Bag-in-Box Container Market Share, Size, Trends, Industry Analysis Report

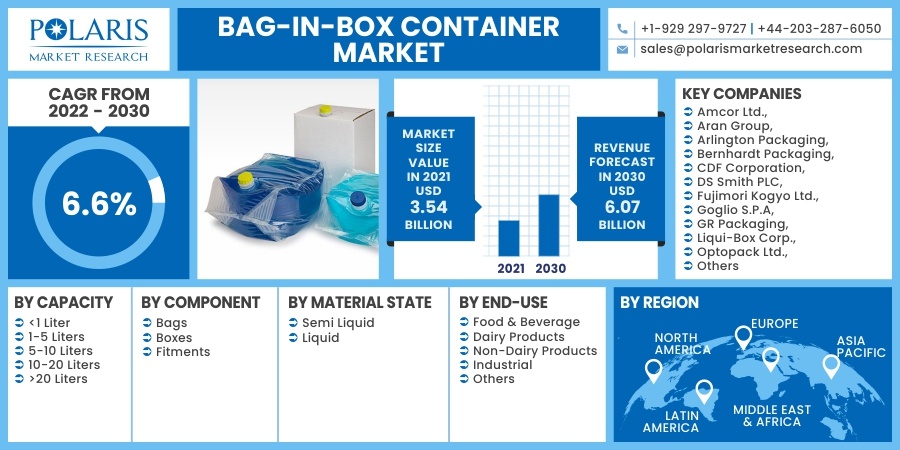

By Capacity (< 1 Liter, 1-5 Liters, 5-10 Liters, 10-20 Liters, >20 Liters); By Material State; By Component; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 117

- Format: PDF

- Report ID: PM2351

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

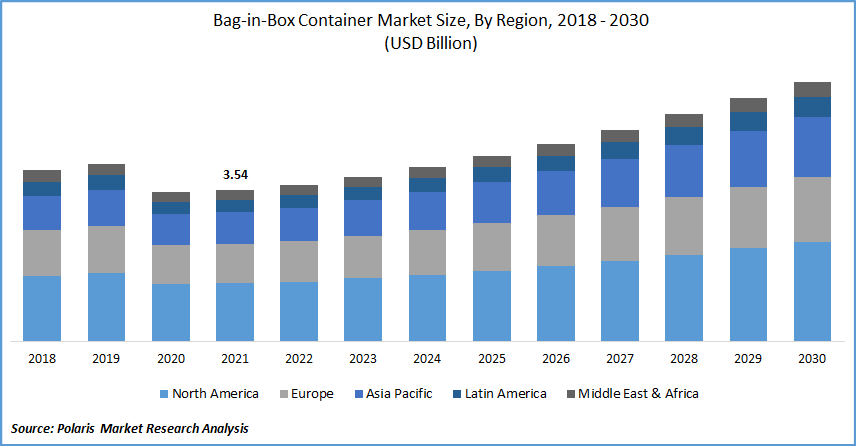

The global bag-in-box container market was valued at USD 3.54 billion in 2021 and is expected to grow at a CAGR of 6.6% during the forecast period. A bag-in-box container is used for storing and transporting liquids. It comprises a robust bladder or plastic bag placed inside a corrugated fiberboard box, usually consisting of many layers of metalized film or other plastics.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

BiB offers a wide range of commercial uses. Among the most popular are the provision of syrup to soft drink fountains and the dispensing of bulk sauces such as ketchup or mustard in the restaurant business. BiB technology is still utilized in garages and dealerships for distributing sulfuric acid for filling lead-acid batteries. BiBs have also been used in consumer applications such as boxed wine.

Industry Dynamics

Growth Drivers

The rising demand for packaged goods and beverages is expected to fuel the bag-in-box container market. Furthermore, the increase in ecologically safer and sustainable packaging is expected to cushion the expansion of the bag-in-box container market.

This technology is gaining popularity for liquids such as wine, juices, and other liquid consumer products, as well as food products such as ice cream and other dairy items. Its packaging provides excellent levels of protection for the contents, both food, and beverage, during transportation, while the smaller weight of the packaging combination reduces overall shipment weight, saving on fuel expenses and minimizing the carbon footprint.

Bag-in-Box container market provides excellent levels of protection for the contents, both food % beverage, during transportation, while the smaller weight of the packaging combination reduces overall shipment weight, saving on fuel expenses and minimizing the carbon footprint. The container adds another layer of protection to food products. CDF, for example, recently passed the strict safety standards for the design of its bag-in-box, earning UN Certification for its 20 Liter package.

The plastic bag used in these containers is also environmentally friendly in a variety of different ways. Producing a plastic file saves energy. At the end of its life, the bag-in-box can be totally recycled through both the fiberboard and polymer recycling streams, including the injection-molded dispensing nozzles utilized in liquid dispensing bag-in-box applications.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of capacity, component, material state, end-use, and region.

|

By Capacity |

By Component |

By Material State |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Capacity

Based on capacity, the 5-10 liters segment held a significant share during the forecasted period. Beverage makers, foodservice operators, and quick-service restaurants have all adopted 5-liter bag-in-boxes in dispensing systems, helping to drive the segment's rapid expansion. The 1-liter segment is predicted to increase at the quickest CAGR during the forecast period because of the rising use of this container for packaging wines and juices for consumer use.

Insight by End-Use

Based on end-use, the food & beverage market segment accounted for the largest share during the forecasted period. The demand for food & beverage bag-in-box (BiB) packaging will skyrocket during the next five years. Manufacturers need smart bag-in-box packaging and filling solutions to meet food industry demand. These containers reduce the carbon footprint of packaging by eight times compared to glass bottles. Furthermore, these containers use 85% less plastic than rigid containers. These factors are contributing to the market growth.

Geographic Overview

Asia Pacific region is expected to dominate the bag-in-box container market during the forecasted period. The food sector in the Asia Pacific region is massive, and it is thus a critical component of the region's economic development possibilities. As the population of the region and disposable income is increasing, the food & beverage industry will substantially rise in the coming years, therefore contributing to the growing demand of the market.

Europe is expected to grow at a significant rate during the forecasted period. Rising population and per capita income, as well as changing lifestyles, are the primary causes driving the region's beverage sector expansion. Therefore, with the growing end-use industry in the region, the demand for the bag-in-box container market is expected to increase.

Competitive Landscape

Major players in the market are Amcor Ltd., Aran Group, Arlington Packaging, Bernhardt Packaging, CDF Corporation, DS Smith PLC, Fujimori Kogyo Ltd., Goglio S.P.A, GR Packaging, Liqui-Box Corp., Optopack Ltd., Scholle Ipn Corp., SLF Packaging, and Smurfit Kappa.

Bag-in-Box Container Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.54 billion |

|

Revenue forecast in 2030 |

USD 6.07 billion |

|

CAGR |

6.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Capacity, By Component, By Material State, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amcor Ltd., Aran Group, Arlington Packaging, Bernhardt Packaging, CDF Corporation, DS Smith PLC, Fujimori Kogyo Ltd., Goglio S.P.A, GR Packaging, Liqui-Box Corp., Optopack Ltd., Scholle Ipn Corp., SLF Packaging, and Smurfit Kappa |