Lithium-Ion Battery Anode Market Share, Size, Trends, Industry Analysis Report

By Materials (Anode Binders, Active Anode Materials); By Battery Product; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 118

- Format: PDF

- Report ID: PM4918

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

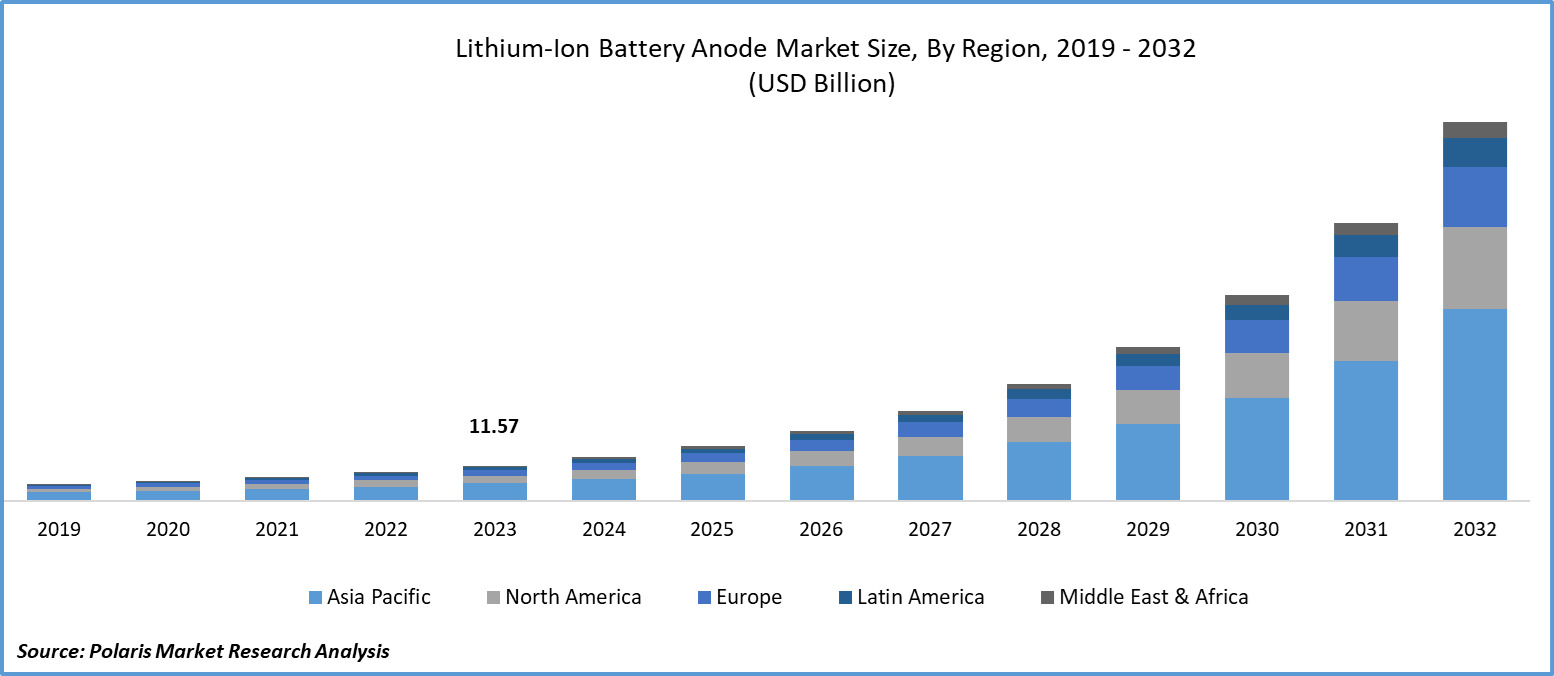

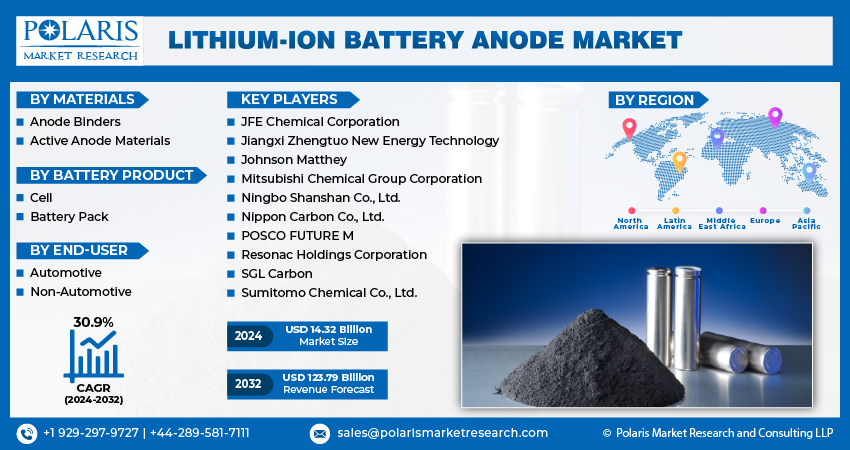

Lithium-ion battery anode market size was valued at USD 11.57 billion in 2023. The market is anticipated to grow from USD 14.32 billion in 2024 to USD 123.79 billion by 2032, exhibiting the CAGR of 30.9% during the forecast period

