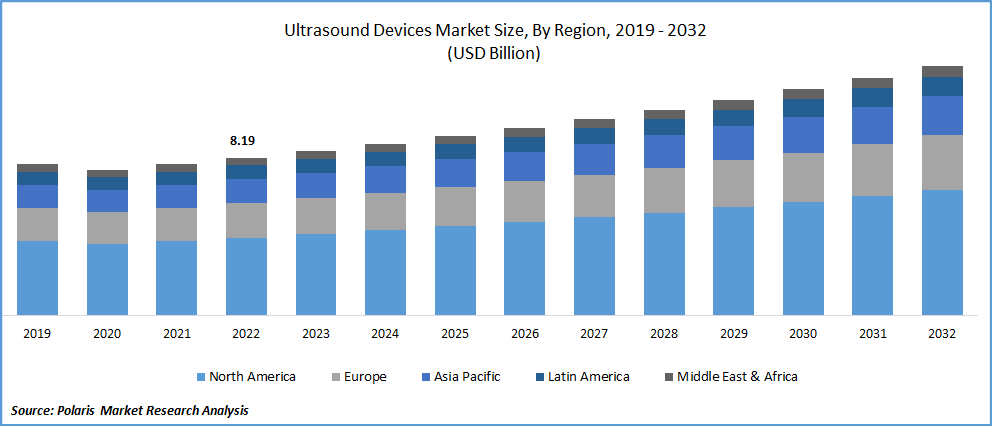

The global ultrasound devices market was valued at USD 10.62 billion in 2024 and is expected to grow at a CAGR of 4.4% during the forecast period. The growth is driven by the increasing adoption of ultrasound devices for diagnostic imaging and treatment, rising demand for minimally invasive surgery, and advancements in ultrasound imaging technology.

Key Insights

- The compact/handheld segment is expected to witness significant growth during the forecast period due to the increasing demand for home healthcare and remote patient monitoring.

- The diagnostic devices dominated with largest share in 2024 due to increasing prevalence of lifestyle-related disorders and the demand for advanced diagnostic tools.

- North America dominated with largest share in 2024 due to rising number of industries in the region.

- Asia Pacific is projected to accounted for a significant share in the global market due to increasing healthcare expenditure.

Industry Dynamics

- The rising adoption in diagnostic imaging and treatment is fueling the market growth.

- The growing demand for minimally invasive surgeries is driving the growth.

- The technological advancement is boosting the industry growth.

- High cost of advanced ultrasound devices and lack of skilled operators in low-resource settings restrain market growth.

Market Statistics

- 2024 Market Size: USD 10.62 Billion

- 2034 Projected Market Size: USD 16.27 Billion

- CAGR (2025-2034): 4.4%

- Largest Market: North America

Impact of AI on Industry

- Improves image accuracy and interpretation by detecting subtle abnormalities that may be missed by human operators.

- Provides real-time guidance during ultrasound exams, which helps clinicians to make faster and more accurate decisions.

- Supports remote diagnostics and telehealth applications, which enables experts to guide and interpret scans from distant locations.

Know more about this report: Request for sample pages

Ultrasound is a valuable diagnostic tool in medical imaging due to its speed, cost-effectiveness, and safety compared to other imaging technologies that use ionizing radiation and magnetic fields. Several technological advancements, such as increasing portability, improving image quality, improving battery technology, and improving overall performance, are synergistically evolving ultrasound technology into a high-performance and affordable imaging tool accessible to a wider user base. Similarly, extensive research and development are underway to incorporate miniaturization, intuitive interfaces, and software-driven platforms in this technology. In the future, as ultrasound is becoming an integral aspect of healthcare, many private companies and public institutions are investing in research and development of novel technologies in the field of ultrasound imaging. The government is taking initiatives to spread awareness among the masses regarding breast cancer, fetal health, and other health-related issues, thereby creating awareness among the people. In addition, the rising tide of the so-called grey tsunami with several chronic ailments coupled with the lower cost and relative safety are boosting market growth together. Improving healthcare infrastructure and increasing disposable incomes in developing countries further fuel the market growth.

Know more about this report: Request for sample pages

Industry Dynamics

What are the Factors Driving the Ultrasound Devices Market Growth?

Increasing demand for diagnostic imaging and treatment is driving the need for ultrasound devices. This is fueled by a growing prevalence of chronic and lifestyle-related disorders, which require regular imaging and monitoring to manage effectively. Additionally, the rising demand for minimally invasive surgery drives the adoption of ultrasound devices, which guide procedures and reduce the risk of complications. Technological advancements in ultrasound imaging technology is further driving the growth. These advancements have significantly improved image quality, enabling more accurate diagnoses and treatment planning. Furthermore, compared to other imaging technologies such as CT scans and MRIs, the safety and cost-effectiveness of ultrasound make it a valuable tool in medical imaging. Another important driver of the ultrasound devices market is the increasing adoption of ultrasound devices for point-of-care and emergency settings. Portable and handheld ultrasound devices are becoming increasingly popular due to their ease of use and ability to provide rapid diagnostic information in various stages. The COVID-19 pandemic has accelerated the adoption of telemedicine and remote patient monitoring, leading to an increased demand for portable ultrasound devices that can be used for remote consultations and monitoring, thereby driving the growth.

