U.S. Artificial Ventilation And Anesthesia Masks Market Size, Share, Trends & Industry Analysis Report

: By Mask (Disposable Masks and Reusable Masks), and By Application, – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5858

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

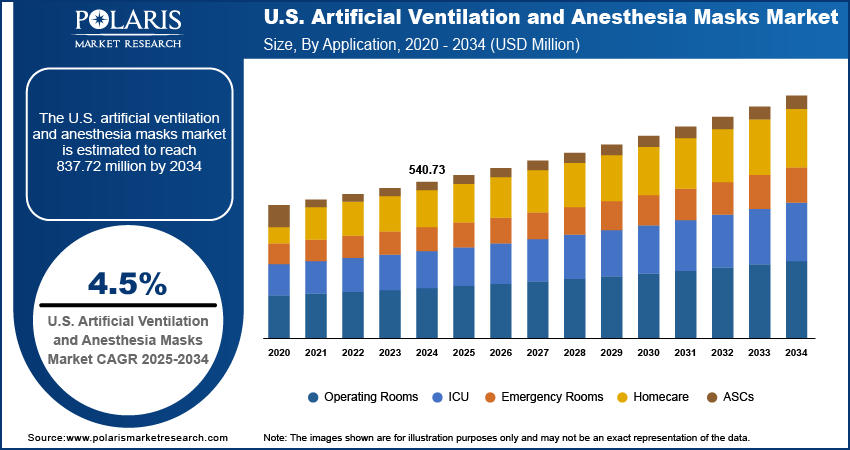

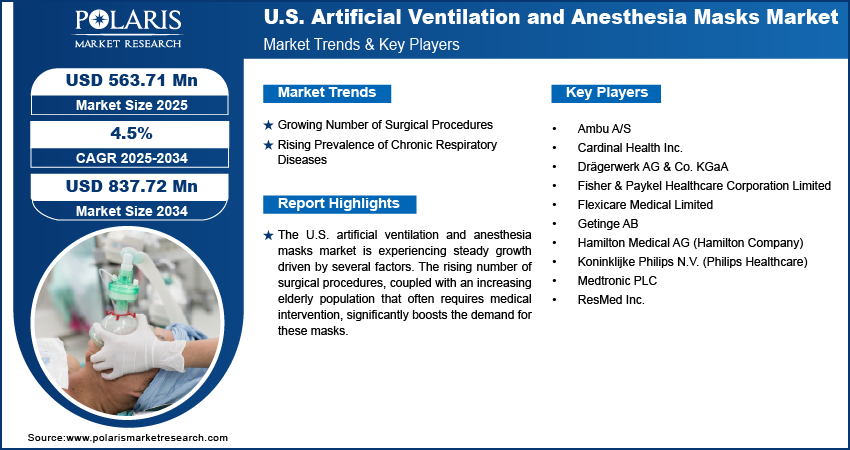

The U.S. artificial ventilation and anesthesia masks market size was valued at USD 540.73 million in 2024, and is anticipated to grow at a CAGR of 4.5% from 2025 to 2034. The U.S. artificial ventilation and anesthesia masks market is largely driven by the increasing number of surgeries and a growing aging population, which often requires more medical interventions.

Artificial ventilation and anesthesia masks are essential medical devices used to deliver oxygen and anesthetic gases to patients while supporting their breathing during medical procedures, emergencies, or for long-term respiratory support. These masks come in various designs to fit different patient needs and medical settings.

Ongoing technological advancements play a crucial role in driving the demand for artificial ventilation and anesthesia masks. Innovations focus on improving patient comfort, enhancing safety, and increasing the efficiency of gas delivery. This includes the development of face masks with better sealing properties, lighter materials, and more ergonomic designs that adapt to different face shapes.

The growing healthcare expenditure in the U.S. is a significant driver for the artificial ventilation and anesthesia masks market. As the nation invests more in its healthcare infrastructure, services, and advanced medical equipment, the adoption of sophisticated devices like these masks becomes more widespread.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Number of Surgical Procedures

The increasing volume of surgical procedures performed in the U.S. is a significant driver for the artificial ventilation and anesthesia masks market. As medical technology advances and healthcare access expands, more patients undergo various operations, from routine to complex. These procedures often require general anesthesia and respiratory support, directly increasing the demand for these essential masks.

For instance, an overview of major ambulatory surgeries published by the Healthcare Cost and Utilization Project (HCUP) in December 2021, titled "Overview of Major Ambulatory Surgeries Performed in Hospital-Owned Facilities, 2019," showed that there were 11.9 million encounters for major ambulatory surgeries in U.S. hospital-owned facilities in 2019. This continued high volume of surgical activity directly translates into a consistent need for surgical masks include artificial ventilation and anesthesia masks, thereby driving the market's growth.

Rising Prevalence of Chronic Respiratory Diseases

The increasing number of individuals suffering from chronic respiratory diseases in the U.S. is another major factor boosting the demand for artificial ventilation and anesthesia masks. Conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea require ongoing respiratory support, both in clinical settings and for home care. The progressive nature of many of these diseases often leads to the need for assisted breathing, making ventilation masks crucial.

According to a November 2023 report from the Centers for Disease Control and Prevention (CDC), titled "Trends in the Prevalence of Chronic Obstructive Pulmonary Disease Among Adults Aged ≥18 Years — United States, 2011–2021," an estimated 6.5% of U.S. adults, or about 14.2 million people, had physician-diagnosed COPD in 2021. The widespread and persistent nature of chronic respiratory illnesses like COPD fuels the steady demand for ventilation and anesthesia masks, driving the market's expansion.

