Building & Construction Tapes Market Share, Size, Trends, Industry Analysis Report

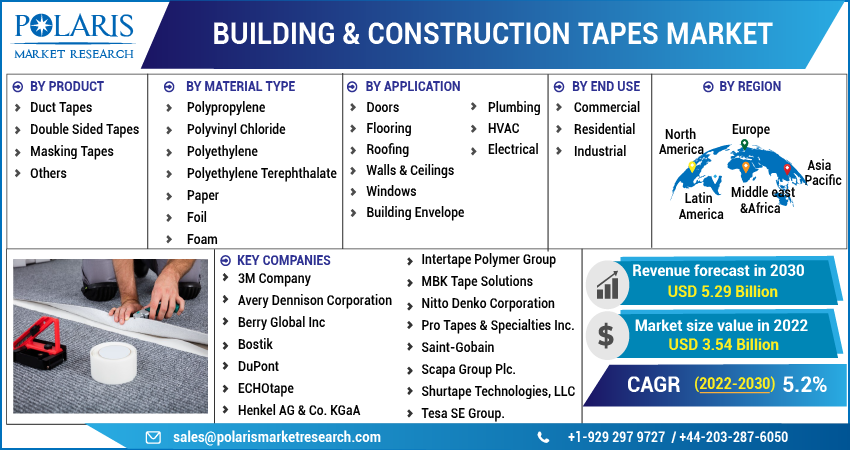

By Product (Duct Tapes, Double Sided Tapes, Masking Tapes, Others); By Material Type; By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 114

- Format: PDF

- Report ID: PM2642

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

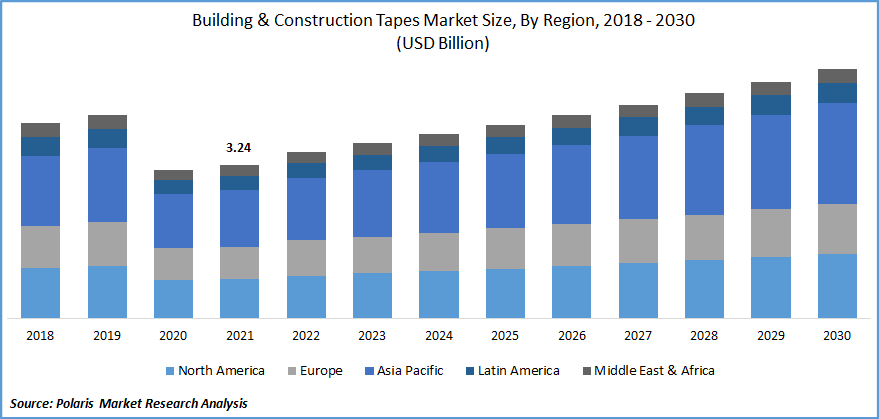

The global building & construction tapes market was valued at USD 3.24 billion in 2021 and is expected to grow at a CAGR 5.2% during the forecast period. Building & construction tapes are utilized for bonding architectural elements and components. These tapes offer good adhesion, high strength, and good holding capacity. Globally, construction and infrastructure projects are rising rapidly, due to which there has been a greater demand for building & construction tapes.

Know more about this report: Request for sample pages

In developing countries such as China, India, South Korea, and Brazil, the construction industry is rapidly growing, which has led to the demand for building & construction tapes. As per the data released by Global Construction Perspectives and Oxford Economics, the worldwide construction volume is projected to increase by 85% by 2030. Of this, 57% growth is expected to be by the U.S, China, and India.

Building & construction tapes bond securely with low surface energy materials. Low outgassing and strong adhesion make advanced tapes ideal for building applications. These tapes find a wide range of applications in windows, doors, panels, and trims. They offer strong bonding ability with wood, metal, and glass. They provide superior strength, durability, and heat and chemical resistance.

Market players are developing innovative products to cater to the growing consumer demand. For instance, Melinex FR32X, launched by DuPont Teijin Films, is widely used in construction & infrastructure activities to provide laminate structures in buildings, shopping malls, offices, and other construction sites.

The COVID-19 pandemic affected the global market. The major factors that impacted the growth are scarcity of raw materials, manufacturing disruptions on a large scale, shortage of workers and employees due to lockdown and fear of the virus, and fluctuating financial circumstances and costs that hinder the demand and supply for building & construction tapes globally.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growth of the global building & construction tapes market is primarily driven by the strengthening construction industry. Improvements in the economic condition in emerging countries such as India, China, and Brazil lead to improving the standard of living. Further, with the increase in urbanization, housing and construction projects are rising.

