Active Insulation Market Share, Size, Trends, Industry Analysis Report

By Material (Polyester, Cotton, Wool, Nylon, Glass Wool, Mineral Wool, EPS, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 115

- Format: PDF

- Report ID: PM1161

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

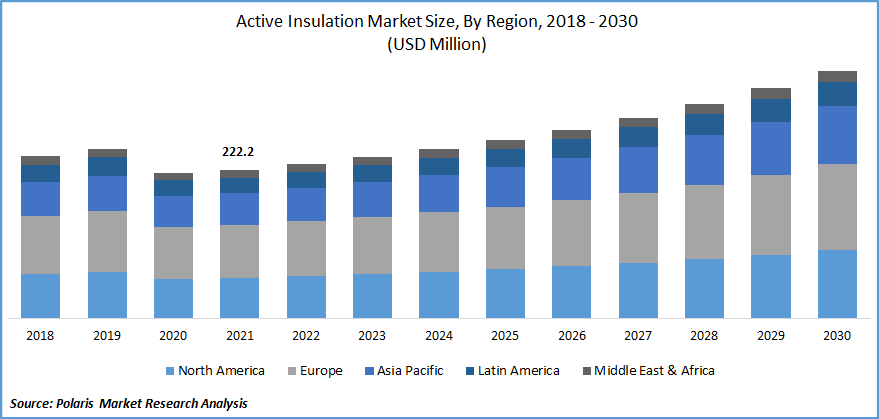

The global active insulation market was valued at USD 222.2 million in 2021 and is expected to grow at a CAGR of 6.1% during the forecast period. The key factors such as ease of installation and improved insulating benefits are expected to drive demand for active insulating products. Product penetration for textile applications is projected to be aided by rising consumer expenditure on performance clothes, particularly active and sportswear.

Know more about this report: Request for sample pages

Active insulating materials have superior insulating qualities and provide considerable performance advantages. These materials help enhance fuel efficiency in building and construction applications by removing the need for heating and cooling systems and lowering carbon emissions connected with these systems.

Active insulation is utilized in the textile industry to create breathable fabrics commonly used in sportswear and activewear. The active insulation industry's future will be bolstered by rising fuel prices and growing customer awareness and understanding of these materials.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the active insulation market. Demand for active insulating materials had decreased, particularly during the early phases of the pandemic, when large construction and infrastructure projects were temporarily suspended, and gyms and fitness facilities were closed.

During the pandemic, the closure of the economy has impacted public places very broadly. Among them, the gyms and fitness centers were affected majorly. Construction activity has risen in many locations as containment measures have become easier to implement. In addition, despite the closing of gyms, home workout regimes have expanded involvement in sports and physical fitness activities. As a result of these factors, product demand has been relatively stable and is likely to rise in the future, propelling the active insulation market.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing construction sector is expected to augment market demand for the product in many refractory materials, including polyester, cotton, wool, and EPS. The number of infrastructure projects is increasing every year, especially in developing economies. The Indian government has implemented several significant policies and projects, such as Smart Cities, Housing for All, and the 'Atal Mission for Urban Rejuvenation and Transformation' (AMRUT), all of which are helping to boost the country's building industry.

For instance, in March 2021, the Indian government passed a law to form the "National Bank for Financing Infrastructure and Development (NaBFID)" to fund infrastructure and related projects. In addition, according to the National Economic and Social Development Council (NESDC), overall construction spending increased by 1.5 percent (to THB1.321 trillion) in 2020, including public sector spending, which increased by 5.0 percent from 3.1 percent in 2019. Thus, the rapid development of the construction industry is boosting market growth.

Report Segmentation

The market is primarily segmented based on material, application, and region.

|

By Material |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

EPS is expected to witness fastest market growth

Expanded polystyrene is a long-lasting material that also saves energy. As a result, these are used as flotation materials in construction and building. Also, plastic foam is a popular active insulating material. Plastic foam was the leading product owing to its widespread application in the building and construction sector and different qualities such as heat transfer and moisture penetration resistance. Polystyrene plastic foam is a transparent, colorless thermoplastic, often insulating concrete block. The closed-cell structure of expanded polystyrene permits only a small amount of water absorption.

