Black Mass Recycling Market Size, Share, Trends, & Industry Analysis Report

By Battery Type (Lithium-Ion Battery and Nickel-Based Battery), By Recovered Metal, By Recycling Process, By Battery Source, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 120

- Format: PDF

- Report ID: PM5808

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

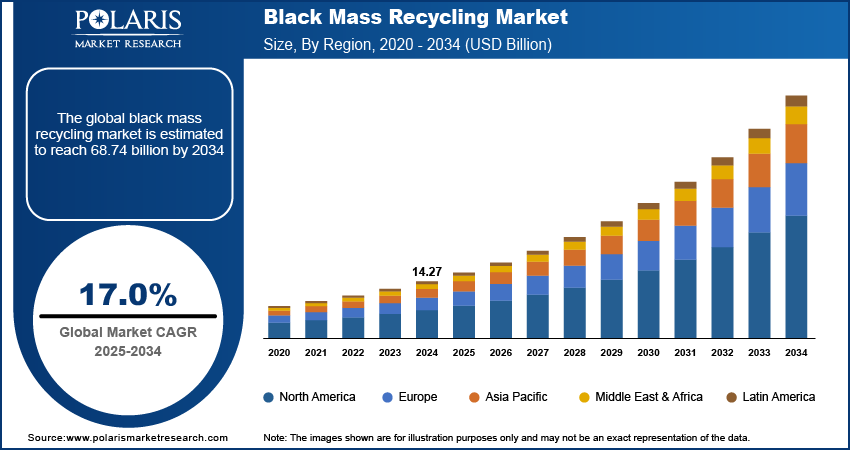

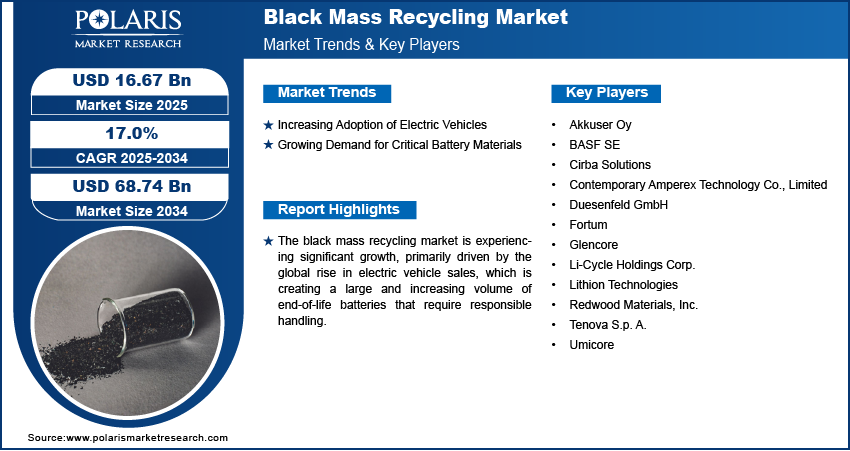

The global black mass recycling market was valued at USD 14.27 billion in 2024 and is anticipated to register a CAGR of 17.0% from 2025 to 2034. The market is primarily driven by the increasing adoption of electric vehicles, which leads to a greater volume of spent batteries requiring processing. Another key factor is the growing demand for critical battery materials such as lithium, cobalt, and nickel-based batteries, making recycling essential for a stable supply. Furthermore, stringent environmental regulations and the global push toward a circular economy significantly boost the need for effective recycling solutions.

Black mass recycling refers to recovering valuable materials, such as lithium, cobalt, and nickel, from spent lithium-ion batteries. These batteries are mainly used in consumer electronics, electric vehicles, and energy storage systems. Once a battery is retired, they are collected, compromised, and then shredded. The shredded material is treated to form a fine, black powder, known as black mass, from which the critical metals can be extracted and reused.

