Aerial Refueling System Market Size, Share, Trends, Industry Analysis Report

: By Aircraft Type, System Type, Components, End User (OEM and Aftermarket), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1664

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

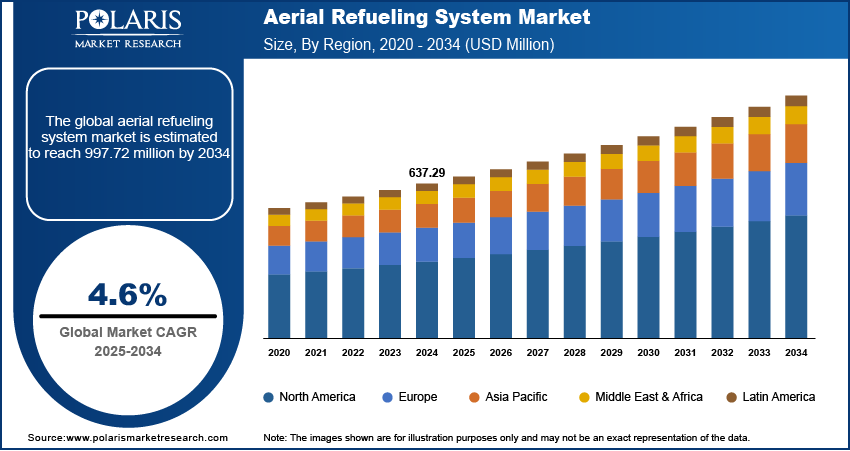

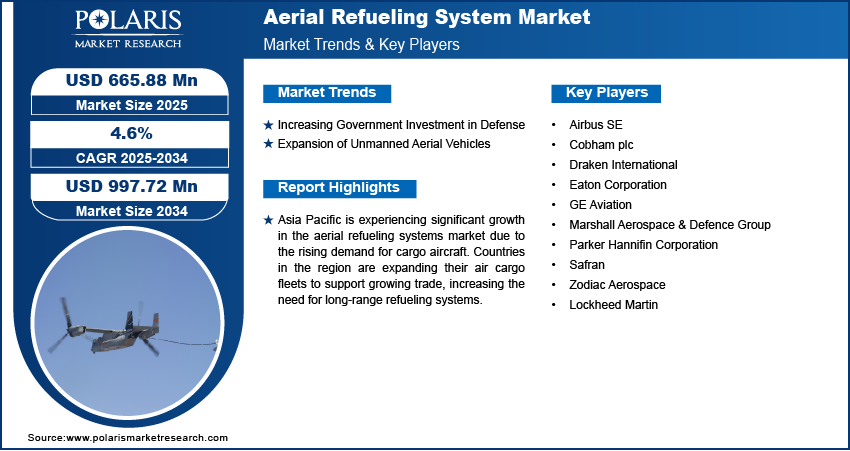

The global aerial refueling system market size was valued at USD 637.29 million in 2024, growing at a CAGR of 4.6% from 2025 to 2034. The rising need for long-duration defense operations and Technological advancements in aircraft and refueling systems are the key factors driving market growth.

Key Insights

- The combat & tanker segment is projected to experience a significant CAGR during the projection period, driven by the need for combat aircraft to extend their range for long missions.

