Aircraft Braking System Market Share, Size, Trends, Industry Analysis Report

By Component (Brake Discs, Wheels, Electronics, Brake Housing, Others), By End-Use (Line-Fit, Retrofit), By Aircraft, By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 123

- Format: PDF

- Report ID: PM2089

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

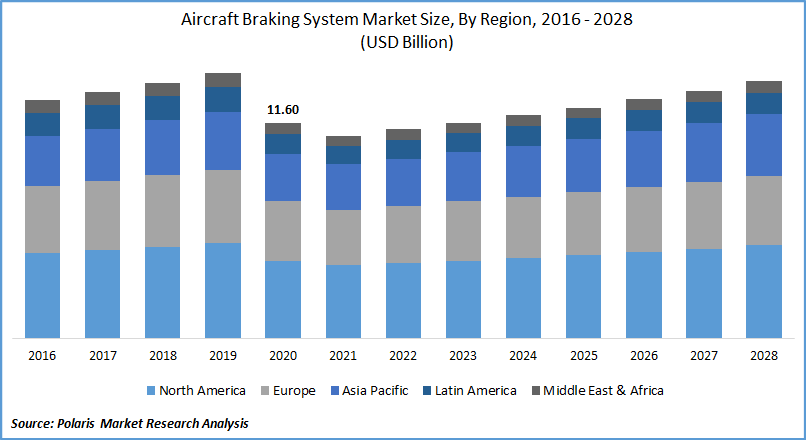

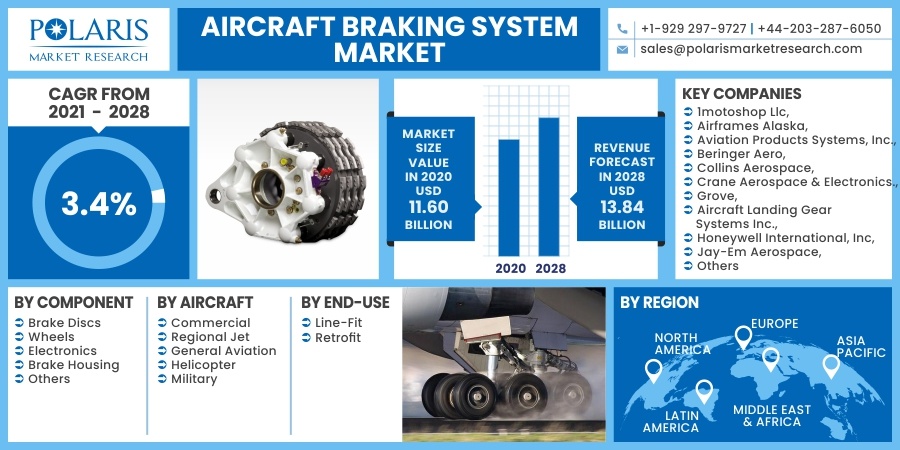

The global aircraft braking system market was valued at USD 11.60 billion in 2020 and is expected to grow at a CAGR of 3.4% during the forecast period. Braking system in aircraft have been gradually witnessing advancements in designs and technology such as integrating electronics with fly-by-wire braking, adopting carbon brake discs reducing significant weight, and increasing penetration of multiple discs system in modern aircraft platforms are driving the industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Organic growth in airplane deliveries and large commercial and regional airplane fleet size further substantiates aircraft braking system market demand globally. COVID-19 pandemic trembled the entire airplane industry value chain with a hefty decline in air travel due to widespread virus across the world. Although airplane braking system hold a very small share in the entire industrial economy but could not escape from the deadly grip of the pandemic witnessing a severe decline in 2020.

However, with the gradual opening of economies worldwide from The Great Lockdown amid the pandemic, the aircraft industry has positive signs of recovery, with domestic air travel recovering at the highest rate and international air travel to follow suit in the coming years as well.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Shorter replacement cycle of brakes and an aging airplane fleet is anticipated to be a relevant driving factor in the aircraft braking system market. An airplane brake generally has a lifecycle of 1,000-2000 landings before replacement. Increasing focus on the enhanced safety of an airplane during ground operations, such as landing, takeoff, and taxiing, is also a key factor driving the industry.

Furthermore, the increase in airplane production due to the rise in air traffic globally substantiates the braking system market demand at the OEM level. Additionally, the increasing demand for lightweight and efficient components from the industry is another driving factor fueling the airplane braking market growth. Carbon brakes offer substantial weight reduction, high durability, and reduced maintenance cost over conventional steel brakes, which is surging its replacement demand in the aircraft braking system market.

