Wire & Cable Compounds Market Share, Size, Trends, Industry Analysis Report

By Type (Halogenated Polymers, Non- Halogenated Polymers); By End-Use (Construction, Wind Energy, Power, Communication, Automotive, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 111

- Format: PDF

- Report ID: PM2381

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

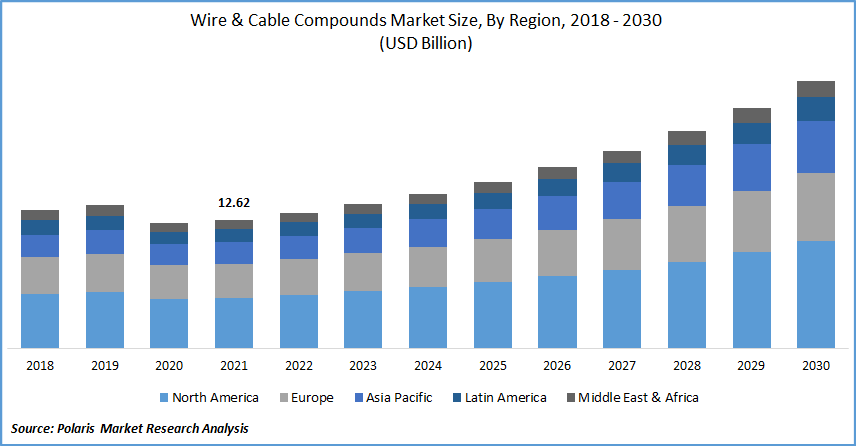

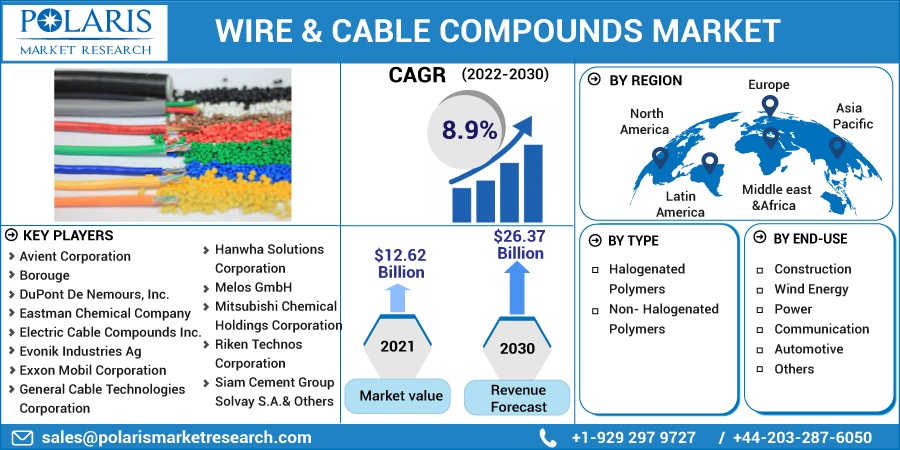

The global wire & cable compounds market was valued at USD 12.62 billion in 2021 and is expected to grow at a CAGR of 8.9% during the forecast period. Factors such as the adoption of wire material due to its benefits, technological advancements, and increasing demand from emerging economies are driving the market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

These compounds provide quality sound-proofing, jacket to conducting metals, and superior mechanical stability, flexibility, and abrasion to the cable and wire compounds. The growing utilization of product compounds in the construction and power sectors has continued to drive wire & cable compounds market growth. Further, due to rapid industrialization, emerging economies' building and infrastructure sectors are rapidly expanding, creating a significant demand for construction materials. As a result, they are in high demand in emerging economies for construction applications.

In emerging economies, affordable commercial air travel is a viable option, providing travelers access to various locations. Customers in emerging economies prefer the affordable option of air travel, which provides speed and convenience, over traditional modes of transportation. Increased commercial airplane production is also expected to increase demand for the product in the aerospace sector.

