Bariatric Surgery Devices Market Share, Size, Trends, Industry Analysis Report

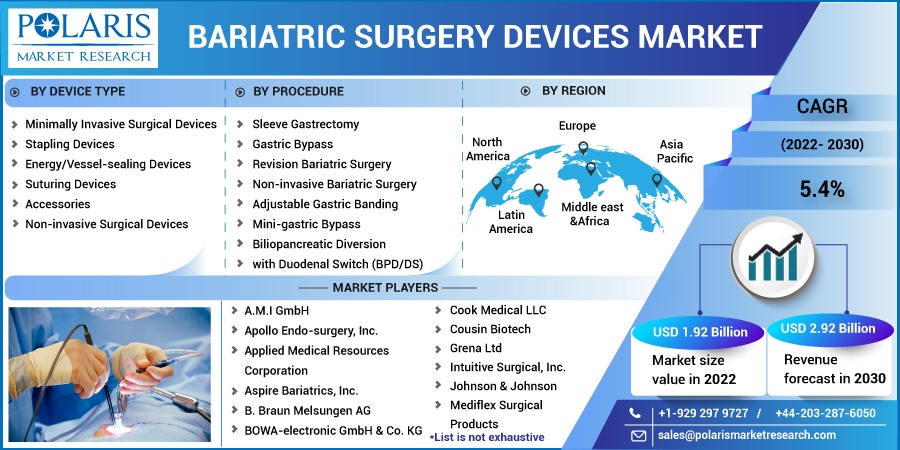

By Device Type (Minimally Invasive Surgical Devices, Non-invasive Surgical Devices); By Procedure; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 114

- Format: PDF

- Report ID: PM2663

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

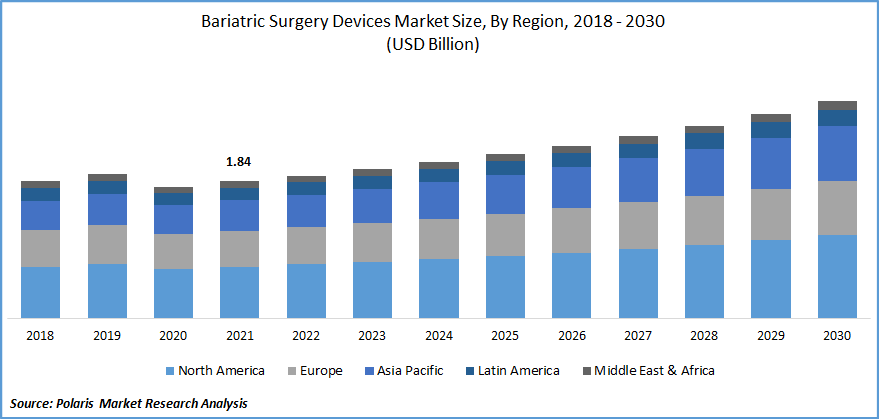

The global bariatric surgery devices market was valued at USD 1.84 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. The growing demand for bariatric surgery devices is expected to be driven by the growing incidence of obesity and the rapid rise in the prevalence of childhood obesity.

Know more about this report: Request for sample pages

Bariatric surgery replaces open surgery, performed with a large incision under general anesthesia. One of the significant reasons anticipated to accelerate the growth and demand of the bariatric surgery devices market is the increase in the need for minimally invasive surgeries throughout the world. Furthermore, the availability of medical specialists, both experienced and new surgeons practicing bariatric procedures, specializing and polishing their surgical skills is expected to impact the market growth positively.

The COVID-19 pandemic had a negative impact on the growth of the bariatric surgery devices market. As lockdown measures were implemented, many patients were not offered bariatric procedures as many doctors were occupied treating the covid infection. Because of restrictions on migration and the lockdown worldwide, the obesity rate rose, and morbidly obese patients were put on hold. However, as the activities resumed, there was a massive demand for the procedure of bariatric surgery.

The quick shift in lifestyle preferences, excessive calorie consumption, and high healthcare costs are anticipated to boost market growth. In addition, government funding and increased awareness regarding poor eating habits in developing countries like India and China will likely complement market growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global bariatric surgery devices market is likely to be driven by the rise in severe obesity around the world, along with teenagers at higher risk of becoming obese than the average adult. Furthermore, the market for bariatric surgical devices is anticipated to expand significantly due to the prevalence of chronic conditions, including high cholesterol, hypertension, and diabetes, which is likely to positively impact the market growth.