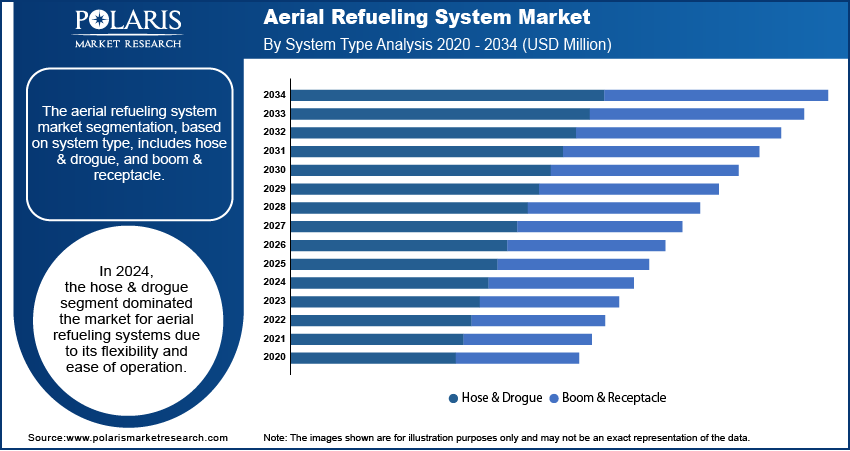

- The hose & drogue segment led the market in 2024, owing to its widespread use for refueling smaller and tactical aircraft.

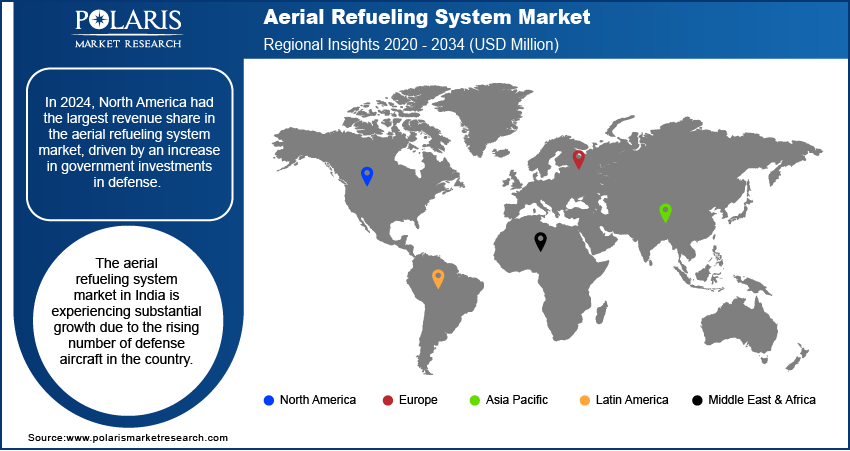

- North America accounted for the largest market revenue share in 2024, owing to increased government spending on defense and the presence of a large number of defense aircraft in countries like the US.

- Asia Pacific is experiencing significant growth due to the expansion of cargo fleets by major economies to support growing trade and logistics needs.

- The aerial refueling system market in India is witnessing substantial growth due to the rising number of defense aircraft in the country.

Industry Dynamics

- The rising defense investments by countries globally to expand their military aircraft fleets is a key factor fueling market development.

- The growing adoption of unmanned aerial vehicles (UAVs) for intelligence, surveillance, and reconnaissance (ISR) missions, where persistent coverage over large areas is crucial, is driving market expansion.

- Automation in refueling processes is expected to provide significant market opportunities in the coming years.

- High initial investment associated with aerial refueling systems may present market challenges.

Market Statistics

2024 Market Size: USD 637.29 million

2034 Projected Market Size: USD 997.72 million

CAGR (2025-2034): 4.6%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Aerial refueling systems allow one aircraft (the tanker) to transfer fuel to another (the receiver) while in flight, extending the range and operational time of the receiving aircraft. This is typically done using either a probe and drogue system or a flying boom, depending on the type of aircraft involved.

Modern military operations need aircraft to stay in the air for long periods for surveillance, reconnaissance, or combat missions. Aerial refueling systems enable this by allowing planes to stay airborne and continue their mission without having to land for fuel. These systems support defense forces to maintain readiness, flexibility, and operational efficiency, playing a key role in supporting extended mission durations in today’s military strategies. Thus, the increasing need for long-duration defense operations is driving aerial refueling systems market growth.

Technological advancements in both aircraft and refueling systems are driving the aerial refuel system market demand. New advancements, such as faster fuel transfer rates and lighter, more fuel-efficient tanker aircraft, are making aerial refueling faster and more cost-effective, thereby driving its adoption. Additionally, automation in refueling processes and the ability to refuel commercial unmanned aerial vehicles (UAVs) are opening new opportunities for growth in the market.

