Terahertz Technology Market Size, Share, Trends, Industry Analysis Report

By Component (Terahertz Sources and Terahertz Detectors), By Product Type, By Application, By End-use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2913

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

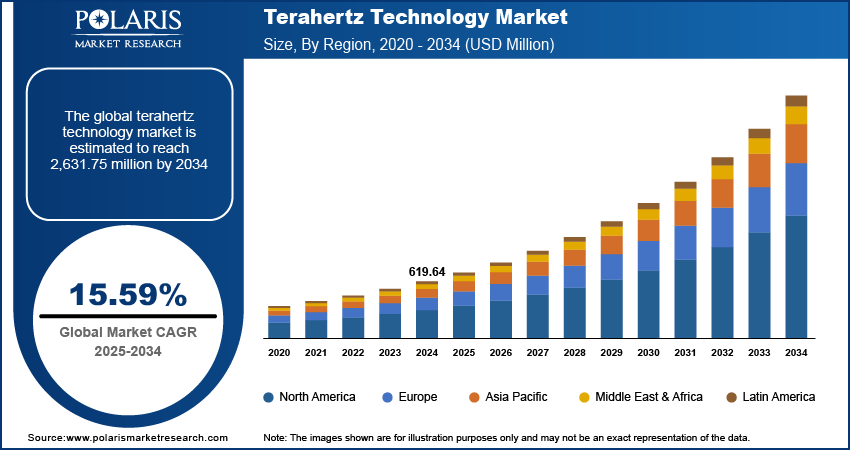

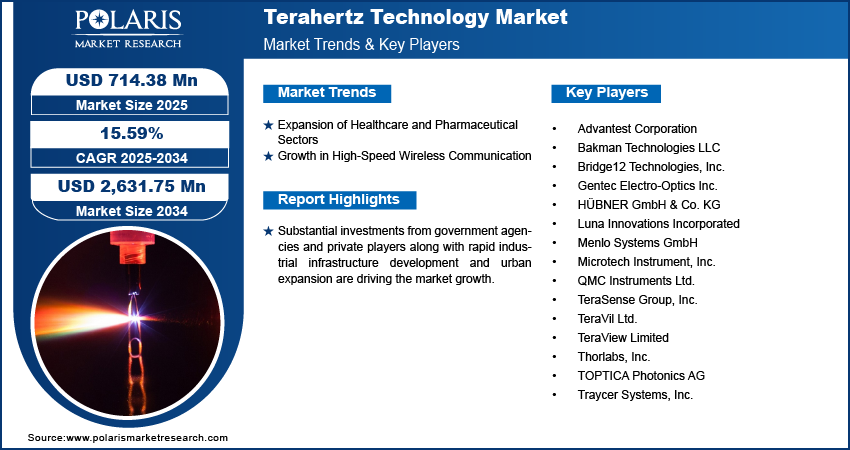

The global terahertz technology market size was valued at USD 619.64 million in 2024, growing at a CAGR of 15.59% from 2025 to 2034. Expansion of healthcare and pharmaceutical sectors coupled with growth in high-speed wireless communication is propelling the market growth.

