U.S. Digital Rights Management Market Size, Share, Trends, Industry Analysis Report

By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6196

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

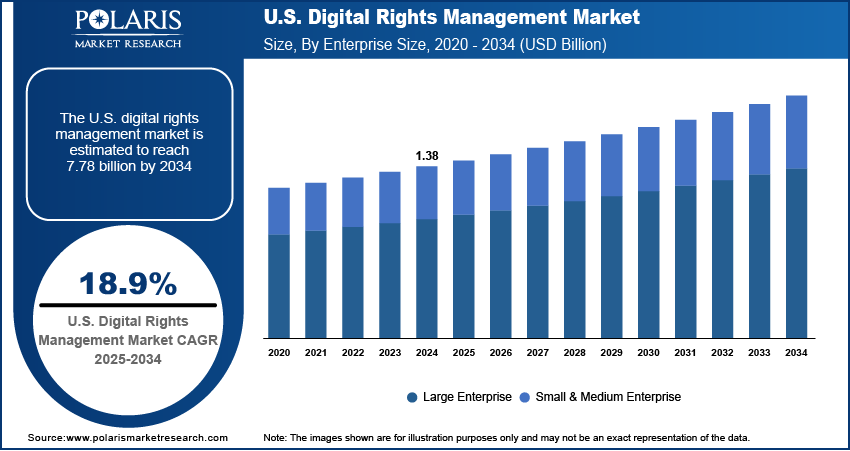

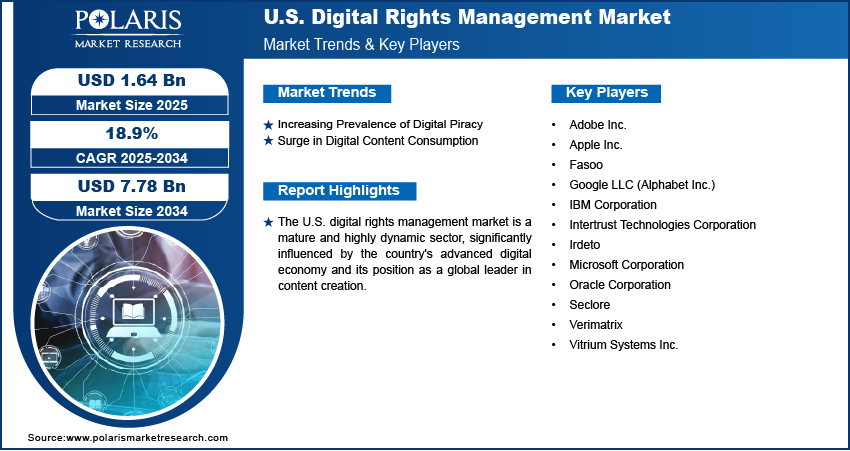

The U.S. digital rights management market size was valued at USD 1.38 billion in 2024 and is anticipated to register a CAGR of 18.9% from 2025 to 2034. The market is driven by the increasing need to protect digital content from piracy and unauthorized use. The widespread growth of digital media, including streaming services and e-books, also contributes significantly to this demand. Additionally, the rising adoption of cloud-based services boosts the need for robust DRM solutions.

Key Insights

- By enterprise size, the large enterprises segment held the largest share in 2024 due to its vast digital content portfolios and substantial resources for investing in comprehensive security solutions.

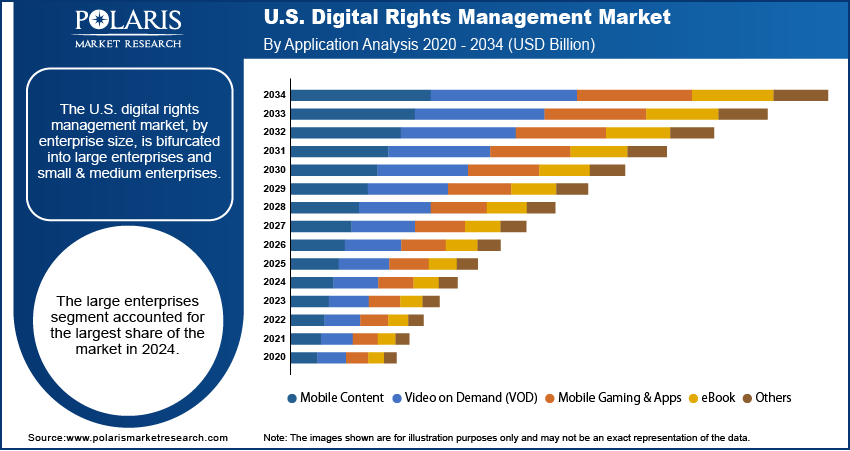

- By application, the video on demand (VOD) segment accounted for the largest share in 2024, fueled by the growth of streaming services and the immense volume of high-value video content consumed.

