Milking Robots Market Share, Size, Trends, Industry Analysis Report

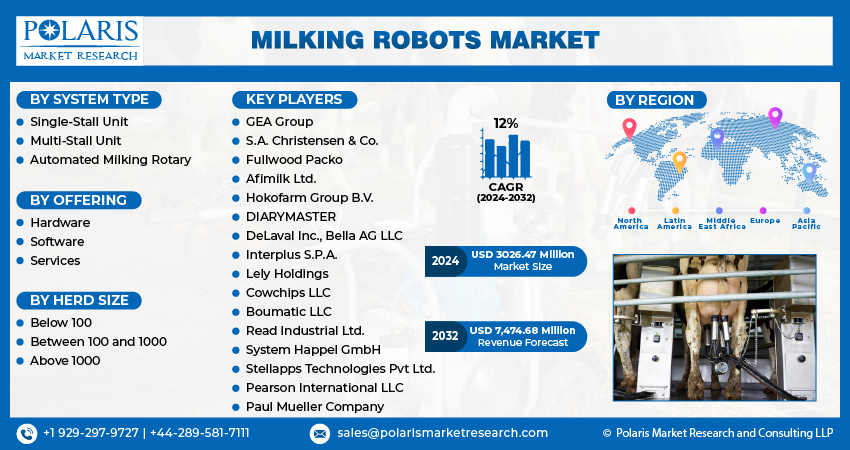

By System Type (Single-Stall Unit, Multi-Stall Unit, and Automated Milking Rotary); By Offering; By Herd Size; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3192

- Base Year: 2023

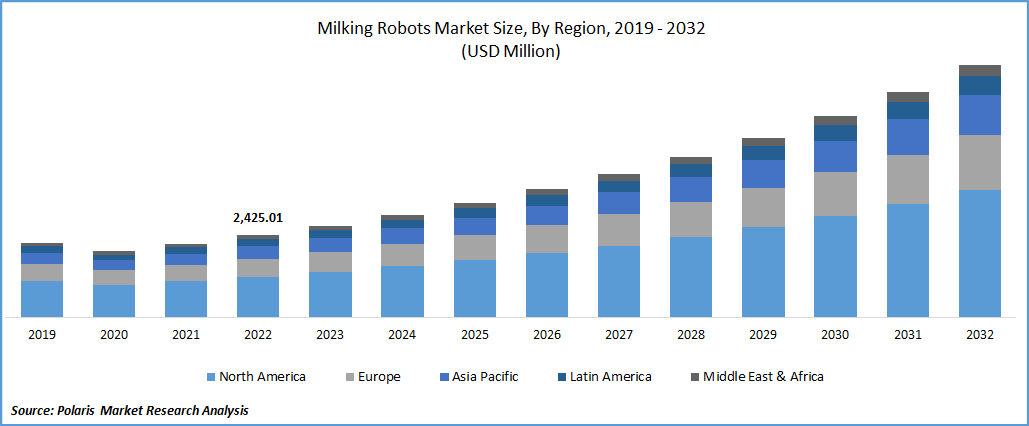

- Historical Data: 2019-2022

Report Outlook

The global milking robots market was valued at USD 2708.49 million in 2023 and is expected to grow at a CAGR of 12% during the forecast period.

Robotic milking systems or automatic milking systems allow cows to select when to be milked by a robotic system in the absence of human assistance. It has a robotic arm and a recognition arrangement. When a cow is admitted it is surveyed if she is ready for milking. If yes, the machine milks her, garners data, and disburses milk to tanks. Triumphant AMS requires adequate farm handling and operates best when stimulated by a feed. The milking robots market size is expanding as for the farm, contemplate phone and broadband scope, the topography, nearness to servicing, and if one is tech-savvy. Establishing needs forethought farm design, water eruption, dairy outline, and intelligent grazing management.

