Automatic Identification and Data Capture Market Size, Share, Trends, Industry Analysis Report

: By Component (Hardware, Software, and Services), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM5235

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

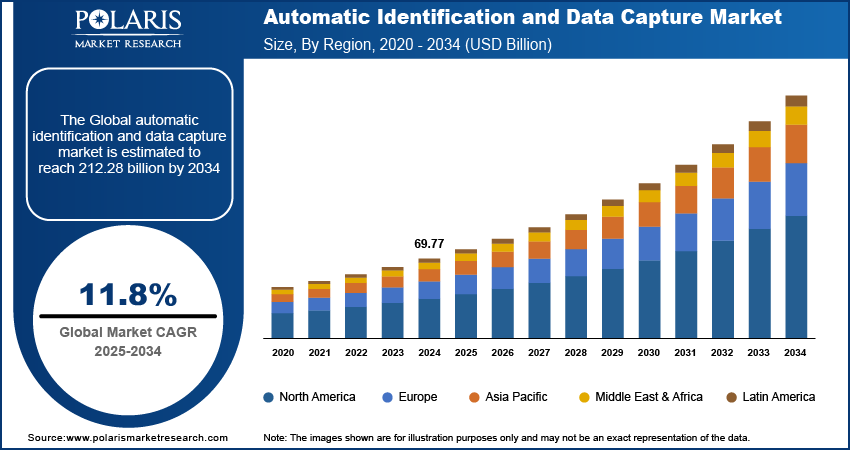

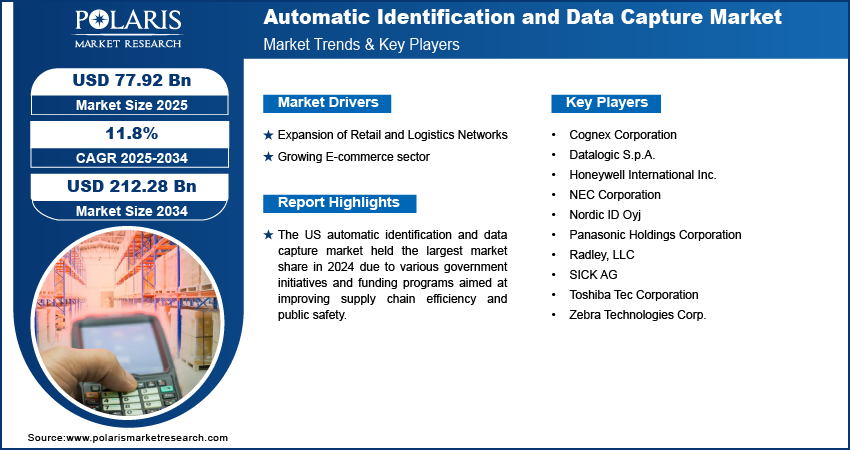

The global automatic identification and data capture market size was valued at USD 69.77 billion in 2024, exhibiting a CAGR of 11.8% during 2025–2034. The market is driven by the increasing adoption of automation in retail, manufacturing, and logistics, as well as the implementation of healthcare, pharmaceutical, and food regulations, smart city initiatives, and the expansion of e-commerce and retail networks.

Key Insights

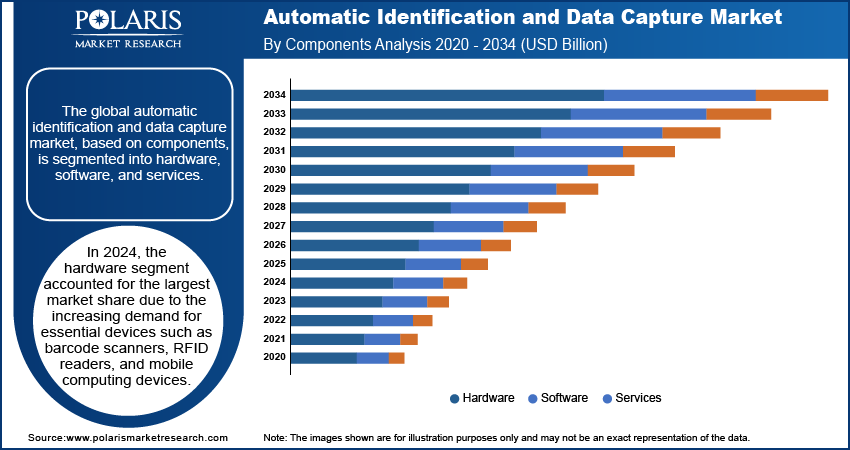

- In 2024, the hardware segment held the largest market share, driven by rising demand for key devices, including barcode scanners, RFID readers, and mobile computing equipment.

