Automotive Composite Market Size, Share, Trends, & Industry Analysis Report

By (Non-Electric and Electric), By Fiber Type, By Manufacturing Process, By Resin Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6047

- Base Year: 2024

- Historical Data: 2020-2023

Overview

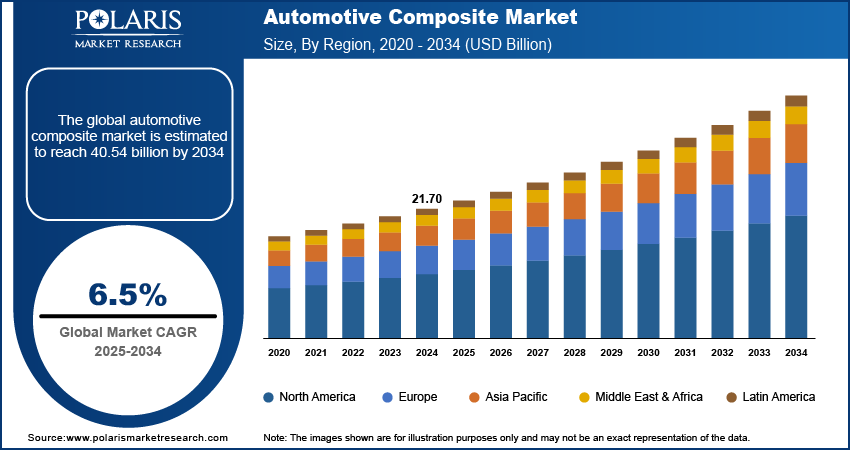

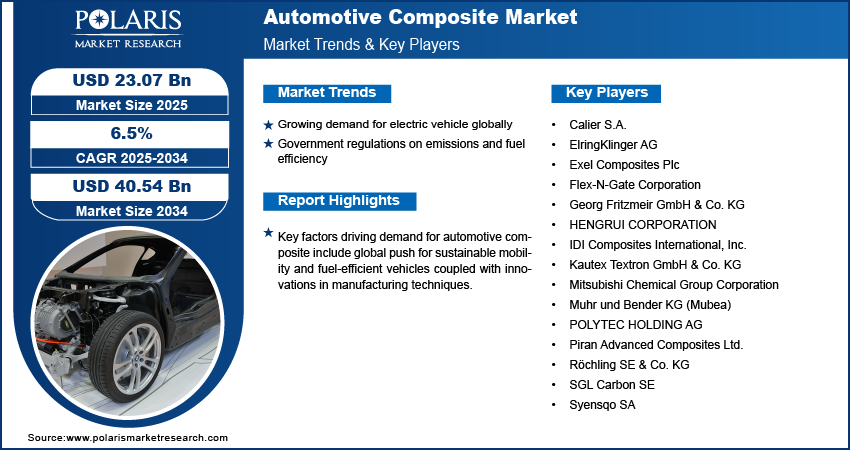

The global Automotive Composite market size was valued at USD 21.70 billion in 2024, growing at a CAGR of 6.5% from 2025–2034. The growing demand for electric vehicles, coupled with government regulations on emissions and fuel efficiency is increasing the demand for automotive composites worldwide.

Key Insights

- The non-electric vehicle segment accounted for significant revenue share in 2024, due to the extensive integration of composite materials in passenger cars and commercial vehicles for structural and functional applications.

- The glass fiber segment held the largest revenue share in 2024, owing to its cost-effectiveness, high tensile strength, and suitability for high-volume manufacturing.

- The North America automotive composite market accounted for significant share of the global market share in 2024.

- The US automotive composite market held largest of the Asia Pacific market share in 2024, driven by federal and state mandates targeting reduced transport emissions across the country.

- The market in Asia Pacific is projected to have highest market share from 2025-2034, due to rapid expansion in electric vehicle manufacturing, supported by government initiatives and localized production incentives.

- The market in China is expanding due to the rising vehicle production coupled with strong domestic demand and robust manufacturing capabilities in the country.

Industry Dynamics

- Growing demand for electric vehicles globally is accelerating the use of lightweight composite materials, as automakers aim to enhance energy efficiency, extend driving range, and reduce overall vehicle weight to meet performance benchmarks.

