Agricultural Micronutrients Market Share, Size, Trends, Industry Analysis Report

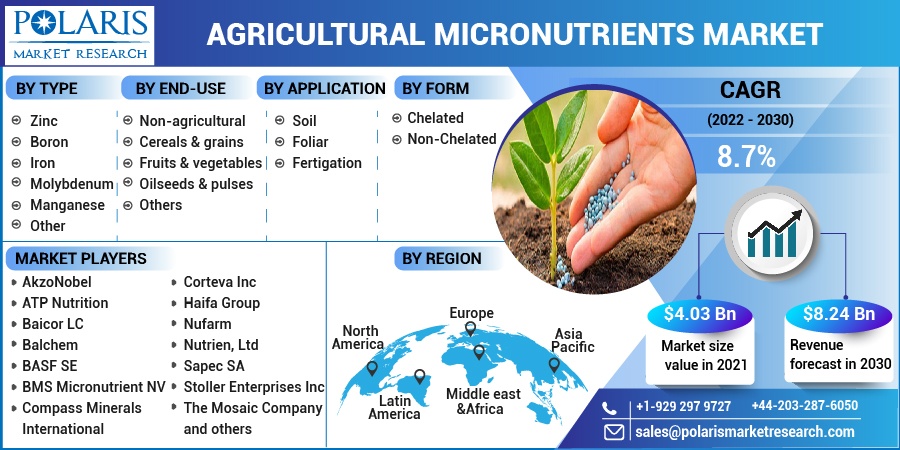

by Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper); By End-Use; By Application; By Form; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 112

- Format: PDF

- Report ID: PM2482

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

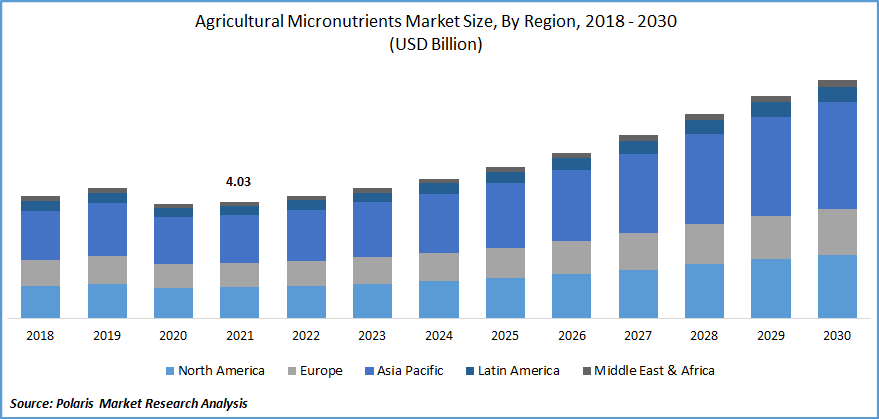

The global agricultural micronutrients market was valued at USD 4.03 billion in 2021 and is expected to grow at a CAGR of 8.7% during the forecast period. The agricultural micronutrients are helpful for plants' growth and play a significant role in balanced crop nutrition. These include Zinc (Zn), Copper (Cu), Manganese (Mn), Iron (Fe), Boron (B), and Molybdenum (Mo). Lack of any of these micronutrients in the soil can hamper plant growth and crop failure.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

With growing plant analysis and soil testing for the requirement of high-quality agricultural production, micronutrient deficiency has been affirmed in many soils, which will further boost the agricultural micronutrients market over the forecast period. The increasing use of chemical fertilizer is also driving the growth of agricultural micronutrients, as it protects crops from UV radiation and insects and offers increased yield, which will further enhance the overall development of the agricultural micronutrients market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing awareness of plant nutrition among growers and advancements in equipment is expected to boost the market in the forecast period. The global industry has seen an increase in growers, awareness of plant nutrition, and acceptance of the need for agricultural micronutrients. The application of zinc to corn has experienced wide acceptance worldwide. New development of technologies related to precision agricultural equipment that enable efficient administration of micronutrients is also expected to boost the industry growth in the forecast period.

The micronutrients are available in low proportions to the plant, and in most cases, their deficiencies can lead to diseases in crops. The crops suffer from imperfections and imbalances of micronutrients due to varying temperatures, humidity, and soil pH. Higher pH levels in the soil diminish the availability of micronutrients. The non-governmental and governmental organizations are stressing the mineral fertilization practices to curb the shortages.

