Anti-Drone Market Size, Share, Trends, Industry Analysis Report

By System Type, By Range, By Deployment Type, By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM1026

- Base Year: 2024

- Historical Data: 2020-2023

What is the Anti-Drone Market Size?

The global Anti-Drone market size was valued at USD 1.85 billion in 2024, growing at a CAGR of 26.6% from 2025 to 2034. Growing defense budgets and modernization programs along with technological collaboration in counter-drone solutions is propelling the market growth.

Key Insights

- Electronic systems were the dominant market in 2024, due to their ability to effectively detect and neutralize drones through electromagnetic and jamming technologies.

- Fixed radar systems are anticipated to grow rapidly, fueled by their capability to monitor targets around the clock and track multiple targets in air defense networks.

- North America held the largest share in 2024, thanks to increasing intrusions of drones around airports, defense bases, and government sites.

- The U.S. dominated the North American market, supported by robust defense spending and robust counter-UAS initiatives by the Department of Defense (DoD).

- Asia Pacific is expected to expand at the highest rate, led by the widespread proliferation of commercial and recreational drones and increasing airspace safety issues.

- China held major market share in Asia Pacific, driven by continuous defense modernization and interest in domestic counter-drone production.

- Key industry operating in the market includes Aaronia AG, Airbus Defence and Space GmbH, Battelle Memorial Institute, Blighter Surveillance Systems Ltd., Boeing Company, CACI International Inc., Chess Dynamics Ltd., Dedrone Holdings, Inc., DroneShield Ltd., Israel Aerospace Industries Ltd., L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation.

Industry Dynamics

- Growing defense expenditures and rising emphasis on military modernization among major economies are fueling mass adoption of counter-drone solutions.

- Intensifying partnerships between defense agencies and technology firms are speeding up innovation in detection, tracking, and neutralization technologies.

- High R&D and deployment expenses of sophisticated anti-drone technologies continue to restrict adoption in emerging markets and smaller security industries.

- The integration of AI-driven threat detection and autonomous response technologies is opening up new avenues for growth by allowing quicker and more precise identification of enemy drones.

Market Statistics

- 2024 Market Size: USD 1.85 Billion

- 2034 Projected Market Size: USD 19.61 Billion

- CAGR (2025–2034): 26.6%

- North America: Largest Market Share

What is Anti-Drone Market?

The Anti-Drone market includes sophisticated drone detection and mitigation solutions to detect, track, and neutralize unauthorized or hostile drones. The solutions integrate radar, radio frequency, electro-optical, and infrared technology to provide airspace protection in defense, critical infrastructure, and public safety sectors. Growing threats from drones and perimeter security needs are driving adoption. Ongoing innovation in sensor fusion, electronic countermeasures, and artificial intelligence-driven threat analysis is increasing the accuracy of response and operational efficiency.

National and regional governments are setting new drone traffic management and urban air mobility security rules, and that is boosting the anti-drone industry. For example, in August 2025, Ireland published a National Policy Framework for Unmanned Aircraft Systems (UAS). The framework will guide its strategic development of drones while ensuring safety, security, environment and public acceptance. These regulations are aimed to give controlled airspace operations, enhance public safety, and prevent unapproved drone operations, resulting in mass installation of counter-drone technologies on critical infrastructure and public areas.

Growing cases of rogue drone activity close to commercial airports sparked heightened aviation security concerns. Aviation officials are responding by implementing heightened safety requirements and requiring the installation of anti-drone systems to identify, locate, and neutralize the possible threat, stimulating demand for highly advanced surveillance and countermeasure technologies.

Drivers & Opportunities

Which are the major factors driving the Anti-Drone Market growth?

Growing Defense Budgets and Modernization Programs: Increasing defense spending and modernization programs in leading economies are boosting the acquisition of counter-unmanned aerial systems (C-UAS). Global spending on military forces increased to USD 2,718 billion in 2024, a real rise of 9.4% from 2023, as per according to the Stockholm International Peace Research Institute (SIPRI). Military organizations are making top priority complex anti-drone technologies to protect airbases, border areas, and key assets from monitoring and potential attacks.

Technological Collaboration in Counter-Drone Solutions: Rising partnership among defense contractors and tech companies is encouraging innovation in next-gen counter-drone weapons. In September 2025, Anduril Industries and Zone 5 Technologies successfully tested their prototypes of drone interceptors under the U.S. Department of Defense. Companies were given additional funding for enhancing their systems and preparing for future live-fire tests after the trial. Advancements in directed energy, radio frequency jamming, and artificial intelligence-based detection systems are improving the accuracy and efficiency of anti-drone operations, stimulating defense forces across the world.