- Government regulations on emissions and fuel efficiency are compelling manufacturers to replace conventional metals with advanced composites that support lower fuel consumption and improved environmental compliance.

- High material and processing costs are restricting widespread adoption of automotive composites in mass-market vehicles.

- Out-of-Autoclave (OoA) processing techniques are creating new opportunities by offering scalable and cost-effective composite manufacturing methods.

Market Statistics

- 2024 Market Size: USD 21.70 Billion

- 2034 Projected Market Size: USD 40.54 Billion

- CAGR (2025-2034): 6.5%

- Asia Pacific: Largest market in 2024

Automotive composites, including glass fiber, carbon fiber, and natural fiber reinforced polymers, are lightweight materials used to reduce vehicle weight and enhance performance. These materials offer superior strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal for applications in vehicle interiors, exteriors, and structural components. The shift toward sustainable and fuel-efficient vehicles further accelerates market growth.

The global push for sustainable mobility and fuel-efficient vehicles is significantly accelerating the market growth. Governments worldwide with corporate average fuel efficiency (CAFE) standards and the European Union’s stringent CO2 emission targets, are enforcing regulations that necessitate lightweight materials, further boosting composite adoption in the automotive sector.

Innovations in manufacturing techniques, such as resin transfer molding, automated fiber placement, and compression molding, significantly reduced production costs and improved composite quality. For instance, in July 2023, Ferodo (Tenneco) introduced advanced copper-free hybrid friction material composites, combining low-steel (LS) and non-asbestos organic (NAO) materials for ICE and electric vehicles. These advancements enable automakers to scale production for mass-market vehicles while maintaining high performance standards. Additionally, research into bio composites and recyclable thermoplastics is expanding the scope of composite applications, further driving market growth.

Drivers & Opportunities

Growing Demand for Electric Vehicle Globally: The surge in electric vehicle production and consumer demand for high-performance, eco-friendly vehicles are driving the market expansion. According to International Energy Agency, global electric car sales surpassed 17 million units in 2024, capturing over 20% of the total market share. Notably, the additional 3.5 million units sold compared to 2023 alone exceeded the entire global EV sales volume recorded in 2020. Composites reduce vehicle weight by approximately 15-20% for glass fiber and 25-40% for carbon fiber compared to traditional materials such as steel, leading to improved fuel economy and reduced greenhouse gas emissions. Thus, this rising adoption of electric vehicles is significantly boosting the demand for lightweight and high-performance materials such as composites, that are crucial in enhancing energy efficiency and reducing emissions.

Government Regulations on Emissions and Fuel Efficiency: Governments across the globe are implementing rigorous environmental standards to curb carbon emissions and promote sustainable transportation, thus boosting the market growth. For example, China’s New Energy Vehicle (NEV) mandate and India’s “Make in India” initiative emphasize lightweight vehicle production to achieve fuel efficiency and reduce emissions. The European Union’s CO2 emission reduction targets aim for a 55% reduction by 2030. These regulations are pushing manufacturers to replace heavier materials such as steel with composites, enhancing vehicle performance while ensuring compliance with environmental mandates.

Segmental Insights

Vehicle Type Analysis

Based on vehicle type, the segmentation includes non-electric and electric. The non-electric vehicle segment accounted for significant revenue share in 2024, due to the extensive integration of composite materials in passenger cars and commercial vehicles for structural and functional applications such as bumpers, underbody shields, door panels, and dashboards. Traditional automakers continue to adopt composites to reduce vehicle weight and meet emission regulations, which boosts the presence of these materials in internal combustion engine-based models. The well-established manufacturing base and volume of production in this category support high demand for automotive composites.

The electric vehicle segment is projected to grow at the fastest rate during the forecast period. Lightweight materials are crucial for improving energy efficiency and extending range in electric vehicles (EVs), driving the adoption of composite solutions in battery enclosures, body panels, and structural frames. Increasing EV production across Asia Pacific, Europe, and North America, supported by government subsidies and emissions mandates, is accelerating the use of advanced fiber-reinforced composites. Manufacturers are leveraging composite-intensive designs to improve thermal management and crash performance in electric vehicle platforms.