Industry Dynamics

- The increasing threat of digital piracy and unauthorized sharing of content is a major force. As more content becomes digital, from movies to e-books, effective ways to prevent illegal copying and distribution are crucial for content creators and owners to protect their investments and intellectual property.

- The rapid expansion of online streaming services and digital media platforms significantly boosts the need for these technologies. With consumers accessing content across various devices and services, robust solutions are required to ensure that only authorized users can view or interact with the content, safeguarding revenue streams.

- Growing legal frameworks and regulations focused on intellectual property protection also play a vital role. Government of the U.S. is imposing stringent laws to combat digital theft, pushing companies to adopt advanced systems that comply with these regulations and prevent costly legal disputes.

Market Statistics

- 2024 Market Size: USD 1.38 billion

- 2034 Projected Market Size: 7.78 billion

- CAGR (2025–2034): 18.9%

AI Impact on U.S. Digital Rights Management Market

- AI tools enhance content protection by detecting and preventing unauthorized access in real time.

- The technology provides improved efficiency and accuracy by automating license tracking and enforcement.

- It enables digital watermarking and fingerprinting to trace content piracy and theft.

- AI is used in DRM to analyze user behavior to identify potential misuse and piracy patterns.

- AI tools enable the automation of DRM processes that helps reduce operational costs.

- Predictive threat detection and response systems due to AI integration strengthen security frameworks.

Digital Rights Management, often known as DRM, refers to a set of technologies and strategies designed to control access to copyrighted digital content. Its main goal is to prevent unauthorized distribution, modification, and use of digital media, software, and other proprietary information. This helps content creators and owners protect their intellectual property and ensure proper compensation for their work in the digital landscape.

One of the prominent drivers in the U.S. digital rights management landscape is the increasing adoption of DRM in non-entertainment sectors, such as corporate enterprises and educational institutions. While media and entertainment traditionally dominate, businesses are increasingly using DRM to secure confidential documents, internal communications, and proprietary data. Educational organizations, similarly, employ these systems to protect e-learning content, digital textbooks, and research materials from unauthorized sharing and intellectual property theft.

Another factor influencing this area is the growing integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into DRM solutions. These technologies enhance the effectiveness of content protection by allowing for real-time monitoring of usage patterns and the detection of unusual activity that might indicate piracy. This evolution in technology helps make DRM systems more adaptive and efficient in combating new forms of unauthorized content access.

Drivers and Trends

Increasing Prevalence of Digital Piracy: Digital piracy continues to be a substantial threat, leading to significant revenue losses for content creators, publishers, and distributors across various industries. The ease with which digital content creation can be copied and distributed online makes robust protection essential. This ongoing challenge forces companies to invest in advanced DRM technologies to secure their intellectual property.

Government reports highlight the scale of this issue. For instance, the United States Department of Justice's "PRO IP Act Annual Report FY 2022," published on August 22, 2024, stated that state and local law enforcement agencies, supported by federal grants, made seizures totaling over $1.662 billion related to intellectual property violations, including counterfeit merchandise and other property, since the inception of the program. During the one year from July 1, 2021 to June 30, 2022, grantees reported seizures of over $436 million. Such significant figures underscore the persistent threat of digital content theft and intellectual property infringement, thereby driving the adoption of digital rights management solutions and threat hunting to mitigate these financial and legal risks in the market.

Surge in Digital Content Consumption: The exponential growth in the consumption of digital content, including streaming video, music, e-books, and online games, is a primary driver for the digital rights management market expansion. As consumers increasingly access content through various digital platforms and devices, the need for effective mechanisms to manage and secure content rights becomes more critical. This widespread consumption means that content providers must ensure their offerings are protected from unauthorized access and distribution, while also delivering a seamless user experience.

Segmental Insights

Enterprise Size Analysis

Based on enterprise size, the U.S. digital rights management market segmentation includes large enterprises and small & medium enterprises. The large enterprises segment held the largest share in 2024. These organizations possess vast amounts of sensitive and valuable digital content, ranging from proprietary business data to extensive media libraries, which necessitate robust and scalable protection. Their considerable financial resources and established IT infrastructures enable them to invest in comprehensive, advanced digital rights management solutions that can be integrated across diverse platforms and geographies. The imperative for these large entities to comply with stringent global copyright laws and data protection regulations also plays a significant role in their high adoption rates. Furthermore, the potential for substantial financial losses due to intellectual property theft or data breaches makes the proactive implementation of sophisticated content security and cybersecurity measures a top priority, reinforcing their dominance in the overall share. This segment's demand is driven by the sheer volume and critical nature of the digital assets they manage.