The working of milking robots involves the cow entering the crate and is recognized through a tag buckled to her leg, surrounding her neck, or in her ear. The software determines if the cow has a milking dispensation. If she is not ready, the anterior gates unlock, and the cow is liberated. If she is ready for milking, the teats are washed, and teat cups are affixed one at a time. Teat cups are separated dependent on flow from discrete quarters. In the meantime, in the course of milking the cow is fed a concentrate. Milk is rerouted to segregate tanks is solicited by the operator utilizing software positioning, if not, it approaches the main part or interim buffer tank.

The rapid growth in herd sizes and increasing introduction to innovative and advanced automated technologies that facilitate a wide range of dairy functions like herd management, dairy farm management, and milking operations, along with the increased process efficiency and frequency, are primary factors expected to boost the growth of the global market over the coming years. In recent years, many large market players have been highly investing in research & development activities to develop and introduce innovative robotic solutions to meet the demand for the dairy industry, which is further likely to generate lucrative market growth opportunities soon.

Know more about this report: Request for sample pages

For instance, in July 2022, AMS Galaxy announced the launch of its latest next-generation automated milking solution for US dairy farmers. The new robot comes with high efficiency, reliability, and better durability and further allows the farmers to easily control their operating equipment expenditure and take farmers' profitability and income to the next level.

In the last few decades, robotic milking has gained significant traction and popularity worldwide, as automatic milking or robotic milking helps reduce tension on the udder and further improves the cow's comfort. It also increases the milk output per cow with more frequent milking up to three times per day, which is expected to emerge significantly in the coming years.

The outbreak of the COVID-19 pandemic has significantly impacted the market's growth. The rapid emergence of the deadly coronavirus has hampered the adoption and demand for robotics and automation in agriculture. To stop the pandemic, which spread across the globe, many countries have imposed lockdowns and many other restrictions on trade activities on international movement, which have led to higher supply chain disruptions and labor shortages, which also had a negative impact on demand and sales of milking robots.

Industry Dynamics

Growth Drivers

The continuous rise in the demand for dairy products in the food industry owing to the increased awareness regarding the nutritional properties of milk and milk-related products and a growing number of dairy industries, coupled with the high cost of labor, resulted in higher adoption of milking robots for a variety of operational purposes across the globe, are driving the demand and growth of the milking robots market. Moreover, the ability of the robot framework to efficiently monitors various vital information, including the electrical conductivity of the milk, production of milk by a particular dairy animal, and the cow rumination data, helps to ensure the increased milk yield and also the periodic monitoring of the steers well-being, are likely to be the major factors propelling the growth and demand over the coming years.

Report Segmentation

The market is primarily segmented based on system type, offering, herd size, and region.

|

By System Type |

By Offering |

By Herd Size |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Multi-stall unit segment accounted for largest market share in 2022

The multi-stall segment accounted for the largest market share in 2022. It is likely to continue its position throughout the anticipated period, mainly driven by increased need and demand for milk and dairy commodities and high implementation on designing these systems to conduct the milking process simultaneously. In addition, increased preferences for multi-stall units among various small and medium-sized enterprises generate an early return on investment, gain optimized efficiency, and further reduce capital expenditure, likely to boost the segment market growth over the coming years.

Furthermore, the single-stall unit and automated milking rotary segment are expected to account for a considerable growth rate over the coming years owing to a rapid increase in the investments for advanced rotary systems and carry a wide range of functions along with the high adoption and prevalence for single-stall systems among small farm owners to reap the benefits at very low capital investments.

Hardware segment held the significant market revenue share in 2022

The hardware segment held the majority market share in 2022, which is highly attributable to the continuous rise in the adoption of milking robots, high penetration for various automated hardware and systems, several technological advancements introduced by key market players, and rising demand for dairy products in both developed and emerging economies. Moreover, the subsequent increase in the number of dairy cows globally is also anticipated to boost the demand and growth of the segment market.

The software segment is expected to grow significantly over the study period due to increasing awareness regarding the remote monitoring of dairy cows, tracking and identification of dairy cows with the help of innovative sensor technology, and control of livestock of the dairy farms.

