Bottle Filling Machine Market Share, Size, Trends, Industry Analysis Report

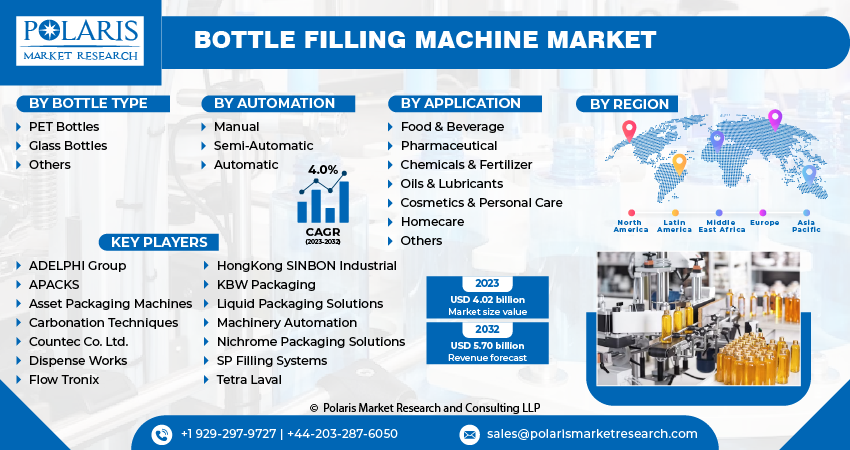

By Bottle Type (PET Bottles, Glass Bottles, and Others); By Automation; By Application; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 114

- Format: PDF

- Report ID: PM3826

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

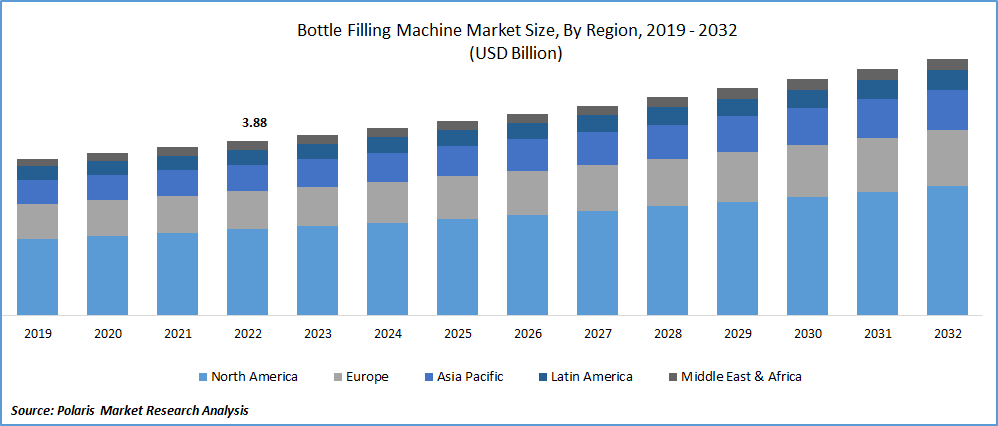

The global bottle filling machine market was valued at USD 3.88 billion in 2022 and is expected to grow at a CAGR of 4.0% during the forecast period.

The exponential rise in the consumption of both alcoholic and non-alcoholic drinks across the world and greater demand for attractive and efficient packaging of food & beverage products coupled with the growing popularity of these machines due to their beneficial features like ease of operation and cost-effectiveness compared to other bottle filling methods are the leading factors driving the global market. Besides this, with the growing advancements in technology, many companies are focusing on launching new and more innovative machines with improved characteristics and the ability to streamline their filling processes. The demand and sales for these machines is likely to exhibit significant growth.

To Understand More About this Research: Request a Free Sample Report

For instance, in April 2022, Synerlink introduced ‘Versatech’, a new future-proof and innovative filling machine for the food & dairy industry. The new machine comes with a modular design that allows customers to easily realign this packaging solution with the evolving or changing business strategy.

Moreover, bottle-filling machines are now being equipped with sensors and connected to the Internet of Things networks, which enables real-time data monitoring and analysis and allows for predictive maintenance, remote monitoring, and data-driven decision-making to optimize machine performance and reduce downtime, which is likely to create ample revenue and growth opportunities for the bottle filling machine market in the near future.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the bottle filling machine market. The rapid spread of the deadly coronavirus across the globe led to huge disruptions in global supply chains. It affected demand and sales, as many countries have imposed stringent measures like lockdowns and trade restrictions. Many industries, especially hospitality and non-essential manufacturing, experienced a decline in demand and operations, led to reduced capital expenditure by businesses globally.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

Rising consumer demand for cosmetics

With the rising consumer disposable income and constantly changing lifestyles and preferences in the last few years, the demand and consumption of cosmetics have surged drastically, as people are significantly investing higher amounts on different cosmetic products such as moisturizers, shampoos, perfumes, and hair oil. Hence, these products require a proper and safe packaging in various shapes and sizes, the demand and prevalence for bottle filling machines among the cosmetics industry is rapidly increasing.

Furthermore, these types of machines are being widely used in the pharmaceutical and chemical industry in order to fill liquid medicine in bottle, personal care, chemical, tobacco, and many other consumable products along with the rising incorporation of innovated bottle filling machines like inline machine and rotary machine, that are being significantly used for filling of drugs, are further likely to boost the global bottle filling machine market growth.