Aerial Refueling System Market Dynamic

Increasing Government Investment in Defense

Countries worldwide are increasing their defense investments, with many expanding their military aircraft fleets. This expansion includes adding more advanced aircraft, such as fighter jets, bombers, and surveillance planes, all of which need aerial refueling to extend their flight ranges. For instance, according to the United States Department of Defense, in 2024, the USA allocated funds worth USD 1.41 trillion for defense, reflecting a large volume of funds for military capabilities. Aerial refueling systems are crucial for ensuring these aircraft can operate effectively on long missions without needing to return to base for fuel. The global rise in defense budgets and the modernization of air forces drive demand for these systems, thereby driving the aerial refueling system market revenue.

Expansion of Unmanned Aerial Vehicles

The expansion of Unmanned Aerial Vehicles (UAVs) in the Aerial Refueling System market is being driven by the increasing demand for enhanced operational efficiency, extended range, and longer mission durations in both military and commercial applications. UAVs are revolutionizing modern warfare, surveillance, and logistics, but their operational endurance is often limited by fuel constraints. Integrating aerial refueling systems with UAVs is addressing this limitation, enabling them to stay airborne for extended periods without needing to land, significantly enhancing mission flexibility and effectiveness.

One of the key drivers of this market is the rising adoption of UAVs in defense operations for intelligence, surveillance, and reconnaissance (ISR) missions, where persistent coverage over large areas is crucial. Autonomous aerial refueling systems are being developed to support these missions, allowing UAVs to refuel mid-air without human intervention, thereby reducing response times and operational downtime. Thus, the ongoing advancements in refueling technologies, coupled with increasing government investments in UAV capabilities and a shift toward cost-effective operational solutions, are expected to fuel this market's growth in the coming years.

Aerial Refueling System Market Segment Insights

Assessment Based on Aircraft Type

The aerial refueling system market, based on aircraft type, is segmented into combat & tanker, turboprop & helicopter, and UAV. The combat & tanker segment is expected to experience significant CAGR in the global market during the forecast period. This is because combat aircraft, such as fighter jets and bombers, are required to extend their range for long missions. Tanker aircraft, which are equipped with refueling systems, are essential in supporting these aircraft during extended operations. Additionally, military forces worldwide are modernizing and expanding their fleets, due to which the demand for efficient aerial refueling systems in combat and tanker aircraft is rising, leading to segmental growth.

Evaluation Based on System Type

The aerial refueling system market, based on system type, is segmented into hose & drogue, and boom & receptacle. The hose & drogue segment dominated the aerial refueling system market in 2024. This system is commonly used for refueling smaller and tactical aircraft, such as fighter jets and helicopters. Its design involves a hose with a drogue at the end, which is deployed from the tanker aircraft, allowing the receiving aircraft to connect and receive fuel mid-flight. The hose and drogue setup is more flexible and easier to operate in various conditions, making it the preferred choice for many air forces worldwide. The popularity and versatility of this system are driving its dominance in the market.

Market Regional Analysis

By region, the study provides the aerial refueling system market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America had the largest share of revenue in the aerial refueling system market, mainly due to increased government spending on defense. These investments are helping to buy new aircraft and upgrade older ones, which is increasing the need for aerial refueling systems. Additionally, the United States has a large number of advanced defense aircraft. This high number of military planes is driving up the demand for refueling systems, boosting the growth of the aerial refueling system market in the region.

The Asia Pacific aerial refueling system market is experiencing significant growth in the global market due to the increasing demand for cargo aircraft. Countries in this region are expanding their air cargo fleets to support growing trade and logistics needs, due to which the need for long-range, efficient refueling systems is increasing. Aerial refueling allows cargo aircraft to operate over long distances without stopping for fuel, ensuring faster delivery times and improved efficiency. Additionally, many countries are investing in modernizing their fleets to meet the rising demand for air transport, thereby driving market expansion in the region.