- Retail is anticipated to witness the highest CAGR during the forecast period, driven by the growing adoption of AIDC technologies to enhance business efficiency and customer experience.

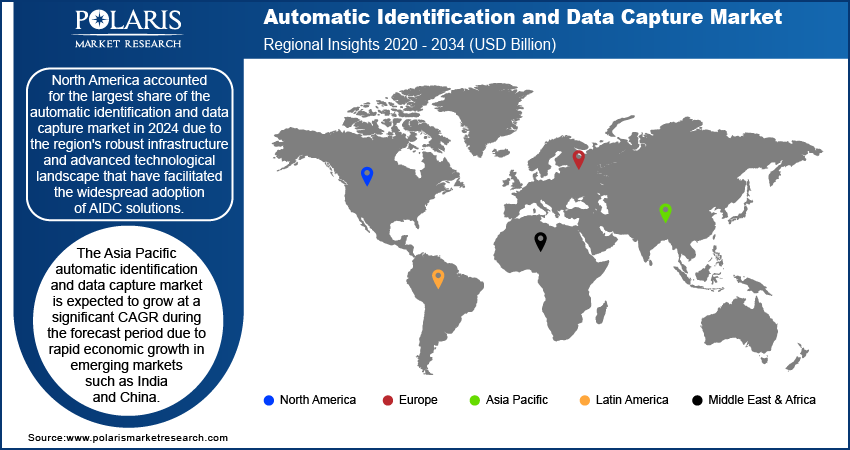

- In 2024, the market was led by North America, owing to its strong infrastructure and advanced technology, enabling it to deploy AIDC solutions in large quantities.

- During the forecast period, the Asia Pacific is predicted to expand at the highest CAGR. The rapid growth of emerging economies has led to increased investment in advanced technology across various sectors in the region.

Industry Dynamics

- The increasing number of clinics and hospitals is driving the adoption of AIDC technology for inventory management, medication tracking, and patient identification, thereby supporting the growth of the healthcare market.

- The growing retail and logistics networks are driving global expansion in the market.

- The fast development of the e-commerce industry is driving the growth of the automatic identification and data capture market.

- One major hindrance in the market is the high setup and integration costs, especially for small and medium-sized enterprises.

Market Statistics

2024 Market Size: USD 69.77 billion

2034 Projected Market Size: USD 212.28 billion

CAGR (2025-2034): 11.8%

North America: Largest Market Share

AI Impact on Automatic Identification and Data Capture Market

- AI is also enhancing data capture precision and speed by improving barcode scanning, RFID recognition, and image recognition, thereby minimizing human error and increasing operational effectiveness.

- Machine learning algorithms are facilitating predictive analytics in AIDC systems, supporting companies in optimizing inventory management, monitoring product movement, and more accurately predicting demand.

- Computerized automation is simplifying processes, enabling AIDC technologies to perform more complex functions, such as real-time data analysis and decision-making, without requiring human intervention.

- AI can enable AIDC solutions to provide improved personalization in customer experiences, such as promotions or services tailored to individual needs, based on customer behavior and buying patterns.

To Understand More About this Research: Request a Free Sample Report

Automatic identification and data capture refers to technologies that automatically identify objects, collect data, and transfer it into systems without manual input. Increased focus on automating operations in industries such as retail, manufacturing, and logistics to enhance productivity and reduce errors is driving the adoption of automatic identification and data capture systems.

The increasing facility of hospitals and clinics has led to a rise in the adoption of automatic identification and data capture (AIDC) technology for patient identification, medication tracking, and inventory management. The adoption is aimed at enhancing safety and efficiency within healthcare, contributing to the automatic identification and data capture market growth.

Regulatory compliance in industries such as pharmaceuticals and food mandates precise tracking of products throughout the supply chain to ensure safety, quality, and authenticity. Thus, growing pharmaceuticals and food industries are increasingly adapting AIDC to comply with regulations, which drives the automatic identification and data capture market growth. Furthermore, government initiatives toward economic development such as smart cities and infrastructure are driving demand for AIDC technologies.

Projects focused on traffic management, public safety, and infrastructure maintenance rely on sensors for real-time data collection and biometric systems for secure access and identification. Automatic identification and data capture technologies enhance operational efficiency, improve citizen services, and ensure better management of urban infrastructure, consequently fueling the automatic identification and data capture market growth.