Thus, these factors are assisting the wire and cable compounds industry in growing. However, strict government regulations for using different types of materials are restraining the market growth. Strict government regulation limits the wire industry's requirement for halogenated compounds. According to the National Institutes of Health in the US, governmental purchasing regulations and policies may restrict certain halogenated plastics.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Over the last few decades, the construction industry has seen significant growth all over the world. With a growing emphasis on sustainable development and green construction techniques, innovations and new technologies progressively establish a large presence in the modern construction sector.

The electrical industry, especially in the construction sector, has also advanced in recent years, resulting in new wire materials on the wire & cable compounds market. The majority of construction projects have increased significantly in several areas worldwide. For instance, as per the Government of India, FDI in the construction industry development sector and construction activities totaled $26.16 billion and $25.95 billion, respectively.

The National Bank for Financing Infrastructure and Development (NaBFID) was established by a bill passed by the Indian Parliament in March 2021 to improve infrastructure projects in India. Infrastructure activities accounted for 13% of total FDI inflows of US$ 81.72 billion in FY21. Under the government route, 100% FDI in the construction industry is allowed in completed projects for operations and management of townships and business building sites. As a result, demand for the product has increased.

Furthermore, players in the current wire materials market are expected to focus on organic and inorganic strategic planning. For example, in March 2021, With new product introductions, Belden Inc. provided its customers with more options for managing high density, reducing installation time, and safely transmitting data and power. Belden's Digital Electricity (DE) Cable transmits information over long distances while delivering DE power (up to 2,000 W) on the copper pair (up to 2 km).

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

The halogenated polymer segment is expected to be the largest revenue share in the global wire & cable compounds market. Polyvinyl Chloride (PVC) and Chlorinated Polyethylene (CPE) are halogenated polymers broadly used in wire, footwear, polymers, and packaging. PVC has a broader range of applications than CPE.

Among all halogenated and non-halogenated polymers, PVC compounds had the largest market share. CPE is a type of polyethylene with a chlorine content ranging from 30.0 to 40.0 %. Depending on the requirements, CPE acts as a multiplier of PVC.

Geographic Overview

North America had the largest regional share in 2021. The region's market is heavily reliant on industrial development in the domestic market. The region's growth is due to technological developments and infrastructural development in the telecommunication sector. Increased state funds to develop green and clean energy through the implementation of renewable power plants and windmill-powered plants are anticipated to drive the power industry's wire & cable compounds industry.

Moreover, Asia Pacific is expected to witness a high CAGR in the global wire & cable compounds market in 2021. Energy demand in the Asia Pacific is expected to rise rapidly during the forecast period, with concurrent increases in energy usage in industry, transportation, households, and newly electrified rural areas in the region's countries.

China's due to rapid population growth, industrial growth, and increased foreign investment. The Indian government is actively working to close the demand-supply gap. These factors are expected to drive the Asia Pacific wire and cable compounds industry over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Avient Corporation, Borouge, DuPont De Nemours, Inc., Eastman Chemical Company, Electric Cable Compounds Inc., Evonik Industries Ag, Exxon Mobil Corporation, General Cable Technologies Corporation, Hanwha Solutions Corporation, Melos GmbH, Mitsubishi Chemical Holdings Corporation, Riken Technos Corporation, Siam Cement Group, Solvay S.A., and Trelleborg AB.

Wire & Cable Compounds Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 12.62 Billion |

|

Revenue forecast in 2030 |

USD 26.37 Billion |

|

CAGR |

8.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Avient Corporation, Borouge, DuPont De Nemours, Inc., Eastman Chemical Company, Electric Cable Compounds Inc., Evonik Industries Ag, Exxon Mobil Corporation, General Cable Technologies Corporation, Hanwha Solutions Corporation, Melos GmbH, Mitsubishi Chemical Holdings Corporation, Riken Technos Corporation, Siam Cement Group, Solvay S.A., and Trelleborg AB |