Autonomous Delivery Robots Market Share, Size, Trends, Industry Analysis Report

By Product (Fully Autonomous Robots, Semi-Autonomous Robots); By Component (Hardware, Software); By End-Use; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 120

- Format: PDF

- Report ID: PM2143

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Outlook

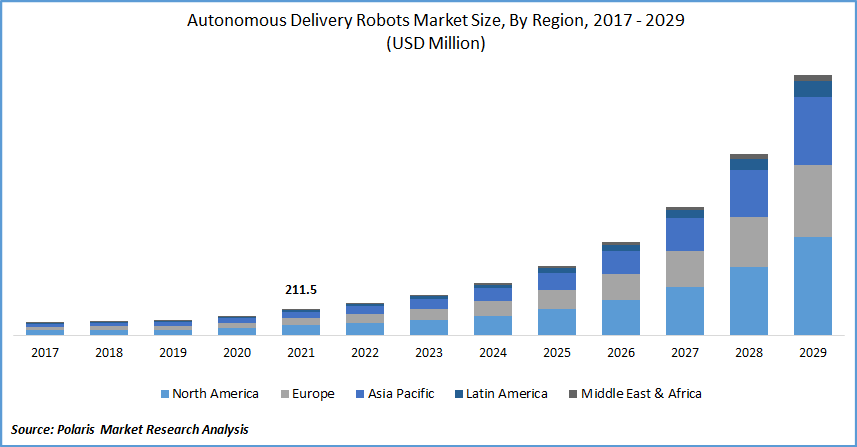

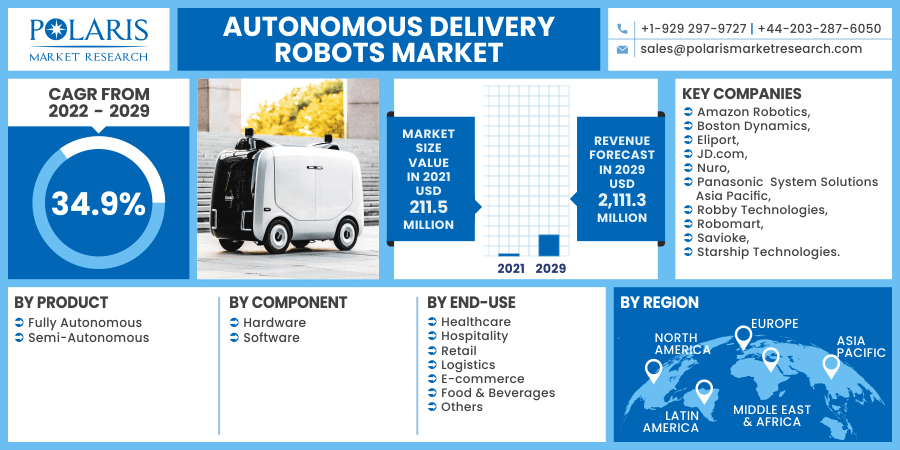

The global autonomous delivery robots market was valued at USD 211.5 Million in 2021 and is expected to grow at a CAGR of 34.9% during the forecast period.

The key factors include the benefits associated with the Autonomous Delivery Robots (ADRs) for the e-commerce sector, continuous improvement in the online retail industry by adopting the latest technologies to reduce the cost of last-mile distribution, and the demand for contactless delivery boost market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The final stage of delivering the product, from the warehousing or distribution center to the end-user, accounts for around 28% of the entire transportation cost in most supply chains. Congestion in urban areas, isolated places, incorrect address details, difficult-to-find destinations, and a severe labor scarcity for supplying on-demand distribution services are all variables that affect last-mile delivery. All of these obstacles are preventing the optimization of this phase. In e-commerce platforms, provide customers with better convenience at a lower cost and fundamentally alter the competitive landscape among major players.

Further, the increasing consumer expectations for faster and frictionless deliveries have provided the attractive potential for autonomous delivery robots market expansion. E-commerce and package delivery are rapidly expanding, and numerous start-ups have already begun testing to deliver packages and groceries to consumers using (ADRs). They are also becoming increasingly adept at executing previously more difficult-to-automate jobs due to outstanding computer vision advancements, Artificial Intelligence (AI), deep learning, and robotic mechanics.

