Automotive Turbocharger Market Size, Share, Trends, Industry Analysis Report

: By Technology (Twin Turbo, Variable Geometry Turbo, Wastegate, Electric, and Others), Material, Fuel Type, Operation, Vehicle, Sales Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 114

- Format: PDF

- Report ID: PM5076

- Base Year: 2023

- Historical Data: 2019-2022

Automotive Turbocharger Market Overview

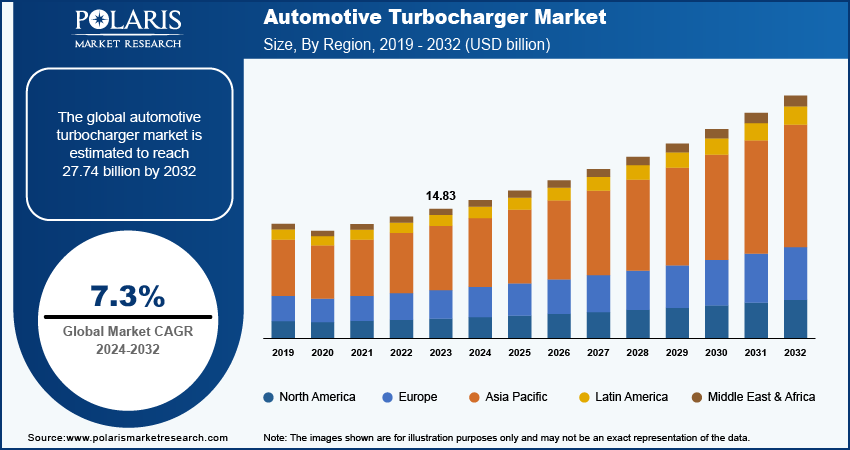

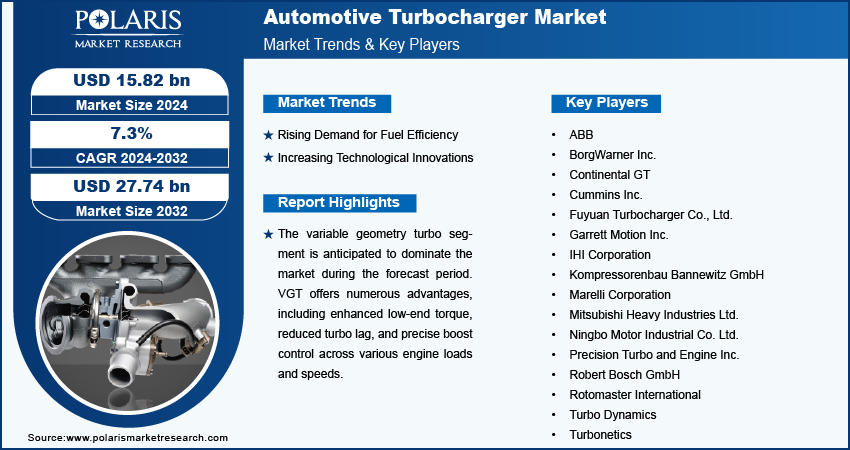

Global automotive turbocharger market size was valued at USD 14.83 billion in 2023. The automotive turbocharger market industry is projected to grow from USD 15.82 billion in 2024 to USD 27.74 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.3% during the forecast period (2024 - 2032).

The automotive turbocharger market encompasses the worldwide sector responsible for producing, distributing, and selling turbochargers designed for vehicles. Turbochargers are forced induction systems that enhance the power and efficiency of internal combustion engines by delivering additional compressed air into their combustion chambers.

The automotive turbocharger market is being significantly driven by government regulations aimed at reducing emissions and enhancing fuel efficiency. For instance, the European Union's stringent CO2 emission targets require new vehicles to emit no more than 95 grams per kilometer by 2021, pushing manufacturers to adopt turbocharging technology. In the United States, the Corporate Average Fuel Economy (CAFE) standards mandate an average fuel economy of 54.5 mpg for cars and light trucks by 2025. These regulations compel automakers to incorporate turbochargers, which allow smaller engines to meet performance and efficiency standards while minimizing environmental impact.

To Understand More About this Research: Request a Free Sample Report

Another key driver of the automotive turbocharger market is the rising consumer demand for fuel-efficient vehicles. According to a report from the International Energy Agency, global electric vehicle sales surged to 6.6 million in 2021, reflecting a growing preference for efficient automotive technologies. Governments worldwide are supporting this shift with incentives; for example, the U.S. offers tax credits for electric and hybrid vehicles, promoting advancements in turbocharged engines as a bridge technology. Additionally, the European Commission's Green Deal aims to make Europe the first climate-neutral continent by 2050, further encouraging the adoption of turbocharged, fuel-efficient vehicles.