Driver Analysis

Expansion of Retail and Logistics Networks

The global expansion of retail and logistics networks is accelerating the adoption of AIDC technologies to strengthen logistic infrastructure and reach a large number of consumers. According to a published report by Transportation Statistics Annual Report 2023, in 2021, the total expenditure on transportation services (for-hire, in-house, and household) amounted to USD 1,330.6 billion, accounting for 5.6% of the US GDP. Businesses growing across borders require reliable solutions for accurate inventory tracking, order fulfillment, and supply chain visibility. AIDC hardware such as RFID, barcodes, and mobile scanners enable seamless data capture, ensuring efficient stock management, real-time shipment tracking, and error-free operations. Additionally, AIDC technologies help manage complexities in multi-location warehouses, cross-border logistics, and omni channel retailing, which support smooth operations, help to deliver faster, and enhance customer satisfaction. Thus, the expanding retail and logistics networks propel the growth of the automatic identification and data capture market globally.

Growing E-commerce Sector

The e-commerce boom has significantly increased the demand for efficient inventory management and order fulfillment, making AIDC technologies essential. For instance, according to the International Trade Administration (ITA), the projected growth for global B2C e-commerce revenue is anticipated to reach USD 5.5 trillion by the end of 2027. Automatic identification and data capture technologies enable real-time tracking of inventory levels, streamline the picking and packing processes, and facilitate accurate order fulfillment across online and offline channels. In addition, AIDC helps improve operational efficiency, reduces errors, and enhances customer satisfaction through timely deliveries and better visibility into stock availability, ultimately supporting the rapid growth of the e-commerce sector. Thus, the significant growth of the e-commerce sector is driving the automatic identification and data capture market expansion.

Segment Analysis

Market Assessment by Components

The global automatic identification and data capture market, based on components, is segmented into hardware, software, and services. In 2024, the hardware segment accounted for the largest market share due to the increasing demand for essential devices such as barcode scanners, RFID readers, and mobile computing devices. Hardware components play a crucial role in automating data collection processes across various industries, including retail, logistics, healthcare, and manufacturing. Additionally, advancements in technology, such as improved sensor capabilities and the development of more versatile mobile devices, have contributed to the hardware segment's growth. For instance, Powercast launched an Extended-Temperature RAIN RFID Reader Module created for reading high-temperature RFID readers and to function reliably in extreme conditions. The ruggedized module can operate from −40°C to +85°C, communicating with and powering RFID tag devices, where typical reader modules could overheat and fail. Thus, the efficient operational efficiency of AIDC hardware to operate at extreme temperatures and conditions is promoting market growth for the segment.

Market Evaluation by End User Insights

The global automatic identification and data capture market segmentation, based on end user, includes manufacturing, retail, transportation & logistics, hospitality, BFSI, healthcare, government, and others. The retail segment is expected to register the highest CAGR during the forecast period due to the increasing adoption of AIDC technologies for enhancing operational efficiency and improving customer experiences. Retailers are frequently adopting innovative products to meet evolving consumer demands and preferences. Additionally, the need for accurate data collection for customer insights and personalized marketing strategies amplifies the reliance on AIDC technologies in the retail sector.

Automatic Identification and Data Capture Industry Insights by Region

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the automatic identification and data capture market in 2024 due to the region's robust infrastructure and advanced technological landscape that have facilitated the widespread adoption of AIDC solutions. The presence of major players and innovative companies in North America has driven continuous advancements in AIDC technologies, such as RFID, barcodes, and biometric systems. Additionally, the increasing demand for efficient inventory management and enhanced supply chain visibility has prompted businesses to invest in AIDC solutions to streamline operations and improve accuracy. The growing e-commerce sector across the region further fuels this demand as retailers seek to optimize order fulfillment processes and provide better customer experiences. Furthermore, stringent regulatory requirements in various industries, such as pharmaceuticals and food, are pushing organizations to adopt AIDC technologies for improved food traceability and compliance. All these factors drive the demand for AIDC solutions across North America.

The US accounted for a larger share of the automatic identification and data capture market in North America in 2024 due to various government initiatives and funding programs aimed at improving supply chain efficiency and public safety that have accelerated the adoption of AIDC solutions. According to the US Department of Commerce’s Economic Development Administration (EDA), the Biden-Harris Administration announced a funding round of ∼USD 504 million in implementation grants to 12 Tech Hubs to scale up critical technologies, create jobs, and strengthen US economic competitiveness and national security.

