Aerospace & Defense Ducting Market Share, Size, Trends, Industry Analysis Report

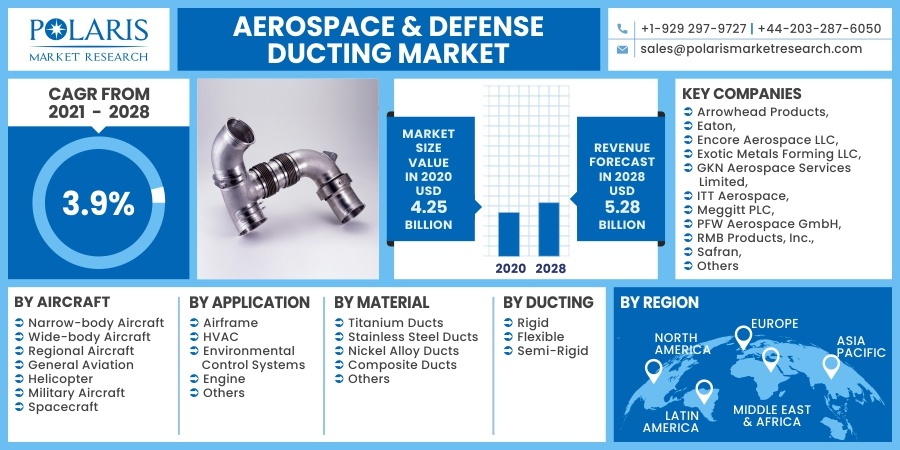

By Application (Airframe, HVAC, Environmental Control Systems, Engine, Others); By Aircraft; By Material; By Ducting; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 114

- Format: PDF

- Report ID: PM2081

- Base Year: 2020

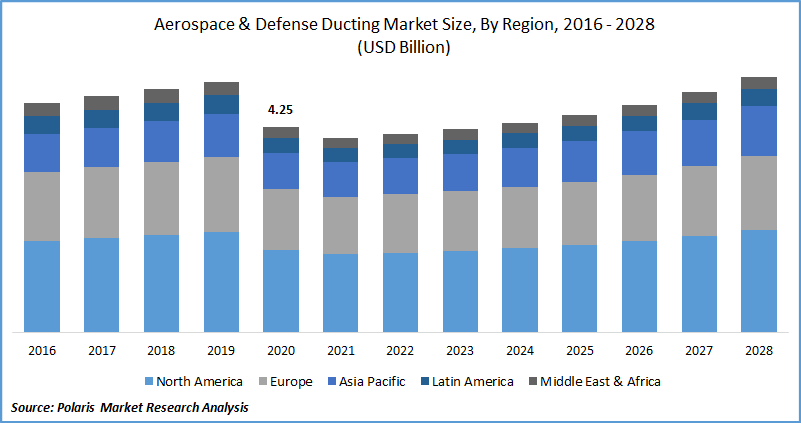

- Historical Data: 2016 - 2019

Report Outlook

The global aerospace & defense ducting market was valued at USD 4.25 billion in 2020 and is expected to grow at a CAGR of 3.9% during the forecast period. Increasing demand for efficient air conditioning, heating, and ventilation, increase in commercial aircraft deliveries, the emergence of lightweight ducting systems, and robust growth in space launch vehicles are some key factors driving the demand for aircraft ducting systems in the global aerospace & defense ducting market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The aircraft industry has been severely hit by the COVID-19 pandemic owing to a serious plunge in seating capacity by about 50% in 2020, translating into just 1.8 billion passengers making air travels in the year 2020 in contrast to 4.5 billion passengers in 2019 (as per ICAO estimates). Aircraft defense components market, including ducting business, has been vulnerable to such industry dynamics due to pandemic and witnessed a substantial double-digit dip in the year 2020.

However, with regain in consumers’ confidence in safe flight travel, the gradual opening of economies, and widespread penetration of COVID-19 vaccination, there is an expected bounce-back in air traffic substantiating the aerospace & defense ducting industry growth in the coming years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing commercial and regional aircraft deliveries is likely to fuel the demand for the global aerospace & defense ducting market. As per Boeing Commercial Outlook (2020-2039), the global aircraft industry is anticipated to witness 32,270 deliveries of single-aisle aircraft, 7,480 deliveries of widebody aircraft, and 2,430 regional jets over the next 20-years thereby showcasing a healthy aircraft defense market outlook in the foreseen future.

Furthermore, increasing aircraft fleet size has led to strong growth potential for aftermarket systems across the globe. Ageing HVAC systems of the older fleet of aircraft have led to significant opportunities for replacing ducting systems in the industry. Lightweight aircraft defense systems having high strength along with excellent corrosion resistance are gaining traction in the replacement demand of older systems.

