Airborne SATCOM Market Share, Size, Trends, Industry Analysis Report

By Platform; By Component; By Application; By Frequency; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2817

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

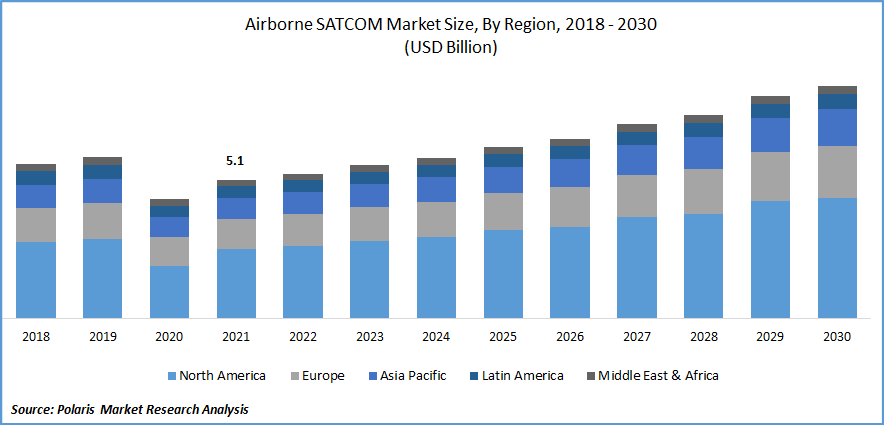

The global airborne SATCOM market was valued at USD 5.1 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period.

Data and voice services for aviation and aerospace use cases are facilitated by airborne SATCOM equipment. This is the main factor driving the market for airborne SATCOM globally. This equipment guarantees efficient flight operations and traveler security. The global airborne SATCOM market is expanding due to the increasing demand from passengers and commercial airlines.

Know more about this report: Request for sample pages

Aviation communication systems must be modernized to improve aircraft safety and reduce flight delays. It offers better aircraft routing choices, improved pilot communication, and increased effectiveness. By utilizing specialized SATCOM on-the-move solutions, North America and Europe have been concentrating on updating and reworking their airplane communication systems.

New technologies and components are incorporated into aircraft and aviation infrastructure as part of modernization programs to improve communication with air traffic controllers, facilitate multidimensional aircraft tracking, and enhance aircraft navigation by producing images of the nearing external topography. For these programs to have better communication skills, airborne SATCOM is required.

Additionally, as part of retrofitting or upgrading efforts, airborne SATCOM can be put in the existing sleet, propelling market growth. For instance January 2022, European nations adopted the Single European Sky ATM Research (SESAR) airspace modernization effort to enhance their Air Traffic Management (ATM). In this program, cutting-edge SATCOM on-the-go technologies are installed to eliminate European air traffic control inefficiencies. The multiple global initiatives to update airplane communication systems are anticipated to raise demand for airborne SATCOM.

Furthermore, an EMEA government unmanned platform will initially be able to communicate outside line-of-sight owing to the new Ka-band capability. It is compatible with millimeter and civil frequencies. These upgrade advancements by major players are boosting market growth.

The COVID-19 pandemic hindered the expansion of worldwide business by severely disrupting the supply chain and production processes and banning international trade. The pandemic's effects on the aviation sector's development in 2020 were also limited by a lack of innovations, component production, and aircraft acquisition.

The lockdowns immediately impacted the airborne SATCOM business’s production of helicopters, commercial and naval aircraft, and other aircraft types. In important areas for aircraft manufacture, the pandemic temporarily halted operations. As a result, several critical technologies and material suppliers shifted their focus to cutting expenses and reducing output.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

For real-time communication & intelligence, observation, and reconnaissance (ISR) data to the ground stations, UAVs with tactical, long-range capabilities are deployed. Beyond-line-of-sight (BLOS) activities are continuously broadband-connected due to reliable, elevated satellite communications. Small aerial vehicles (UAVs) with excellent power and capacity L-Band SATCOM terminals and small footprints have seen a substantial rise in demand in recent years. For instance, in October 2021, The FB250 & Fleet One L-band terminals from Intellian received Inmarsat type certification; the company declared the “Intellian Fleet One” terminal is a compact, reliable, and affordable option for 150kbps simultaneous phone and data transmission.

Furthermore, in January 2022, Ultra intelligence & Communications was permitted by Inmarsat, the industry leader in global mobile satellite communications, to utilize its compact SATCOM terminal with the network of the Inmarsat APAC Xpress. In terms of size, lightness, power, and improved performance standards, the new ultra-terminal is a front-runner for developing a communications capacity on the battlefield that will permit mission-critical contact between soldiers there and command and control centers.

Additionally, it guarantees continual, secure access to voice conversations, emails, internet-based messages, navigational warnings, and alerts. To develop the hardware antennas & terminals with low size, weight, & Power (SWaP) & high capabilities, leading satellite makers are collaborating with cutting-edge interface manufacturers. The airborne SATCOM industry will have the chance to grow due to the rising demand for high-throughput, beyond-line-of-sight (BLOS) connections for tiny aviation platforms globally.