The Asia Pacific automatic identification and data capture market is expected to register the highest CAGR during the forecast period. Rapid economic growth of emerging markets such as India and China is leading to increased investments in technology across various sectors, significantly boosting the demand for AIDC solutions. Furthermore, the region's booming e-commerce sector is propelling the AIDC demand as retailers seek efficient inventory management and order fulfillment processes to enhance customer experiences.

The China automatic identification and data capture market is expected to grow significantly during the forecast period due to the rapid urbanization and infrastructure development in the country. Moreover, the growing requirements for efficient logistics networks across cities necessitate the demand for reliable data capture solutions. Thus, there will be increasing opportunities for the market in China in the coming years.

Key Players & Competitive Analysis Report

The competitive landscape of the automatic identification and data capture market is dynamic and characterized by a mix of established multinational corporations and innovative startups. Major players such as Zebra Technologies, Honeywell International Inc., Datalogic S.p.A, and Avery Dennison Corporation dominate the market, leveraging their extensive product portfolios and global distribution networks to capture significant market share. Technological innovation is a key driver in this highly competitive environment, with companies investing heavily in research and development to enhance their offerings, including advanced barcode scanning systems and RFID technologies. Strategic partnerships and collaborations between hardware manufacturers and software developers are common, enabling the integration of AIDC solutions into broader business applications.

Companies are increasingly focusing on customer experience by providing tailored solutions to meet industry needs, helping them differentiate themselves in a global competitive market. A few major players include Cognex Corporation; Datalogic S.p.A.; Honeywell International Inc.; NEC Corporation; Nordic ID Oyj; Panasonic Holdings Corporation; Radley, LLC; SICK AG; Toshiba Tec Corporation; and Zebra Technologies Corp.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas—building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities.

In June 2023, Honeywell introduced SwiftDecoder, a software development kit for developing and deploying vision-based software solutions for demanding barcode-decoding workflows in various industries such as retail, transportation, and logistics.

Panasonic Holdings Corporation is a multinational electrical, electronics, and appliance manufacturing company that operates in various industries, including electronics devices and industrial solutions. The company also has specialty business segments that include business solutions, artificial intelligence, engineering, the Internet of Things, productivity improvement, facial recognition, supply chain management (SCM), and digital transformation. In June 2024, Panasonic Life Solutions India launched eSignCard. This digital tent card display system allows businesses to update information wirelessly in real-time through a centralized cloud-based system accessible from smartphones.

List Of Key Companies

- Cognex Corporation

- Datalogic S.p.A.

- Honeywell International Inc.

- NEC Corporation

- Nordic ID Oyj

- Panasonic Holdings Corporation

- Radley, LLC

- SICK AG

- Toshiba Tec Corporation

- Zebra Technologies Corp.

Automatic Identification and Data Capture Industry Developments

In May 2024, Datalogic launched a new version of the Magellan 900i scanner to replace the GPS44XX series and offer high-performance capabilities in handheld form devices.

In December 2023, Panasonic Holdings Co., Ltd. created an image recognition AI featuring an advanced classification algorithm capable of effectively managing complex data derived from diverse subject and shooting conditions.

Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- RFID Reader

- Barcode Scanner

- Smart Cards

- Optical Character Recognition Devices

- Biometric Systems

- Others

- Software

- Services

- Integration & Installation Services

- Support & Maintenance Services

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Retail

- Transportation & Logistics

- Hospitality

- BFSI

- Healthcare

- Government

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 69.77 billion |

|

Market Size Value in 2025 |

USD 77.92 billion |

|

Revenue Forecast by 2034 |

USD 212.28 billion |

|

CAGR |

11.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automatic identification and data capture market size was valued at USD 69.77 billion in 2024 and is projected to grow to USD 212.28 billion by 2034.

The global market is projected to register a CAGR of 11.8% during the forecast period.

North America accounted for the largest market share in 2024 due to the region's robust infrastructure and advanced technology.

A few key players in the market are Cognex Corporation; Datalogic S.p.A.; Honeywell International Inc.; NEC Corporation; Nordic ID Oyj; Panasonic Holdings Corporation; Radley, LLC; SICK AG; Toshiba Tec Corporation; and Zebra Technologies Corp.

The hardware segment dominated the market in 2024 due to the increasing demand for essential devices such as barcode scanners, RFID readers, and mobile computing devices.

• The retail segment is expected to register the highest CAGR during the forecast period due to the increasing adoption of AIDC technologies for enhancing operational efficiency and improving customer experiences.