Automotive Turbocharger Market Drivers and Trends

Rising Demand for Fuel Efficiency

The increasing demand for fuel efficiency in vehicles is a significant driver of the automotive turbocharger market. As consumers become more environmentally conscious and fuel prices fluctuate, there is a growing preference for vehicles that offer better fuel economy. Turbochargers play a crucial role in this context by improving the power output of engines while allowing for smaller engine sizes. For instance, in August 2022, Cummins Turbo Technologies (CTT) is geared up to launch the 8th generation Holset HE400VGT turbocharger in 2024, promising 5 percent improved efficiency over its predecessor and delivering enhanced performance, durability and fuel economy benefits for heavy-duty trucks.

This technology enables manufacturers to produce vehicles that maintain performance levels without the increased fuel consumption typically associated with larger engines. Consequently, turbocharging has emerged as a preferred solution in the automotive industry, especially for both gasoline and diesel engines, as it effectively balances power and efficiency. Turbochargers not only meet customer demand but also help manufacturers in adhering to strict emission requirements. By enhancing the combustion process, turbochargers allow for more efficient fuel usage, resulting in reduced emissions of harmful pollutants.

Increasing Technological Innovations

Continuous advancements in turbocharger technology, particularly the development of electric turbochargers, are significantly enhancing fuel economy and reducing emissions in modern vehicles. Electric turbochargers, or "e-turbos," address a common issue known as turbo lag, which is the delay between pressing the accelerator and the engine's response. By utilizing an electric motor to spin the compressor, these systems can provide an immediate boost, improving engine responsiveness and overall performance. For instance, in April 2022, The Mercedes-AMG C 43 debuted with the production of the electric turbocharger, enhancing both engine power and hybrid-electric battery charging capabilities.

This innovation allows manufacturers to optimize smaller engine designs without sacrificing power, making them an essential component in the push for more efficient automotive solutions. The integration of smart sensors and advanced materials into turbocharger design is significantly advancing the market. These sensors monitor various engine parameters in real-time, allowing for precise control over boost levels and combustion efficiency, which effectively minimizes fuel consumption and emissions. Additionally, the use of lightweight, heat-resistant materials enhances both durability and performance, enabling turbochargers to operate at higher temperatures without sacrificing efficiency. This combination of technological advancements is not only improving the effectiveness of turbochargers but also driving revenue growth in the automotive turbocharger market.

Automotive Turbocharger Market Segment Insights

Automotive Turbocharger Market Analysis by Technology Insights

The global automotive turbocharger market segmentation based on technology, includes twin turbo, variable geometry turbo, wastegate, electric, and others. The variable geometry turbo segment is anticipated to dominate the market during the forecast period. VGT offers numerous advantages, including enhanced low-end torque, reduced turbo lag, and precise boost control across various engine loads and speeds. These features make them highly sought after globally, enabling improved engine performance, greater fuel efficiency, and compliance with stringent emission standards.

VGT turbochargers are increasingly adopted across a wide range of vehicle categories, including passenger cars, commercial vehicles, and heavy-duty trucks and buses. Major industry players such as BorgWarner Inc.; Garrett Motion Inc.; and Cummins Turbo Technologies are making substantial investments in advancing VGT technology. Their initiatives focus on integrating sophisticated electronic control units (ECUs) to further enhance performance, efficiency, and reliability. As these companies continue to innovate and refine VGT systems, the market is expected to benefit from improved engine responsiveness and fuel economy, solidifying the position of VGT turbochargers as a key component in modern automotive engineering.

