Aircraft Filters Market Share, Size, Trends, Industry Analysis Report

By Aircraft Type (Narrow-body, Wide-body, Regional, General Aviation, Helicopter, Military); By Product (Fluid, Air); by Application (Cabin, Engine, Hydraulics, Avionics, Others); By End-Use (OEM, Aftermarket), By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 112

- Format: PDF

- Report ID: PM2079

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

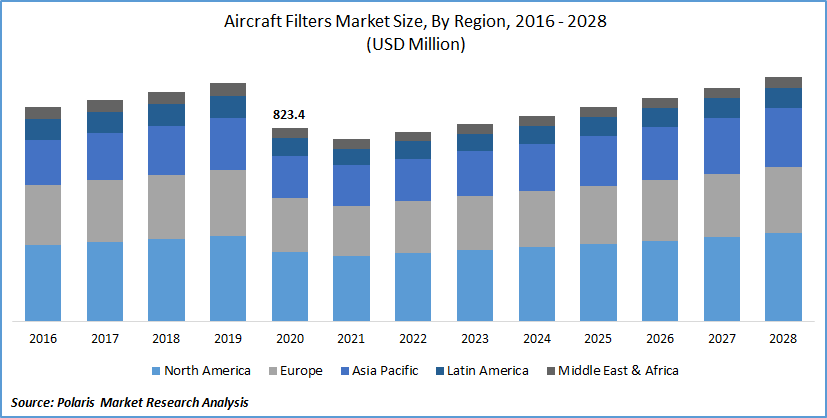

The global aircraft filters market was valued at USD 823.4 million in 2020 and is expected to grow at a CAGR of 4.3% during the forecast period. Increasing airlines' focus on cabin safety and air quality, the short replacement cycle of filters, increasing air passenger traffic coupled with increasing flight hours, and growing demand from fuel filtration and refueling filter products are key factors boosting the demand for the aircraft filters market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

As per ICOA's (Aug 2021) outlook, passenger traffic resulted in an overall 50% reduction in seats offered by airlines and an overall 2,699 million passengers' reduction in the year 2020 over 2019 owing to the severe impact of the COVID-19 pandemic. Based on ICOA's preliminary estimates, a further 37% to 40% reduction in seats offered by airlines is estimated to be in 2021 compared to 2019 levels.

It would take two to three years of recovery cycle for the aircraft industry to recoup from the losses caused by the pandemic. However, the industry's long-term outlook looks promising, thereby creating substantial opportunities for industry stakeholders, including filter suppliers competing in the global aircraft filters market. Furthermore, strong industry fundamentals such as thousands of backlog orders and expected recovery in the worldwide air passenger as well as cargo traffic ensure a resilient outlook for the aircraft filters market, including niche components such as filtration in the aircraft industry.

In the post-COVID era, there is a high focus on controlling microbial and viral containment through efficient filtration. The shift from chemical additives and coatings towards filters is further escalating the market demand across the globe. There are also growing advancements in improvising orders and VOCs (volatile organic compounds) with the addition of carbon filters.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing market demand for improving operating reliability and performance, growing concern over the increasing component service life, and increasing airline's need to reduce maintenance costs fuel the market demand for filters in the global market. Additionally, increasing market demand for a safe, healthy, and comfortable environment in the cabin for passengers and crew on board. Organic growth in aircraft production and deliveries further ensures healthy market demand for filtration in the global aircraft filters market.

Report Segmentation

The market is segmented in the most comprehensive way based on aircraft type, product, application, end-use, and region.

|

By Aircraft Type |

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Aircraft Type

The cabin air quality of aircraft is one of the key concerns for passengers' safety and enhanced comfort on board. Short-haul or narrow-body aircraft have showcased significant usage of filters as cabin air quality has garnered increased attention with the passage of time, making it the most dominant aircraft type segment in the global market. Amid pandemic, HEPA (High-Efficiency Particulate Air) filters have gained more recognition as it is highly efficient in filtering out bacteria and viruses in recirculated cabin air.

