2K Protective Coatings Market Share, Size, Trends, Industry Analysis Report

By Resin (Polyurethane, Acrylic, Polyester, Epoxy, Alkyd); By End-Use; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 121

- Format: PDF

- Report ID: PM2003

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

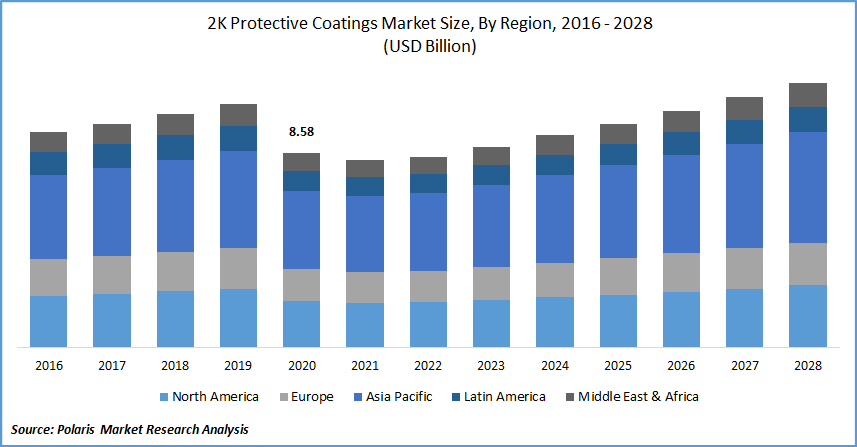

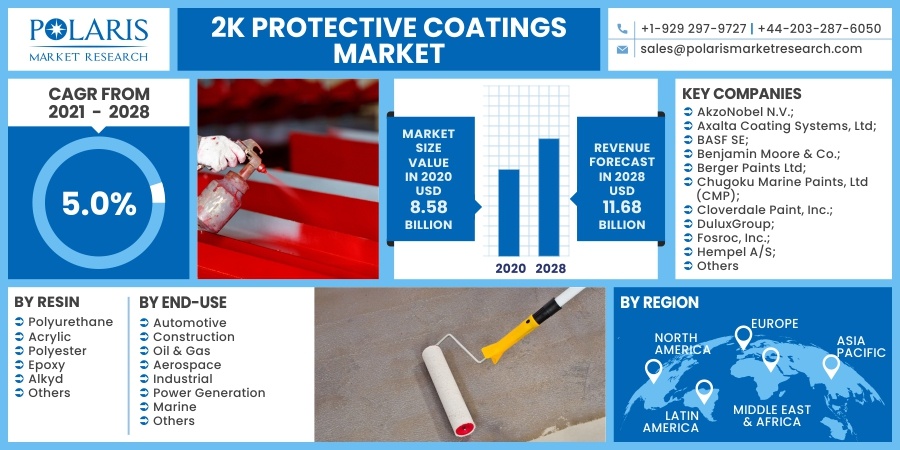

The global 2K protective coatings market size was valued at USD 8.58 billion in 2020 and is expected to grow at a CAGR of 5.0% during the forecast period. 2K protective coatings are increasingly being used in various applications to protect surfaces from corrosion, humidity, UV, and harsh weather conditions.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

These coatings also resist acids, oils, gases, and microorganisms. They are used in applications requiring good hardness and hardness development, high chemical and solvent resistance, flexibility and toughness, and quick drying.

The demand for 2K protective coatings has increased from various industries such as petrochemical, marine, power generation, building and infrastructure, and food and beverages. Growing environmental concerns and regulations in various markets and geographies have encouraged market players to develop products to cater to changing consumer demands.

The COVID-19 outbreak has negatively impacted the 2K protective coatings market due to supply chain disruption, operational challenges, lack of raw materials, trade and travel restrictions. Manufacturing and construction activities have also been halted due to various government regulations across the globe.

The pandemic has severely affected the paints and coatings industry and has experienced reduced demand and workforce impairment. Restrictions on imports of goods to curb the spread of the virus have further restricted the market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Rising industrialization, urbanization, and increasing commercial activities across the globe drive the growth of the market protective varnishes. The application of 2K protective coatings has increased in the building and construction sector owing to the greater need to improve the longevity and stability of structures.

Growing investment in the construction industry, development of offices, factories, and manufacturing units, and development of public infrastructure are factors driving the market's growth. 2K protective products are being increasingly used in oil & gas exploration, energy and power, and marine sectors.