Between 100-100 segment to expand at fastest growth rate during forecast period

The 100-1000 segment is projected to witness the fastest growth rate during the anticipated period. The growth of the segment market is mainly attributable to the increasing demand for milk and a variety of milk commodities across several regions and the surging focus of medium-sized dairy farms to install multi-stall or rotary milking robots for enhancing efficiency, increased productivity, and obtaining maximum yield through herds.

However, the less than 100 segment is projected to grow at a substantial rate of growth throughout the forecast period due to the rise in the number of herds, increasing concerns regarding dairy management and farm management, and high penetration for this herd size for being an efficient way to perform the milking activity across several farms all over the world, thereby positively influencing the milking robots market growth at a rapid pace.

Europe region dominated the global market in 2022

Europe dominated the global market for milking robots in 2022 and is projected to maintain its dominance throughout the projected period. The robust presence of key manufacturers of milk-related products, demand for milk commodities in the region, and heavy investment in research & development activities in countries including the UK, Germany, and France are among the prominent factors boosting the growth and demand of the market. In addition, the growing need to mitigate or reduce the high labor costs in these countries and the adoption of robotics technology among dairy farmers is likely to fuel the market's growth.

Asia Pacific is likely to emerge as the fastest-growing region in the global market, with a significant share over the coming years. The regional market growth is attributed to increasing average herd size, higher implementation of technological upgradation among other regions, and development of milk production centers at a rapid pace in countries like China, Indonesia, and India. In addition, extensive growth in the population among various Asian countries and a rise in the number of animal-rearing operations are further expected to augment the market growth in the forecast period.

Competitive Insight

Some of the major players operating in the global milking robots market include GEA Group, S.A. Christensen & Co., Fullwood Packo, Afimilk Ltd., Hokofarm Group B.V., DIARYMASTER, DeLaval Inc., Bella AG LLC, Interplus S.P.A., Lely Holdings, Cowchips LLC, Boumatic LLC, Read Industrial Ltd., System Happel GmbH, Stellapps Technologies Pvt Ltd., Pearson International LLC, and Paul Mueller Company.

Recent Developments

- In January 2022, Quebec Company introduced a milking robot named “ROBOMAX.” It allows the farmers to select the milking frequency between 1 to 4 times/day. With this technology, milk analysis is done in a real-time manner & provides access to the data, including milk rearing, cleaning, & lactation curves.

- In August 2022, DeLaval introduced its new milking methodology, which effectively responds to the natural milk of cows to save time and enhance animal welfare. The first two products to be launched under the DeLaval Flow-Responsive system will include Flow-Adjusted Vacuum & Flow-Adjusted Stimulation, which will be available for rotaries & parlors.

- In January 2024, integrated milking solutions provider Fullwood JOZ announced that it will be moving its location on Grange Road to other location within the region. The shift in the location has been made to keep up with the rising demand for integrated quality milking solutions.

- In January 2024, global dairy farming solutions provider DeLaval introduced its VMS Batch Milking system. The new innovation is an advancement in robotic milking technology that helps reduce labor and improve efficiency. VMS Batch Milking involves dividing herds into various groups and bringing them together to the milking system.

Milking Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3026.47 million |

|

Revenue forecast in 2032 |

USD 7,474.68 million |

|

CAGR |

12% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019- 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By System Type, By Offering, By Herd Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

GEA Group, S.A. Christensen & Co., Fullwood Packo, Afimilk Ltd., Hokofarm Group B.V., DIARYMASTER, DeLaval Inc., Bella AG LLC, Interplus S.P.A., Lely Holdings, Cowchips LLC, Boumatic LLC, Read Industrial Ltd., System Happel GmbH, Stellapps Technologies Pvt Ltd., Pearson International LLC, and Paul Mueller Company. |

FAQ's

The milking robots market report covering key segments are system type, offering, herd size, and region.

Milking Robots Market Size Worth $7,474.68 Million By 2032.

The global milking robots market expected to grow at a CAGR of 11.9% during the forecast period.

Europe is leading the global market.

Key driving factors in milking robots market are increased awareness regarding the nutritional properties.