Bio-Based Textiles Market Size, Share, Trends, & Industry Analysis Report

By Source Material (Plant-Based, Animal-Based, Microbial/Bioengineered, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5794

- Base Year: 2024

- Historical Data: 2020-2023

Overview

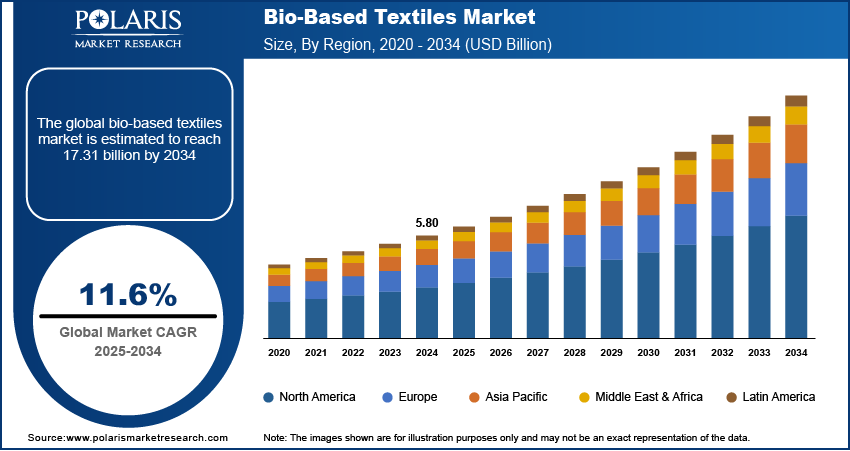

The global bio-based textiles market size was valued at USD 5.80 billion in 2024, growing at a CAGR of 11.6% during 2025–2034. Key factors driving demand for bio-based textiles include stringent environmental regulations globally, rising consumer demand for eco-friendly apparel, growing government initiatives and support, and expanding textile sector globally.

Bio-based textiles are fabrics derived wholly or partially from renewable biological resources, such as plants, animals, or microorganisms, offering a sustainable alternative to conventional fossil fuel-based textiles such as polyester or nylon. Bio-based materials encompass a wide range of fibers, including traditional natural fibers such as cotton, linen, hemp, and silk, as well as modern innovations such as bamboo fiber and lyocell. Bio-based textiles are increasingly used in the fashion industry, home furnishings, and technical applications due to their versatility, biodegradability, and reduced carbon footprint compared to conventional textiles.

The stringent environmental regulations globally are driving the market growth. Governments worldwide are enforcing strict rules on carbon emissions, waste disposal, and the use of nonrenewable resources, which are pushing companies to adopt sustainable alternatives. Bio-based textiles, made from renewable sources such as organic cotton, hemp, and bamboo, align with these regulatory requirements. This drives textile producers increasingly to shift toward bio-based materials to avoid penalties, improve their brand image, and appeal to environmentally conscious consumers.

To Understand More About this Research: Request a Free Sample Report

The bio-based textiles demand is driven by the rising consumer demand for eco-friendly apparel. Consumers are actively seeking sustainable clothing options that minimize pollution, reduce waste, and use renewable resources. This shift in preferences is encouraging brands to offer textiles made from organic cotton, bamboo, hemp, and other biodegradable fibers. Fashion and home furnishing companies are also responding to this demand by expanding their eco-conscious product lines, which further fuels innovation and investments in the bio-based textile market.

Industry Dynamics

Growing Government Initiatives and Support

Governments across various regions are introducing subsidies, tax incentives, and research grants to encourage the production and adoption of eco-friendly materials, including bio-based. They are also launching awareness campaigns and implementing procurement policies that prioritize sustainable products in the public sector. These actions are lowering the financial barriers for manufacturers and stimulating innovation in bio-based textile technologies. Governments are also fueling bio-based textiles adoption by actively promoting a circular economy and supporting green manufacturing.

Expanding Textile Sector Globally

Textile manufacturers are seeking innovative and eco-friendly materials, including bio-based materials, to differentiate their products in the expanding textile industry across developed and emerging economies. The expanding textile sector is further fueling the international brands' aim to meet consumer expectations and regulatory standards by incorporating sustainable textiles such as bio-based textiles. Therefore, as the textile sector expands globally, the demand for bio-based textiles also rises.

