Automotive Fuel Cell Market Size, Share, Trends, Industry Analysis Report

: By Component, Fuel Type, Vehicle Type (Passenger Vehicles and Commercial Vehicles), Electrolyte Type, Power Output, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM4637

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

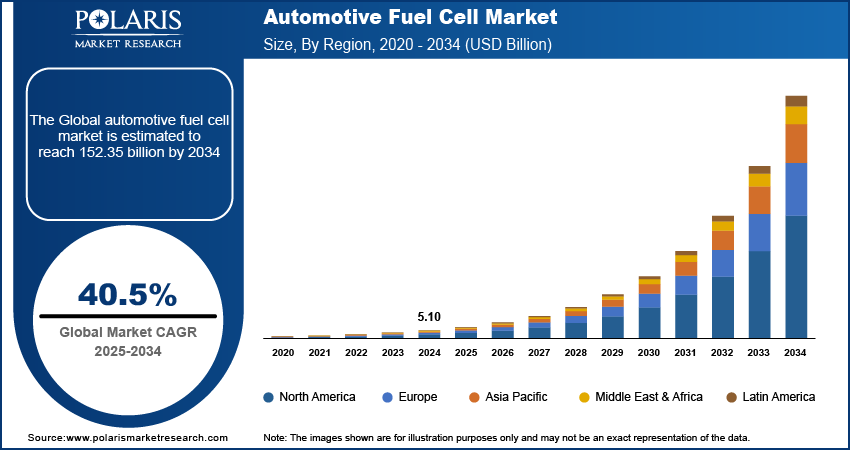

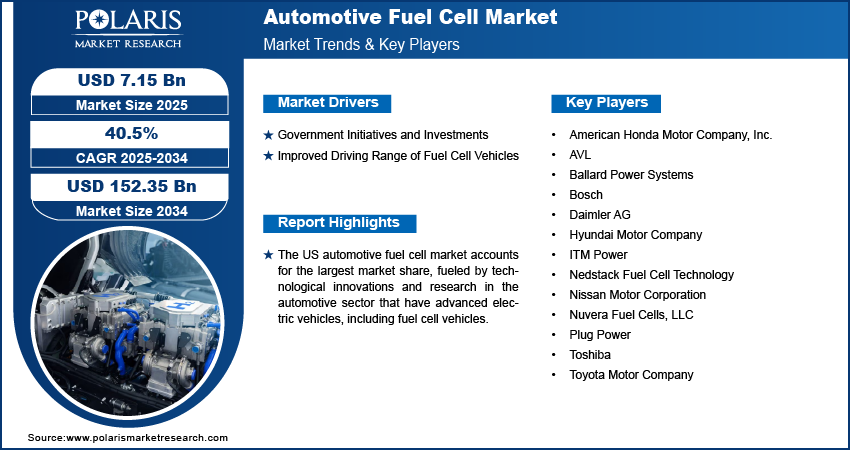

The automotive fuel cell market size was valued at USD 5.10 billion in 2024. The market is projected to grow from USD 7.15 billion in 2025 to USD 152.35 billion by 2034, exhibiting a CAGR of 40.5% from 2025 to 2034.

Fuel cells are electrochemical power generators that use hydrogen and oxygen to produce energy. In automobiles, fuel cells utilize hydrogen stored in onboard tanks to generate electricity, emitting zero gases.

The rising concerns over harmful emissions from combustion engine vehicles have led to increased demand for fuel cell vehicles, thereby boosting automotive fuel cell market growth. In addition, limited reserves of crude oil have resulted in a growing emphasis on alternative modes of transport, thereby increasing the demand for EVs, FCVs, and hydrogen vehicles. Thus, the need for sustainable development to preserve crude oil is a key factor driving market growth.

To Understand More About this Research: Request a Free Sample Report

The demand for fuel cell vehicles is increasing due to the development of hydrogen-producing companies across different regions. These companies are focusing on producing clean hydrogen and are actively pursuing initiatives to expand the infrastructure for hydrogen refilling stations and production plants. For instance, Plug Power, a hydrogen and fuel cell provider, has expanded its hydrogen plants in the US to deliver hydrogen to consumer sites, thereby contributing to increased demand for fuel cell vehicles. Moreover, the rising number of hydrogen fuel cell plants is boosting the automotive fuel cell market.

