Aircraft Cabin Interior Composites Market, By Aircraft (Narrow-Body, Wide-body, Regional, General Aviation, Military); By Application; By Matrix; By Fiber; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 123

- Format: PDF

- Report ID: PM2012

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

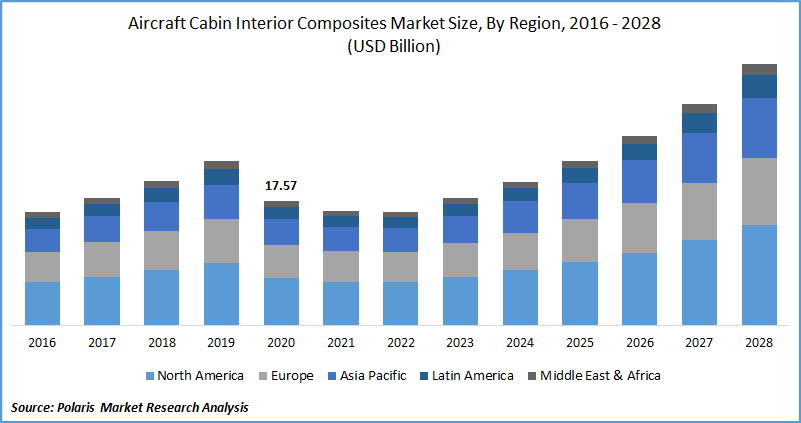

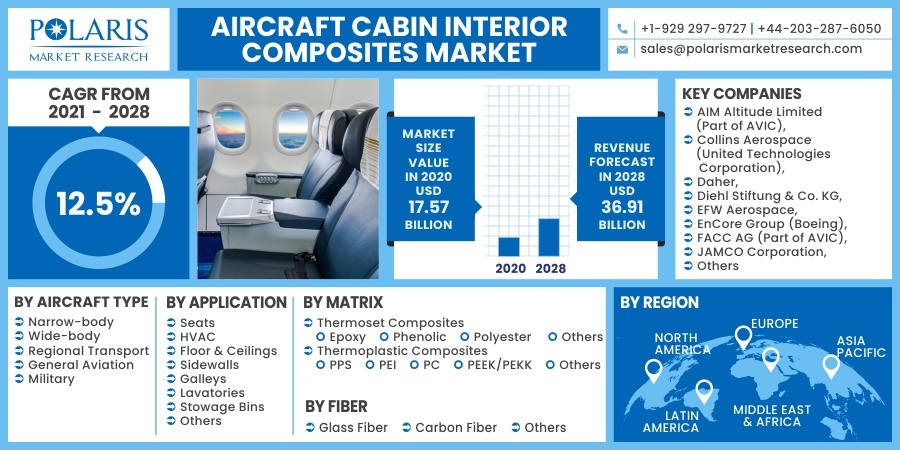

The global aircraft cabin interior composites market was valued at USD 17.57 billion expected to grow at a CAGR of 12.5% during the forecast period. Increasing market demand for lightweight materials in cabin interiors to meet stringent carbon emission norms and enhance the fuel efficiency of the airplane is the primary driver fueling the growth of the aircraft cabin interior composites market. Next-generation aircraft programs such as Boeing B787 and Airbus A350XWB have more than 50% content of composites replacing the metal counterparts such as steel and aluminum.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The aircraft industry has been drastically hit by the COVID-19 pandemic, which has led to a hefty downfall in air traffic and new airplane production, mainly due to air travel restrictions on domestic and international flights across the world. The market for airplane cabin interior composites is also witnessing turbulence in the short term, and it would take at least 3-5 years to recover from the heavy financial losses and reach pre-COVID levels. However, with gradual lift in lockdowns and opening of economies, domestic air travel is recouping at an impressive rate, showcasing positive for the industry.

Industry Dynamics

Growth Drivers

Organic growth in aircraft production and deliveries expected surge in air passenger and air cargo traffic, the large fleet size of aircraft fueling the market demand for cabin retrofits and increasing demand for advanced lightweight composite materials to enhance the fuel efficiency of an airplane are key factors burgeoning the aircraft cabin interior composites market demand.

Stringent emission regulations by the regulatory bodies in the aircraft industry have led to a robust increase in penetration of lightweight materials, including composites in modern airplane platforms such as A350XWB, B787, A220, and B777x. A significant reduction in operating costs can be achieved by integrating high content of advanced cabin interior materials.

Know more about this report: request for sample pages

For instance, Airbus A350XWB has 70% content of advanced materials, of which 53% is composites which contribute towards a reduction in operating costs by 25% with lower fuel burns (as claimed by Airbus) and reduction in CO2 emissions when compared to older generation aircraft.