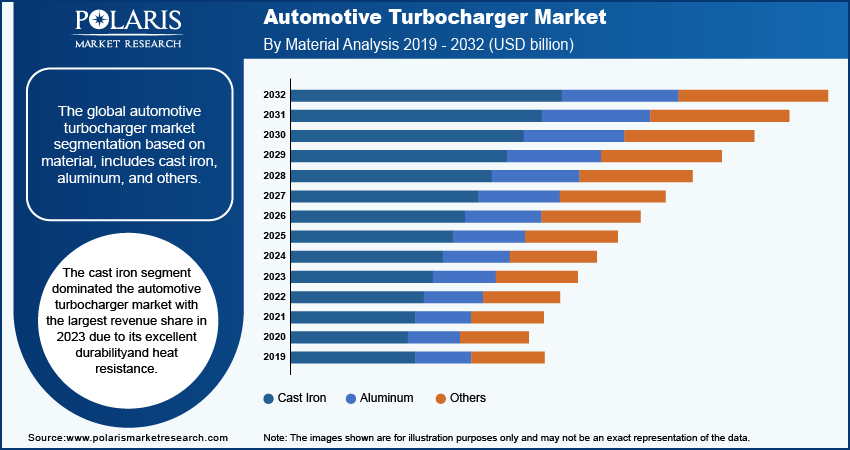

Automotive Turbocharger Market Analysis by Material Insights

The global automotive turbocharger market segmentation based on material, includes cast iron, aluminum, and others. The cast iron segment dominated the automotive turbocharger market with the largest revenue share in 2023. It is highly favored for manufacturing turbochargers due to its exceptional heat resistance, capable of withstanding temperatures up to 900°C. This durability makes cast iron the preferred choice for crafting turbocharger housings. Variants such as grey cast iron, ductile iron, and silicon molybdenum are commonly used for this purpose.

Major suppliers rely on cast iron for producing turbochargers. For example, Mitsubishi Heavy Industries (MHI) offers turbine housings made from cast iron, engineered to endure temperatures of up to 700°C, as well as austenitic stainless cast steel designed for temperatures exceeding 1,000°C. The increasing demand for turbocharged diesel engines in commercial vehicles also boosts the growth of the cast iron segment. In addition, global cargo transportation is rising, which drives the growth of commercial vehicles equipped with cast iron turbochargers.

Automotive Turbocharger Market Analysis by Regional Insights

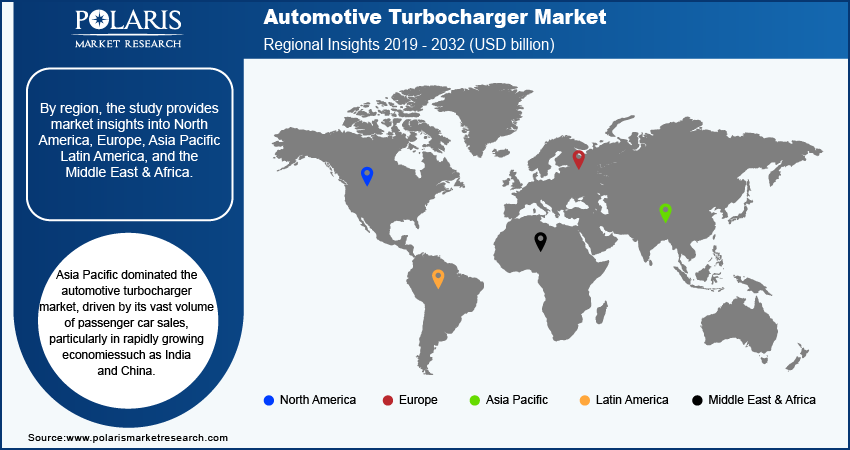

By region, the study provides market insights into North America, Europe, Asia Pacific Latin America, and the Middle East & Africa. Asia Pacific dominated the automotive turbocharger market, driven by its vast volume of passenger car sales, particularly in rapidly growing economies such as India and China. These countries are pivotal due to their significant automotive production and increasing adoption of turbocharged vehicles. Factors such as rapid urbanization, expanding industrialization, improved infrastructure, and rising disposable incomes are fueling this market growth.

Stringent government regulations on emissions, exemplified by India's recent transition to BS-VI standards, are accelerating the adoption of turbochargers as automakers strive to enhance fuel efficiency and meet environmental standards. Also, In April 2024, the Indian government was preparing to implement stringent BS-VII and CAFE-III emission norms to reduce vehicle air pollution and enhance fuel efficiency, aligning with European standards to facilitate exports and necessitating significant investments from both the oil and auto sectors.

These underscore a robust outlook for turbocharger technology in Asia Pacific, where demand continues to rise amidst evolving automotive and regulatory landscapes.

North American automotive turbocharger market is anticipated to grow at the fastest pace over the forecast period, driven by the enthusiastic adoption of advanced turbocharger technologies and the increasing demand for fuel-efficient vehicles. Innovations such as electric and variable geometry turbochargers are gaining traction, enhancing engine performance while adhering to stringent emissions regulations set by the US Environmental Protection Agency (EPA). These regulations compel automakers to develop cleaner, more efficient engines, further fueling the demand for turbochargers.

The rising consumer preference for high-performance vehicles and the shift towards small-displacement turbocharged engines in SUVs and crossovers are contributing to market expansion.