The black mass recycling industry has grown significantly due to several qualitative factors. A major driver is the rapid increase in the production and adoption of EVs globally, leading to a surge in end-of-life batteries that need proper disposal and material recovery. Additionally, there is a strong push toward establishing a circular economy where resources are reused and recycled, rather than discarded, which naturally boosts the demand for recycling processes.

Another key driver for the black mass recycling sector is the rising global demand for critical battery materials and concerns about their supply chain. These materials are essential for new battery manufacturing, and their extraction from virgin sources can be costly and have environmental impacts. Recycling offers a way to secure a domestic supply of these valuable resources. For instance, the US Department of Energy (DOE) emphasizes the importance of battery recycling in reintroducing critical materials back into the supply chain, thereby increasing domestic sources. The DOE's Battery and Critical Mineral Recycling Program, supported by the Bipartisan Infrastructure Law, funds projects to increase the reuse and recycling of batteries and the extraction of critical minerals from them.

Industry Dynamics

Increasing Adoption of Electric Vehicles

The rapid global increase in electric vehicle (EV) sales is driving the market expansion. Recent data from the International Energy Agency (IEA) in their "Global EV Outlook 2025" report highlights this trend by stating that global electric car sales topped 17 million in 2024, representing over 20% of new cars sold worldwide. The report further projects that global sales of electric cars are on track to surpass 20 million in 2025, accounting for over a quarter of cars sold worldwide.

As more EVs are produced and eventually reach the end of their lifespan, the volume of discarded lithium-ion batteries grows significantly, creating a substantial feedstock for recycling. This rising number of spent batteries necessitates a robust recycling infrastructure to manage waste and reclaim valuable materials.

Growing Demand for Critical Battery Materials

The surging demand for critical minerals vital to battery manufacturing, such as lithium, cobalt, and nickel, is another major factor boosting the black mass recycling market. These materials are finite resources, and their extraction from virgin sources can face geopolitical challenges and environmental concerns. Recycling black mass offers a strategic pathway to secure a domestic and sustainable supply of these essential elements, reducing reliance on mining and international markets.

According to the US Geological Survey (USGS), "USGS projects world production capacity for 7 critical minerals and helium from 2025 to 2029," the world's capacity to produce cobalt and lithium, crucial for batteries, is expected to double over the next five years. This projected increase in production capacity reflects the immense demand for these minerals, and recycling offers a vital complement to traditional mining to meet this demand. The US Department of Energy (DOE) also emphasizes this, with initiatives such as the Battery and Critical Mineral Recycling Program, aimed at increasing the reuse and recycling of batteries to reintroduce critical materials into the supply chain, as detailed on their website.