Key Insights

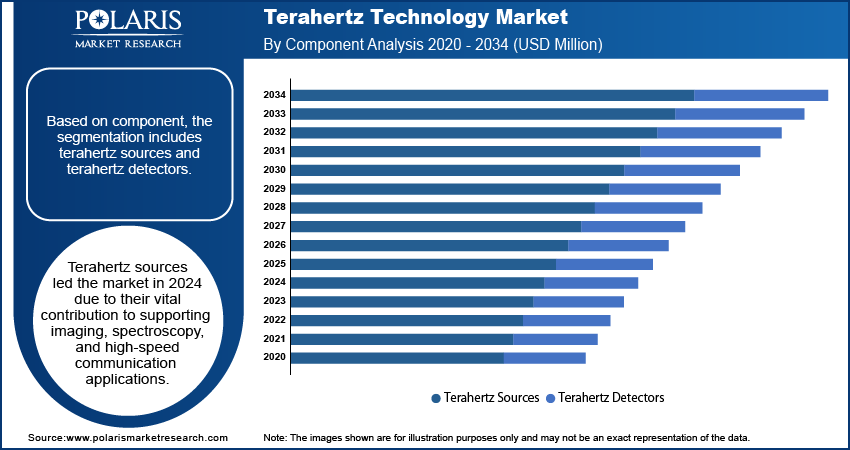

- Terahertz sources segment held the largest share in 2024 due to their pivotal position in facilitating high-resolution imaging, spectroscopy, and ultra-fast wireless communication applications.

- Spectrometer segment is expected to expand at a very high rate propelled by the increasing demand coming from pharmaceutical testing, chemical analysis, and state-of-the-art scientific research labs.

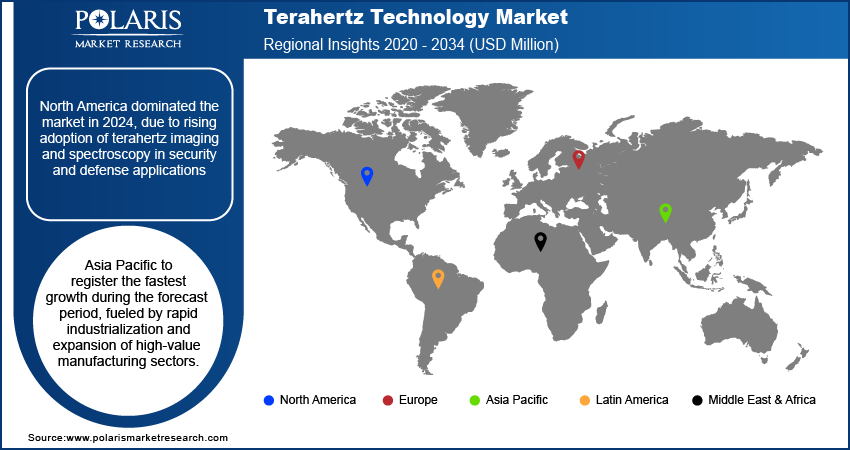

- North America led the global terahertz technology market in 2024 due to robust growth in security screening, defense intelligence, and non-destructive testing applications.

- The U.S. dominated the region, propelled by the location of prominent research centers and government-sponsored innovation initiatives that are driving the terahertz commercialization process.

- Asia Pacific is expected to exhibit the highest growth over the forecast period due to fast-paced industrialization and growth of high-value manufacturing and electronics industries.

- China led the region fueled by aggressive investments in next-generation telecommunication infrastructure and early-stage 6G terahertz-based network trials.

Industry Dynamics

- Pharmaceutical, biomedical imaging, and material testing expansion is driving the adoption of terahertz spectroscopy and diagnostic equipment at an increasingly rapid pace.

- Increasing emphasis on ultra-high-speed wireless communication is making terahertz technology crucial to 6G and next-generation data transfer.

- Specialized operational needs and high cost, along with high complexity, continue to restrict adoption in small and mid-sized businesses.

- AI-driven hyperspectral terahertz imaging is creating opportunities for autonomous defect detection, predictive diagnosis, and intelligent manufacturing.

Market Statistics

- 2024 Market Size: USD 619.64 Million

- 2034 Projected Market Size: USD 2,613.75 Million

- CAGR (2025–2034): 15.59%

- North America: Largest Market Share

The terahertz technology market comprises sophisticated systems and devices that function within the frequency of terahertz for imaging, sensing, spectroscopy, and high-speed wireless communications applications. These solutions contains extensive applications in security screening, non-destructive testing, medical diagnosis, semiconductor inspection, and scientific research owing to their penetration capability without inducing ionizing radiation damage.