The small and medium enterprise (SME) segment is anticipated to register the highest growth rate during the forecast period. This acceleration is primarily driven by the increasing digitalization of business operations across smaller entities, leading to a greater awareness of and vulnerability to digital content risks. As SMEs increasingly adopt cloud-based solutions and engage in online content creation and distribution, the need for cost-effective and easy-to-deploy digital rights management tools becomes more pressing. The emergence of flexible, subscription-based DRM services and managed service providers is making sophisticated content protection more accessible and affordable for these businesses, lowering the entry barriers that previously limited their adoption. This growing accessibility, coupled with a rising understanding of intellectual property protection, is fueling substantial growth within the SME segment as they seek to safeguard their evolving digital footprint and compete effectively in the digital economy.

Application Analysis

Based on application, the U.S. digital rights management market segmentation includes mobile content, video on demand (VOD), mobile gaming & apps, ebook, and others. The video on demand (VOD) segment held the largest share in 2024, due to the growth of streaming services and platforms offering movies, TV shows, and other video content directly to consumers. The sheer volume of high-value cinematic and episodic content being distributed digitally necessitates robust protection against piracy and unauthorized access. Content providers, including major studios and independent creators, rely heavily on digital rights management to control how their video assets are consumed, ensuring adherence to licensing agreements, geographic restrictions, and subscription models. The continuous innovation in streaming technology and consumer demand for instant access to a vast library of video entertainment further solidifies the VOD segment's leading position, driving substantial investments in advanced security measures to protect revenue streams.

The mobile gaming and apps segment is anticipated to register the highest growth rate during the forecast period. The proliferation of smartphones and tablets, coupled with improving internet connectivity, has transformed mobile devices into primary platforms for entertainment and productivity. This has led to a surge in the development and consumption of mobile games and various applications. Developers and publishers in this space increasingly face challenges related to app piracy, unauthorized in-app purchases, and intellectual property theft. As the mobile ecosystem continues to mature and monetize, there is a growing recognition of the need for effective digital rights management to secure game assets, protect proprietary code, and ensure fair revenue generation from in-app transactions and premium content. The dynamic nature of mobile app updates and new content releases also necessitates agile and scalable protection, making this segment a focal point for future growth in digital rights management.

Key Players and Competitive Insights

The U.S. digital rights management market features a diverse set of participants, ranging from large technology corporations to specialized solution providers. These companies compete on various fronts, including the breadth of their protection features, compatibility across different devices and operating systems, and the ability to integrate with existing content delivery ecosystems. Innovation in areas such as forensic watermarking, multi-DRM support, and cloud-based deployments is crucial for maintaining a competitive edge. The increasing sophistication of piracy methods continually pushes these players to develop more robust and adaptive security measures, influencing their research and development investments and partnership strategies.

A few prominent companies in the industry include Microsoft Corporation, Adobe Inc., Apple Inc., Google LLC (Alphabet Inc.), Oracle Corporation, IBM Corporation, Intertrust Technologies Corporation, Verimatrix, Irdeto, Fasoo, Seclore, and Vitrium Systems Inc.

Key Players

- Adobe Inc.

- Apple Inc.

- Fasoo

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Intertrust Technologies Corporation

- Irdeto

- Microsoft Corporation

- Oracle Corporation

- Seclore

- Verimatrix

- Vitrium Systems Inc.

U.S. Digital Rights Management Industry Developments

May 2025: Irdeto and Anypoint Media announced a strengthened strategic partnership. This collaboration focuses on empowering Over-The-Top (OTT) and Free Ad-supported TV (FAST) providers by pre-integrating Anypoint Media's FLOWER advertising solution with Irdeto Experience, a streaming aggregation platform.

March 2025: Verimatrix introduced its XTD Velocity Partner Alliance, a new program designed to accelerate global channel sales for its extended threat defense solutions.

U.S. Digital Rights Management Market Segmentation

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprise

- Small & Medium Enterprise

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Mobile Content

- Video on Demand (VOD)

- Mobile Gaming & Apps

- eBook

- Others

U.S. Digital Rights Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.38 billion |

|

Market Size in 2025 |

USD 1.64 billion |

|

Revenue Forecast by 2034 |

USD 7.78 billion |

|

CAGR |

18.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.38 billion in 2024 and is projected to grow to USD 7.78 billion by 2034.

The market is projected to register a CAGR of 18.9% during the forecast period.

A few key players in the market include Microsoft Corporation, Adobe Inc., Apple Inc., Google LLC (Alphabet Inc.), Oracle Corporation, IBM Corporation, Intertrust Technologies Corporation, Verimatrix, Irdeto, Fasoo, Seclore, and Vitrium Systems Inc.

The large enterprise segment accounted for the largest share of the market in 2024.

The mobile gaming and apps segment is expected to witness the fastest growth during the forecast period.