Report Segmentation

The market is primarily segmented based on bottle type, automation, application and region.

|

By Bottle Type |

By Automation |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Bottle Type Analysis

PET bottles segment accounted for the largest market share in 2022

The PET bottles segment accounted for the largest market share in 2022. The growth of the segment market can be largely accelerated by its cost-effectiveness and beneficial characteristics like shatterproof and anti-bacterial properties coupled with the rising awareness of the importance of safe drinking water and the convenience of packaged water across the globe that have led to a surge in demand for PET bottles.

The glass bottles segment is likely to gain a substantial growth rate over the coming years on account of continuously increasing awareness about environmental concerns and the growing demand for eco-friendly packaging options globally, which have fueled the adoption and use of glass bottles, as glass is a recyclable and reusable material, that makes it an attractive choice for consumers and businesses looking to reduce their environmental impact.

By Automation Analysis

Automatic segment is anticipated to witness highest growth over forecast period

The automatic segment is projected to grow at the highest growth rate during the anticipated period, which is highly attributable to an increasing rate of incorporation for automatic machines in various end-users, including food & beverages, pharmaceuticals, cosmetics & personal care, and chemicals due to their range of benefits like human error reduction and faster nature.

Moreover, the significant advancements in automation technology and rising innovations that have made automatic bottle filling machines more sophisticated and reliable along with the integration of features such as IoT integration, advanced sensors, and real-time monitoring capabilities, which have further fueled their adoption, are likely to cater to this growing segment market.

By Application Analysis

Food & beverage segment held the significant market share in 2022

The food & beverage segment held the majority market share in terms of revenue, which largely accelerated the rapid adoption of bottle filling machines across the food & beverage industry to increase productivity and, reduce labor costs, and meet the growing demand from a large global population. Additionally, the surging consumption of different types of processed foods and beverages across the world and higher consumer inclination towards ready-to-drink products due to hectic lifestyles, particularly in urban areas.

The pharmaceutical segment is projected to exhibit the fastest growth rate throughout the study period, mainly driven by rising investments by major research institutions and government authorities towards the development of the sector. Besides this, the incorporation of automated bottle filling machines will also help pharmaceutical companies to maintain product integrity and reduce the risk of contamination, thereby influencing the segment market.

Regional Insights

North America region dominated the global market in 2022

North America held the largest share because of several favorable factors, including higher consumption of beverages like wine, significant adoption of advanced or innovative technologies, and robust presence of major bottle-filling machine manufacturers. Apart from this, with the increasing environmental concerns and adoption of sustainable practices across the industry, machines that promote eco-friendly packaging, reduce material wastage, and optimize energy consumption are gaining huge traction and popularity.

For instance, the total production of wine across the United States was over 773 million gallons in 2021, which accounts for nine percent of the world’s total wine production volume. The average consumption of wine per person in the US was around 3.18 gallons in 2021, with a significant increase from 2.34 gallons in 2005.

The Asia Pacific region is likely to emerge as the fastest growing region with a healthy growth rate during the projected period, owing to continuous expansion and development of end-use sectors, including food & beverages, pharmaceuticals, and chemicals & fertilizers coupled with the growing production of different types of cooking oils in countries like India, China, and Indonesia among others.

Market Key Players & Competitive Insight

The global bottle-filling machine market is characterized by intense competition among players. These companies strive to gain a competitive edge through continuous innovation in their product offerings, including advanced bottle-filling machines like inline and rotary machines. Additionally, a focus on meeting the specific needs of diverse industries, including cosmetics, pharmaceuticals, chemicals, and more, helps these players maintain a strong market presence.

Some of the major players operating in the global market include:

- ADELPHI Group

- APACKS

- Asset Packaging Machines

- Carbonation Techniques

- Countec Co. Ltd.

- Dispense Works

- Flow Tronix

- HongKong SINBON Industrial

- KBW Packaging

- Liquid Packaging Solutions

- Machinery Automation

- Nichrome Packaging Solutions

- SP Filling Systems

- Tetra Laval

Recent Developments

- In March 2022, Romaco Macofar launched its new and latest liquid filling machine, which is specially designed for the aseptic filling of sterile eye drops, injectables, and nasal sprays. The newly developed filling machine can be easily equipped to fill all types of liquids, like highly viscous and oily fluids, with up to eight different piston pumps made up of stainless steel and ceramic.

- In November 2021, SIG introduced its latest next-generation food & beverage filling technology, having a total output of up to 18000 packs per hour for family-sized packs. The new machine also features an automatic volume change function in less than 10 minutes to run 500 ml, 750 ml, & 1000 ml pack sizes.

Bottle Filling Machine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.02 billion |

|

Revenue forecast in 2032 |

USD 5.70 billion |

|

CAGR |

4.0% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Bottle Type, By Automation, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in bottle filling machine market are SP Filling Systems, Liquid packaging Solutions, Dispense Works

The global bottle filling machine market is expected to grow at a CAGR of 4.0% during the forecast period.

The bottle filling machine market report covering key segments are bottle type, automation, application and region.

key driving factors in industrial bottle filling machine market are rising consumer demand for cosmetics.

The global bottle filling machine market size is expected to reach USD 4.70 billion by 2032.