Segmental Insights

By Battery Type

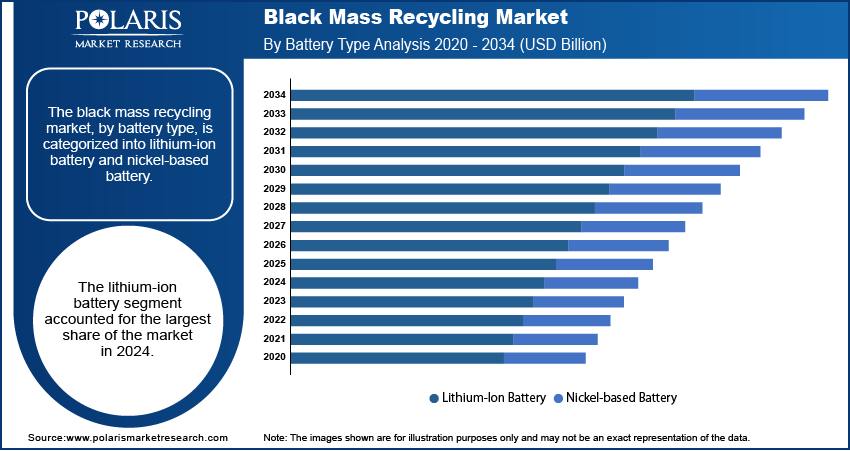

The lithium-ion batteries segment held the largest share in 2024. This dominance is driven by the widespread use of LIBs across numerous applications, including electric vehicles, various consumer electronics such as smartphones and laptops, and large-scale energy storage systems. As these devices and systems end their useful life, the sheer volume of spent lithium-ion batteries entering the recycling stream far exceeds that of other battery chemistries. For example, the US Environmental Protection Agency (EPA) mentions that lithium-ion batteries are commonly found in cellphones, power tools, digital cameras, laptops, children's toys, e-cigarettes, small and large appliances, tablets, and e-readers, underscoring their ubiquity and the resulting need for recycling.

The lithium-ion battery segment is anticipated to register the highest growth rate during the forecast period. This is primarily fueled by the accelerating global transition to electric mobility and the continued expansion of renewable energy storage infrastructure. The International Energy Agency (IEA), in its "Global EV Outlook 2025" report published in May 2025, noted that global electric car sales are projected to exceed 20 million in 2025, significantly contributing to the future volume of batteries needing recycling. This immense and sustained growth in key sectors relying on lithium-ion technology ensures a continuous and increasing supply of end-of-life batteries, making the recycling of lithium-ion black mass the fastest-growing segment as the industry scales to meet this future demand.

By Recovered Metal

The nickel segment held the largest share in 2024. These metals are highly concentrated in the cathodes of many high-energy density lithium-ion batteries, particularly those used in electric vehicles and consumer electronics. The economic incentive for recovering nickel and cobalt is substantial due to their high market prices and the challenges associated with their virgin extraction. The National Renewable Energy Laboratory (NREL), a US Department of Energy laboratory, highlights the focus on improving direct recycling of lithium-ion batteries to capture more critical materials such as cobalt, emphasizing its importance due to being primarily mined or refined in geopolitically sensitive areas.

The lithium segment is anticipated to record the highest growth rate during the forecast period. Although often present in lower weight percentages compared to nickel or cobalt in some battery types, lithium is a fundamental component of all lithium-ion batteries. Its demand is rising with the proliferation of EVs and large-scale grid storage. The US Geological Survey (USGS) in its March 2025 news release, "USGS projects world production capacity for 7 critical minerals and helium from 2025 to 2029," projects a significant increase in lithium production capacity, reflecting the intense global demand. As more batteries are recycled and technologies for lithium recovery improve, the volume of recovered lithium is expected to grow at an accelerated pace in the coming years.

By Recycling Process

The pyrometallurgical process segment held the largest share in 2024, particularly due to its robust nature and ability to handle diverse battery chemistries without extensive pre-sorting. This process involves smelting the black mass at high temperatures, effectively recovering valuable metals such as nickel and cobalt into an alloy. While it has been a common method for processing various types of waste, including batteries, it often leads to the loss of certain critical materials, including lithium, into slag, and can produce gaseous emissions requiring further treatment. Despite these drawbacks, its established infrastructure and operational simplicity have allowed it to maintain a considerable presence in the market.

The hydrometallurgical process is anticipated to witness the highest growth rate during the forecast period. This method uses chemical leaching to dissolve the black mass, purification, and selective precipitation to recover metals with higher purity and better recovery rates, including lithium. Research published via the United Nations Sustainable Development Goals platform in a review on "Hydrometallurgy for EV batteries" notes that hydrometallurgy can allow an overall recovery rate of up to 95% of the black mass, including critical components such as lithium, nickel, cobalt, and manganese, with reduced environmental impact.

By Battery Source

The automotive batteries segment, particularly those from electric vehicles, held the largest share in 2024. These batteries are typically much larger and more complex than those found in consumer electronics, contributing substantial material when they reach their end-of-life. The rapid global shift toward electric mobility has led to a growing fleet of EVs, and as these vehicles age, their batteries will increasingly enter the recycling stream.