Market Trends and Drivers Analysis

Government Initiatives and Investments

The rise in government initiatives, such as tax incentives, subsidies, and low production costs, has led to increased demand for automotive fuel cells. Substantial government investments in infrastructure, including the development of roads and refueling stations, are encouraging individuals to shift from petrol vehicles to fuel cell vehicles. Besides, the increased government focus on research and development is facilitating innovations and driving the automotive fuel cell market revenue.

Improved Driving Range of Fuel Cell Vehicles

The automotive fuel cell market is experiencing significant growth due to extended battery power that enables individuals to travel long distances by FCVs to a range of 300–400 miles. In addition, fuel cells offer greater efficiency by converting chemical energy into electrical energy without combustion, reducing energy wastage. According to the US Department of Energy, fuel cells are 40% to 60% energy efficient, enhancing the driving experience for customers.

For instance, Hyundai introduced its fuel cell bus, Elec City, which comes equipped with a 180kwh hydrogen fuel system and 78.4kwh battery capacity. The bus can travel up to the range of 550km, providing higher efficiency and extended driving range to customers. Henceforth, the higher hydrogen fuel tank capacity, which helps provide a higher driving range, is boosting the automotive fuel cell market growth.

Market Segment Analysis

Automotive Fuel Cell Market Assessment by Vehicle Type

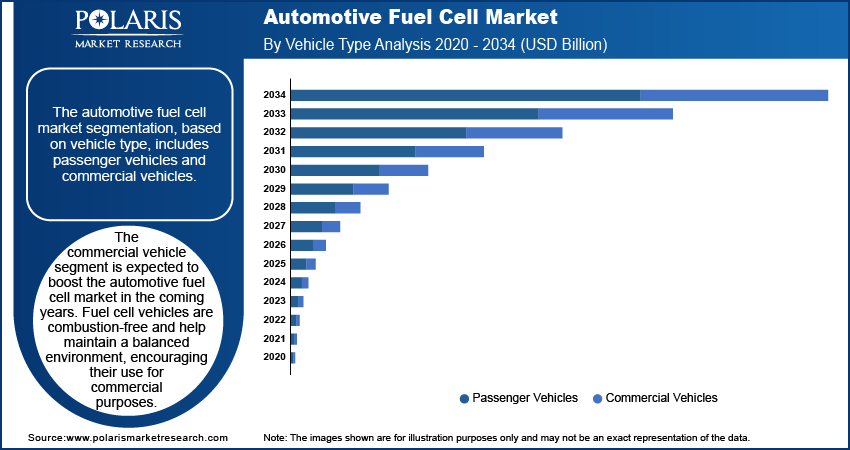

The automotive fuel cell market segmentation, based on vehicle type, includes passenger vehicles and commercial vehicles. The commercial vehicle segment is expected to boost the automotive fuel cell market in the coming years, driven by the shift from petrol vehicles to electric vehicles or fuel cell vehicles. Fuel cell vehicles are combustion-free and help maintain a balanced environment, encouraging their use for commercial purposes. In addition, more organizations and individuals are opting for fuel-cell commercial vehicles due to their availability, scalability, and affordability as compared to petrol vehicles.

Automotive Fuel Cell Market Evaluation by Electrolyte Type Insights

The automotive fuel cell market segmentation, based on electrolyte type, includes proton exchange membrane fuel cells (PEMFC) and phosphoric acid fuel cells (PAFC). The proton exchange membrane fuel cell (PEMFC) segment accounted for the largest share of the automotive fuel cell market in 2024. This is primarily due to the high efficiency and excellent power density of PEMFCs that provide high acceleration for heavy-load vehicles. Furthermore, proton exchange membrane fuel cells use water-based electrolytes that allow them to operate under low temperatures and produce electrical energy to enhance power to the vehicles. In addition, PEMFCs are relatively lightweight and compact compared to other fuel cell technologies, making them easier to integrate into vehicles without significantly impacting their overall weight or size. This characteristic is particularly advantageous for automotive applications where space and weight constraints are critical factors.