Segmental Insights

By Source Material Analysis

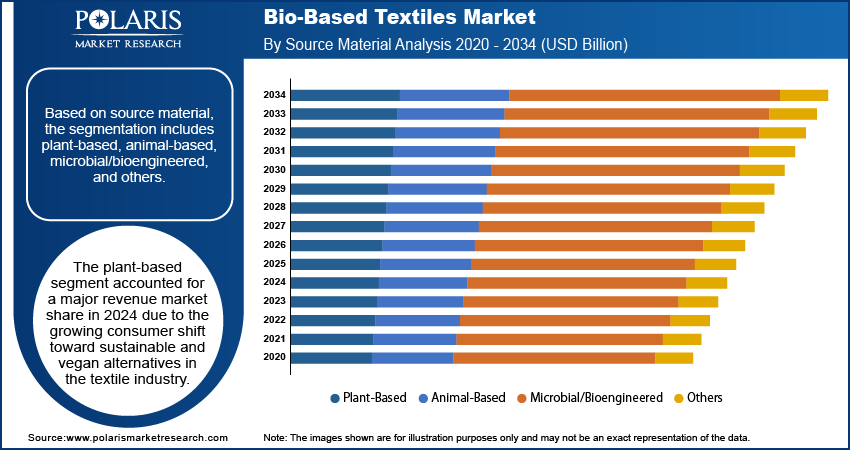

Based on source material, the segmentation includes plant-based, animal-based, microbial/bioengineered, and others. The plant-based segment accounted for a major revenue market share in 2024 due to the growing consumer shift toward sustainable and vegan alternatives in the textile industry. Natural fibers such as organic cotton, hemp, flax, bamboo, and banana fiber witnessed increased adoption owing to their biodegradability, low environmental impact, and alignment with eco-conscious consumer preferences. Major apparel brands actively expanded their sustainable product lines by incorporating plant-derived materials, thereby driving demand. Additionally, plant-based textiles benefit from established agricultural supply chains and relatively low production costs, which further support their dominant market position. Governments and regulatory bodies across regions such as Europe and North America also promoted plant-based fiber usage through incentives, labeling mandates, and environmental regulations, which contributed to their market dominance.

By Application Analysis

In terms of application, the segmentation includes apparel, home textiles, industrial textiles, and others. The home textiles segment is projected to grow at a robust pace in the coming years, owing to the increasing demand for sustainable products in the residential and hospitality sectors. Rising awareness about indoor environmental quality, coupled with concerns over synthetic fiber toxicity and nonbiodegradability, is encouraging the use of bio-based or renewable alternatives in bedding, curtains, upholstery, and kitchen towels. Furthermore, hotel chains and real estate developers are adopting green building standards and sustainability certifications, which include the use of biodegradable or low-impact textile materials.

Regional Analysis

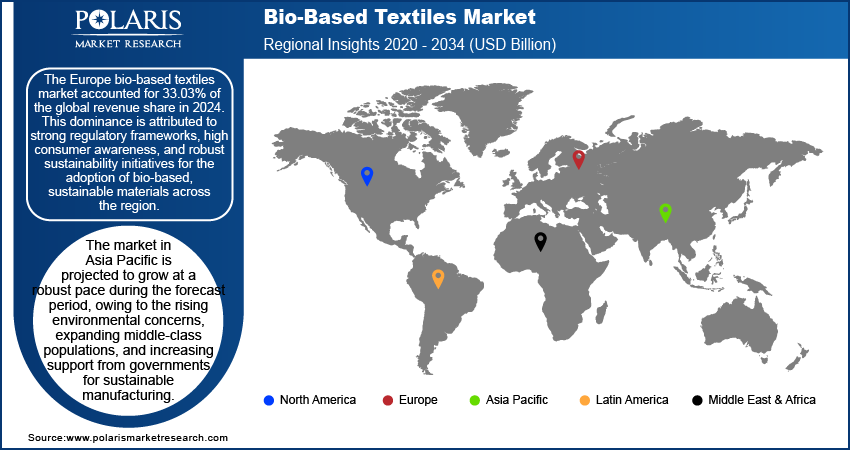

The Europe bio-based textiles market accounted for 33.03% of global revenue share in 2024. This dominance is attributed to strong regulatory frameworks, high consumer awareness, and robust sustainability initiatives across the region. The European Union's Green Deal and Circular Economy Action Plan encouraged manufacturers to shift toward renewable and biodegradable materials. Countries such as Germany, France, and the Netherlands made substantial investments in bio-based textile technologies and circular fashion practices. The existence of advanced manufacturing infrastructure, high adoption of eco-friendly practices, and a strong presence of global apparel and textile companies fueled the market demand in the region.

Germany Bio-Based Textiles Market Insight

Germany led the regional dominance in 2024 due to strict environmental regulations, high consumer awareness, and rising corporate sustainability commitments. The country’s stringent policies, such as the EU’s Circular Economy Action Plan and Germany’s sustainability laws, encouraged the adoption of bio-based materials in the textile industry. Additionally, major fashion brands and retailers in Germany increasingly adopted bio-based textiles to meet corporate social responsibility (CSR) goals and comply with extended producer responsibility (EPR) regulations, leading to market dominance.