Report Segmentation

The aircraft defense systems market is segmented in the most comprehensive way based on aircraft, application, material, ducting, and region.

|

By Aircraft |

By Application |

By Material |

By Ducting |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft

Narrow-body aircraft holds a gigantic share of the aircraft defense market-driven by bestselling short-haul aircraft platforms A320 and B737. Quick recovery in domestic air travel is driving the segment’s demand across the globe. Furthermore, the entry of Comac C919 aircraft is likely to substantiate the need during the forecast period. Wide-body aircraft have larger HVAC systems and generates higher demand for ducts.

However, the segment has witnessed a hefty decline amid pandemic due to a halt in international flights across the regions, causing a serious plunge in production rates of wide-body aircraft. Spacecraft segment witnessed robust growth in 2020 amid a pandemic mainly driven by a large number of small satellites launches with, SpaceX’s Starlink constellation being the major one. The market is expected to exhibit promising growth opportunities with thousands of new satellite launches pipelined in the aircraft defense systems market.

Insight by Application

Among application types, the airframe is likely to retain its dominance in the global aerospace & defense ducting systems market. There exists a significant demand for high-pressure ducts across the wing-to-body application areas. HVAC also generates substantial aircraft defense industry demand from advancements in ducting systems for aircraft cabin ventilation and pressure management systems.

Engine application has also led to a unique opportunity for aircraft defense systems in crucial components such as bleed-air ducting, APU ducting, and cryogenic propulsion lines. High-performance materials such as titanium ducts play a vital role in such application areas to withstand harsh environments and extreme pressure conditions.

Insight by Material

Nickel alloy ducts hold a significant share of the global aerospace & defense ducting systems market due to their considerable usage in ECS and HVAC application areas. Inconel 718 is the most widely used nickel alloy in aircraft ducting applications. Titanium ducts also hold a reasonable share of the aircraft defense industry due to their robust high strength and performance in extreme temperature environments.

Composite ducts are likely to exhibit the fastest growth with a rise in demand for lightweight materials due to stringent requirements to reduce carbon emissions in the industry. Thermoplastic composites are further gaining traction in the aerospace & defense ducting market.

Geographic Overview

Geographically, North America is estimated to maintain its leading position in the global aircraft defense systems market during the forecast period. The region is driven by the leading aircraft industry OEMs, tier players, aero-engine OEMs, MRO companies, and airlines. The region is also an early mover in the industry in adopting lightweight composite materials in ducting solutions of aircraft. U.S. acts as a growth engine for the region’s demand being a pioneer in the aerospace industry.

It is the single largest aircraft defense systems industry for various major platform types, including commercial aircraft, business jets, military aircraft, and spacecraft. Asia Pacific offers robust growth opportunities in the global aircraft defense systems market during the forecast period. China dominates the region’s market and is likely to drive the market in the coming years. Increasing air traffic, the shift of manufacturing base of leading OEMs to China, and the upcoming aircraft program COMAC C919 are likely to drive the aircraft defense systems market in the region in the near term.

Competitive Landscape

Key strategy adopted by leading players to gain competitive edge in the aircraft defense systems market includes merger & acquisitions, new product launches, integration of advanced manufacturing technologies such as 3D printed ducts. Further formation of long-term contracts and certification of ducting products in new and upcoming platforms are some other key strategic moves of aircraft ducting systems market players.

Some of the Major Players competing in the global aircraft defense systems market are Arrowhead Products, Eaton, Encore Aerospace LLC, Exotic Metals Forming LLC, GKN Aerospace Services Limited, ITT Aerospace, Meggitt PLC, PFW Aerospace GmbH, RMB Products, Inc., Safran, Saint-Gobain Performance Plastics, SEKISUI Aerospace, Senior Aerospace, Senior plc, Stelia Aerospace, and Unison Industries.

Aerospace & Defense Ducting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 4.25 billion |

|

Revenue forecast in 2028 |

USD 5.28 billion |

|

CAGR |

3.9% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft, By Application, By Material, By Ducting, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Arrowhead Products, Eaton, Encore Aerospace LLC, Exotic Metals Forming LLC, GKN Aerospace Services Limited, ITT Aerospace, Meggitt PLC, PFW Aerospace GmbH, RMB Products, Inc., Safran, Saint-Gobain Performance Plastics, SEKISUI Aerospace, Senior Aerospace, Senior plc, Stelia Aerospace, and Unison Industries. |