Anisole Market Share, Size, Trends, Industry Analysis Report

By Purity (Up To 99.5%, Above 99.5%); By Application (Pharmaceuticals, Cosmetics, Food & Beverages, Perfumes, Pesticides and Insecticides, Others), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 118

- Format: PDF

- Report ID: PM1207

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

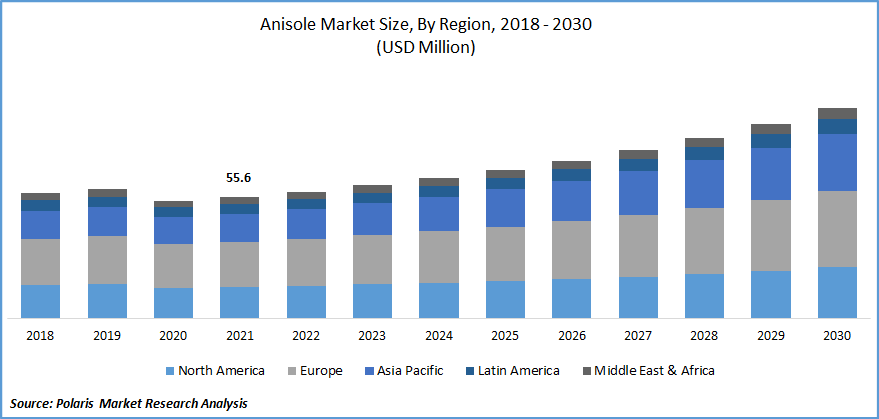

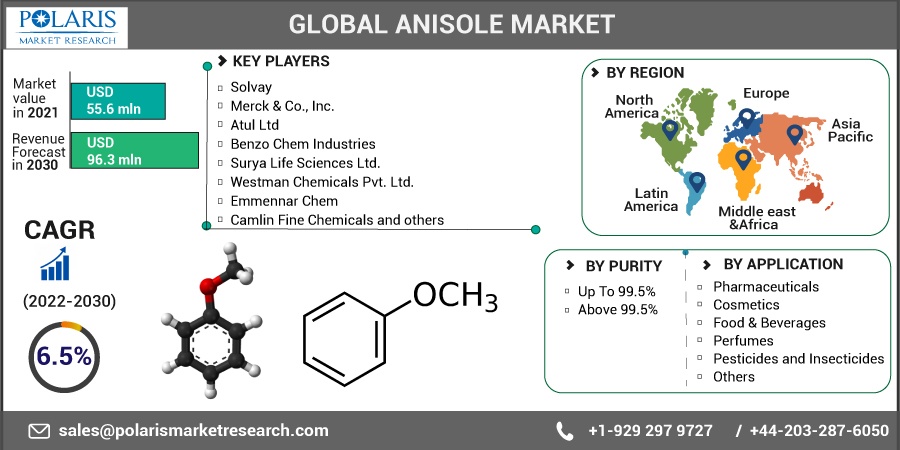

The global anisole market was valued at USD 55.6 million in 2021 and is expected to grow at a CAGR of 6.5% during the forecast period. The use of anisole in a variety of end-use industries has increased demand for the chemical. A major driver of the global anisole market is the use of anisole in the production of perfumes and cosmetics.

Know more about this report: Request for sample pages

The global fragrance market is projected to be valued at around USD 52.4 billion by 2025. Moreover, the high proclivity of the general public for personal grooming, health, and self-care goods has increased the demand for anisole. An isoline is also an effective insect pheromone. All these factors are expected to have a positive impact on the revenue growth of the target anisole market.

The breakout of COVID-19 has had a significant impact on the chemical industry's manufacturing operations and global supply chain. Even after the lockdown is removed, most likely in stages, the manufacturers of anisole will continue to face long-term challenges due to workforce shortages and stifled logistics.

But during the pandemic, sales of pharmaceutical products surged. Hence the demand for anisole increased in this sector as it uses as an intermediate in the manufacturing of several medicines. Also, the sales of cosmetic products through e-commerce platforms have increased at a rapid pace after the spread of COVID 19.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The chemical sector is an important part of the economy. Hence governments of developing countries have started taking various initiatives to strengthen this sector. Governments are changing old tax policies and launching new schemes to strengthen the chemical sector. Since 2019, the Indian government has allowed 100% FDI in the chemical industry. This factor is anticipated to augment the revenue growth of the global anisole market during the forecast period.

Increasing disposable income and rapid population growth have resulted in increased demand for cosmetics, pharmaceuticals, beverages, etc., all over the world. An increase in disposable income is allowing people to be more focused on personal care. According to United Nations, the global population is estimated to reach 9.7 Bn by 2020.

In 2016, Americans had approx. 13.6 trillion dollars in disposable income, which increased up to approximately 14.9 trillion dollars in 2019. This is the major factor that is driving the growth of the target market. According to the EIPA (Euromonitor International Personal Appearance Survey), the variety of socially acceptable beauty and personal care (BPC) products for men has widened in the last ten years.