The automotive batteries segment is anticipated to record the highest growth rate during the forecast period. The accelerating pace of EV adoption worldwide ensures an exponential increase in batteries that eventually require recycling. The International Energy Agency (IEA) in its "Global EV Outlook 2025" report, published in May 2025, highlighted that global electric car sales are on track to surpass 20 million in 2025, marking significant growth. This sustained expansion directly translates into a swelling pipeline of end-of-life automotive batteries in the coming years.

Regional Analysis

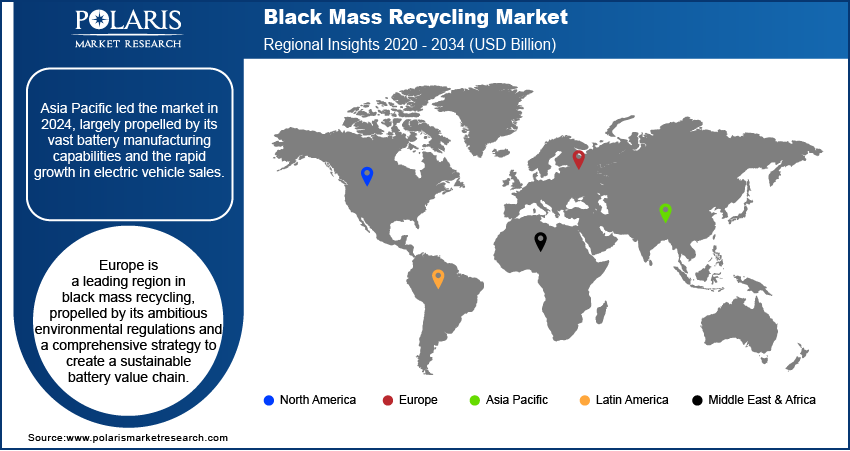

The Asia Pacific black mass recycling market dominated with the largest revenue share in 2024, due to its vast battery manufacturing capabilities and the rapid growth in electric vehicle sales. With their large-scale battery production and consumption, countries such as China, are at the forefront of generating and processing black mass. The black mass recycling market led the regional market, largely due to its immense battery manufacturing capacity and the rapid adoption of electric vehicles. The sheer volume of lithium-ion batteries produced and consumed in this region generates a substantial amount of black mass feedstock. Governments in the region are increasingly implementing policies and standards to promote efficient and environmentally sound battery recycling. China, for instance, has introduced comprehensive measures to manage end-of-life batteries, including "whitelist" systems for compliant recycling companies and stricter recovery rate requirements for critical minerals. This combination of high battery volumes and evolving regulatory frameworks positions Asia Pacific, with China at its forefront, as a major driver for the global black mass recycling industry.

North America Black Mass Recycling Market

The North America black mass recycling market is rapidly developing, driven by increasing adoption of electric vehicles (EVs) and a strong push for domestic critical mineral supply chains. Government initiatives play a crucial role in fostering this growth, with significant funding and policy support to establish a circular economy for batteries. For instance, the US Department of Energy (DOE) has launched substantial Battery Manufacturing and Recycling Grants, including awards for projects to build and expand commercial-scale facilities for battery material extraction and recycling.

US Black Mass Recycling Market Insight

The US is a significant player in North America, characterized by robust government support and a growing ecosystem of battery manufacturing and recycling companies. The country's commitment to reducing reliance on foreign sources for critical minerals and promoting sustainable practices translates into tangible investments in recycling infrastructure. The Inflation Reduction Act (IRA) and other federal and state-level initiatives offer domestic recycling incentives, encouraging the development of advanced facilities.