Moreover, rapid urbanization has affected the construction industry all over the globe. The growth in urban population is concentrated in emerging economies of the world, which makes construction chemicals crucial as these regions have high development rates for infrastructure.

Moreover, advanced technologies utilized in tapes have impressive performance and assembly-related characteristics, which include the ability to withstand harsh environments and high temperatures and bond securely with various materials and substrates. High-performance adhesive tapes are increasingly being utilized in the building & construction industry.

Report Segmentation

The market is primarily segmented based on product, material type, application, end-use, and region.

|

By Product |

By Material Type |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Duct tape segment accounted for the largest market share in 2021

By product, the building and construction tapes market are segmented into duct tapes, double-sided tapes, masking tapes, and others. Among these, the market for the duct tape segment is expected to hold a significant share.

Duct tapes are used in HVAC applications for protection and safeguarding, which is expected to stimulate the building & construction tapes market growth. There are several key players producing and manufacturing such tapes, which are used across several applications such as sealing, wrapping, and protecting.

Polyethylene accounted for the largest market share

By material type, the building & construction tapes market is segmented into polypropylene, polyvinyl chloride, polyethylene, polyethylene terephthalate, paper, foil, and foam. Among these, polyethylene is expected to be the largest market in the building & construction tapes industry. It is utilized in the construction sector owing to its ability to bond with different substrates, such as ceiling rafters and drywall.

Windows segment accounted for the largest market share

By application, the building and construction tapes market is categorized into doors, flooring, roofing, walls & ceilings, windows, building envelope, plumbing, HVAC, and electrical. The windows segment is expected to account for the largest share during the forecast period.

The tapes are employed as an effective solution for sealing windows and doors of the building that are usually exposed to environmental conditions. Insulation tapes are usually employed with such tapes owing to their ability to offer resistance from environmental factors such as fluctuating temperature range, UV rays, expansion & contraction mechanism, and water vapor.

The residential segment accounted for the largest market share

By end-use, the building and construction tapes market is categorized into residential, commercial, and industrial. The residential segment is expected to account for the largest share during the forecast period. This is due to the increasing usage of products for barrier protection and bonding.

Hence, the adoption of innovative products for binding and glazing panes and trims is anticipated to stimulate market growth over the coming years. A rise in the disposable income of consumers in developing countries and an improvement in living standards have resulted in greater investment in the development of residential spaces.

Asia-Pacific region will lead the global building & construction tapes market by 2030

The Asia-Pacific region is expected to account for a larger share of the building and construction tapes market. The increasing initiatives towards the construction industry by the governments across the Asia-Pacific region have led to growth in the building and construction tapes market. Moreover, rapid urbanization in the region and the increasing standard of living of the people the driving the growth of the building and construction tapes market in the Asia-Pacific region.

In addition, the building and construction tapes are witnessing growth in the Asia-Pacific region owing to new product launches and technological advancements. Key players are developing new and innovative tapes and adhesives that offer high performance and are usually used in commercial and residential applications.

Competitive Insight

Some of the major players operating in the global market include 3M Company, Avery Dennison Corporation, Berry Global Inc, Bostik, DuPont, ECHO tape, Henkel AG & Co. KGaA, Intertape Polymer Group, MBK Tape Solutions, Nitto Denko Corporation, Pro Tapes & Specialties Inc., Saint-Gobain, Scapa Group Plc., Shurtape Technologies, LLC, and Tesa SE Group. The prominent market payers operating in the global building and construction tapes market are investing in material innovation and technological advancements to offer a wider portfolio of products. They also collaborate with other companies to enter new geographies and strengthen distribution networks.

Recent Development

In May 2022, Bostik launched its next generation of tapes and adhesives for woodworking.

In March 2021, 3M Company launched bonding tape that has acrylic adhesive and is coated on both sides.

Building & Construction Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.54 billion |

|

Revenue forecast in 2030 |

USD 5.29 billion |

|

CAGR |

5.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Material Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M Company, Avery Dennison Corporation, Berry Global Inc, Bostik, DuPont, ECHOtape, Henkel AG & Co. KGaA, Intertape Polymer Group, MBK Tape Solutions, Nitto Denko Corporation, Pro Tapes & Specialties Inc., Saint-Gobain, Scapa Group Plc., Shurtape Technologies, LLC, and Tesa SE Group. |