Cellulose Ether & Derivatives Market Share, Size, Trends, Industry Analysis Report

By Type (Carboxymethyl Cellulose, Hydroxypropyl Cellulose, Methyl Cellulose, Hydroxyethyl Cellulose, Ethyl Cellulose); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM2662

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

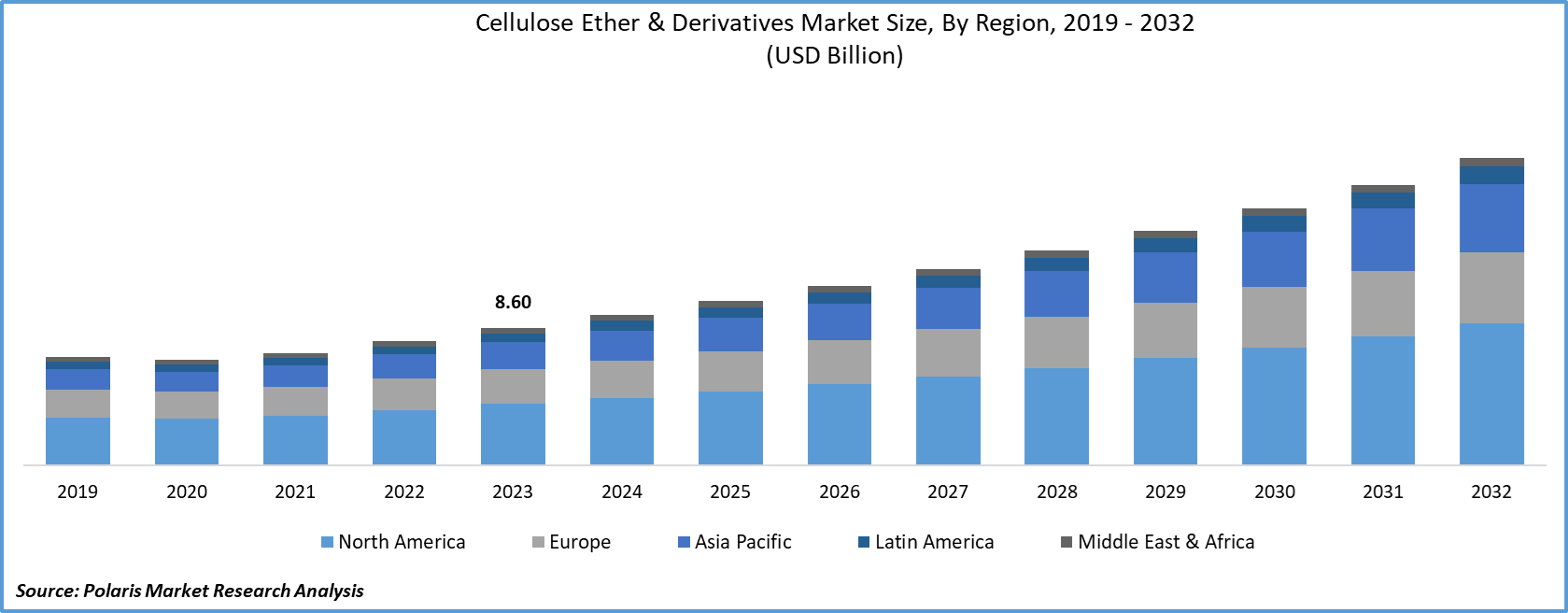

The global cellulose ether & derivatives market size was valued at USD 8.60 billion in 2023. The market is anticipated to grow from USD 9.40 billion in 2024 to USD 19.24 billion by 2032, exhibiting the CAGR of 9.4% during the forecast period.

Cellulose ether is a derivative of cellulose, which is used across industries such as personal care, pharmaceutical, and construction, among others.

Know more about this report: Request for sample pages

It offers high versatility, increasing its application in cleaning agents, paints, textiles, paper, food production, and construction materials. It can be used as a thicker binder, water retention agent, and protective colloid, among others. Industrial production of cellulose ether involves the use of cotton and wood cellulose. Cottonseeds offer a high amount of cellulose, with approximate content around 65% to 80%, whereas wood has a content of around 35% to 45% cellulose.

There has been a greater demand for cellulose ether & derivatives in the development of paints and inks. They offer eco-friendly properties, biodegradability, and versatility across several applications in the textile, construction, and automotive industries. The construction sector utilizes cellulose ether for its properties, such as water retention and thickening.

It is also used as a rheology modifier across several construction applications. The food and beverages industry has been known to utilize cellulose ether & derivatives in products such as baked foods, sauces, sweeteners, and creams. Cellulose ether & derivatives are widely used in personal care and pharmaceutical products.

Cellulose ethers are natural-based polymers with high value in pharmaceutical applications. They offer high glass transition temperatures, solubility, and hydrogen bonding capability. They are also known for properties such as superior chemical and photochemical stability and low toxicity.

Growing consumer consciousness associated with the use of environment-friendly products, rising concerns regarding wellness and personal care products, and advancements by industry players leading to the launch of new innovative and sustainable products have increased the demand for cellulose ether & derivatives.