Report Segmentation

The market is segmented in the most comprehensive way based on component, aircraft, end-use, and region.

|

By Component |

By Aircraft |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

Brake disks account for a significant share of the global market and are also attributed to depict impressive growth in the worldwide market during the forecast period driven by the emergence of carbon brakes. Carbon brakes have advanced lightweight carbon fiber construction, which offers significant weight reduction over conventional sintered steel counterparts, thereby contributing towards improvement in aircraft fuel economy.

The electronics segment is also likely to offer healthy growth opportunities in the market driven by the transition towards electrically activated braking system. Modern aircraft programs demand lighter and electronically integrated sensors into braking, thereby replacing the traditional bulky hydraulic fluid system and pumps to save weight and improve fuel economy, proliferating market growth at an excellent rate.

Insight by Aircraft

The commercial aircraft segment is expected to hold the largest share of the global market during the foreseen future, driven by increasing demand for lightweight yet high-performance next-generation braking system in commercial airplane programs. There is also a gradual shift towards multiple discs braking system in large commercial airplane platforms driven by a surge in demand for more powerful disc system for extended life and reduced airplane maintenance.

Modern commercial aircraft platforms such as B737 Max, A320 neo, A350XWB, and B777x are increasingly replacing conventional steel-based braking system with advanced carbon fiber based braking system driven by various operation advantages like longer life, robust performance, weight reduction, and reduction in fuel consumption leading to lower CO2 emissions.

Military aircraft require specialized braking system to meet the highly severe environment and temperature conditions with efficient performance. Next-generation military aircraft platforms are deployed with braking system with advanced friction and antioxidant materials, the quick turnaround time for combat situations, and extremely high reliability driving the market demand globally.

Insight by End-Use

Based on the End-Use, the fine-fit segment accounts for significant global market dominance, driven by new aircraft deliveries to meet the ever-increasing air traffic. As per May 2021 data of IATA (International Air Transport Association), the global air passenger traffic is estimated to recover to 52% and 88% of pre-pandemic levels (2019) during the years 2021 and 2022, respectively.

This is likely to substantiate new aircraft orders from airlines deferring deliveries amid pandemic, which will drive the market demand globally. The retrofit segment is attributed to grow at the highest CAGR in the global market during the forecast period. Wheels and brakes tend to be among the most predictable maintenance and replacement component in an aircraft due to wear caused by every landing and takeoff time usage. Modern carbon brakes require less maintenance but need a complete replacement of all discs when worn, fueling substantial aftermarket demand.

Geographic Overview

North America is attributed to remain the largest region of the market during the forecast period. The region is the largest producer of commercial aircraft, business jets, and military aircraft, elevating its position in the global market. As per data of SIPRI (Stockholm International Peace Research Institute), in the year 2020, the US defense spending topped in the world with USD 778 billion outpacing the following nine big countries in terms of defense spending.

Asia Pacific is anticipated to witness the fastest growth in the market in the near-term driven by increasing penetration of advanced lightweight and high-performance braking system over conventional hydraulic braking system which is still widely used by the airlines in the region. Emerging Asian economies such as China and India are increasingly focusing on improving domestic production in the industry rather than relying on imports from Western Economies, which is fueling the market of the region.

Competitive Landscape

Major players are focusing on advancements in braking system offerings such as electrical braking system to reduce maintenance, improve reliability, and reduce the overall weight of the braking system. Furthermore, leading players are also working on improving the lifespan of braking system providing cost savings to the airlines.

Key players competing in the global market are 1motoshop Llc, Airframes Alaska, Aviation Products Systems, Inc., Beringer Aero, Collins Aerospace, Crane Aerospace & Electronics., Grove, Aircraft Landing Gear Systems Inc., Honeywell International, Inc, Jay-Em Aerospace, Matco Mfg., Mcfarlane Aviation, Inc., Meggitt Plc, Parker-Hannifin Corporation, Rapco, Inc., Safran, Sonex Aircraft, Llc, Tactair, and The Carlyle Johnson Machine Company, Llc.

Aircraft Braking System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 11.60 billion |

|

Revenue forecast in 2028 |

USD 13.84 billion |

|

CAGR |

3.4% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Component, By Aircraft, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

1motoshop Llc, Airframes Alaska, Aviation Products Systems, Inc., Beringer Aero, Collins Aerospace, Crane Aerospace & Electronics., Grove, Aircraft Landing Gear Systems Inc., Honeywell International, Inc, Jay-Em Aerospace, Matco Mfg., Mcfarlane Aviation, Inc., Meggitt Plc, Parker-Hannifin Corporation, Rapco, Inc., Safran, Sonex Aircraft, Llc, Tactair, and The Carlyle Johnson Machine Company, Llc |