Moreover, most online retailers constantly try to offer faster, cheaper shipping or easier returns. This competition among e-commerce marketplace has significantly improved the e-commerce industry and is driving the global autonomous delivery robots market growth. The order fulfillment process is generally simple for brick-and-mortar retailers; packages arrive directly to stores at predetermined intervals, either from suppliers or corporate distribution centers.

However, getting goods to various locations safely and timely necessitates some advanced planning for online businesses. Last-mile delivery and reverse logistics are expensive and complicated processes, so online retailers constantly innovate their procedures by adopting ADRs to meet customer needs and stay competitive.

For instance, in September 2020, China’s Alibaba Group has launched an autonomous robot for logistics support. The robot can deliver around 500 packages a day. However, malfunctioning robots and weather issues are the main factors impeding autonomous delivery robots' market growth. In today's world, autonomous delivery robots can only handle a light dusting of snow.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The majority of growth originates from developing countries in Asia and South America, where economic growth shapes consumer confidence and creates markets with larger disposable income. For instance, in the Philippines, the average family income was USD 5,087 in 2015, while Filipino families earned 16.8% more in 2018, averaging USD 5,941.5, while expenditure increased by 10.6%. Besides, spending has fueled demand for ADRs by increased disposable income due to economic expansion.

In addition, according to the Organization for Economic Co-operation and Development, the annual growth of the household disposable income in 2020 in Costa Rica was around 7.5%. Besides, in 2019, Lithuania was around 6.8%, Estonia was around 6.5%, Poland was around 6.0%, and Ireland was around 5.2%. Thus, the high disposable income across developing countries and awareness among people for online shopping has created the demand for the products through an online platform, which has led to an increase in demand for autonomous delivery robots among start-ups and major players, propelling the market growth during the forecast period.

Besides, the major players are taking initiatives by innovating technologies in the autonomous delivery robots industry. For instance, in June 2021, JD.com has revealed the deployment of 30 new autonomous vehicles in Changshu to meet consumer delivery expectations. JD's self-driving delivery vehicles are regularly used in over 20 Chinese cities for e-commerce parcel delivery. JD is the world's first corporation to use Level-4 self-driving technology on public roads with no human intervention.

Also, in December 2021, Ottonomy, a deep tech firm, announced the introduction of its Ottobot fleet for food and commerce at the Cincinnati/Northern Kentucky International Airport (CVG). Customers can place orders at orderatcvg.com from various retail stores run by Paradies Lagardere. They'll get updates about their order on their phone, and they'll use a QR code to unlock the robot's secure compartment and retrieve their things. Thus, the players’ contribution to improving the latest technologies is to drive the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on product, component, end-use, and region.

|

By Product |

By Component |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

The hardware segment is expected to be the most significant revenue contributor and is expected to retain its dominance in the foreseen period. The segment accounted for a higher portion of the market. However, the increased supply of robots with auto navigating and autonomous decision-making skills makes the market for software components likely to rise faster CAGR during the forecast period.

Geographic Overview

In terms of geography, North America had the largest revenue share. Major suppliers are based here, and the presence of a huge number of innovative start-ups and a strong focus on precision manufacturing to advance the process of autonomous delivery robots. Moreover, the region is also having key ancillary companies supporting the growth of the parent market.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2020. For a long time, the future factory has existed; digital platforms are extensively used, people and robots collaborate in everyday work, and automation is getting more efficient. Industry 4.0 will only work at its best if production and logistics systems are well-connected. We can observe how mobile robots can facilitate the movement of goods and services among static production lines and production cells at Kamstrup. Human life has become increasingly reliant on robots.

Competitive Insight

Some of the major players operating in the global market include Amazon Robotics, Boston Dynamics, Eliport, JD.com, Nuro, Panasonic System Solutions Asia Pacific, Robby Technologies, Robomart, Savioke, and Starship Technologies.

Autonomous Delivery Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 211.5 Million |

|

Revenue forecast in 2029 |

USD 2,111.3 Million |

|

CAGR |

34.9% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Product, By Component, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amazon Robotics, Boston Dynamics, Eliport, JD.com, Nuro, Panasonic System Solutions Asia Pacific, Robby Technologies, Robomart, Savioke, and Starship Technologies. |