Airport Security Market Share, Size, Trends, Industry Analysis Report, By Type (Access Control, Cyber Security, Perimeter Security, Screening, Surveillance, Others); Systems & Equipment (Metal Detector, Backscatter X-Ray System, Others), Technology (RFID, Biometrics, Others), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2173

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

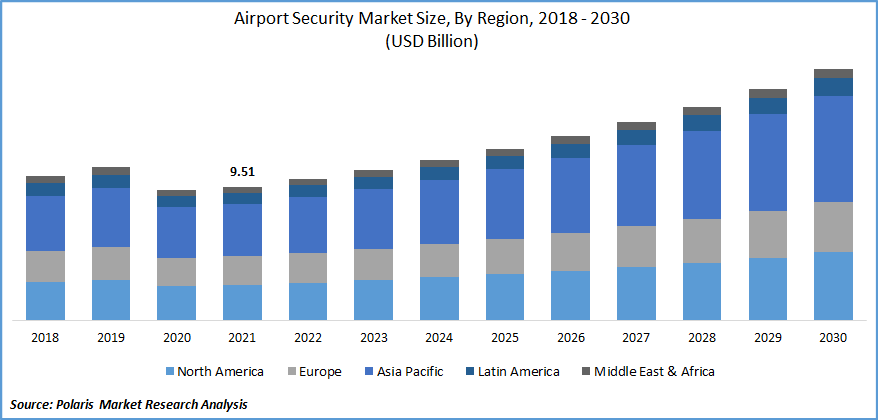

The global airport security market was valued at USD 9.51 billion in 2021 and is expected to grow at a CAGR of 7.5 % during the forecast period. The growth in the airport security market is being driven by an increase in international trade and the number of flying travelers around the world. The Federal Aviation Administration (FAA) supports about 45,000 flights and 2.9 million airline passengers per day over a total area of airspace of more than 29 million square miles, according to the FAA. Besides, the rising government spending for airline safety is also the factor that is driving the market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, in 2018, the TSA has announced that it is spending USD 7.6 Billion on aviation safety. In addition, the European airports would need to invest over USD 17 billion by 2022 to fulfill EU baggage screening rules, according to Airports Council International (ACI). Furthermore, the potential of criminal attacks and terrorism has prompted governments around the world to improve their safety measures. Market growth has been fueled by technological improvements and the availability of a wide range of solutions.

Government regulations relating to aviation safety have a beneficial influence on the adoption of monitoring, screening, and access control technology. For instance, the Federal Aviation Regulation (FAR) controls all aviation activities in the United States. The FAR 1542 establishes several airline securities programs. This law encourages the building and using safety equipment, such as the Security Identification Display Area (SIDA), to prevent crimes and terrorism. Similarly, the International Air Transport Association (IATA) resolution 753, in June 2018, mandated member airlines to inspect luggage before aircraft loading. These rules encourage the sector to put in place robust safety measures to manage passengers and goods more effectively. Such factors are expected to have a favorable influence on airport security market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The airport security market has observed extensive developments in the last few decades supported by various factors such as the rising cyber security attacks at airfields. One of the major concerns for the aviation market is cyber security. Airfields worldwide have grown more dependent on crucial information and communication technologies to manage operations, provide passenger services, and sustain communication with their various services over time. However, the airlines' dependence on technology has increased their susceptibility to numerous dangers, such as cyber-attacks. The growing number of sophisticated cyberattacks on airport safety systems worldwide has led airports to increase their investment in cyber safety to protect operations and passengers. As a result, this element will drive airline security systems forward.

Furthermore, since airports are part of a country's critical infrastructure, safety breaches could have far and far-reaching implications in addition to financial and reputational damage. Hackers broke into two San Francisco Airport websites in March 2020, obtaining the identities and passwords of employees and contractors. The airport had to take down the impacted websites and require a password change before resuming operations to avoid any adverse effects. For passenger convenience and operational efficiency, airports rely significantly on technology and automation for ticketing, check-ins, Wi-Fi, employee identification, access restrictions, surveillance, and staff management. Due to the linked nature of airport systems, unsecured data transfer in this network increases the attack surface.