Growing investment in R&D, technological advancements, and application in diverse industries are driving the growth of the advanced composites market. However, high prices associated with 2K protective coatings and more significant operating costs limit the development of the market for 2K protective coatings.

The global industry for 2K protective products is fueled by increasing demand from the building and infrastructure sector. It is utilized in a wide range of applications such as walls, façade, flooring, ceilings, and doors, among others. The application of 2K protective coatings has increased in the development of infrastructures such as bridges, stadiums, and highways for improved structural strength, durability, and longevity of structures.

The economic growth in countries such as China, Japan, and India, rising industrialization, and growing demand from emerging countries of Asia Pacific supplements the industry growth. Global players are introducing new innovative products to tap market potential provided by energy and construction sectors, further boosting the industry growth for 2K protective coatings.

In March 2021, Axalta Coating Systems introduced Imron industrial 2k polyurethane high gloss clearcoat. Imron 2100 HG-C is a 2.1 Volatile Organic Compound with low hazardous air pollutants. The coating offers polyester and acrylic urethane properties for a high-quality appearance. The new clearcoat simplifies and improves the efficiency of repair work by quickly melting and flowing into damaged areas. This product launch expands the company's portfolio in North America.

Report Segmentation

The market is primarily segmented on the basis of resin, end-use, and region.

|

By Resin |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Resin Outlook

The resin segment has been divided into polyurethane, acrylic, polyester, epoxy, alkyd, etc. The demand for epoxy is anticipated to be high during the forecast period owing to wide use in automotive, electrical, and marine applications. The use of these coatings offers benefits such as flexibility, durability, and chemical resistance.

End-Use Industry Outlook

On the basis of end-use industry, the market for 2K protective coatings is segmented into automotive, construction, oil and gas, aerospace, industrial, power generation, marine, and others. 2K protective coatings are used in the construction segment to offer durability, structural strength, and longevity.

These coatings are used in wide applications such as walls, roofs, entry doors in the construction sector. Increasing investments in the construction sector, development of public infrastructure, and rising adoption of energy-efficient buildings support the market's growth.

Regional Outlook

Asia-Pacific dominated the global 2K protective coatings market in 2020. There has been a growing demand for 2K protective coatings from the construction, marine, and industrial sectors. The economic growth in countries such as China, India, and Japan, rising automotive penetration, and the growing application in power generation drive the development of this region. Increasing urbanization, expansion of international players in this region, and technological advancements further support the growth of 2K protective coatings in this region.

Competitive Landscape

The leading market players in the 2K protective coatings industry include AkzoNobel N.V.; Axalta Coating Systems, Ltd; BASF SE; Benjamin Moore & Co.; Berger Paints Ltd; Chugoku Marine Paints, Ltd (CMP); Cloverdale Paint, Inc.; DuluxGroup; Fosroc, Inc.; Guangdong Maydos Building Materials Limited Company; Hempel A/S; Jotun A/S; Kansai Paint Co., Ltd; Nippon Paint Holdings Co. Ltd; NOROO Paint & Coatings Co., Ltd; Parker-Hannifin Corporation (Parker LORD); PPG Industries, Inc; Premium Coatings and Chemicals Pvt Ltd.; RPM International Inc; Shawcor Ltd; Sherwin-Williams Company; Sika AG; Teknos Group Oy; Tnemec Company, Inc; and Weilburger Coatings GmbH.

To increase their client base and improve their market position, these firms are expanding their presence across different geographies and entering new markets in developing areas. In order to meet the rising customer demand, the firms are also offering new inventive items to the market.

2K Protective Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 8.58 billion |

|

Revenue forecast in 2028 |

USD 11.68 billion |

|

CAGR |

5.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Volume in Kilotons; Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Resin, By End-use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

AkzoNobel N.V.; Axalta Coating Systems, Ltd; BASF SE; Benjamin Moore & Co.; Berger Paints Ltd; Chugoku Marine Paints, Ltd (CMP); Cloverdale Paint, Inc.; DuluxGroup; Fosroc, Inc.; Guangdong Maydos Building Materials Limited Company; Hempel A/S; Jotun A/S; Kansai Paint Co., Ltd; Nippon Paint Holdings Co. Ltd; NOROO Paint & Coatings Co., Ltd; Parker-Hannifin Corporation (Parker LORD); PPG Industries, Inc; Premium Coatings and Chemicals Pvt Ltd.; RPM International Inc; Shawcor Ltd; Sherwin-Williams Company; Sika AG; Teknos Group Oy; Tnemec Company, Inc; and Weilburger Coatings GmbH |