One-third of men spend well over 30 minutes per day grooming, presenting a wide range of potential for BPC makers to offer solutions that cater to the specific demands of men who are concerned about their appearance. Over the projection period, such factors are anticipated to boost the anisole market for cosmetics and personal care products. And this factor, in turn, will boost demand for anisole.

Anisole is used as an intermediary in the production of many derivatives, such as 4-allyl anisole, which is a key element in pesticides used to protect conifers in parks, forests, and leisure areas from insects like bark beetles. As per Eurostat data, the EU-28 had a total land area grown as organic in 2015 of 11.1 million hectares, up from 5 million hectares in 2002. During the last decade, the EU's organic land area grew at an annual rate of roughly 500,000 hectares each year. This trend is anticipated to have a positive impact on the growth of the target market.

Report Segmentation

The market is primarily segmented based on purity, application and region.

|

By Purity |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Up to 99.5% purity segment is expected to witness fastest market growth

Low purity (Up to 99.5%) anisole has a vast number of applications. It can be used in various consumer products. As the average disposable income rises, the demand for several consumer products is rising. Also, low purity anisole has high demand from end-use industries such as cosmetics, food & beverages, pharmaceuticals, etc.

Europe's 500 million customers utilize cosmetic and personal care goods on a daily basis to safeguard their health, improve their well-being, and increase their self-esteem. Cosmetics, which include antiperspirants, scents, make-up, and shampoos, as well as soaps and toothpaste, are needed in all phases of life and provide significant practical and emotional benefits.

The above 99.5% segment is anticipated to grow at a high CAGR during the forecast period. Highly pure anisole is not used in many consumer products. It is used in research laboratories for research purposes. Research and development activities are at a peak in the pharmaceutical sector. Anisole is used as an important intermediate during the development phase of new medicines. These factors are anticipated to drive the CAGR growth of this particular segment.

Pharmaceutical accounted for the largest market share in 2021

In recent years, the global pharmaceutical market has seen a tremendous increase. The overall worldwide pharmaceutical market was estimated to be worth around 1.27 trillion dollars by 2020. This represents a considerable gain from 2001 when the market was only worth USD 390 billion. Also, after the outbreak of COVID, governments of several countries are strengthening the healthcare sector as pharmaceutical companies are an important part of the healthcare system, and governments are providing various subsidies and funding to the companies.

The cosmetic segment is anticipated to grow at a high CAGR in the years to come. Consumers from developing countries are becoming more aware of the usage of various cosmetic products. Hence, the demand for cosmetic products is rising at a rapid rate in these regions.

The annual growth rate of the world was 8% in the year 2021, which was the highest ever since the year 2004. The demand surge and higher growth are ensuring the high use of anisole in various cosmetic products, and these factors are anticipated to have a positive impact on the growth of the target segment.

Asia-Pacific is estimated to capture the highest revenue share

Rapid population growth and a rise in the adoption of western beauty and skincare habits are driving the demand for several cosmetic products in this region. China, with a population of 1.3 billion people and over half a billion urban residents, would have the most potential cosmetic buyers in the globe, followed by India.

Due to the growth of the cosmetic and pharmaceutical industries, the demand for anisole is rising at a rapid rate from the companies present in this region. All these factors are anticipated to have a favorable impact on the growth of the target market.

Over the forecast period, the North American market is expected to grow at a high CAGR. Most of the consumers present in this region spend a large number on cosmetics and pharmaceutical products. In terms of value, the United States was the world's biggest consumer of beauty products in 2018.

In that year, the value of beauty products consumed in the United States was estimated to be around 89.71 billion dollars. Moreover, due to the presence of big end-user companies from cosmetics, pharmaceutical, food and beverage, chemical, etc., this region is expected to grow at a rapid pace.

Competitive Insight

Major players operating in the global market include Atul Ltd, Benzo Chem, Camlin Fine, Clean Science, Emmennar Chem, Evonik Industries, Kessler Chemical, Merck, Shaanxi Top Chemical, Solvay, Surya Life Sciences, Triveni Chemicals, Westman Chemicals, Yasho Industries, and others.

Recent Developments

In July 2021, Clean Science and Technology raised more than Rs 430 crores from 40 different investors. Performance chemicals (MEHQ, BHA, and AP), pharmaceutical intermediates, Anisole and other chemicals are manufactured by the Clean Science. Customers use the company's goods as critical starting level components, inhibitors, or additives in products marketed in regulated markets.

Anisole Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 55.6 million |

|

Revenue forecast in 2030 |

USD 96.3 million |

|

CAGR |

6.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Purity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Solvay, Merck & Co., Inc., Atul Ltd, Benzo Chem Industries, Surya Life Sciences Ltd., Westman Chemicals Pvt. Ltd., Emmennar Chem, Camlin Fine Chemicals, Evonik Industries AG., Kessler Chemical, Inc., Shaanxi Top Chemical Co., Ltd., Yasho Industries Pvt., and Ltd. Clean Science & Technology, Triveni Chemicals |