Lithium-Ion Battery Anode Market Overview

The lithium-ion battery anode market is set to witness growth as Li-ion batteries have emerged as the most dependable and appropriate solution for energy storage. They find utility in a wide range of applications, ranging from small-scale devices like mobile phones to larger applications such as electric vehicles. The Li metal anodes possess numerous desirable qualities, including the highest theoretical capacity, lightweight construction, and high energy density. These factors make them an appealing choice for applications that exhibit the lowest electrochemical potential compared to the standard hydrogen electrode. Before being employed in larger applications, advanced batteries must meet certain prerequisites, such as the ability to store more energy, occupy less space, and deliver superior cyclic and rate capability.

- For instance, in April 2024, Green Li-ion inaugurates North America's premier commercial-scale plant for recycling lithium-ion batteries into sustainable battery-grade cathode and anode materials, utilizing patented Green-hydro rejuvenation technology.

Researchers are currently exploring alternative materials for anodes. Various structural anode materials are being tested, and different anode chemistries are being experimented with. Silicon additive anodes show promise in potentially replacing the standard anode material due to their significantly larger specific capacity. This improvement in performance has the potential to enhance the efficiency of Li-ion batteries compared to those currently available anodes on the market. For instance, in February 2024, an article published in Nature Communications suggests that the energy density of lithium-ion batteries can be greatly enhanced at a low cost by incorporating micro-sized silicon anodes.

To Understand More About this Research: Request a Free Sample Report

In recent years, various methods have been utilized to improve the efficiency of silicon-based anodic materials in lithium-ion batteries by tackling issues such as electrochemical properties, volume expansion, low conductivity, and inconsistent kinetic reactions. One popular technique involves applying a protective layer on the Si-based anodic material. The primary coating used is carbon coating, which is achieved by depositing carbon onto the silicon anode using the chemical vapor deposition (CVD) technique to improve the electrical conductivity.

Lithium-Ion Battery Anode Market Dynamics

Market Drivers

- Rising adoption of electric vehicles

The lithium-ion battery anode market is experiencing significant growth due to the electric vehicle adoption. The increasing popularity of plug-in hybrids and EVs directly contributes to the rising demand for lithium-ion batteries. Consumers are embracing EVs more due to their positive impact on the environment, as they help reduce pollution. Additionally, advancements in battery technology are enhancing the range of EVs and reducing maintenance requirements, further driving the adoption of these vehicles. Given that EVs are widely regarded as the future of transportation, this trend is expected to persist and drive the growth of the lithium-ion battery anode market.

- Renewable energy integration

Lithium-ion batteries have become a popular choice for storing renewable energy due to their lightweight, high-energy density, and efficient electricity storage capabilities. They are considered a key solution for addressing the variability of wind and solar energy sources. The IEC (International Electrotechnical Commission) is responsible for standardizing Li-ion cells (including anode and cathode) and has released the IEC 62660 series specifically for secondary li-ion cells used in electric vehicles with the aim to emphasize the accurate assessment of battery performance. Additionally, it has published standards for renewable energy storage systems. Recent trends indicate a significant increase in the demand for lithium-ion batteries in the near future.

Market Restraints

- Limited raw material availability is likely to impede the market growth.

The lithium-ion battery market is facing a significant challenge due to the limited availability of raw materials such as Li, Sn, Gr, antimony (Sb), lithium titanium oxide, and silicon-based materials like silicon oxycarbide (SiOC) are widely used as anode elements. The increasing demand driven by electric vehicles, portable electronics, and energy storage applications has raised concerns about the sustainable sourcing of this material. Additionally, geopolitical factors, trade tensions, and mining constraints further complicate the issue, potentially disrupting the supply chain and causing price fluctuations. To tackle this challenge, various efforts are being made to diversify supply sources, explore alternative battery chemistries that rely less on critical materials, and implement recycling initiatives to recover valuable metals from used batteries. These measures aim to reduce dependence on virgin resources and ensure a more sustainable future for the industry.

Report Segmentation

The market is primarily segmented based on materials, battery product, end-user and region.

|

By Materials |

By Battery product |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Lithium-Ion Battery Anode Market Segmental Analysis

By Materials Analysis

- The anode binders segment has dominated the market over the forecast period largely attributed to cost-effectiveness, which makes them an appealing choice for battery manufacturers who aim to decrease production expenses. Additionally, these binders can be synthesized using environmentally friendly methods and are less likely to release harmful compounds during the battery manufacturing process. Moreover, they exhibit exceptional adhesion properties, ensuring a strong connection between the anode materials and current collectors. This attribute can significantly enhance the overall performance and lifespan of lithium-ion batteries. Furthermore, anode binders can be customized to meet specific requirements, providing greater flexibility in the design of battery electrodes.

