Cloud Professional Services Market Share, Size, Trends, Industry Analysis Report

By Service Type; By Deployment Model (Public, Private); By Vertical; By Region; Segment Forecast, 2022-2030

- Published Date:Oct-2022

- Pages: 112

- Format: PDF

- Report ID: PM2692

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

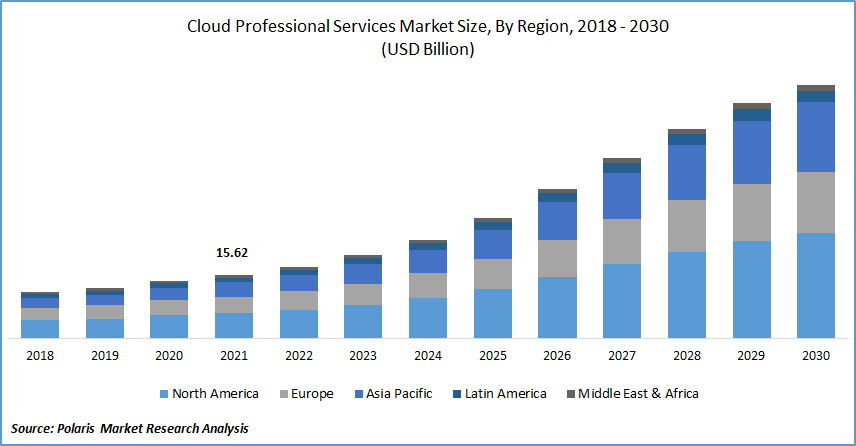

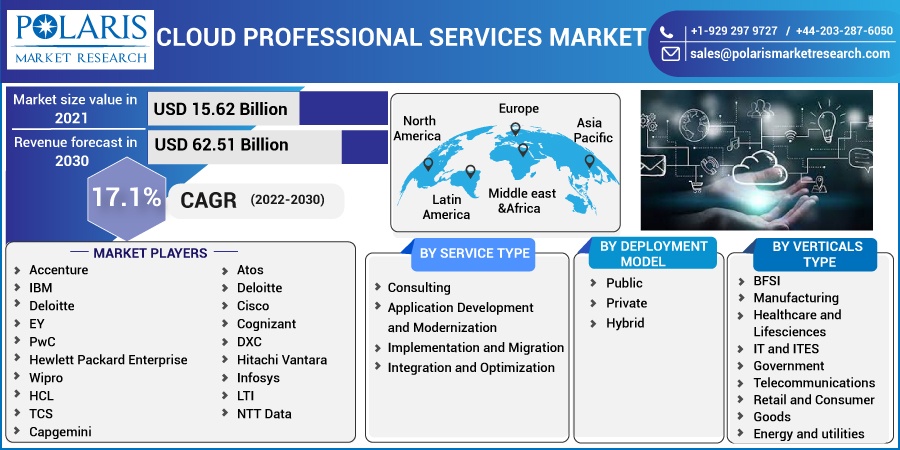

The global cloud professional services market was valued at USD 15.62 billion in 2021 and is expected to grow at a CAGR of 17.1% during the forecast period. The growing demand for cloud professional services is expected to be driven by increasing popularity of cloud computing, which encourages businesses to select various cloud services. The need for professional cloud services is growing as more market players provide cloud-based services for companies of all sizes, from small and medium-sized enterprises to large enterprises across multiple industry verticals.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Another aspect of the cloud's rapid acceptance is the large range of services offered by cloud service providers. CPS providers are integrating cloud platforms to broaden their product offerings and create an ecosystem for their clients. AI and ML are two of these new technologies. According to an OTVA analysis, as businesses employ AI to automate operations and streamline corporate processes, it will become increasingly significant in the workplace.

Businesses are being urged to embrace cloud professional services due to benefits like increased productivity, decreased costs, reduced risk, and more competition. To ensure that their clients' migration to the cloud is easy, CPS s suppliers and cloud service providers are forming strategic collaborations.

During COVID-19, several companies were driven to modify their policies and practices in order to safeguard the safety of their employees. Due to the inability to travel, cross borders, and interact socially, businesses have been forced to change their current modes of operation and review strategic decisions.

Governments and cloud service providers are working together to combat the COVID-19 outbreak. For instance, the COVID-19 high-performance computing consortium, which was just launched by the White House, will provide researchers studying the virus with access to the most advanced high-performance computing resources available.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing adoption of the cloud is influenced by the abundance of services offered by cloud providers. Cloud platforms and cutting-edge technologies like AI and ML are being included by CPS vendors to expand their product lines and create an ecosystem for their clients. Cost reductions, better productivity, and risk reduction are benefits of cloud professional services over traditional enterprise techniques.

In addition, technological advancements such as AI & ML, with a rising focus on digital transformation initiatives, open up many opportunities to this market.