The rise in government financing and technological advancement in developing and developed countries are expected to contribute to market growth. Additionally, the growing demand for minimally invasive surgeries (MIS) is one of the significant factors expected to drive market growth. Furthermore, manufacturers focus on creating minimally invasive bariatric surgery devices that meet the demands of patients, which eventually has created a lucrative opportunity for the market's growth.

Report Segmentation

The market is primarily segmented based on device type, procedure, and region.

|

By Device Type |

By Procedure |

By Region |

|

|

|

Know more about this report: Request for sample pages

Minimally Invasive Surgical Devices Accounted for the Largest Share in 2021

The minimally invasive surgical devices market segment accounted for the highest revenue share in 2021 owing to they are less painful and involve fewer incisions on the human body. Also, the high-occurrence of obesity-related illness are growing worldwide, which requires fewer internal scars and less pain during surgery.

Moreover, the demand for minimally invasive surgery, also known as laparoscopic surgery, is replacing traditional surgical instruments as they ensure faster recovery and are linked to a much-decreased incidence of complications and death.

Additionally, the market for minimally invasive surgery was equipped with the category of stapling devices owing to increased bariatric operations and the introduction of new and impressive stapling technologies, which would accelerate the market growth in the forecast period.

Sleeve Gastrectomy are Expected to Spearhead the Market Growth

The demand for sleeve gastrectomy is driven by the rising demand for efficient, safe, and affordable surgeries. Additionally, the food and drug administration has also approved that incision-free operations are better than traditional ones, of which sleeve gastrectomy delivers better results.

Moreover, this procedure has a shorter hospital stay of about two days after surgery and fewer complications than other procedures, which is likely to complement market growth. Furthermore, it involves a smaller incision, which makes it easier for patients to accept the surgery without fear. This is one of the significant factors that increase the demand for the procedure in the market.

North America Dominated and will Continue to Dominate the Market

North America is the largest region in the bariatric surgery devices market. It is expected to continue its dominance over the forecast period owing to the increasing cases of obesity and diabetes, the prevalence of chronic diseases, and lifestyle changes with poor eating habits. In addition, the bariatric surgery device market is expanding due to rising obesity management awareness and the existence of sizable medical device companies.

The Asia Pacific is expected to expand and show significant growth for bariatric surgery devices because of the increasing rate of obesity-related disorders in regions such as India, China, and Japan. Furthermore, the growing teenage and adult population, fast-rising co-morbidities like diabetes and heart diseases, and government initiatives to treat obesity are the major factors to accelerate the bariatric surgery devices market in this region.

Competitive Insight

Some of the major players operating in the global market include A.M.I GmbH, Apollo Endo-surgery, Inc., Applied Medical Resources Corporation, Aspire Bariatrics, Inc., B. Braun Melsungen AG, BOWA-electronic GmbH & Co. KG, Cook Medical LLC, Cousin Biotech, Grena Ltd, Intuitive Surgical, Inc., Johnson & Johnson, Mediflex Surgical Products, Medsil, Medtronic plc, Olympus Corporation, Reach Surgical, Reshape Lifesciences Inc., Richard Wolf GmbH, Shanghai Yisi Medical Technology Co, Ltd., Silimed Industries de Implants, Ltd., Spatz Medical, Standard Bariatrics, Inc., Surgical Innovations Group plc, Trokamed GmbH, Victor Medical Instruments Co., Ltd.

Recent Developments

- In January 2022, Spatz3 launched new product which is approved by FDA named Spatz3 Adjustable Balloon has the highest chance of treating obesity and shows better results of weight loss without loss of any deficiencies in micronutrients from the human body.

- In May 2022, ReShape Lifesciences made an agreement with OpenLoop to deliver virtual health services nationwide, which would be about weight loss and wellness with the help of reshapcare, which is a telehealth solution.

Bariatric Surgery Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.92 billion |

|

Revenue forecast in 2030 |

USD 2.92 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Device Type, By Procedure, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

A.M.I GmbH, Apollo Endo-surgery, Inc., Applied Medical Resources Corporation, Aspire Bariatrics, Inc., B. Braun Melsungen AG, BOWA-electronic GmbH & Co. KG, Cook Medical LLC, Cousin Biotech, Grena Ltd, Intuitive Surgical, Inc., Johnson & Johnson, Mediflex Surgical Products, Medsil, Medtronic plc, Olympus Corporation, Reach Surgical, Reshape Lifesciences Inc., Richard Wolf GmbH, Shanghai Yisi Medical Technology Co, Ltd., Silimed Industries de Implants, Ltd., Spatz Medical, Standard Bariatrics, Inc., Surgical Innovations Group plc, Trokamed GmbH, Victor Medical Instruments Co., Ltd. |