- The active anode materials segment is projected to grow at a CAGR during the projected period, mainly driven by high-capacity materials like silicon or tin, which play a crucial role in improving the overall performance and efficiency of lithium-ion batteries. Unlike traditional graphite anodes with limited lithium-ion storage capacity, active anode segments offer much higher energy density, allowing batteries to store more energy in the same volume. This has resulted in increased battery capacity and longer runtime for a variety of applications, from consumer electronics to electric vehicles. Additionally, active anode segments help enhance charging rates and cycle life in battery technology.

By End-User Analysis

- The automotive segment held the largest market share and is expected to grow at the fastest CAGR over the forecast period. Lithium-ion batteries are presently employed in the majority of electric vehicles due to their superior energy density compared to other electrical energy storage systems. Additionally, they possess a remarkable power-to-weight ratio, excellent energy efficiency, commendable high-temperature performance, and minimal self-discharge. The majority of lithium-ion battery components are recyclable. Furthermore, lithium-ion batteries demonstrate exceptional efficiency in terms of charge and discharge, allowing for quick charging and minimizing vehicle downtime.

Lithium-Ion Battery Anode Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share

The Asia Pacific region dominated the global market with the largest market share and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to the increasing demand for consumer electronics. This is particularly due to the popularity of portable devices such as laptops, gaming consoles, smartphones, torches, and digital cameras, as well as the availability of high-speed internet connectivity, which has had a positive effect on the market. Furthermore, the market is being accelerated by the growing demand for high-quality rechargeable batteries. These batteries are not only used in consumer electronics but also play a crucial role as an essential component in electric vehicles. Governments are implementing favorable initiatives to promote the sales of EVs, which in turn has a positive impact on the lithium-ion battery market. In addition, factors such as rapid urbanization, changes in lifestyle, increased investments, and higher consumer spending are all contributing to the growth of the lithium-ion battery market.

Europe is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to its applications in electric mobility, renewable energy storage, and grid stabilization. The transition to cleaner energy sources has led to the widespread adoption of electric vehicles equipped with lithium-ion batteries. Moreover, lithium-ion batteries are employed in residential and commercial energy storage systems, enabling consumers to optimize energy usage, cut costs, and contribute to a more sustainable energy landscape in Europe.

Competitive Landscape

The lithium-ion battery anode market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading to meet the demand for battery electric cars, and vehicles are the main driving force behind the advancements in this field. In order to achieve widespread adoption of electric vehicles and enhance the durability and functionality of electronic devices and tools, it is crucial to make improvements in battery performance and cost, which has resulted in intense competition among developers to create next-generation Li-ion anode battery technologies that can meet these requirements to capture a significant market share.

Some of the major players operating in the global market include:

- JFE Chemical Corporation

- Jiangxi Zhengtuo New Energy Technology

- Johnson Matthey

- Mitsubishi Chemical Group Corporation

- Ningbo Shanshan Co., Ltd.

- Nippon Carbon Co., Ltd.

- POSCO FUTURE M

- Resonac Holdings Corporation

- SGL Carbon

- Sumitomo Chemical Co., Ltd.

Recent Developments

- In March 2024, Panasonic is set to establish a joint venture with IOCL to manufacture cylindrical lithium-ion batteries. This strategic move is motivated by the projected increase in the need for batteries in the Indian market, particularly for two- and three-wheel vehicles and energy storage systems.

- In February 2024, Greenfuel Energy has formed a collaboration with lithium battery manufacturer EVE Energy. This partnership will guarantee that Greenfuel has access to high-quality lithium cells, which includes pouch, prismatic cells, and other types of cylindrical cells.

- In January 2024, Ningbo Shanshan Technology Co., Ltd., a prominent firm specializing in manufacturing synthetic graphite anode materials for lithium-ion batteries, has recently inaugurated a new production facility known as the 300,000-ton anode integrated project in Yunnan, China.

Report Coverage

The lithium-ion battery anode market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, materials, battery product, end-user and their futuristic growth opportunities.

Lithium-Ion Battery Anode Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.32 billion |

|

Revenue forecast in 2032 |

USD 123.79 billion |

|

CAGR |

30.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Materials, By Battery Product, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Lithium-Ion Battery Anode Market are Johnson Matthey, Mitsubishi Chemical Group Corporation, Ningbo Shanshan Co., Ltd., Nippon Carbon Co., Ltd., POSCO FUTURE M

Lithium-ion battery anode market exhibiting the CAGR of 30.9% during the forecast period

The Lithium-Ion Battery Anode Market report covering key segments are materials, battery product, end-user and region.

key driving factors in Lithium-Ion Battery Anode Market are rising adoption of electric vehicles

The global Lithium-Ion Battery Anode market size is expected to reach USD 123.79 billion by 2032