High investments by government organizations and private stakeholders in terahertz technology research are driving product innovation and commercialization worldwide. These investments are helping to drive the development of next-generation imaging, sensing, and spectroscopy applications, enabling businesses to take products to market more quickly.

Rapid industrial infrastructure growth and urbanization in emerging markets are generating high demand for sophisticated imaging, sensing, and inspection technologies. A United Nations report estimates that urbanization to add an extra 2.5 million people into cities by 2050 as the world shifts from rural to urban lifestyles. The growing rate of urbanization is fueling the use of terahertz-based technology in industrial and business applications.

Drivers & Opportunities

Expansion of Healthcare and Pharmaceutical Sectors: Increasing need for non-invasive medical diagnostic services, drug testing, and quality checks is driving the terahertz market. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the pharmaceutical industry's direct GDP contribution has increased over 20% in the last ten years, from USD 623 million in 2012 to USD 755 million in 2022. The trend identifies the increasing role of terahertz technology in improving healthcare and pharmaceutical competence.

Growth in High-Speed Wireless Communication: The international move towards 6G and ultra-high-frequency communication technologies is boosting the adoption of terahertz frequencies for transmitting data. As per 5G America, the global wireless telecommunication industry accounted for 2.25 million 5G connections in 2024. Development of wireless communications is turning terahertz technology into a pillar of future high-speed data networks.

What are the Segmental Insights?

By Component

In terms of component, the terahertz technology market is divided into terahertz sources and terahertz detectors. Terahertz sources led the market in 2024 due to their vital contribution to supporting imaging, spectroscopy, and high-speed communication applications.

Terahertz detectors are anticipated to record robust growth during the forecast period fueled by the growing usage in security screening, non-destructive testing, and biomedical diagnostics in which accuracy in signal detection and sensitivity are of utmost significance.

By Product Type

Based on product type, the market is divided into imaging scanners, imaging cameras, antennas, spectrometers, and body scanners. Imaging scanners held dominating share in 2024, due to widespread usage in security screening, quality inspection, and industrial process monitoring.

Spectrometers are projected to grow at a high rate, propelled by increasing application in pharmaceutical testing, chemical analysis, and scientific research.

By Application

By application, the market is categorized into imaging, communications, and spectroscopy. Imaging held the largest market share in 2024 as terahertz imaging is widely used for security screening, medical imaging, and defect detection in the manufacturing industry.

Communications segment is anticipated to grow at a robust pace, fueled by breakthroughs in 6G and ultra-high-speed wireless technologies.

By End-use

By end-use, the market is divided into IT & telecom, medical & healthcare, laboratory research, defense & security, semiconductor testing, and others. The IT & telecom segment held dominating proportion in 2024, driven by increasing investments in next-gen wireless communication technologies.

The medical & healthcare industry is anticipated to experience robust growth, driven by increasing use of terahertz systems to detect cancer, image tissues, and make non-invasive diagnoses.

Which Regional Factors Contributed to the Market Growth?

North America dominated the market for terahertz technology due to growing use of terahertz imaging and spectroscopy in security and defense systems, particularly for airport checkpoints and screening in public venues. Growing investments by government bodies and private companies in healthcare diagnostics are hastening the application of non-invasive terahertz imaging in the early detection of diseases.

The U.S. Terahertz Technology Market Overview

The U.S. led the North America market due to the presence of high-class research institutions and universities driving innovation in terahertz technologies. In February 2024, MIT researchers created terahertz-driven anti-tampering tags that are more compact and affordable than radio-frequency identification (RFID), solidifying the nation's dominance in cutting-edge terahertz R&D and supply chain protection solutions.

Asia Pacific Terahertz Technology Market Insights

Asia Pacific projected to grow rapidly in the terahertz technology market, driven by speedy industrialization and high-value manufacturing industries' expansion. The technology is also increasingly finding utility in new medical imaging applications as healthcare modernization gains momentum throughout the region.