Cloud professional service vendors are expanding their offerings and giving their customers a smooth experience by integrating cutting-edge technologies like Artificial Intelligence and Machine Learning with a variety of cloud platforms.

Report Segmentation

The market is primarily segmented based on service type, deployment model, vertical type, and region.

|

By Service Type |

By Deployment Model |

By Verticals Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Consulting segment is expected to witness fastest growth

The consulting segment is expected to have the largest market size over the forecast period. Consulting is a professional services practice for corporate infrastructure. It consists of counseling customers on how to manage their organization's IT infrastructure and improve infrastructure performance, including security and process improvements.

Cloud professional service vendors provide consulting users with services that have insufficient knowledge about upgrading current enterprise infrastructure. Users who want to improve their infrastructure can benefit from the knowledge of cloud professional service providers who are specialized in cloud base systems across different industries, which aids in the implementation of the proper mix of services.

The organizations of end users must be well informed of the precise business requirements because the adoption of cloud-based systems can be an expensive procedure for some businesses.

The hybrid cloud segment will account for a higher share of the market.

The hybrid cloud industry has grown significantly faster than the other cloud services. Organizations with large data sets and processing demands can benefit in particular ways. Several aspects, including cost and efficiency, flexibility, agility, and privacy, are projected to boost demand for hybrid clouds. Hybrid cloud reduces the distance between information technology and businesses by enhancing agility and efficiency and swiftly delivering IT resources at an affordable price.

Nutanix Enterprise Cloud Index analysis shows that as cloud usage increases, enterprise workloads quickly leave traditional data center infrastructure, falling from 41% to 18% in two years. With 2nd highest rate of the hybrid cloud models at 21%, the retail industry outperforms the norm for all the other allied industries across the globe with an acceptance rate of 93% among hybrid deployments.

Healthcare and Lifesciences are expected to hold the significant revenue share

Healthcare and Lifesciences market sector would have a promising CAGR during the projection period. The COVID-19 mandate's use of EHR, e-prescribing, telemedicine, eHealth, and other healthcare IT services, as well as the expanding usage of big data analytics, wearable technologies, and the Internet of Things, are all factors in the growth of the healthcare cloud computing market.

Cisco provides telehealth and remote patient monitoring systems to more than 17,000 healthcare organizations across 118 nations. The use of the tele cloud is anticipated to rise in numerous countries as a result of the growing awareness of telehealth among health providers, providing significant growth possibilities to companies in the healthcare cloud professional services market.

The demand in Asia-Pacific is expected to witness significant growth

Asia-Pacific is one of the extremely fast sectors in terms of technology adoption, with various initiatives carried out by multiple governments and significant corporations in the region driving demand for digitalization. Leading this technology adoption are nations like China, Australia, Singapore, and India, which embrace cutting-edge technologies like AI, edge, IoT, analytics, and cloud. Numerous businesses in the manufacturing, energy and utility, transportation and logistics, chemicals, and aerospace sectors are located in the region, which is projected to further fuel demand for cloud professional services.

For instance, REACH, Alcatel-Lucent, Cisco, PLDT, EMC, Microsoft, NetApp, Nokia Siemens, Smart, Rackspace, and Telenor first sponsored the open collaboration forum known as Asia Cloud. To improve the region's adoption of cloud computing, the group strives to explore and address regional concerns currently experienced.

Competitive Insight

Some of the major players operating in the global market include Accenture, IBM, Deloitte, TCS, Hewlett Packard Enterprise, Wipro, HCL, Capgemini, Cisco, Cognizant, Deloitte, Hitachi Vantara, Infosys, LTI, NTT Data, Rackspace, T-Systems, AWS, Google, and Microsoft.

Recent Developments

- Cartesian Consulting and IBM have partnered as of March 2021. Through this partnership, IBM expanded its "Cloud Pak for Data," a multi-cloud data platform that helps businesses with a lot of data by helping them unlock the value of data in different ways and accelerating their transition to artificial intelligence.

- Accenture acquired Cygni in March 2021. This acquisition supports Accenture's Cloud First vision and the company's ongoing cloud-first growth.

- In February 2021, Imaginea, a company that develops cloud-native products and platforms, was acquired by Accenture. The acquisition enhanced Accenture Cloud First's global capabilities.

Cloud Professional Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 15.62 billion |

|

Revenue forecast in 2030 |

USD 62.51 billion |

|

CAGR |

17.1 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Service Type, By Deployment Model, By Verticals Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Accenture, IBM, Deloitte, EY, PwC, Hewlett Packard Enterprise, Wipro, HCL, TCS, Capgemini, Atos, Deloitte, Cisco, Cognizant, DXC, Hitachi Vantara, Infosys, LTI, NTT Data, Rackspace, T-Systems, AWS, Google, Microsoft, and others. |