The aerial refueling system market in India is experiencing substantial growth due to the increase in the number of defense aircraft. The Indian military is expanding and modernizing its air force with advanced fighter jets, bombers, and surveillance aircraft, all of which require aerial refueling to extend their operational range. For instance, according to the Indian Air Force Database, India presently operates a substantial fleet of defense aircraft totaling 2,846 units. Aerial refueling allows these aircraft to conduct longer missions without needing to return to base for fuel, driving demand for refueling systems and boosting market growth in the country.

Key Players and Competitive Insights

The aerial refueling system market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the aerial refueling system market include Airbus SE, Cobzzham plc, Draken International, Eaton Corporation, GE Aviation, Marshall Aerospace & Defence Group, Parker Hannifin Corporation, Safran, Zodiac Aerospace, and Lockheed Martin.

Eaton Corporation is a power management company that provides power solutions through industry-aerospace, electrical, vehicle, and hydraulic products and services. Its energy-efficient products and services enable customers to manage hydraulic, electrical, and mechanical power effectively. The company’s products and services are categorized under various business segments, including aerospace, vehicle, mobility, and hydraulics. The company offers multiple products, including actuators and motion control, clutches and brakes, cylinders, electric circuit protection, energy storage systems, hydraulic motors & generators, lighting and controls, plastics, pumps, utility & grid solutions, valves, and others. In addition, the company provides various services for electrical and power management, including consulting services, engineering studies, design and analysis, grid modernization, power systems automation and control, preventive maintenance, and other turnkey electrical services.

Airbus is a designer, manufacturer, and service provider of aeronautics, space, and others, with a comprehensive range of passenger airliners. The company also provides tankers, combat, transport, and mission aircraft in Europe. Further, Airbus offers civil and military rotorcraft solutions worldwide for helicopters. As of 2023, Airbus employs over 130,000 people across multiple locations in Europe, the Americas, and Asia and operates in the fields of commercial and military aircraft, helicopters, satellites, and defense systems. The company's product portfolio includes aircraft, such as the A320neo family of single-aisle aircraft, the A350 XWB wide-body aircraft, and the A330neo long-haul aircraft. The company is investing in new areas such as electric and hybrid-electric propulsion systems, autonomous systems, and urban air mobility.

List of Key Companies

- Airbus SE

- Cobham plc

- Draken International

- Eaton Corporation

- GE Aviation

- Marshall Aerospace & Defence Group

- Parker Hannifin Corporation

- Safran

- Zodiac Aerospace

- Lockheed Martin

Aerial Refueling System Industry Developments

In November 2024, a USD 3.5M contract was awarded to Eaton by the Air Force Research Lab to design a new podded refueling boom, enhancing in-flight refueling capabilities for traditional and non-traditional tanker aircraft.

Aerial Refueling System Market Segmentation

By Aircraft Type Outlook (Revenue – USD Million, 2020–2034)

- Combat & Tanker

- Turboprop & Helicopter

- UAV

By System Type Outlook (Revenue – USD Million, 2020–2034)

- Hose & Drogue

- Boom & Receptacle

By Components Outlook (Revenue – USD Million, 2020–2034)

- Hose

- Drogue

- Probe

- Boom

- Refueling Pods

- Others

By End User Outlook (Revenue – USD Million, 2020–2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aerial Refueling System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 637.29 million |

|

Market size value in 2025 |

USD 665.88 million |

|

Revenue Forecast by 2034 |

USD 997.72 million |

|

CAGR |

4.6% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The aerial refueling system market size was valued at USD 637.29 million in 2024 and is projected to grow to USD 997.72 million by 2034.

The global market is projected to register a CAGR of 4.6% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Airbus SE, Cobzzham plc, Draken International, Eaton Corporation, GE Aviation, Marshall Aerospace & Defence Group, Parker Hannifin Corporation, Safran, Zodiac Aerospace, and Lockheed Martin.

The combat & tanker segment is expected to experience significant CAGR in the global market during the forecast period due to extended surveillance and missions.

The hose & drogue segment dominated the market in 2024 due to its flexibility and ease of operation.