Automotive Turbocharger Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the automotive turbocharger market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, automotive turbocharger industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global automotive turbocharger market to benefit clients and increase the market sector. In recent years, the market has offered some technological advancements. Major players in the automotive turbocharger market includes ABB; BorgWarner Inc.; Continental GT; Cummins Inc.; Fuyuan Turbocharger Co., Ltd.; Garrett Motion Inc.; IHI Corporation; Kompressorenbau Bannewitz GmbH; Marelli Corporation; Mitsubishi Heavy Industries Ltd.; Ningbo Motor Industrial Co. Ltd.; Precision Turbo and Engine Inc.; Robert Bosch GmbH; Rotomaster International; Turbo Dynamics; and Turbonetics.

Cummins, a global provider of power technologies, operates through diverse business segments, specializing in designing, manufacturing, distributing, and servicing a comprehensive array of power solutions. The company offers a wide range of products encompassing internal combustion engines and electric and hybrid integrated power solutions, along with components such as filtration systems, aftertreatment devices, turbochargers, fuel systems, control systems, air handling systems, and others. In July 2024, Cummins Components and Software (CCS) launched the HE200WG turbocharger, delivering superior performance and efficiency for global light-duty on-highway and off-highway applications.

ABB Ltd is a manufacturer and distributor of electrification, automation, robotics, and motion products. It serves industries with renewable power solutions, electric vehicle charging, industrial robots, autonomous mobile robotics, drives, generators, motors, and advanced process control software. ABB supports sectors including automotive, mining, oil and gas, and power generation, offering comprehensive solutions from distribution automation to cybersecurity services. In February 2022, ABB's Turbocharging division unveiled "Accelleron," a brand focused on inspiring innovation and sustainability in global engine technology markets.

List of Key Companies in Automotive Turbocharger Market

- ABB

- BorgWarner Inc.

- Continental GT

- Cummins Inc.

- Fuyuan Turbocharger Co., Ltd.

- Garrett Motion Inc.

- IHI Corporation

- Kompressorenbau Bannewitz GmbH

- Marelli Corporation

- Mitsubishi Heavy Industries Ltd.

- Ningbo Motor Industrial Co. Ltd.

- Precision Turbo and Engine Inc.

- Robert Bosch GmbH

- Rotomaster International

- Turbo Dynamics

- Turbonetics

Automotive Turbocharger Industry Developments

- March 2024: Ferrari has patented an inverted I6 hydrogen engine with electric turbocharging, exploring unconventional layouts to enhance packaging and performance in future high-performance vehicles. This innovative design aims to optimize both space and efficiency, showcasing Ferrari's commitment to pushing the boundaries of automotive technology while embracing sustainable fuel alternatives.

- May 2023: Mercedes-AMG introduced the SL 43 with an electrically assisted turbocharger, enhancing throttle response and torque delivery across the rpm range, inspired by Formula 1 technology.

- April 2023: Garrett Motion Inc. presented advanced turbocharger and e-mobility solutions at Auto Shanghai 2023. It aimed at advancing vehicle efficiency and electrification in the automotive sector.

Automotive Turbocharger Market Segmentation

By Technology Outlook

- Twin Turbo

- Variable Geometry Turbo

- Wastegate

- Electric

- Others

By Material Outlook

- Cast Iron

- Aluminum

- Others

By Fuel Type Outlook

- Gasoline

- Diesel

- Alternate Fuel/CNG

By Operation Outlook

- Conventional Turbochargers

- e-Turbochargers

By Vehicle Outlook

- Passenger Vehicles

- Light Commercial Vehicles

- Trucks

- Buses & Coaches

- Off-road Vehicles

- Industrial Vehicles

By Sales Channel Outlook

- OEMs

- Aftermarket

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Turbocharger Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 14.83 billion |

|

Market Size Value in 2024 |

USD 15.82 billion |

|

Revenue Forecast in 2032 |

USD 27.74 billion |

|

CAGR |

7.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

FAQ's

The global automotive turbocharger market size was valued at USD 14.83 billion in 2023 and is anticipated to reach at USD 27.74 billion by 2032.

The global market is projected to register a CAGR of 7.3% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market

The key players in the market are ABB; Aptiv PLC; BorgWarner Inc.; Continental GT; Cummins Inc.; Fuyuan Turbocharger Co., Ltd.; Garrett Motion Inc.; IHI Corporation; Kompressorenbau Bannewitz GmbH; Marelli Corporation; Mitsubishi Heavy Industries Ltd.; Ningbo Motor Industrial Co. Ltd.; Precision Turbo and Engine Inc.; Robert Bosch GmbH; Rotomaster International; Turbo Dynamics; and Turbonetics.

The variable geometry turbo category dominated the market in 2023.

The cast iron had the largest share of the global market.