Report Segmentation

The market is segmented in the most comprehensive way based on aircraft type, application, matrix, fiber, and region.

|

By Aircraft Type |

By Application |

By Matrix |

By Fiber |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft Type

The narrow-body aircraft segment is likely to remain the vanguard of the market driven by high production rates, large fleet size, and increasing composite content in newer variants of aircraft. Wide-body aircraft programs such as A350XWB and B787 have a significantly higher penetration of composites thereby representing strong market opportunities in the segment.

Modern narrow-body aircraft programs such as COMAC C919, Irkut MC-21, and Airbus A220 have escalated the usage of composites with an aim to achieve fuel economy and reduction in carbon emissions. For instance, an Airbus A220 (formally Bombardier C-Series) has about 70% usage of advanced materials of which 46% is composite materials.

Insight by Application

The floor & ceilings cabin interior segment is attributed to account for the largest share in the global market during the forecast period. Floor beams and floor panel skins of the modern aircraft programs have been manufactured with composites over aluminum which is driving the segment. Carbon-epoxy composite skins and Nomex honeycomb core materials are the perennial choices of composites in the flooring application area.

HVAC (Heating Ventilation and Air Conditioning) cabin interior application is likely to offer the highest growth opportunities in the global cabin interior market during the foreseen future, with growing interest in lightweight yet high-performance thermoplastic composites in ducts for cabin interiors. Significant weight reduction, recyclability, and high performance are some key attributes driving the cabin interior composites in the market segment.

Insight by Matrix

Based on the matrix type, the thermoset composites segment holds high dominance in the global market driven by high usage of epoxy resin along with carbon fiber composites across application cabin interiors verticals such as the floor, sidewalls, ceilings, stowage bin, lavatory, and galleys.

The thermoplastic composites segment is estimated to witness the highest growth in the coming years, with PPS, PEEK, and PEI resins being the prominent materials in cabin interiors. PPS resin offers excellent chemical resistance along with high performance making it an ideal choice of resin material for cabin interiors. Similarly, PEI resin offers outstanding FST properties, making it a suitable material for certain cabin interior applications.

Geographic Overview

Geographically, North America dominates the global market driven by composite-rich aircraft platforms such as B787, A220, B777x, and B737 Max. The region also has a suit of legacy business jets that have seen a surge in advanced materials, including composites in their cabin interiors. Furthermore, the strong fleet size of the region with sheer interest in switching to composites from traditional metals is creating substantial market demand from cabin retrofits.

Asia Pacific cabin interior composites are expected to showcase promising growth over the study period, driven by the largest fleet size substantiating market demand from cabin retrofits and the increase in market demand for the new commercial aircraft. Upcoming indigenous commercial and regional aircraft such as COMAC C919 and Mitsubishi MRJ further escalate the region's cabin interior materials market demand.

Competitive Insight

Airlines have a growing interest in customizing cabin interiors and opt for buyer furnished equipment (BFE). This has led to the emergence of modern interiors with advanced materials creating room for market players to gain a competitive edge. The market is also experiencing consolidation, with big tier players acquiring smaller players serving the industry. For instance, Safran acquisition of Zodiac Aerospace, Rockwell Collins Acquisition of B/E Aerospace, and UTC's acquisition of Rockwell Collins are some renowned acquisitions in the industry that took place in the past few years.

Some of the key players competing in the global market are AIM Altitude Limited (Part of AVIC), Collins Aerospace (United Technologies Corporation), Daher, Diehl Stiftung & Co. KG, EFW Aerospace, EnCore Group (Boeing), FACC AG (Part of AVIC), Dutch Thermoplastic Components B.V. (DTC), JAMCO Corporation, Triumph Group Inc., Safran SA, and Singapore Technologies Engineering Ltd, The Gill Corporation, and The Nordam Group.

Aircraft Cabin Interior Composites Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 17.57 billion |

|

Revenue forecast in 2028 |

USD 36.91 billion |

|

CAGR |

12.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft Type, By Application, By Matrix, By Fiber, and By Region. |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AIM Altitude Limited (Part of AVIC), Collins Aerospace (United Technologies Corporation), Daher, Diehl Stiftung & Co. KG, EFW Aerospace, EnCore Group (Boeing), FACC AG (Part of AVIC), Dutch Thermoplastic Components B.V. (DTC), JAMCO Corporation, Triumph Group Inc., Safran SA, and Singapore Technologies Engineering Ltd, The Gill Corporation, and The Nordam Group |