Blockchain Devices Market Share, Size, Trends, Industry Analysis Report

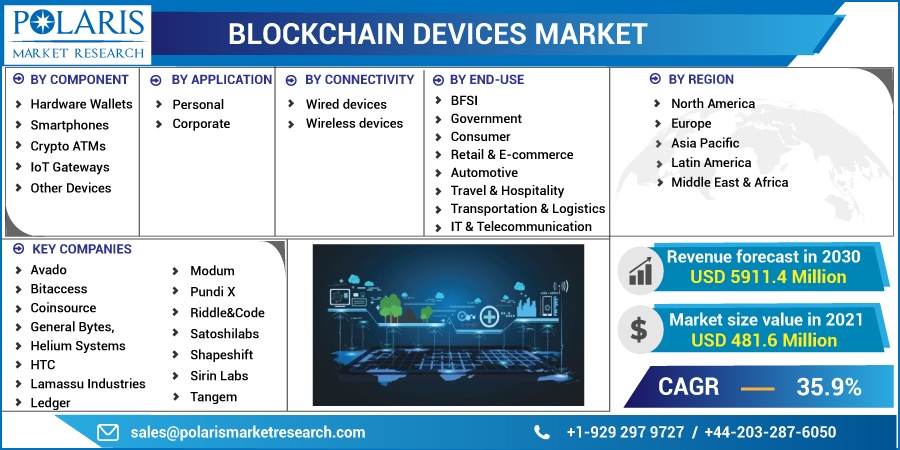

By Application; By Connectivity (Wired, Wireless); By Component (Hardware Wallets, Smartphones, Crypto ATMs, IoT Gateways, Others); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 118

- Format: PDF

- Report ID: PM2170

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

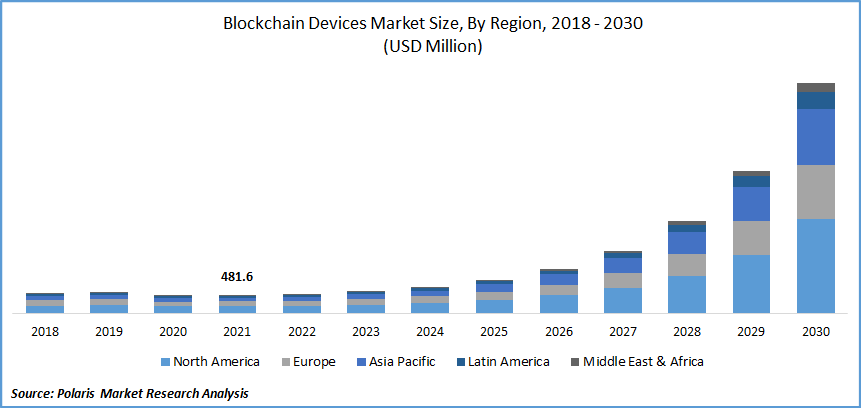

The global blockchain devices market was valued at USD 481.6 million in 2021 and is expected to grow at a CAGR of 35.9% during the forecast period. The key factor, such as the advent of Bitcoin, this technology quickly gained traction and is now employed by various financial organizations, is boosting the industry growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

A few applications for this technology include payments, exchanges, smart contracts, documentation, and digital identity. The financial services sector can benefit from enhanced accuracy and secure data sharing thanks to this technology's provision of safe and impenetrable ledgers. According to the National Payments Corporation of India (NPCI), the technology would significantly increase industry openness. The use of blockchain technology facilitates the creation of an ecosystem of open activity records to which all industry players have immediate access.

Additionally, the financial sector's growing need for blockchain devices is accelerating the industry's growth during the projection period. Records of the transactions and asset ownership are kept at each process step. This significantly reduces the risk for numerous asset categories as well as the need for worry-inducing mitigating measures. With this skill, it is possible to lessen theft, cyberattacks, and misspellings of intellectual property.

However, one of the significant barriers to the adoption of blockchain technology across industries is regulatory uncertainty. Associations and consortiums that have established their standard of operation and protocol include the Blockchain Collaborative Consortium (BCCC), Hyperledger, R3CEV Blockchain Consortium, Financial Blockchain Shenzhen Consortium (FBSC), CU Ledger, and Global Payments Steering Group (GPSG). However, there isn't a set of guidelines for bitcoin transactions that is always followed.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Blockchain device market participants are introducing such technology to their other worldwide industry endeavors. For instance, BEN Inc. declared in December 2021 that BEN's formal beta testing would start in Northern Arizona in January 2022. In order to optimize ad space, BEN is a cutting-edge platform that allows consumers control over their data. Contrary to current advertising, which can be irrelevant, bothersome, and exploitative, BEN provides a special privacy-oriented marketing solution that offers pertinent interaction tailored to consumers' needs and interests, managed to play at the right time in the right place while rewarding them and protecting their data.

Thus, this platform will benefit the technology providers and boost market growth during the forecast period. Furthermore, the increasing adoption of such technology by the retail and supply chain management sectors is expected to be the primary driver of the blockchain devices market. The growing use of crypto money in various industries and the high adoption rate provide enough prospects for expansion, resulting in greater chances for such device providers.

Report Segmentation

The market is primarily segmented based on component, application, connectivity, end-use, and region.

|

By Component |

By Application |

By Connectivity |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by End-Use

Based on the end-use segment, the consumer segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. As to the increasing usage of cryptocurrencies and the acceptance of cryptocurrencies as a payment mechanism by businesses, the consumer end-user sector is likely to dominate the market during the forecast period.

Global crypto ownership is predicted to reach 3.9 percent as of April 2021, with over 300 million crypto users. As a result, individuals and businesses are more likely to use cryptocurrencies for transactions, propelling the blockchain devices market. The consumer products business is expanding due to the growing demand for better inventory management. It is merged with IoT devices and concerned sensors. It provides substantial visibility and real-time efficiency throughout the entire value chain process, which is expected to increase consumer demand for monitoring and tracking devices.

Geographic Overview

In terms of geography, North America had the highest share in 2021. Microsoft Corp, IBM Corp., and Oracle are the top service providers in North America. These companies offer services that can be used with this technology and IoT devices to track and monitor assets across the supply chain.

North America is also a center for security chips and solutions that help businesses strengthen their security. Companies in North America that supply security chips and IoT gateways include Xage Security, GridPlus, and NetObjex. As a result, the blockchain devices market in North America has a lot of promise in the next four to five years, notably for asset tracking and monitoring and chip-level security.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. A 'Blockchain Accelerator' provides entrepreneurs with sufficient technicalities to flourish before drafting rules and regulations in the sector by the GOI. Telangana government has employed the blockchain concept in education and partnered with CoinSwitchKuber and Lomos Labs for innovation-driven initiatives.

Competitive Insight

Some of the major players operating in the global market include Avado, Bitaccess, Coinsource, General Bytes, Helium Systems, HTC, Lamassu Industries, Ledger, Modum, Pundi X, Riddle&Code, Satoshilabs, Shapeshift, Sirin Labs, and Tangem.

Blockchain Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 481.6 million |

|

Revenue forecast in 2030 |

USD 5,911.4 million |

|

CAGR |

35.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Application, By Connectivity, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Avado, Bitaccess, Coinsource, General Bytes, Helium Systems, HTC, Lamassu Industries, Ledger, Modum, Pundi X, Riddle&Code, Satoshilabs, Shapeshift, Sirin Labs, and Tangem. |