Asset Integrity Management Market Share, Size, Trends, Industry Analysis Report

By Service Type; By Industry (Oil & Gas, Power, Mining, Aerospace, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 114

- Format: PDF

- Report ID: PM2408

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

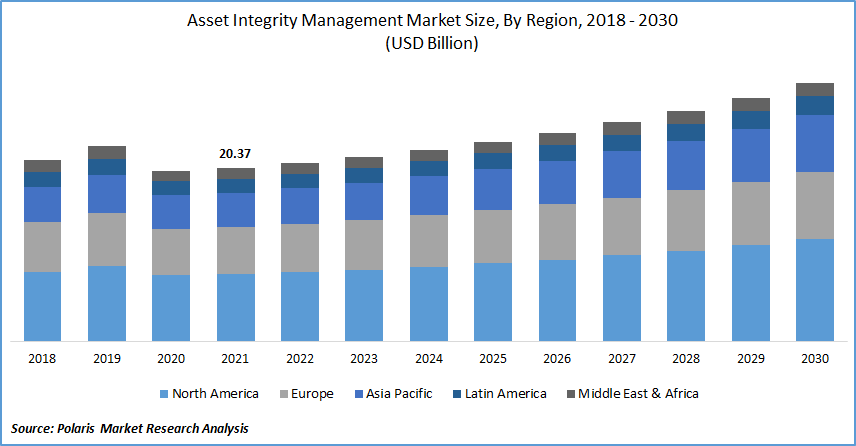

The global asset integrity management market was valued at USD 20.37 billion in 2021 and is expected to grow at a CAGR of 4.8% during the forecast period. The factors such as the rising market demand for asset integrity management solutions across various verticals, agreement among players for the expansion of solutions offerings, and the increasing adoption of cloud-based solutions are driving the asset integrity management market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Among significant areas such as energy and utilities, construction activities, manufacturing engineering, oil & gas, and others, the proper operating of any organization necessitates the use of a system that can preserve the integrity of all assets. An asset integrity management system is essential for performing operations such as monitoring, governance, and initiatives to ensure a firm's effective operation and minimize hazards and risks. The system is connected to any asset's ability to perform effectively and successfully, improving the protection and health of all related entities and the environment by reducing hazards and risks.

Moreover, in May 2021, Intertek Group plc confirmed that it had agreed to acquire SAI Global Assurance. Intertek is a worldwide leader in Assurance solutions, assisting clients in identifying and mitigating inherent risk in their operational processes, supply and distribution chain stores, and organization standards. Intertek's Assurance offering would be strengthened further by acquiring SAI Global Assurance, which will provide additional scale, expanded geographic coverage, and technical innovations.

Furthermore, the increasing market for asset integrity management in new offshore areas in deep waters and the acceptance of cloud technology with asset integrity administration solutions have significantly contributed to the market's growth. Thus, these factors are driving the market growth during the forecast period. However, the expensive cost and configuration complexities impede asset integrity management market growth over the forecast period. Asset integrity management services are being used to monitor investments through most of their entire life cycle, which assist in making maintenance decisions to avoid breakdowns and natural calamities.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Climatic changes over time have a significant impact on the operations of the oil & gas and energy plants. Various industries and government agencies increasingly recognize the importance of climate adaptation planning and incorporating it into overall risk management strategies. Risk-based inspections of assets in oil and gas and power generation plants assist in understanding the risks associated with predicted climatic changes and the damages incurred by such changes in the past. Asset integrity management services assist decision-makers in developing risk management strategies, minimizing the incidence of climatic changes on manufacturing systems.

Further, many infrastructures that use hazardous processes have prioritized asset integrity to maintain safety. Various standard institutions have also set up guidelines to provide end-users with a more defined framework. The potential danger of an accident has also managed to push regulatory authorities to enforce additional safety regulations and improve enforce such rules in the immediate wake of several high-profile accidents. Those who do not comply may face significant fines. End users in the oil & gas, refining, petrochemical, and mining industries are investing to comply with increasingly stringent safety and environmental regulations.

Report Segmentation

The market is primarily segmented based on service, industry, and region.

|

By Service |

By Industry |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Vertical

Based on the industrial market segment, the power segment is expected to be the most significant revenue contributor in the global market. In the power industry, asset integrity management services ensure that power plants operate efficiently and optimally. So the sector involves many complex equipment and components, and the likelihood of failure and unplanned shutdown increases. An unplanned power plant shutdown can be utterly devastating for end-user industries and organizations. As a result, asset integrity management services must be implemented to keep power plants operational.

Geographic Overview

In terms of geography, North America had the largest market share. The region's key players in the oil & gas and energy plants are significant end-users of asset integrity management services. Due to the general region's growing consumption of power, oil, and gas, respectively, oil & gas plants and power plants in North America must operate at peak efficiency. In the oil & gas market, optimal resource utilization necessitates continuously operating plants with negligible downtime and lowered energy consumption; effective resource integrity monitoring and management solution helps achieve these situations.

Moreover, the Asia Pacific market is expected to witness a high CAGR in the global asset integrity management market. The market's expansion is being driven primarily by rising market demand for oil & gas and a boost in merger and acquisition activity, which has increased investment opportunities in the regional energy sector. For instance, as per the IBEF, according to the IEA (India Energy Outlook 2021), the primary energy demand is expected to well almost double to 1,123 million metric tons by 2040, as the country's GDP rises to USD 8.6 trillion. India is considered a significant contributor to non-OECD petroleum consumption growth worldwide.

According to the International Energy Agency (IEA), organic gas consumption in India is estimated at 25 billion cubic meters per year, with an annual growth of 9% until 2024. Economic growth, infrastructure development, and power plant construction all contribute to the growth of the Asia Pacific asset integrity management market. Asset integrity management services are supported by exhibitions and associations in Asia Pacific countries.

Competitive Insight

Some of the major market players operating in the global market include ABS Consulting, Aker Solutions, Applus RTD, Bureau Veritas, EM&I, Fluor Corporation, Intertek Group, LifeTech, Meridium Inc., Metegrity, Oceaneering International, Rosen Swiss, SGS, TechnipFMC, TÜV SÜD, and TWI.

Asset Integrity Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 20.37 Billion |

|

Revenue forecast in 2030 |

USD 30.42 Billion |

|

CAGR |

4.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Service, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aker Solutions, ABS Consulting, Applus RTD, Bureau Veritas, EM&I, TechnipFMC, Intertek Group, Fluor Corporation, LifeTech, Meridium Inc., Metegrity, Oceaneering International, Rosen Swiss, SGS, TÜV SÜD, and TWI |