Nematicide Market Share, Size, Trends, Industry Analysis Report

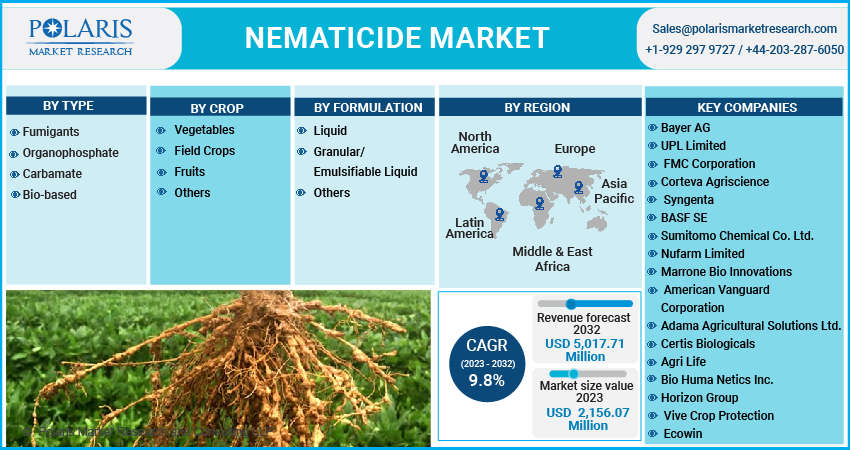

By Type (Fumigants, Organophosphate, Carbonate, and Bio-based); By Crop; By Formulation; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 119

- Format: PDF

- Report ID: PM3182

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

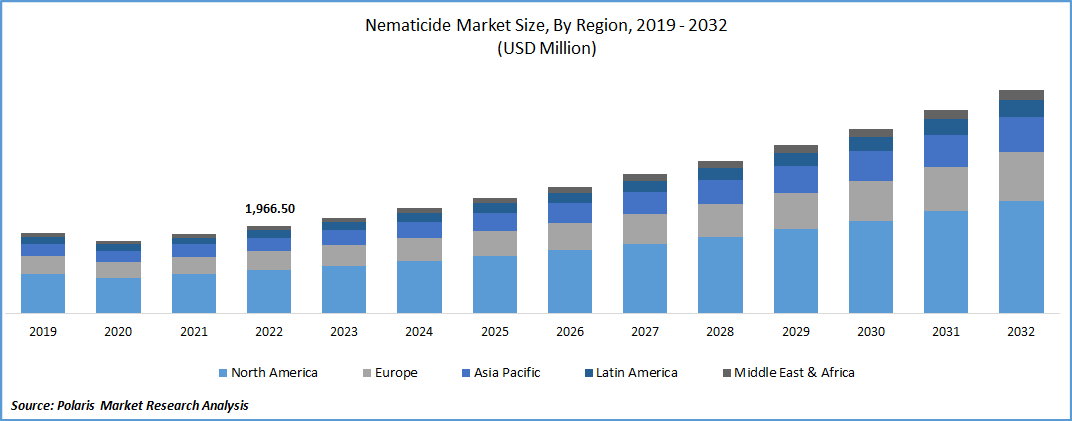

The global nematicide market was valued at USD 1,966.50 million in 2022 and is expected to grow at a CAGR of 9.8% during the forecast period. The rapid increase in the nematode infestation around the world and continuously growing demand for high-value crops like vegetables and fruits, along with the higher acceptance and adoption of nematicide products in both developed and developing regions and ongoing research & development activities for better and sustainable product development are among the key factors influencing the global market growth. In addition, the rapidly booming agriculture industry and the increasing need to enhance the productivity of the agriculture fields and crops with the introduction of various advanced liquid formulations by key market players globally are further creating huge growth opportunities in the market over the coming years.

Know more about this report: Request for sample pages

For instance, in March 2022, BIOCONSORTIA introduced two new and more effective nematicides that control nematode pests and further increase crop yields. These are the best microbial nematicides available in the market, bringing both efficacy and consistency to row crops.

Recently, the preferences for biological or bio-based nematicides have gained significant traction and popularity, mainly because of the growing adoption of integrated pest management techniques and various sustainable agricultural practices undertaken globally.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the nematicide market. The emergence of the deadly coronavirus across the globe has resulted in various types of socio-economic changes, and manufacturers of nematicides have faced several challenges due to the highly disrupted supply chains, low availability of required raw materials, shortage of labor workforce, and various trade barriers imposed by governments of different countries. Temporary limitations on the aviation industry, a ban on international flights, and a drop in the dry cargo movement have also negatively affected the market growth.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The extensive rise in environmental concerns and various health-related issues caused due to the synthetic agri-inputs people consume daily in their diets and meals have led to the significant growth in the demand for sustainable and environment-friendly agri-inputs like bio-based nematicides and acting as a major factor driving the global nematicide market growth. Moreover, prominent market players focus on getting stringent regulatory submissions and new product innovations and developments to meet consumer and grower demand. For instance, in August 2021, Sumitomo Chemical unveiled Brazil's latest bionematicide for seed treatment. The Aveo bionematicide ensures a range of benefits to the plant, including high efficacy in nematode control and safety.