Furthermore, expanded polystyrene insulation is frequently employed in residential and commercial construction. It aids in the creation of an envelope around the building and the overlaying wall to improve heat transmission and moisture impact toughness. As a result, the market is expected to grow during the forecast period. Active insulation products made of glass and mineral wool can reduce energy usage while controlling temperature changes. As a result, rising market demand for active insulation materials in residential and commercial buildings is projected.

Polyester accounted for the second-largest market share in 2021

Polyester has high dimensional stability and is resistant to decay, dirt, and alkali, resulting in a higher adoption rate. Polyester fiber is utilized in pillows and upholstery as a cushioning material. Polyester textiles are stain-resistant due to their hydrophobic nature, making it difficult for liquids to absorb. The sole type of dye is used to change the color of the polyester fabric.

Furthermore, polyester fiber has good thermal stability or heat resistance, making it ideal for use in outdoor clothing. Cotton is a fantastic combination of softness and comfort. Because of its strong moisture absorption and retention qualities, the material is not recommended for use as a foundation layer in active sportswear. However, the product is designed to increase loft and trap air to improve the material's total insulating capability significantly, boosting its demand in the sportswear market segment.

Textiles are expected to hold the significant revenue share

Greater engagement in outdoor sporting activities like hiking, jogging, walking, strolling, and others have resulted from rising consumer focus on health and physical fitness. The quickening pace of life, busy work schedules, and long working hours made consumers more focused on their health and fitness goals.

The market is projected to grow significantly due to the rising health awareness among consumers, weight management, and muscular strength. The increasing obese population and rising health concerns are other significant aspects that encourage market growth. The number of people exercising in gyms and at home has also dramatically increased. As a result of these conditions, there is a higher market demand for breathable clothes.

The military sector, where army men may be exposed to adverse weather conditions, is likewise seeing strong demand for active insulation clothing and apparel. Current technological advancements in the design of active insulation materials, including multilayer textiles and improved finishing treatments, will improve the performance and durability of clothing materials even further.

The market demand in North America is expected to witness significant growth

The presence of key players in the region and continuing expansion in the application industry are expected to boost demand for active insulation products. These materials not only encourage sustainability but also help to reduce noise pollution and save energy. The regional market will be propelled forward in the coming years by tight energy efficiency standards and ambitious green infrastructure initiatives.

Asia Pacific is expected to be the fastest-growing global market over the forecast period. The increased demand for active insulation from the construction industry coupled with the growing housing and construction industry. Countries including China, India, South Africa, and Brazil are investing significantly in the construction industry.

Rising urbanization is also boosting market growth. Urbanization is defined as the population shift from rural to urban areas. According to the UN, around 55% of the population lived in the metropolitan area in 2018, estimated at approximately 4.2 billion. It is expected to reach 68% by 2050, reaching more than 6 billion people.

Competitive Insight

Some of the major players operating in the global active insulation market include Armacell International S.A, Knauf Gips KG, Minwool Rock Fibres Ltd., Neo Thermal Insulation (India) Pvt. Ltd., Owens Corning, Polybond Insulation Pvt Ltd., PrimaLoft, Inc., Remmers Limited, Rockwool International A/S., Rock Wool India Pvt Ltd., Sintex Plastics Technology Ltd., Saint-Gobain Group, Thermocare Imerys Group, Unger Diffutherm GmbH, and W.L. Gore and Associates, Inc.

Recent Developments

In January 2022, Knauf Insulation acquired the glass mineral wool plant in Central Romania. The plant purchase will provide Knauf Insulation's technologies closer to customers in Romania, Eastern Europe, and the Commonwealth of Independent States (CIS). Knauf Insulation intends to invest in cutting-edge technology and improve the Romanian factory, bringing the production processes up to the company's standards.

Active Insulation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 222.2 million |

|

Revenue forecast in 2030 |

USD 371.40 million |

|

CAGR |

6.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Armacell International S.A, Knauf Gips KG, Minwool Rock Fibres Ltd., Neo Thermal Insulation (India) Pvt. Ltd., Owens Corning, Polybond Insulation Pvt Ltd., PrimaLoft, Inc., Remmers Limited, Rockwool International A/S., Rock Wool India Pvt Ltd., Sintex Plastics Technology Ltd., Saint-Gobain Group, Thermocare Imerys Group, Unger Diffutherm GmbH, and W.L. Gore and Associates, Inc. |