To assist the market in addressing this ever-evolving problem, IATA (International Air Transport Association) established a market-wide Aviation Cyber Security Strategy. IATA developed the Aviation Cyber Security Position Paper as part of this process, which describes IATA's cyber security vision and goal and the following steps to tackle the aviation cyber safety problems.

Report Segmentation

The market is primarily segmented based on type, systems & equipment, technology, and region.

|

By Type |

By Systems & Equipment |

By Technology |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Technology

Based on the technology segment, the cybersecurity segment is expected to be the most significant revenue contributor in the global market in 2020 and is expected to retain its dominance in the foreseen period. Cybersafety encompasses a broad array of operational and information technology safety tools, methods, and techniques. To safeguard networks and data from being attacked and compromised, this technique employs protective and responsive measures. In addition, cybersecurity employs traditional malware protection, web filtering, and advanced threat protection to protect consumers from Internet-borne dangers while also assisting businesses in enforcing internet policy compliance.

Geographic Overview

In terms of geography, the APAC had the highest share in 2020. The market for Asia Pacific region is anticipated to grow significantly as a result of escalating terrorist activities and increased expenditures in aviation infrastructure, which is fueled by an increase in air passenger traffic. Due to government initiatives to promote air travel, the airline infrastructure in smaller cities in nations like India and China is projected to grow. Market demand for such infrastructure and applications is expected to rise in the region as new airports are built with more entry gates, bigger airfields, and better traffic management systems.

China's Aviation Administration aims to build 200 additional airports by 2035 to fulfill 450 airports. China invested about USD 70 billion on upgrades to ground infrastructure, air traffic control systems, and other systems. Besides, in February 2020, Lanzhou, the capital of the northern province of Gansu, has received approval from China's top economic planner for an airfield expansion project that would allow the city to expand into a regional aviation center. According to the National Development and Reform Commission, the total investment for the phase-3 development of Lanzhou Zhongchuan International Airport was 33.55 billion yuan (about 4.8 billion USD). By 2030, the extension is expected to boost the airport's annual passenger capacity to 38 million passengers, with a total cargo turnover of 300,000 tonnes. As a result, the Chinese market is anticipated to expand even more over the forecast period, owing to aggressive airfield development building plans and ongoing activities in this region.

Besides, The Western Sydney Infrastructure Plan (WSIP) is a 10-year investment of USD4.4 billion by the Australian and New South Wales governments, with the Australian government contributing over USD3.5 billion, began development in September 2018 and is expected to open in 2026. Similarly, by the end of 2019, plans for the development of Jakarta Airport and the start of work on a new international airport project in the Philippines are expected to be completed.

Moreover, North America is expected to witness a high CAGR in the global market in 2020. The presence of established players, continuing infrastructural developments, and growing air passengers in the region are expected to drive the market demand for Airport Safety in the area over the projected period. In addition, market development is influenced by the adoption of international standards increased safety, and the use of modern machinery for safety. The Department of Homeland Security (DHS) and the Transportation Security Administration (TSA), among other regulatory agencies in the United States, concentrate on guaranteeing safety standards adapted to the particular operational environment of each airport.

Competitive Insight

Some of the major players operating in the global market include American Science and, Engineering Inc, Autoclear LLC, Axis Communication AB, Delta Air Lines Inc., FLIR Systems Inc., Honeywell International Inc, OSI Systems Inc, Robert Bosch GmbH, SafranMorpho, Siemens AG, Smiths Detection, Thales Group.

Airport Security Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.51 billion |

|

Revenue forecast in 2030 |

USD 17.95 billion |

|

CAGR |

7.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Systems & Equipment, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

American Science and, Engineering Inc, Autoclear LLC, Axis Communication AB, Delta Air Lines Inc., FLIR Systems Inc., Honeywell International Inc, OSI Systems Inc, Robert Bosch GmbH, SafranMorpho, Siemens AG, Smiths Detection, Thales Group. |