In the general aviation segment, business jets have also seen a sharp focus on cabin air quality with various business jets using 100% fresh air systems, compressing, and sterilization air, whereas HEPA filters are most used within jets with systems that recirculate cabin's air. For instance, Bombardier Global 6000, 6500, and 7500 business jet models are fitted with HEPA filters. Similarly, Cessna Citation Longitude and Citation Latitude have HEPA filters installed.

Insight by Application

The cabin application segment is depicted to grow at the highest CAGR in the global market during the forecast period. Growing concern over cabin air quality and passenger health and safety has led to advancement in filters for both OE as well as retrofit demand, especially from commercial aircraft programs. Modern cabin air filters in aircraft are designed with an excellent capability of trapping very tiny air particles. For instance, Collins Aerospace (Part of Raytheon Technologies Inc.) introduced a cabin air HEPA filter kit for use on Dash 8 aircraft, which traps a minimum of 99.97% of airborne particles such as bacteria and viruses that have a diameter of 0.3 microns.

Insight by End-Use

The OEM market contributes a higher share of the global market due to significant market demand from upgraded filters in ever-increasing aircraft deliveries. Leading OEMs and tier players have been revolutionizing filtration technologies and offering high-efficiency fine-filtration solutions for line-fit applications in modern aircraft platforms. Besides, extended filter service life, reduced maintenance cost, and extensive control of bacterial and viral containment, eliminating chemical additives and coatings are driving the OEM filters market globally.

The replacement cycle of filters can be as low as 300 flight hours, generating substantial aftermarket opportunities driving the segment's demand at an impressive rate. Increasing passenger traffic worldwide is creating a surge in in-flight hours and subsequently increasing the replacement demand for aircraft filters.

Geographic Overview

North America to retain its huge dominance in the global aircraft filtration market driven by its progressive efforts in improving cabin air quality, stringent norms for passenger and crew health and safety by regulatory authorities such as FAA (Federal Aviation Administration), and high integration of electronics and in-flight entertainment among American OEMs and airlines substantiating the demand for advanced filtration solutions with an aim to protect critical electronic components.

Asia-Pacific region to hold for more than 50% of the new air travelers over the next 20 years gives rise to purchasing new aircraft and maximizing usage of their existing fleets, leading to more flight hours. Increasing flight hours in the region is increasing the replacement cycle of filters creating substantial market demand in the region.

Airlines in the emerging Asian economies are working on increasing efficiency as consumers increasingly prefer superior onboard experience. Increasing emphasis of airlines on passenger safety and flight worthiness, advancement in electronic components as well as in-flight entertainments, growing need for reducing downtime by predictive maintenance and timely replacement of components also favors the demand for aircraft filters.

Competitive Insight

Some of the main strategies adopted by leading players include new product developments, mergers & acquisitions, and the formation of long-term contracts to gain a competitive edge in the market. Major players are well-diversified into various other industries and related component businesses, which reduces their business risks.

Some of the key players competing globally are Aerospace Systems & Components, Arrowprop Co Inc, Camfil, Donaldson Inc., Eaton Corporation Plc, Filtration Group, Fluid Conditioning Products, Inc., Freudenberg & Co. KG, HFE International, LLC, Hollingsworth & Vose, Honeywell International Inc., Pall Corporation, Parker Hannifin Corporation, Porvair plc, PTI Technologies, Rapco Inc., Recco Products, Safran Group, Sky Power Gmbh, Swift Filters Inc., and Tempest Plus.

Aircraft Filters Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 823.4 million |

|

Revenue forecast in 2028 |

USD 1040.4 million |

|

CAGR |

4.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Aircraft Type, By Product, By Application, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aerospace Systems & Components, Arrowprop Co Inc, Camfil, Donaldson Inc., Eaton Corporation Plc, Filtration Group, Fluid Conditioning Products, Inc., Freudenberg & Co. KG, HFE International, LLC, Hollingsworth & Vose, Honeywell International Inc., Pall Corporation, Parker Hannifin Corporation, Porvair plc, PTI Technologies, Rapco Inc., Recco Products, Safran Group, Sky Power Gmbh, Swift Filters Inc., and Tempest Plus. |