Automotive Fuel Cell Market Breakdown by Regional Insights

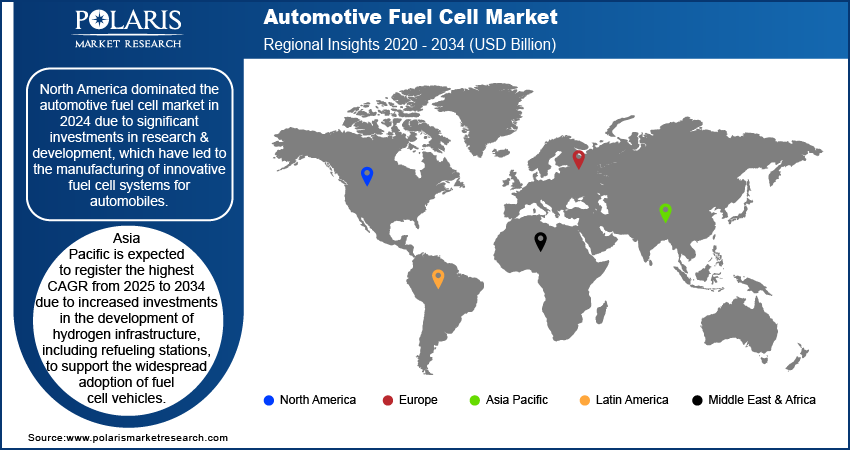

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the automotive fuel cell market in 2024 due to significant investments in research & development, which have led to the manufacturing of innovative fuel cell systems for automobiles. In addition, the presence of major companies such as Ballard Power Systems, Plug Power Inc., and others offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The US automotive fuel cell market accounts for the largest market share, fueled by technological innovations and research in the automotive sector that have advanced electric vehicles, including fuel cell vehicles. Many major automotive manufacturers, research institutions, and technology companies in the US are actively developing and commercializing fuel cell technology for automotive applications. This leadership in innovation has enabled US to maintain a competitive edge in the global market for fuel cells. Governments in the US at both the federal and state levels have implemented policies and incentives to promote the adoption of fuel cell vehicles. These include financial incentives such as tax credits, rebates, grants, and subsidies for fuel cell vehicle purchases, as well as funding for research and development projects aimed at advancing fuel cell technology. Additionally, regulatory measures aimed at reducing greenhouse gas emissions and promoting clean transportation further support the growth of the fuel cell market in North America.

Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to increased investments in the development of hydrogen infrastructure, including refueling stations, to support the widespread adoption of fuel cell vehicles. The expansion of infrastructure increases the availability of hydrogen fuel to consumers, thereby enhancing the attractiveness of fuel cell vehicles as a viable transportation option. Moreover, automotive manufacturers and technology companies in Asia Pacific are actively investing in research and development to improve the performance, efficiency, and affordability of fuel cell vehicles. Advancements in fuel cell technology, battery technology, and vehicle design are making fuel cell vehicles more competitive with traditional internal combustion engine vehicles. In addition, the region is experiencing rapid urbanization and population growth, leading to increased demand for transportation solutions, which is a key factor in boosting the automotive fuel cell market.

Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their fuel cell offerings, which will help the automotive fuel cell market to grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the automotive fuel cell market must offer cost-effective products and services.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the automotive fuel cell market to benefit clients and increase the market sector. Moreover, in recent years, the market has offered some technological advancements. Major players in the automotive fuel cell market include American Honda Motor Company Inc.; AVL; Ballard Power Systems; Bosch; Daimler AG; Hyundai Motor Company; ITM Power; Nedstack Fuel Cell Technology; Nissan Motor Corporation; Nuvera Fuel Cells LLC; Plug Power; Toshiba; and Toyota Motor Company.