Segmental Insights

By System Type

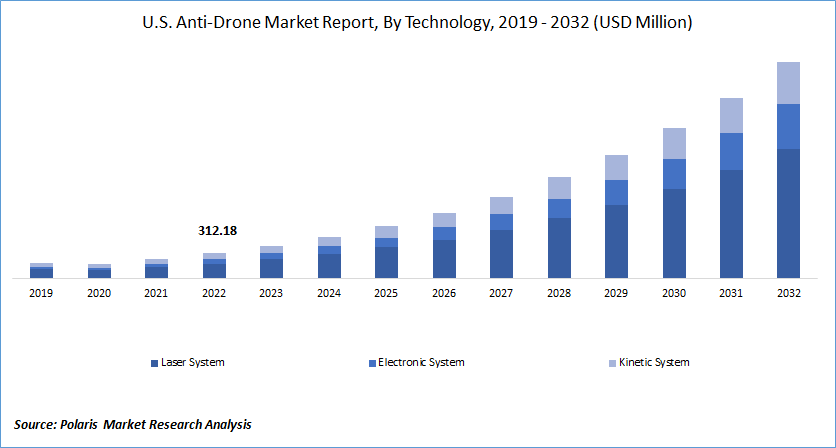

Based on system type, the anti-drone market is categorized into electronic systems, laser systems, and kinetic system. Electronic systems held the dominating market share in 2024 due to their ability to detect and deter drones through electromagnetic signals and jamming technologies.

Laser systems are expected to grow rapidly, driven by its ability to precisely target and instantly neutralize enemy drones. Growing defense spends and consistent R&D in directed-energy weapons are likely to further push their adoption higher over the next few years.

By Range

Based on range, the anti-drone market is divided into short-range (<2 km), medium-range (2–5 km), and long-range (>5 km) systems. Short-range systems dominated the market position in 2024 owing to its extensive usage for facility security, border security, and event monitoring.

Medium-range systems are expected to grow at a fast pace, owing to its ability to protect industrial assets, transportation facilities, and sensitive infrastructures. These systems provide an optimal coverage range versus cost ratio, well-suited for mid-sized security perimeters.

By Deployment Type

By deployment type, the market is segmented into portable radar, fixed radar, and vehicle-mounted radar. Portable radar systems dominated the market in 2024 owing to their mobility and ease of operation in tactical missions and temporary surveillance operations.

Fixed radar systems are expected to experience steady growth, as it is well suited for airports, power plants, and defense bases that require continual monitoring. These systems are leveraged for their capability to offer 24/7 surveillance, monitor multiple targets at a single time, and connect with larger air defense networks.

By Application

On the basis of application, the anti-drone market is classified into detection systems and detection & disruption systems. Detection & disruption systems held market dominance in 2024 owing to its total threat detection and neutralization in real time.

Detection-only systems are anticipated to grow rapidly, serving commercial segments with an emphasis on surveillance and early-warning uses. Their ease of use, affordability, and compatibility with established security structures are also driving the demand.

By End-Use

Based on end-use, the market is segmented into military & defense, commercial, government, and others. The military & defense segment held the largest share in 2024 owing to increasing demand for counter-UAV systems to safeguard strategic assets, combat areas, and controlled airspace.

The aviation industry is projected to grow at a fast pace, as airports, event promoters, and private security companies are integrating anti-drone technology for public protection. Rising drone intrusions near forbidden areas and mass events have spurred the need for sophisticated monitoring and discouragement systems.

Regional Analysis

North America held the largest share in the global anti-drone market in 2024. Rising cases of illegal drone use near airports, military bases, and government buildings are driving the growth of counter-drone technology adoption. Increasing public and private expenditures to safeguard strategic infrastructure like energy facilities and prisons are also propelling regional market growth.

U.S. Anti-Drone Market Overview

The U.S. continues to lead the North American market, supported by significant defense funding and active programs from the U.S. Department of Defense (DoD). The U.S. Department of Defense requested USD 3.1 B USD for counter-drone capabilities in its fiscal 2026 budget, contingent on broader legislation. In the current fiscal year, the Pentagon spent USD 7.4 B USD on counter-drone systems, over 50% more than a decade ago. Mass procurements and deployment of counter-unmanned aerial systems (C-UAS) are given top priority in order to better secure national security and safeguard high-risk areas.