Europe Black Mass Recycling Market

Europe is a leading region in black mass recycling, propelled by its ambitious environmental regulations and a comprehensive strategy to create a sustainable battery value chain. For example, the European Union's Battery Regulation sets stringent requirements for recycled content in new batteries and mandates extended producer responsibility for end-of-life battery management. This regulatory framework significantly incentivizes investments in advanced recycling technologies and infrastructure across the region. Proactive policy measures ensure a robust demand for black mass processing and the recovery of essential metals, solidifying Europe's position as a key area for recycling innovation and deployment. The Germany black mass recycling market contributes significantly to the black mass recycling landscape in Europe. With its strong automotive industry and a firm commitment to environmental protection, Germany has implemented national legislation, such as the German Batteries Act (BattG), which transposes EU directives into national law, requiring manufacturers and retailers to participate in take-back schemes for used batteries. This emphasis on producer responsibility and established collection systems ensures a steady flow of batteries into the recycling chain. The country’s focus on sustainable manufacturing and its role as an industrial powerhouse further strengthens its influence on developing and adopting black mass recycling technologies throughout the European market.

Key Players and Competitive Insights

The competitive landscape of the black mass recycling market is dynamic and expanding, featuring a mix of established metals and materials companies, specialized battery recyclers, and new entrants driven by the surge in end-of-life lithium-ion batteries. Competition primarily revolves around developing more efficient and environmentally friendly recycling technologies, securing consistent feedstock of spent batteries, and forming strategic partnerships across the battery value chain.

Prominent companies in the industry include Umicore; Glencore; Li-Cycle Holdings Corp.; Redwood Materials, Inc.; BASF SE; Contemporary Amperex Technology Co.; Limited (Brunp Recycling); Cirba Solutions; Tenova S.p.A.; Lithion Technologies; Akkuser Oy; Duesenfeld GmbH; and Fortum.

Key Players

- Akkuser Oy

- BASF SE

- Cirba Solutions

- Contemporary Amperex Technology Co., Limited (Brunp Recycling)

- Duesenfeld GmbH

- Fortum

- Glencore

- Li-Cycle Holdings Corp.

- Lithion Technologies

- Redwood Materials, Inc.

- Tenova S.p. A.

- Umicore

Industry Developments

April 2025: Redwood Materials and Isuzu Commercial Truck of America partnered to create a circular battery supply chain for medium- and heavy-duty commercial vehicles.

September 2024: BMW of North America and Redwood Materials announced a partnership to recycle lithium-ion batteries from all electric, plug-in hybrid-electric, and mild hybrid BMW, MINI, Rolls-Royce, and BMW Motorrad vehicles.

Black Mass Recycling Market Segmentation

By Battery Type Outlook (Revenue – USD Billion, 2020–2034)

- Lithium-Ion Battery

- Nickel-Based Battery

By Recovered Metal Outlook (Revenue – USD Billion, 2020–2034)

- Nickel

- Cobalt

- Lithium

- Copper

- Manganese

- Other metals

By Recycling Process Outlook (Revenue – USD Billion, 2020–2034)

- Hydrometallurgical Process

- Pyrometallurgical Process

- Other Processes

By Battery Source Outlook (Revenue – USD Billion, 2020–2034)

- Automotive Batteries

- Industrial Batteries

- Consumer Electronic Batteries

- Power Batteries

- Marine Batteries

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Black Mass Recycling Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD14.27 billion |

|

Market Size in 2025 |

USD16.67 billion |

|

Revenue Forecast by 2034 |

USD 68.74 billion |

|

CAGR |

17.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 14.27 billion in 2024 and is projected to grow to USD 68.74 billion by 2034.

The global market is projected to register a CAGR of 17.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Umicore; Glencore; Li-Cycle Holdings Corp.; Redwood Materials, Inc.; BASF SE; Contemporary Amperex Technology Co., Limited (Brunp Recycling); Cirba Solutions; Tenova S.p.A.; Lithion Technologies; Akkuser Oy; Duesenfeld GmbH; and Fortum.

The lithium-ion batteries segment accounted for the largest share of the market in 2024.

The lithium-ion battery segment is expected to grow fastest during the forecast period.