Fiber Type Analysis

By fiber type, the market includes carbon fiber, glass fiber, and other fiber types. The glass fiber segment held the largest revenue share in 2024, owing to its cost-effectiveness, high tensile strength, and suitability for high-volume manufacturing. Glass fiber composites are extensively used in interior and exterior automotive components such as hoods, roofs, and HVAC systems. The compatibility of glass fiber with multiple molding processes and resins enables manufacturers to achieve a balance between performance and affordability. The wide adoption of glass fiber across traditional vehicle platforms are boosting its position in the global market.

The carbon fiber segment is expected to witness the fastest growth over the forecast period. The increasing demand for lightweight and high-strength materials in premium vehicles and EVs is driving the adoption. Carbon fiber composites offer superior stiffness-to-weight ratio and structural durability, making it suitable for applications such as body panels, roof systems, suspension parts, and battery enclosures. Growing investments in mass production technologies and reductions in carbon fiber costs are further expanding the accessibility beyond high-performance and luxury models.

Manufacturing Process Analysis

By manufacturing process, the market includes compression molding process, injection molding process, resin transfer molding process, and other manufacturing processes. The compression molding process segment accounted for the largest share of the market in 2024. This process is widely adopted for manufacturing high-strength and lightweight automotive parts using fiber-reinforced composites. It offers benefits such as reduced cycle times, minimal material waste, and improved mechanical properties, which make it suitable for mass production. Automotive OEMs continue to use compression molding for manufacturing exterior panels, structural parts, and reinforcement systems, contributing to the segment’s widespread utilization.

The resin transfer molding (RTM) process is projected to grow at the fastest rate during the forecast period. RTM allows precise control over fiber alignment and resin distribution, resulting in parts with high dimensional accuracy and surface finish. This process is increasingly used for producing structural components and battery enclosures in electric and high-performance vehicles. Advancements in automation and tooling, along with the compatibility of RTM with carbon and glass fibers, are contributing to its rapid adoption among automotive composite manufacturers seeking design flexibility and weight reduction.

Resin Type Analysis

By resin type, the market includes thermoset and thermoplastic. The thermoset segment held the largest revenue share in 2024, owing to its widespread application in structural and semi-structural parts due to excellent thermal stability, strength, and durability. Thermoset resins such as epoxy and polyester are used extensively in body panels, chassis parts, and under-the-hood components. These resins enable long-term mechanical performance under extreme conditions, that are ideal for high-temperature environments and load-bearing applications in vehicles.

The thermoplastic segment is projected to register the fastest CAGR during the forecast period, due to the increasing demand from automotive OEMs seeking sustainability and production efficiency. Thermoplastics offer shorter cycle times, superior impact resistance, and better moisture tolerance, which are essential for interior components, electric vehicle parts, and modular assemblies. Growth in electric vehicle manufacturing and rising regulatory focus on circular material use is increasing the demand for thermoplastic-based composites.

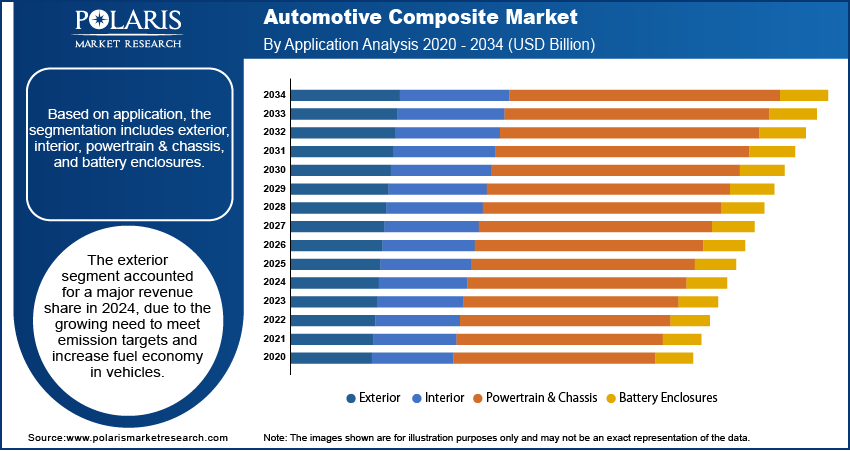

Application Analysis

By application, the market includes exterior, interior, powertrain & chassis, and battery enclosures. The exterior segment held the largest revenue share in 2024. Composite materials are widely used in exterior components such as hoods, bumpers, roof panels, and doors to improve aerodynamic performance, reduce weight, and enhance design flexibility. The growing need to meet emission targets and increase fuel economy in vehicles is propelling automakers to increasingly integrate composites into outer body structures. In addition, rising innovation in surface finishing and paint compatibility is further strengthening increasing the adoption in this application area.