Furthermore, with the rise in the emphasis on various integrated pest management solutions and support from governments across many countries in the encouraging development of innovative solutions as a substitute or alternative to conventional synthetic pesticides along with the rising incidences of pollution and crop losses especially in countries like India, Africa, and Indonesia, are likely to fuel the market expansion at a rapid pace over the coming years.

Report Segmentation

The market is primarily segmented based on type, crop, formulation, and region.

|

By Type |

By Crop |

By Formulation |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Fumigants segment accounted for the largest market share in 2022

The fumigants segment accounted for the largest market share in 2022 and is likely to retain its position over the study period. The growth of the segment market is mainly driven by its high efficiency, volatility, and short period of residual pesticide activity, and it is very effective compared to other types available in the market. They are also very useful against various soil-borne pests and pathogens and are widely used to disinfect the soil and reduce the yield loss risks in high-value crops like fruits and vegetables, likely to fuel the segment market growth exponentially.

Furthermore, the bio-based segment is expected to register the highest growth rate throughout the forecast period because of the rapidly growing proliferation and adoption rate of several types of bio-based nematocide products across the globe. Increased awareness among the farmers regarding the benefits associated with the use of bio-based products like eco-friendliness and cost-effectiveness than chemical products, which is further expected to boost the utilization rate and growth of the segment in the coming years.

Fruit segment is expected to hold largest market share during anticipated period

The fruit segment is projected to account for the largest share of the nematicide market during the anticipated period, mainly driven by its increased usage of fruit plants because of the growing risk of plant-parasitic nematodes on the leaves and roots of various fruit crops. Moreover, many nematodes have recently gained traction, causing extensive root necrosis in the fruit orchards. Thus nematode management is vital for high-quality yields and fruit production, propelling market growth.

The vegetable segment held the largest market with a healthy revenue share in 2021, owing to the rapid surge in nematode infestation on various vegetables, including carrots, potatoes, and tomatoes. The infected roots of vegetable crops become damaged and distorted, hampering the product quality and quantity.

Liquid formulation segment dominated the global market in 2022

The liquid formulation segment dominated the global market for nematicide in 2022 and is expected to grow fastest over the study period, which is mainly accelerated by the high demand for liquid nematode control liquid products from farmers all over the world due to its various features, including ease of application, convenience in the product usage, and ability to evade any spoilage or wastage of the product due to the contamination. The availability of various liquid formulations of nematicides with unique characteristics like differences in the solubility of the active component, pest control capacity, and their high handling and transportation convenience is also likely to boost the segment market.

The demand in Asia Pacific is expected to witness significant growth over forecast period

The Asia Pacific region is anticipated to be the fastest-growing region in the global market over the coming years, owing to the extensive rise in the cultivation of high-value crops, including vegetables and fruits, coupled with numerous prominent players operating in the region. In addition, the increase in the nematode attacks on major crops like maize, vegetables, soybean, and coffee, among others, could affect the yield quality and quantity severely. Thus, the demand for innovated nematicides is growing exponentially in the APAC region.

However, the North American region dominated the global market in 2022 and will likely maintain its dominance throughout the projected period. The regional market demand and growth are mainly attributed to declinable arable land, high awareness regarding the advantages of product applications, and high prevalence of bionematicides because of the heavily rising organic farming and demand for organic food products, especially in well-developed countries like US and Canada.

Competitive Insight

Some of the major players operating in the global market include Bayer, UPL Limited, FMC Corporation, Corteva Agriscience, Syngenta, BASF, Sumitomo Chemical, Nufarm Limited, Marrone Bio Innovations, American Vanguard Corporation, Adama Agricultural, Certis Biologicals, Agri Life, Bio Huma Netics Inc., Horizon Group, Vive Crop Protection, Ecowin, Isagro., & Real IPM Kenya.

Recent Developments

- In July 2022, Corteva Agriscience announced the launch of its two new seed treatment packages containing multiple products available for canola and corn farmers across Canada.

- In September 2022, Bayer introduced its nematicide solution for greenhouse tomato cultivation, innovation, sustainability, and digitalization. The cultivation process complied with the solution by ensuring optimal solarization, using solar radiation to control the nematodes.

Nematicide Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,156.07 million |

|

Revenue forecast in 2032 |

USD 5,017.71 million |

|

CAGR |

9.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Crop, By Formulation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Bayer AG, UPL Limited, FMC Corporation, Corteva Agriscience, Syngenta, BASF SE, Sumitomo Chemical Co. Ltd., Nufarm Limited, Marrone Bio Innovations, American Vanguard Corporation, Adama Agricultural Solutions Ltd., Certis Biologicals, Agri Life, Bio Huma Netics Inc., Horizon Group, Vive Crop Protection, Ecowin, Isagro S.p.A., and Real IPM Kenya. |

FAQ's

The global nematicide market size is expected to reach USD 5,017.71 million by 2032.

Key players in the nematicide market are Bayer, UPL Limited, FMC Corporation, Corteva Agriscience, Syngenta, BASF, Sumitomo Chemical, Nufarm Limited, Marrone Bio Innovations, American Vanguard Corporation.

Asia Pacific contribute notably towards the global nematicide market.

The global nematicide market expected to grow at a CAGR of 9.8% during the forecast period.

The nematicide market report covering key segments are type, crop, formulation, and region.