Report Segmentation

The market is primarily segmented based on product type, portability, application, end-use, and region.

|

By Product Type |

By Portability |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Why Diagnistics Devices Dominated with Largest Share in 2024?

The diagnostic devices segment dominated with largest share in 2024 due to increasing prevalence of lifestyle-related disorders and the demand for advanced diagnostic tools in various medical fields such as obstetrics, cardiology, and oncology. Diagnostic ultrasound devices offer a non-invasive and cost-effective method for diagnosing different medical conditions, making them an essential tool for medical professionals. In addition, technological advancements such as miniaturized 2D and 3D/4D imaging have significantly contributed to the growth of the diagnostic devices segment in the market. These advancements have enabled healthcare professionals to obtain high-quality diagnostic images and provide accurate diagnoses and treatment recommendations. Furthermore, the increasing demand for portable and handheld ultrasound devices for point-of-care and emergency settings has further driven the growth of the diagnostic devices segment.

Which Segment By Portability is Expected to Witness Significant Growth?

The compact/handheld segment is expected to grow faster during the forecast period due to the increasing demand for home healthcare and remote patient monitoring, where compact/handheld devices are used during the COVID-19 pandemic. Furthermore, technological advancements such as miniaturization and improved imaging capabilities are expected to boost the adoption of handheld ultrasound devices, thereby driving the segment growth.

How North America Captured Largest Share in 2024?

North America dominated with largest share in 2024 due to increasing technological advancements, rising demand for minimally invasive diagnostic procedures, and the high adoption of ultrasound devices in various medical applications. In this region United States is largest market driven by the high prevalence of chronic diseases, well-established healthcare infrastructure, and the increasing demand for minimally invasive diagnostic procedures, thereby driving the industry demand in the region.

What are the Reasons for Asia Pacific's Significant Growth?

The Asia Pacific is expected to witness significant growth during the forecast period due to increasing healthcare expenditure, rising awareness about the benefits of early disease diagnosis, and the expanding patient pool. The government in the region are actively investing in the healthcare sector to expand the healthcare services in the rural areas and improve healthcare infrastructure in the urban areas, which is driving the demand for ultrasound devices. The region also offers substantial growth opportunities for market players due to many untapped markets and the rising demand for advanced ultrasound devices.

Competitive Insight

Some of the major players operating in the global market include Toshiba Medical Systems Corporation, SonaCare Medical, Analogic Corporation, GE Healthcare, Koninklijke Philips N.V., Philips Healthcare, Canon Medical Systems, Siemens AG, FUJIFILM Holdings Corporation Hitachi Medical Corporation, Esaote S.p.A. Samsung Medison, Shimadzu Corporation and Mindray Medical International Limited.

Recent Developments

- September 2025, Exo Imaging launched its FDA-approved portable AI ultrasound device in Bangladesh, marking its first Asian deployment. Designed for remote diagnostics, the device aimed to revolutionize healthcare access by enabling early detection of diseases in rural communities.

- August 2025, GE HealthCare launched the Vivid Pioneer, its most advanced AI-powered cardiovascular ultrasound system, enhancing image quality, diagnostic speed, and workflow efficiency. The system received FDA 510(k) clearance and CE Mark, marking a major advancement in cardiac imaging technology.

- September 2024: Samsung Medison, a worldwide medical equipment company and a subsidiary of Samsung Electronics, took part in the 34th World Congress. The company showcased its advanced AI-driven diagnostics, enhanced image quality, and commitment to sustainable design.

- September 2024: Exo introduced SweepAI, an FDA-approved AI-driven application for scanning the heart and lungs, designed for its Iris portable ultrasound system. It offers immediate diagnostic insights without needing the internet, enhancing precision and simplicity in identifying heart failure, stroke volume, and left ventricular hypertrophy.

- February 2023: GE Healthcare will acquire Caption Health, a company that offers FDA-approved, AI-powered diagnostic imaging solutions. This acquisition is expected to expand the use of ultrasound technology and provide support to new users.

- December 2022: Siemens Healthineers Ultrasound has introduced an AWS Remote Services platform that offers diagnostic, functional, and financial solutions for various clinical areas. This platform is designed to cater to the specific needs of healthcare providers and is powered by AWS, making it easily accessible and efficient

Ultrasound Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size in 2024 |

USD 10.62 billion |

| Market size in 2025 | USD 11.07 billion |

|

Revenue forecast in 2034 |

USD 16.27 billion |

|

CAGR |

4.4% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2034 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Portability, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Toshiba Medical Systems Corporation, SonaCare Medical, Analogic Corporation, GE Healthcare, Koninklijke Philips N.V., Philips Healthcare, Canon Medical Systems, Siemens AG, FUJIFILM Holdings Corporation Hitachi Medical Corporation, Esaote S.p.A. Samsung Medison, Shimadzu Corporation and Mindray Medical International Limited. |

FAQ's

Key companies in ultrasound devices market are Toshiba Medical Systems Corporation, SonaCare Medical, Analogic Corporation, GE Healthcare, Koninklijke Philips N.V., Philips Healthcare, Canon Medical Systems, Siemens AG.

The global ultrasound devices market expected to grow at a CAGR of 4.4% during the forecast period.

The ultrasound devices market report covering key segments are product type, portability, application, end-use, and region.

Key driving factors in ultrasound devices market are increasing demand for diagnostic imaging and treatment.

The global ultrasound devices market size is expected to reach USD 16.27 billion by 2034.