Segmental Insights

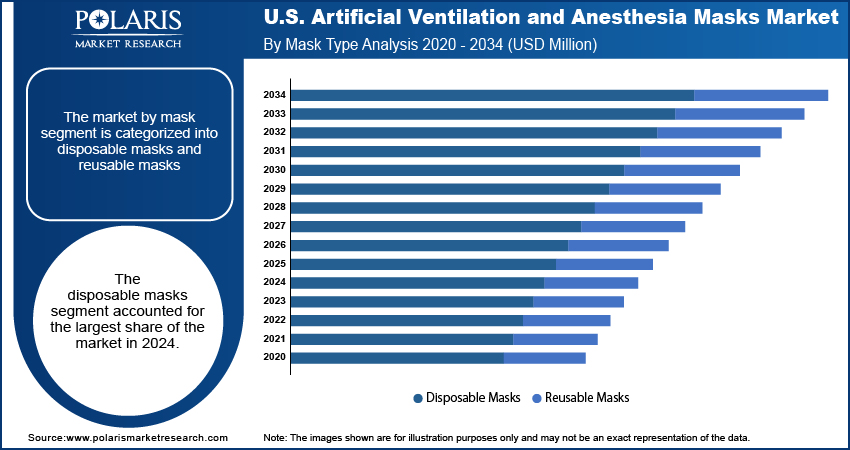

By Mask

The disposable masks held the largest share in 2024. This dominance stems from their widespread adoption in healthcare settings, primarily due to benefits such as enhanced infection control, convenience, and cost-effectiveness over time, as they eliminate the need for cleaning and sterilization. Healthcare providers increasingly prefer single-use products to minimize the risk of cross-contamination, especially in critical care and surgical environments. This aligns with strict hygiene protocols and patient safety standards, making disposable options a preferred choice across hospitals and clinics for various procedures, from routine to emergency.

The reusable masks subsegment is anticipated to show the highest growth rate during the forecast period. This growth is driven by a rising focus on sustainability and waste reduction within the healthcare industry, along with potential long-term cost savings for facilities. As healthcare providers look for ways to lessen their environmental impact and manage budgets effectively, reusable options, which can be sterilized and used multiple times, are gaining more interest. Innovations in materials and designs that ensure effective sterilization without compromising patient safety or comfort are also contributing to the increasing acceptance and adoption of reusable masks in various medical applications.

By Application

The operating rooms segment held the largest share in 2024. This is due to the high volume of surgical procedures performed across the country, all of which require precise anesthesia delivery and respiratory management. In these controlled environments, the consistent use of both ventilation and anesthesia masks is critical for patient safety and successful outcomes during operations. The continuous need for these essential tools in every surgery solidifies the operating room's leading position in terms of market demand and usage.

Ambulatory Surgical Centers (ASCs) segment is anticipated to show the highest growth rate during the forecast period. This growth is driven by the increasing shift towards outpatient procedures, which offer cost-effective and convenient alternatives to traditional hospital stays. As medical advancements enable more complex surgeries to be performed in an outpatient setting, the demand for ventilation and anesthesia masks in ASCs is rapidly increasing. The focus on efficiency and patient comfort in these centers further contributes to their rising importance in the market.

Key Players and Competitive Insights

The U.S. artificial ventilation and anesthesia masks market features a competitive landscape with a mix of established global players and specialized regional companies. Competition often revolves around product innovation, patient comfort, safety features, and cost-effectiveness for healthcare providers. Companies strive to differentiate their offerings through advanced materials, improved mask designs, and integrated monitoring capabilities to meet the evolving demands of various clinical settings.

Prominent companies in the industry include Koninklijke Philips N.V. (Philips Healthcare), Medtronic PLC, ResMed Inc., Drägerwerk AG & Co. KGaA, Getinge AB, Fisher & Paykel Healthcare Corporation Limited, Ambu A/S, Vyaire Medical Inc., Flexicare Medical Limited, Hamilton Medical AG (Hamilton Company), and Cardinal Health Inc.

Key Players

- Ambu A/S

- Cardinal Health Inc.

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Corporation Limited

- Flexicare Medical Limited

- Getinge AB

- Hamilton Medical AG (Hamilton Company)

- Koninklijke Philips N.V. (Philips Healthcare)

- Medtronic PLC

- ResMed Inc.

Industry Developments

March 2025: Fisher & Paykel Healthcare launches F&P Nova Nasal mask in New Zealand and Australia.

April 2024: Fisher & Paykel Healthcare launches revolutionary F&P Solo™ Nasal mask for obstructive sleep apnea in the United States.

U.S. Artificial Ventilation And Anesthesia Masks Market Segmentation

By Mask Outlook (Revenue – USD Million, 2020–2034)

- Disposable Masks

- Reusable Masks

By Application Outlook (Revenue – USD Million, 2020–2034)

- Operating Rooms

- ICU

- Emergency Rooms

- Homecare

- ASCs

U.S. Artificial Ventilation And Anesthesia Masks Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 540.73 million |

|

Market Size in 2025 |

USD 563.71 million |

|

Revenue Forecast by 2034 |

USD 837.72 million |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 540.73 million in 2024 and is projected to grow to USD 837.72 million by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Key players in the market include Koninklijke Philips N.V. (Philips Healthcare), Medtronic PLC, ResMed Inc., Drägerwerk AG & Co. KGaA, Getinge AB, Fisher & Paykel Healthcare Corporation Limited, Ambu A/S, Vyaire Medical Inc., Flexicare Medical Limited, Hamilton Medical AG (Hamilton Company), and Cardinal Health Inc.

The disposable masks segment accounted for the largest share of the market in 2024.

The ASCs segment is expected to witness the fastest growth during the forecast period.