Airborne ISR Market Share, Size, Trends, Industry Analysis Report

By Type (Manned Airborne ISR System, Unmanned Airborne ISR System); By Operation (Intelligence, Surveillance, Reconnaissance); By System; By Application; By Regions; Segment Forecast, 2021 - 2028

- Published Date:May-2021

- Pages: 118

- Format: PDF

- Report ID: PM1876

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

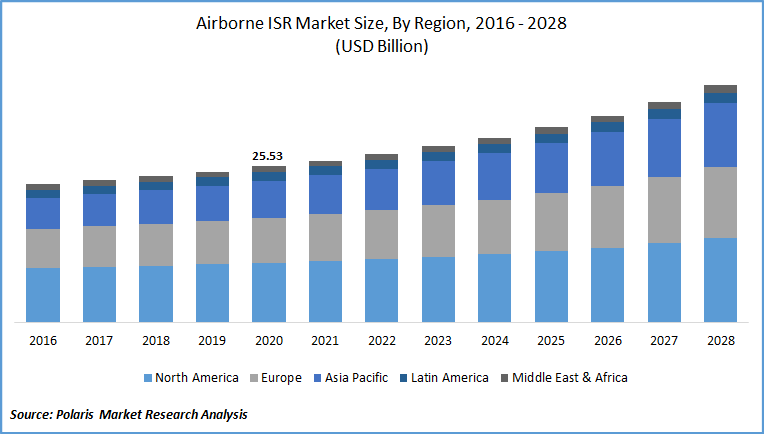

The global airborne ISR System market size was valued at USD 25.53 billion in 2020 and is anticipated to grow at a CAGR of 6.6% during the forecast period. The adoption of the systems has increased significantly across intelligence, defense, and homeland security. Airborne ISR systems offer intelligence, surveillance, and reconnaissance solutions, which include multi-intelligence data collection and processing, analysis, exploitation, and dissemination services.

Know more about this report: request for sample pages

The systems are equipped with sensors and radar systems, which are integrated with advanced technologies such as artificial intelligence and big data techniques to provide information analytics, effective decision support, improved geolocation and identification, protection against cyber-attacks, and enhanced situational awareness.

The increasing threat of terrorism & violence coupled with the rising need to provide safety provides growth opportunities for this market. High demand for airborne ISR systems from federal agencies, local, and state governments, and defense organizations for various purposes such as border monitoring, infrastructure security, and homeland security are contributing significantly to the growth of the market.

The applications offered by these systems include detection of humans and vehicles, perimeter protection, border security, wide-open area security, fenced compounds security, military installations, and surveillance of guarded facilities, among others.

A major factor positively affecting the growth of the market is the large investment by governments across the world due to increasing disputes, regional unrest, and terrorism. Military expenditure among various developed countries has gone up significantly and this phenomenon is expected to elevate in the coming years boosting the market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Market players are introducing technologically advanced airborne ISR systems in the market to appeal to a range of consumers. Innovations in the market have resulted in the launch of ISR systems with improved efficiency and reduced overall costs. The use of higher bandwidth of frequency range, and advanced hardware components increase the overall efficiency of airborne ISR systems.

Technological advancement in terms of miniaturization and improvement of components such as sensors, radars, antenna, transmitter, receiver, and diplexer among others, along with decreasing prices of the same is expected to further increase the demand for airborne ISR systems in the market.

In September 2019, L3Harris Technologies launched its advanced Network Control System, which is an ISR and C2 management tool developed for the U.S. Army Aviation. The solution observes, analyses, and presents high-quality video, telemetry, and annotated map views of the airborne, ground, and mobile vehicles to warfighters.

The system plans, monitors, analyzes, and stores data of pre- and post-mission situations for enhanced configuration, command, and control. It is also responsible for the management of communications, mitigation of environmental conditions, and control of data link reliability and data dissemination.

Airborne ISR Market Report Scope

The market is primarily segmented on the basis of type, operation, system, application, and region.

|

By Type |

By Operation |

By System |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Type Outlook

On the basis of type, the market is segmented into manned and unmanned. The demand for unmanned airborne ISR is expected to increase during the forecast period. Unmanned airborne ISR is increasingly being used for critical military operations owing to ease of deployment, lower risks, and reduced costs. Unmanned systems require lower costs to purchase, fuel, and maintain. They offer greater efficiency and can operate for a longer duration. Greater accuracy is another feature boosting the growth of unmanned systems.

Operation Outlook

The operation segment has been divided into intelligence, surveillance, and reconnaissance. In 2020, the surveillance segment accounted for the highest market share. ISR is integrated with advanced equipment to offer coordinated acquisition, processing, and provision of accurate and timely surveillance to assist in an effective decision-making process.

Technological advancements in components such as antenna, transmitter, receiver, and diplexer among others, which are majorly used in airborne ISR systems, along with decreasing prices of the same is expected to further increase the use of airborne ISR system for surveillance.

System Outlook

On the basis of the system, the market is segmented into airborne early warning and control, signals intelligence, maritime patrol, airborne ground surveillance, electronic warfare, and others. A massive increase in the use of electronic warfare has been observed. Electronic warfare systems include radar warning receiver, electronic support measure, electronic intelligence, electronic attack, communications intelligence, and anti-jam GPS solutions.

Increasing investments by governments across the world for improvement of defense infrastructure and the growing need to provide national safety provides growth opportunities for this market. High demand from federal agencies, local, and state governments for various purposes such as border monitoring, infrastructure security, and homeland security are contributing significantly to the growth of the market.

Application Outlook

On the basis of application, the market is segmented into Law Enforcement, Surveillance & Reconnaissance, Search & Rescue, Delivery & Logistics, Engineering, Surveying and Mapping, and Others. The demand for Surveillance & Reconnaissance has increased over the past few years.

Airborne ISR systems are equipped with high-definition action cameras with superior quality of pixel resolution, motion sensors, thermal sensors, laser sensors, and infrared sensors among others to capture information, which is then analyzed and used for various purposes such as imaging, security, and others.

Airborne ISR systems are used for applications such as detection of mines and explosives, hidden tunnels and buried stores, a survey of large terrains for detection, identification, and tracking of fixed ground targets & moving ground targets.

Geographic Overview

North America market dominated the global airborne ISR market in 2020. The U.S accounts for approximately 46% of the global military spending. The rising investment in the field of the defense sector, along with technological advancement in the telecommunication industry is expected to drive the airborne ISR market during the forecast period.

Implementation of airborne ISR systems for border security and monitoring high-risk situations by federal agencies, government, and non-government organizations is likely to raise the market investment. The U.S. government has been using airborne ISR systems for various defense, and security purposes, which includes tracking and detection of threats, surveillance, search, and rescue.

Competitive Landscape

The leading players in the market include The Boeing Company, L3 Technologies Inc., Thales Raytheon Systems, Harris Corporation, General Dynamics Corporation, Northrop Grumman Corporation, UTC Aerospace Systems, Rockwell Collins Inc., General Atomics, BAE Systems PLC, Elbit Systems Ltd, Lockheed Martin Corporation, FLIR Systems Inc., Kratos Defense & Security Solutions Inc., Airbus, and CACI International Inc.