The battery enclosures segment is expected to experience the fastest growth during the forecast period. Surge in electric vehicle production is pushing manufacturers to adopt composite materials over traditional metals for lighter weight, better corrosion resistance, and improved thermal insulation. Composites help optimize energy density and safety while enabling intricate design geometries. The non-conductive nature supports better electrical isolation and fire resistance, making it ideal for enclosing lithium-ion battery modules in EVs.

Regional Analysis

The market in Asia Pacific is projected to have highest market share from 2025-2034, due to rapid expansion in electric vehicle manufacturing, supported by government initiatives and localized production incentives. Countries such as China, South Korea, and Japan are offering subsidies, tax breaks, and policy support to boost EV production, pushing automakers to adopt lightweight composites for improved range and energy efficiency. Additionally, the presence of major composite and resin manufacturer is further propelling the market growth in the region. This ecosystem coupled with strong manufacturing capability with government-backed EV expansion is boosting composite usage across mass-market and premium vehicle segments.

China Automotive Composite Market Overview

The market in the China is expanding due to the rising vehicle production coupled with strong domestic demand and robust manufacturing capabilities in the country. According to the International Energy Agency, China accounted for over 70% of global electric car production in 2024. The expansion is largely driven by domestic automakers, which contributed to more than 80% of local vehicle production in 2024 up from around two-thirds in 2021. This rapid scale-up in vehicle output is increasing the demand for lightweight composite materials to improve energy efficiency, reduce emissions, and support evolving design requirements.

North America Automotive Composite Market

North America automotive composite market accounted for significant share in 2024. This is due to the region's well-established and technologically advanced automotive manufacturing infrastructure, which enables efficient integration of lightweight composite materials into vehicle production. Additionally, high electric vehicle adoption, driven by growing consumer awareness, incentives, and availability of charging infrastructure, is further boosting the demand for composites that enhance energy efficiency and vehicle range. Strong regulatory support in the form of fuel efficiency standards, emissions regulations, and sustainability mandates further accelerates the shift toward lightweight and environmentally friendly materials, therefore fueling the market growth in the region.

The US Automotive Composite Market Insight

The US dominate in the North America automotive composite landscape in 2024, driven by federal and state mandates targeting reduced transport emissions across the country. Lightweight composite materials are crucial in improving fuel efficiency and extending EV range, aligning with these environmental goals. According to the International Council on Clean Transportation, several U.S. cities have set aggressive EV adoption goals. Los Angeles targets 80% zero-emission vehicle registrations by 2035 and 100% by 2050. San Francisco aims for 100% electric vehicle sales by 2030, while Memphis plans for 50% of vehicle miles traveled to be electric by 2050. These efforts are prompting automakers to adopt lightweight design strategies, contributing to the growth of the automotive composite market in the U.S.

Europe Automotive Composite Market

The automotive composite landscape in the Europe is projected to hold a substantial share in 2034, driven by stringent emission regulations along with high demand for sustainable materials. In May 2025, the European Parliament adopted updated CO₂ emissions regulations, introducing flexibility measures for carmakers. Under the new framework, starting in 2025, manufacturers must achieve an annual CO₂ emissions reduction of 15% compared to 2021 levels throughout the 2025–2029 period. These strict regulations are pushing automakers to adopt composites for weight reduction and reduce carbon emission. Additionally, investments in recyclable composites and public-private partnerships, such as the European Lightweight Materials Initiative, are further accelerating the market growth in the region.