Asia Pacific Anti-Drone Market Insights

Asia Pacific is expected to grow rapidly during the forecast period. Rising growth in drone proliferation for commercial and recreational uses is creating concerns regarding airspace security and privacy intrusion. Governments are putting more emphasis in counter-drone systems to deal with these issues. Growing concerns on border security and anti-terror activities is also driving strong regional demand for sophisticated detection and neutralization technologies.

China Anti-Drone Market Analysis

China is leading the Asia Pacific market, driven by expanding defense modernization initiatives and rising emphasis on domestic defense manufacturing. In April 2024, Xi Jinping announced a military reorganization aimed to enhance the People's Liberation Army's (PLA) capacity to engage in information warfare and execute combined joint operations during wartime. Spending on radar, electronic warfare, and directed-energy technology is driving the development of next-generation counter-drone technologies.

Europe Anti-Drone Market Assessment

Europe held substantial market share, fueled by growing attention to protecting airports, public spaces, and energy installations from unauthorized drone activity. Growing investments by European defense institutions and NATO in advanced counter-drone and air defense systems are fortifying regional defense structures. In September 2025, NATO invested in an Australian-designed high-power laser system, also known as "Apollo," to enhance its capability to counter drones. The Apollo laser weapon by Electro Optic Systems (EOS) uses thermal destruction to disable drones and operate well in various weather conditions.

Key Players & Competitive Analysis

The anti-drone market globally is highly competitive and fueled by ongoing technological development in detection, tracking, and neutralization systems. Firms are placing emphasis on creating comprehensive counter-UAV solutions that integrate radar, RF sensors, electro-optical systems, and jamming systems to make the defense more effective against unauthorized or adversary drones. Increasing security threats to key infrastructure, defense facilities, and public areas are driving product development and deployment. Strategic partnerships between defense contractors and technology innovators are also driving market growth and innovation.

Which are the key players in the Anti-Drone Market?

Major players in the global Anti-Drone market are Aaronia AG, Airbus Defence and Space GmbH, Battelle Memorial Institute, Blighter Surveillance Systems Ltd., Boeing Company, CACI International Inc., Chess Dynamics Ltd., Dedrone Holdings, Inc., DroneShield Ltd., Israel Aerospace Industries Ltd., L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation.

Key Players

- Aaronia AG

- Airbus Defence and Space GmbH

- Battelle Memorial Institute

- Blighter Surveillance Systems Ltd.

- Boeing Company

- CACI International Inc.

- Chess Dynamics Ltd.

- Dedrone Holdings, Inc.

- DroneShield Ltd.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

Anti-Drone Industry Developments

In May 2025, India tested Bhargavastra, a low-cost anti-swarm drone system manufactured by Solar Defence and Aerospace Limited (SDAL). The test was conducted at the Seaward Firing Range off the coast of Gopalpur. Being designed to perform hard-kill operations, Bhargavastra can identify and destroy small or incoming drones within ranges of up to 2.5 kilometers.

In April 2025, The Tawazun Council, the defense procurement agency of the UAE, signed a term sheet with Raytheon for a joint production of the company's Coyote counter-UAS interceptor systems in the UAE. The partnership is an extension of their 2023 cooperation agreement to localize counter-drone technology in Abu Dhabi.

Anti-Drone Market Segmentation

By System Type Outlook (Revenue, USD Billion, 2020–2034)

- Electronic Systems

- Laser Systems

- Kinetic Systems

By Range Outlook (Revenue, USD Billion, 2020–2034)

- Short-Range (<2 KM)

- Medium-Range (2-5 KM)

- Long-Range (>5 KM)

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Portable Radar

- Fixed Radar

- Vehicle-Mounted Radar

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Detection Systems

- Detection & Disruption Systems

By End-Use Outlook (Revenue, USD Billion, 2020–2034)

- Military & Defense

- Commercial

- Government

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anti-Drone Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.85 Billion |

|

Market Size in 2025 |

USD 2.34 Billion |

|

Revenue Forecast by 2034 |

USD 19.61 Billion |

|

CAGR |

26.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.85 billion in 2024 and is projected to grow to USD 19.61 billion by 2034.

The global market is projected to register a CAGR of 26.6% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Aaronia AG, Airbus Defence and Space GmbH, Battelle Memorial Institute, Blighter Surveillance Systems Ltd., Boeing Company, CACI International Inc., Chess Dynamics Ltd., Dedrone Holdings, Inc., DroneShield Ltd., Israel Aerospace Industries Ltd., L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation.

The electronic systems segment dominated the market revenue share in 2024.

The medium-range systems segment is projected to witness the fastest growth during the forecast period.