Report Segmentation

The market is primarily segmented based on type, end-use, application, form, and region.

|

By Type |

By End-use |

By Application |

By Form |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The zinc segment is expected to have the fastest growth.

The zinc segment holds the largest share in the agricultural micronutrients market and is expected to grow further over the forecasted period owing to the increasing awareness of zinc deficiency in soils worldwide and its wide range of functions in the development of plants. This plays an essential micronutrient role in human metabolism, catalyzing more than 100 enzymes and facilitating protein folding to help & regulate gene expression.

Malnutrition, inflammatory bowel disease, alcoholism, and malabsorption disorders raise the risk of zinc insufficiency in patients. Growth retardation, nail dystrophy, lowered immunity, diarrhea, baldness, glossitis, and hypogonadism in men are all non-specific signs of zinc deficiency. After iron, zinc is the trace segment most widely distributed in the body. As a result, governments worldwide are working to reduce their deficit by raising the number of agricultural products. The industry for agricultural micronutrients will expand rapidly over the projected period due to the rising demand for zinc.

Fruits & Vegetables accounted for the second-largest market share in 2021

The fruits & vegetable segment is expected to dominate the industry owing to increasing nutrient loss incidences in fruits and vegetable crops. There is high demand for fruits & vegetables-based crops as staples in many developed and developing economies, along with the increase in micronutrient fertilizer application in these crops.

Fruits & vegetables have become an indispensable part of the human diet, especially with the surge in awareness regarding their nutritional value. The increased export prospect of fruits & vegetables has led to an increase in their production levels worldwide which has driven the requirement for micronutrient products to use agricultural inputs to meet export quality standards efficiently.

The rising health consciousness among consumers has fueled the consumption of fruits & vegetables worldwide. Furthermore, the global production of fruits & vegetables aims to meet the high demand. Therefore, the growing production and rising demand for fruits & vegetables boost the utilization of the global agricultural micronutrients market over the forecast period.

The soil sector is expected to hold the significant revenue share

The soil application segment accounted for a major share of the overall agriculture micronutrients market in 2021. The growing share of this segment is mainly attributed to its cost-effective and effortless application and the better micronutrient results over any other application methods.

Furthermore, the growing preference by farmers from developing economies for this method is mainly due to the rampant use of traditional agriculture methods in the current farming system, the occurrence of minimal resources, and minor adoption of the advanced fertilizer applications methods across the globe is fueling to the overall growth of the market over the forecast period.

The demand in the Asia Pacific is expected to witness significant growth

The Asia Pacific region accounted for the largest share worldwide and is expected to grow further over the forecast period in terms of value and volume, respectively. The increasing awareness among farmers and rising demand for high-value crops about micronutrients are expected to provide more opportunities for market expansion over the forecast period.

The adhering to government policies by Asia Pacific countries and the large subsidies for the nutrition of crops and fertilization sometimes offer up to a 100% margin to farmers. Fertilizers are the significant factors triggering the growth of this market across the region. The requirement for high-quality agricultural products and growing agricultural practices are some factors that are expected to drive the micronutrient fertilizer market growth in the Asia Pacific region over the projected period.

Competitive Insight

Some of the major players operating in the global agricultural micronutrients market include AkzoNobel, ATP Nutrition, Baicor LC, Balchem, BASF SE, BMS Micronutrient NV, Compass Minerals International, Coromandel International Ltd, Corteva Inc, Haifa Group, Helena Chemical Company, Nufarm, Nutrien, Ltd, Sapec SA, Stoller Enterprises Inc, and The Mosaic Company. To increase their consumer base and solidify their position in the market, these businesses are extending their reach across various geographies and breaking into new markets in emerging nations.

Recent Developments

In May 2022, Coromandel International introduced five new products under its product portfolio to support its crop protection range.

In February 2022, The Mosaic Company announced to partner with the Ethos Institute to support their supply chain partners to address all the impacts.

In September 2021, Coromandel International Limited launched a new fertilizer brand GroShakti Plus for farmers of India.

Agricultural Micronutrients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.03 billion |

|

Revenue forecast in 2030 |

USD 8.24 billion |

|

CAGR |

8.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, By Application, By Form, By Region |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America; Middle East & Africa |

|

Key companies |

AkzoNobel, ATP Nutrition, Baicor LC, Balchem, BASF SE, BMS Micronutrient NV, Compass Minerals International, Coromandel International Ltd, Corteva Inc, Haifa Group, Helena Chemical Company, Nufarm, Nutrien, Ltd, Sapec SA, Stoller Enterprises Inc, The Mosaic Company |