Key Players & Competitive Analysis Report

The automotive composite market is moderately consolidated, with competition focused on lightweight material innovation, structural performance, and cost-effective manufacturing processes. Leading players are investing in advanced composite technologies including carbon fiber-reinforced polymers, thermoplastics, and hybrid materials to meet stringent regulatory standards on emissions and improve fuel efficiency across vehicle platforms. Companies are expanding applications in structural, interior, and under-the-hood components to reduce vehicle weight without compromising safety or durability. Strategic partnerships with OEMs, tier-1 suppliers, and research institutions are accelerating the development of scalable, high-strength composites tailored for electric vehicles, hybrid systems, and next-generation mobility solutions. In addition, manufacturers are enhancing production capabilities through automation, recycling technologies, and resin innovation to meet growing demand from premium and mass-market automotive segments. The transition toward electric mobility, rising consumer expectations for high-performance vehicles, and the global push for sustainable transportation are shaping long-term growth trajectories in this market.

Prominent companies in the automotive composite market include Calier S.A., ElringKlinger AG, Exel Composites Plc, Flex-N-Gate Corporation, Georg Fritzmeir GmbH & Co. KG, Hengrui Corporation, IDI Composites International, Inc., Kautex Textron GmbH & Co. KG, Mitsubishi Chemical Group Corporation, Muhr und Bender KG (Mubea), POLYTEC HOLDING AG, Piran Advanced Composites Ltd., Röchling SE & Co. KG, SGL Carbon SE, and Syensqo SA.

Key Players

- Calier S.A.

- ElringKlinger AG

- Exel Composites Plc

- Flex-N-Gate Corporation

- Georg Fritzmeir GmbH & Co. KG

- HENGRUI Corporation

- IDI Composites International, Inc.

- Kautex Textron GmbH & Co. KG

- Mitsubishi Chemical Group Corporation

- Muhr und Bender KG (Mubea)

- POLYTEC HOLDING AG

- Piran Advanced Composites Ltd.

- Röchling SE & Co. KG

- SGL Carbon SE

- Syensqo SA

Industry Developments

- July 2025: McLaren developed an aerospace-inspired Automated Rapid Tape (ART) method for high-volume carbon-fiber component production at its Composites Technology Centre in Sheffield. The ART process reduced cycle times and material waste, positioning it for scalable application in performance and luxury vehicles.

- November 2024: Toray Advanced Composites expanded its continuous fiber-reinforced thermoplastic (CFRT) product capacity by acquiring Gordon Plastics’ Colorado facility. The new lines supported high-throughput production of CFRT tapes for aerospace and automotive OEMs using PA6, PPS, and Ultem matrices.

- June 2024: Xenia Materials launched carbon-fibre-reinforced PVDF compounds optimized for pellet-fed 3D printing, offering enhanced chemical resistance, strength, and dimensional stability. The product was designed for high-precision functional parts used in EVs, hydrogen fuel systems, and chemically exposed zones.

Automotive Composite Market Segmentation

By Vehicle Type Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Non-Electric

- Electric

By Fiber Type Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Carbon Fiber

- Glass Fiber

- Other Fiber Types

By Manufacturing Process Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Compression Molding Process

- Injection Molding Process

- Resin Transfer Molding Process

- Other Manufacturing Processes

By Resin Type Vertical Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Thermoset

- Thermoplastic

By Application Vertical Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Exterior

- Interior

- Powertrain & Chassis

- Battery Enclosures

By Regional Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Composite Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.70 Billion |

|

Market Size in 2025 |

USD 23.07 Billion |

|

Revenue Forecast by 2034 |

USD 40.54 Billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.70 billion in 2024 and is projected to grow to USD 40.54 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific dominated the global market share in 2024.

A few of the key players in the market are Calier S.A., ElringKlinger AG, Exel Composites Plc, Flex-N-Gate Corporation, Georg Fritzmeir GmbH & Co. KG, Hengrui Corporation, IDI Composites International, Inc., Kautex Textron GmbH & Co. KG, Mitsubishi Chemical Group Corporation, Muhr und Bender KG (Mubea), POLYTEC HOLDING AG, Piran Advanced Composites Ltd., Röchling SE & Co. KG, SGL Carbon SE, and Syensqo SA.

The non-electric segment dominated the market in 2024.

The carbon fiber segment is expected to witness the fastest growth during the forecast period.