Report Segmentation

The market is primarily segmented based on platform, component, application, frequency, and region.

|

By Platform |

By Component |

By Application |

By Frequency |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The commercial segment is expected to witness the fastest growth

The growth of the broadcasting industry has been impacted by the rise in demand for satellite technology for pay-TV and radio uses. Satcoms provides connectivity to the remotest places. With network coverage & changing lifestyles, the internet has become more widely adopted in the past few years. Applications in agriculture & public safety also should use Satcom to transfer data using navigation and observation satellites.

The transceivers segment industry accounted for the highest market share in 2021

Satcom transceivers garnered the largest revenue share due to the demand for trans-continental coverage across networks. The main applications for the Satcom device are weather prediction, military operations, navigation, & during critical communications. The system gathers real-time data during conflicts, too, among many other things, track movements, recognize targets, and discover secret passageways. The market for airborne Satcom is expanding due to increasing demand for high throughput satellite services and the spread of cloud-based services in terrestrial mobility platforms.

The demand in North America is expected to witness significant growth

North America is expected to hold a sizable portion of the airborne SATCOM market during the projected period. The increased need for airborne SATCOM solutions in defense and commercial applications is responsible for the market expansion in the area. Additionally, it is anticipated that the presence of the top market participants in the area and the government's increasing investment in constructing military infrastructure will further fuel market expansion.

In terms of market share in 2021, Europe came in second. With the ongoing implementation of new safety laws and emission standards, aircraft manufacturers in this region focus on creating more unique generation aircraft types. Integrating complex subsystems and cutting-edge technologies in airplanes is required to meet these demanding compliance standards. One of the main drivers of the increase in airborne SATCOM market share in Europe is the presence of a few prominent aircraft manufacturers. Since air travel is the most popular mode of transportation in Europe, the aviation sector is one of the most important contributors to the continent's overall GDP.

Competitive Insight

Some of the major players operating in the global market include Aselsan, Astronics Corporation, Cobham, Collins Aerospace, General Dynamics, Gilat Satellite Networks, Harris Corporation, Honeywell International, Hughes Network System, Israel Aerospace, Norsat International, Orbit Communication, Raytheon Company, Thales Group, and Viasat.

Recent Developments

In January 2022, “Iridium Certus Developmental Over the Air License” for Collins Aerospace's new Active Low Gain Antenna (ALGA) & High Gain Antenna (HGA) was granted. The most recent license was granted to Collins for its 2022 release of the “Iridium Certus airborne satellite communications (SATCOM) technology.”

In March 2022, Dubai Aviation Engineering Projects (DAEP) chose Ihales' ground-breaking Air Traffic Management (ATM) system, TopSky Air Traffic Control (AIC), to boost the safety, capacity, and effectiveness of air navigation systems.

In April 2022, General Dynamics Mission Systems provided Boeing with a 1,000 Iri-band radome for commercial and military aircraft installation. These radomes shield the aircraft's antennas, providing dependable in-flight SATCOM, including live television and Wi-Fi internet connection.

Airborne SATCOM Market Report Scope

|

Report Attributes |

Details |

|

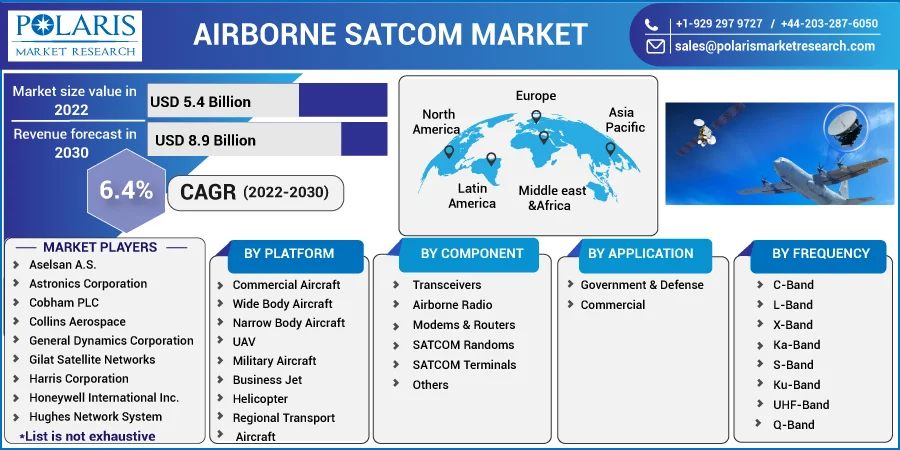

Market size value in 2022 |

USD 5.4 billion |

|

Revenue forecast in 2030 |

USD 8.9 billion |

|

CAGR |

6.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By platform, By Component, By Application, By Frequency, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aselsan A.S., Astronics Corporation, Cobham PLC, Collins Aerospace, General Dynamics Corporation, Gilat Satellite Networks, Harris Corporation, Honeywell International Inc., Hughes Network System, Israel Aerospace Industries, Norsat International Inc., Orbit Communication system Ltd, Raytheon Company, Thales Group, and Viasat, Inc. |