Ballard Power Systems, headquarter in Canada, is a global manufacturer of fuel cell solutions. The company’s fuel solutions include heavy-duty modules, marine systems, fuel cell stacks, and stationary power that are used in different automotive sectors, such as trains, buses, trucks, ships, rails, and stationary powerhouses. Further, the heavy-duty modules are fitted in trucks, buses, rails, and other transportation means that have 45kW to 120kW net power. Ballard Power Systems aims to promote a sustainable planet and provide consumers with alternatives to petrol or fuel-based vehicles. For instance, In May 2024, Ballard launched a 9th-generation high-performance fuel cell designed for heavy-duty vehicles.

Hyundai Motor Corporation, established in 1967 and headquartered in South Korea, is a leading automobile manufacturer across the globe. Hyundai’s product range includes several models, such as Elantra N, i20, IONIQ5, Tucson, Creta, Venue, and others, all designed to provide luxury and comfort to drivers and passengers. Furthermore, to promote environmental safety, Hyundai has developed fuel-cell electric vehicles, which include fuel-cell trucks and buses. For instance, Hyundai’s XCIENT Fuel Cell electric heavy-duty truck is powered by two 90-kW fuel cell systems (total 180-kW power) and a 350-kW e-motor, giving a maximum range of over 400 km for fleet operations in Switzerland. To date, 48 XCIENT fuel cell trucks are in operation in Switzerland.

List of Key Companies in the Automotive Fuel Cell Market

- American Honda Motor Company, Inc.

- AVL

- Ballard Power Systems

- Bosch

- Daimler AG

- Hyundai Motor Company

- ITM Power

- Nedstack Fuel Cell Technology

- Nissan Motor Corporation

- Nuvera Fuel Cells, LLC

- Plug Power

- Toshiba

- Toyota Motor Company

Market Developments

January 2024: Hyundai Motor Company and Kia Corporation unveiled their partnership to advance the development of polymer electrolyte membrane (PEM) for hydrogen fuel cell systems. Their collaboration aims to pioneer advanced PEM technology for the next generation of fuel cell electric commercial vehicles.

May 2023: Hyundai collaborated with Plus to demonstrate the XCIENT Fuel Cell truck equipped with Plus's Level 4 autonomous driving software at the Advanced Clean Transportation (ACT) Expo in the US. The collaboration aims to enhance road safety and freight efficiencies.

August 2023: Ballard Power Systems partnered with Ford Trucks to develop fuel cell-powered heavy-duty trucks. The partnership aims to supply 2 FC move™-XD 120 kW fuel cell engines to Ford Trucks.

Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Fuel Processor

- Fuel Stack

- Power Conditioner

- Air Compressor

- Humidifier

By Fuel Type Outlook (Revenue – USD Billion, 2020–2034)

- Ethanol

- Methanol

- Hydrogen

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Vehicle

- Commercial Vehicles

By Electrolyte Type Outlook (Revenue – USD Billion, 2020–2034)

- Proton Exchange Membrane Fuel Cell (PEMFC)

- Phosphoric Acid Fuel Cell (PAFC)

By Power Output Outlook (Revenue – USD Billion, 2020–2034)

- Below 100 kW

- 100–200 kW

- Above 200 kW

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.10 billion |

|

Market Size Value in 2025 |

USD 7.15 billion |

|

Revenue Forecast in 2034 |

USD 152.35 billion |

|

CAGR |

40.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive fuel cell market size was valued at USD 5.10 billion in 2024 and is expected to grow to USD 152.35 billion by 2034

The market is projected to grow at a CAGR of 40.5% from 2025 to 2034.

North America is projected to dominate the automotive fuel cell market.

The key players in the market are American Honda Motor Company Inc.; AVL; Ballard Power Systems; Bosch; Daimler AG; Hyundai Motor Company; ITM Power; Nedstack Fuel Cell Technology; Nissan Motor Corporation; Nuvera Fuel Cells LLC; Plug Power; Toshiba; and Toyota Motor Company.

The passenger vehicle type dominated the market in 2024.

The proton exchange membrane fuel cell (PEMFC) segment had the largest market share in 2024.