Asia Pacific Bio-Based Textiles Market

The market in Asia Pacific is projected to grow at a robust pace during the forecast period, owing to the rising environmental concerns, expanding middle-class populations, and increasing support from governments for sustainable manufacturing. Countries such as China, India, and Japan are introducing initiatives to reduce the environmental impact of textile production by promoting cleaner technologies and renewable fiber usage. Furthermore, rapid urbanization, increasing disposable income, and growing environmental consciousness among consumers in the region are projected to fuel demand for bio-based textiles in apparel and home furnishings during the forecast period. For instance, United Nations Human Settlements Programme stated that the urban population in Asia is expected to grow by 50% by 2050.

India Bio-Based Textiles Market Overview

In India, the demand for bio-based textiles is growing due to a combination of government initiatives, traditional textile practices, and rising eco-consciousness among consumers. The government of India is promoting bio-based and sustainable textiles through schemes such as the "National Mission on Sustainable Agriculture" and incentives for organic farming, including organic cotton production. India’s rich heritage in natural fibers such as jute, bamboo, and hemp is also supporting the India bio-based textile market growth.

North America Bio-Based Textiles Market

The market in North America is projected to hold a substantial market share by 2034, due to rising consumer preference for sustainable products, corporate sustainability goals, and government incentives. In the US and Canada, rising awareness of fast fashion’s environmental impact is leading to a surge in demand for organic cotton, recycled polyester, and plant-based alternatives such as Tencel and hemp. Major brands and retailers in the region are incorporating bio-based materials to appeal to eco-conscious shoppers and comply with regulations. Additionally, agricultural policies supporting hemp cultivation and innovations in bio-fabrication are propelling the shift toward bio-based textiles in the region.

Key Players and Competitive Analysis Report

The bio-based textiles market is highly competitive, driven by increasing demand for sustainable alternatives to conventional synthetic fabrics. Key players such as DuPont, Lenzing AG, and Fulgar SpA dominate the market with their innovative bio-based fibers such as LYOCELL, Modal, and Bio-Nylon. These companies invest heavily in R&D to enhance fiber performance, scalability, and eco-friendliness, leveraging partnerships with fashion brands to expand their reach. Competition in the industry is also intensifying as fast-fashion brands such as H&M and Zara are integrating bio-textiles into mainstream collections, pressuring suppliers to reduce costs. However, challenges such as higher production costs and limited raw material supply restrain market growth.

A few major companies operating in the bio-based textiles market include Acme Mills Company; Arkema; Archroma; Avantium N.V.; Biome Bioplastics; DuPont; Fulgar Sp.A; Lenzing AG; Mitsubishi Chemical Corporation; NatureWorks LLC; Novamont S.p.A; Toray Industries, Inc.; and TotalEnergies Corbion.

Key Players

- Acme Mills Company

- Arkema

- Archroma

- Avantium N.V.

- Biome Bioplastics

- DuPont

- Fulgar SpA

- Lenzing AG

- Mitsubishi Chemical Corporation

- NatureWorks LLC

- Novamont S.p.A

- Toray Industries, Inc.

- TotalEnergies Corbion

Bio-Based Textiles Industry Developments

January 2025: Arkema introduced bio-based acrylic binders to lower the carbon footprint of performance textiles.

December 2024: Acme Mills Company, a global company in textile innovation, introduced Natura, its line of bio-based polylactic acid (PLA) fabrics.

October 2024: Archroma, a global company in specialty chemicals toward sustainable solutions, introduced the NTR Printing System to make bio-based textiles.

Bio-Based Textiles Market Segmentation

By Source Material Outlook (Revenue, USD Billion, 2020–2034)

- Plant-Based

- Animal-Based

- Microbial/Bioengineered

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Apparel

- Home Textiles

- Industrial Textiles

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bio-Based Textiles Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.80 Billion |

|

Market Size in 2025 |

USD 6.46 Billion |

|

Revenue Forecast by 2034 |

USD 17.31 Billion |

|

CAGR |

11.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.80 billion in 2024 and is projected to grow to USD 17.31 billion by 2034.

The global market is projected to register a CAGR of 11.6% during the forecast period.

Europe dominated the market share in 2024.

A few of the key players in the market are Acme Mills Company; Arkema; Archroma; Avantium N.V.; Biome Bioplastics; DuPont; Fulgar Sp.A; Lenzing AG; Mitsubishi Chemical Corporation; NatureWorks LLC; Novamont S.p.A; Toray Industries, Inc.; and TotalEnergies Corbion.

The plant-based segment dominated the market share in 2024.

The home textiles segment is expected to witness the fastest growth during the forecast period.