China Terahertz Technology Market Analysis

China led the Asia Pacific market, due to the aggressive move towards next-generation telecommunication, including pioneering-stage 6G trials. In July 2025, China Mobile recorded 280 Gbps download speeds during a 6G test, downloading a 50GB file in 1.4 seconds showing the future commercial potential of terahertz communication.

Europe Terahertz Technology Market Assessment

Europe maintained substantial market share in terahertz technology propelled by the growing adoption of terahertz technology for industrial testing, material analysis, and process monitoring in automotive and aerospace manufacturing. European Union R&D programs' strong support further drives innovation in this technology. For example, in February 2024, an ERC project that was funded by the EU successfully established a method for ultra-accurate spatiotemporal control of terahertz waves by employing disordered materials demonstrating Europe's leading role in cutting-edge terahertz research and industrial application maturity.

Key Players & Competitive Analysis

The terahertz technology market globally is moderately competitive, with firms highlighting developments in high-resolution imaging, non-destructive testing, and ultra-fast communication technologies. Innovation in products is concentrated on increasing sensitivity, miniaturization, and real-time scanning to enable applications within healthcare diagnostics, security screening, semiconductors, material inspection, and wireless communications.

Key companies operating in the global terahertz technology market include Advantest Corporation, Bakman Technologies LLC, Bridge12 Technologies, Inc., Gentec Electro-Optics Inc., HÜBNER GmbH & Co. KG, Luna Innovations Incorporated, Menlo Systems GmbH, Microtech Instrument, Inc., QMC Instruments Ltd., TeraSense Group, Inc., TeraVil Ltd., TeraView Limited, Thorlabs, Inc., TOPTICA Photonics AG, and Traycer Systems, Inc.

Key Players

- Advantest Corporation

- Bakman Technologies LLC

- Bridge12 Technologies, Inc.

- Gentec Electro-Optics Inc.

- HÜBNER GmbH & Co. KG

- Luna Innovations Incorporated

- Menlo Systems GmbH

- Microtech Instrument, Inc.

- QMC Instruments Ltd.

- TeraSense Group, Inc.

- TeraVil Ltd.

- TeraView Limited

- Thorlabs, Inc.

- TOPTICA Photonics AG

- Traycer Systems, Inc.

Terahertz Technology Industry Developments

In August 2024, TeraView launched new sensor technology part of its TeraCota product line designed specifically to measure the thickness, density and loading of coatings on anodes in lithium-ion batteries used for electric vehicles (EVs) and energy-storage systems.

Terahertz Technology Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Terahertz Sources

- Terahertz Detectors

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Imaging Scanner

- Imaging Cameras

- Antennas

- Spectrometer

- Body Scanner

By Application Outlook (Revenue, USD Million, 2020–2034)

- Imaging

- Communications

- Spectroscopy

By End-Use Outlook (Revenue, USD Million, 2020–2034)

- IT & Telecom

- Medical & Healthcare

- Laboratory Research

- Defense & Security

- Semiconductor Testing

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Terahertz Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 619.64 Million |

|

Market Size in 2025 |

USD 714.38 Million |

|

Revenue Forecast by 2034 |

USD 2,631.75 Million |

|

CAGR |

15.59% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 619.64 million in 2024 and is projected to grow to USD 2,631.75 million by 2034.

The global market is projected to register a CAGR of 15.59% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Advantest Corporation, Bakman Technologies LLC, Bridge12 Technologies, Inc., Gentec Electro-Optics Inc., HÜBNER GmbH & Co. KG, Luna Innovations Incorporated, Menlo Systems GmbH, Microtech Instrument, Inc., QMC Instruments Ltd., TeraSense Group, Inc., TeraVil Ltd., TeraView Limited, Thorlabs, Inc., TOPTICA Photonics AG, and Traycer Systems, Inc.

The terahertz sources segment dominated the market revenue share in 2024.

The spectrometers segment is projected to witness the fastest growth during the forecast period.