The outbreak and spread of COVID-19 worldwide have negatively influenced the growth of the cellulose ether & derivatives market. Restrictions and limitations in the global automotive, textile, and construction sectors during the pandemic hampered the growth of the global market.

Governments across the world imposed lockdown restrictions to limit the movement of goods and people, which led to the closure of global markets to contain the spread of the virus. The global market also witnessed the unavailability of raw materials, transportation limitations, and a reduced workforce.

Manufacturing facilities were closed, and import/export activities were halted, leading to a decline in demand for cellulose ether & derivatives during the pandemic. However, the global market would witness growth post-pandemic as the global markets revive and industrial growth is observed.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising urbanization and industrialization across the world boost the demand for cellulose ether & derivatives. The increasing population, rising inclination toward sustainable products, and growth in demand from diverse industries such as automotive, construction, textile, food and beverages, and pharmaceutical drive the industry growth.

The application of cellulose ether in the production of personal care products has increased over the years. Consumers are increasingly aware of beauty, personal care, and wellness. The rise in disposable income and improving the standard of living has increased the demand for sustainable personal care products, driving the demand for cellulose ether & derivatives.

Growth in the global building and construction sector and the development of public infrastructure have increased the utilization of cellulose ether & derivatives in the construction sector. The rise in investments associated with material innovation and technological advancements further drives market growth. There has been a rise in demand observed from developing nations, which is expected to offer growth opportunities during the forecast period.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Methyl Cellulose segment accounted for a significant share

The methylcellulose segment accounted for a major share of the global market in 2021. Methyl cellulose is a prominent cellulose ether used for commercial applications. It has wide applications owing to its properties, such as water solubility and excellent UV and solvent resistance. It is used in the production of paints, dyes, inks, and adhesives.

It is also utilized in personal care and cosmetics products. Rising investment in research and development, technological advancements, rise in disposable income of consumers, and greater demand from emerging economies would contribute to the growth of this segment during the forecast period.

Construction accounted for a major share in 2021

The construction segment accounted for a major share of the market in 2021. Cellulose ether is used in the construction sector to enhance mortar properties such as strength, water retention, processability, and consistency, among others. They also provide significant improvements through superior tensile strength, fracture toughness, and compressive strength.

Cellulose ether & derivatives are also used in the production of paints and, coatings and adhesives, among others. Growth in the development of residential and commercial buildings, rising demand for sustainable products, and increasing inclination toward the development of green buildings are factors expected to offer growth opportunities during the forecast period.

Asia Pacific generated significant revenue in 2021

Asia Pacific dominated the global cellulose ether & derivatives market in 2021. The rise in population and industrialization supports market growth. The presence of established market players, growth in the construction sector, and rising demand from the food and beverage industry drive growth in the region.

Material innovation and technological advancements are expected to offer growth opportunities. The rise in application in personal care products, textile, and pharmaceutical industries has been observed. Rise in environmental consciousness and greater inclination toward the use of sustainable products further boost the demand for cellulose ether & derivatives in the region.

Competitive Insight

Some major players operating in the global cellulose ether & derivatives market include Ashland Global Holdings, Inc, Colorcon, DKS Co. Ltd, Fenchem Biotek Ltd., Hebei Jiahua Cellulose Co., Ltd., J.M. Huber Corporation, J. RETTENMAIER SOHNE GmbH + Co KG, Lamberti S.p.A, LOTTE Fine Chemicals, Nouryon Chemical Holdings B.V, Rayonier Advanced Materials Inc., Shandong Head Co., Ltd, Shin-Etsu Chemical Co., Ltd, The Dow Chemical Company, and Zibo Hailan Chemical Co., Ltd.

These prominent players are launching new products to serve a wider audience and strengthen market presence. Partnerships and mergers further enable these market players to expand their offerings and enter new geographies for business expansion.

Recent Developments

In January 2022, Ashland initiated efforts to strengthen its production capabilities for its Benecel cellulose ethers in Belgium. The development aims at expanding the company’s production by more than 50% by the year 2023 to cater to the growing demand for cellulose ether & derivatives across nutrition and pharmaceuticals applications.

In April 2022, Nouryon announced the introduction of Bermocoll FLOW cellulose ether. The new product offers high properties of sag resistance and spatter resistance. It can be used paint formulations and airless spray applications. The product is designed to be a sustainable alternative owing to its low volatile organic compound (VOC).

Cellulose Ether & Derivatives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.40 billion |

|

Revenue forecast in 2032 |

USD 19.24 billion |

|

CAGR |

9.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Ashland Global Holdings, Inc, Colorcon, DKS Co. Ltd, Fenchem Biotek Ltd., Hebei Jiahua Cellulose Co., Ltd., J.M. Huber Corporation, J. RETTENMAIER SOHNE GmbH + Co KG, Lamberti S.p.A, LOTTE Fine Chemicals, Nouryon Chemical Holdings B.V, Rayonier Advanced Materials Inc., Shandong Head Co., Ltd, Shin-Etsu Chemical Co., Ltd, The Dow Chemical Company, and Zibo Hailan Chemical Co., Ltd |