Cloud Security Posture Management Market Size, Share, Trends, & Industry Analysis Report

By Component (Solution and Services), By Cloud Service, By Enterprise Size, By Cloud, By Industry Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5816

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

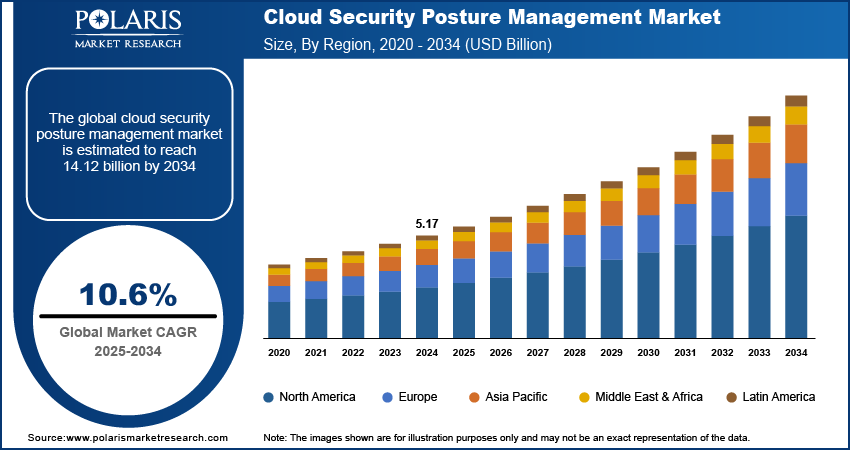

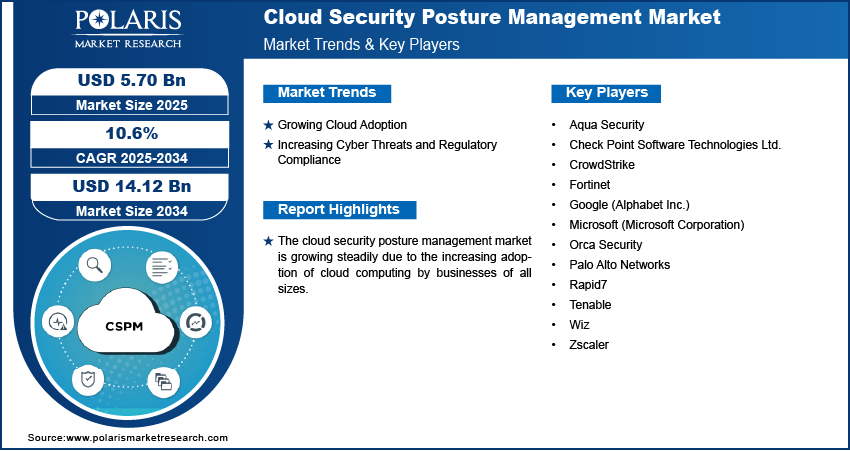

The global cloud security posture management market size was valued at USD 5.17 billion in 2024 and is anticipated to register a CAGR of 10.6% from 2025 to 2034. The market is largely driven by the increasing use of cloud services and the growing number of cyber threats. Additionally, the need for organizations to meet strict regulatory compliance requirements also plays a major role in boosting the market growth.

Cloud security posture management (CSPM) refers to a set of tools and practices that continuously monitor cloud environments. Its main purpose is to find and fix security risks and misconfigurations in cloud services, applications, and resources. These solutions provide visibility and help enforce security policies to lower overall risk.

The cloud security posture management (CSPM) market growth is driven by the increasing adoption of cloud computing by businesses. As more companies move their operations and data to cloud platforms, managing and securing these complex environments becomes a significant challenge. This is especially true for those using multiple cloud providers (multi-cloud) or a mix of on-premises and cloud solutions (hybrid cloud).

Another key factor boosting the demand for CSPM is the growing number of cyber threats and the increasing focus on regulatory compliance. Organizations face a constant stream of sophisticated attacks, making it crucial to protect their cloud assets. At the same time, the imposition of strict data protection and privacy regulations, such as HIPAA in healthcare or GDPR in Europe, requires businesses to ensure their cloud environments meet specific security standards. CSPM tools help by continuously checking configurations against these rules, identifying gaps, and offering ways to fix them.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growing Cloud Adoption

The rapid shift of businesses toward cloud environments is a significant driver for the cloud security posture management (CSPM) market growth. As organizations increasingly move their data, applications, and infrastructure to various cloud platforms, the complexity of managing and securing these diverse environments grows. This widespread adoption, often involving multiple cloud providers (multi-cloud strategies), creates a larger attack surface and more potential points of misconfiguration.

This trend is clearly reflected in government spending and business practices. For example, the US Government Accountability Office (GAO) noted that federal agencies alone spent $6.6 billion on cloud services in fiscal year 2020, showing a notable increase from previous years. Similarly, the US Census Bureau reported that 63.3% of businesses utilized cloud computing services in 2021, a rise from 48.7% in 2018. These figures highlight the widespread and increasing reliance on cloud infrastructure across both public and private sectors, which fuels the need for CSPM solutions to maintain security and control.

Increasing Cyber Threats and Regulatory Compliance

The escalating number of cyber threats and the increasing emphasis on adhering to strict regulatory compliance standards are major forces behind the growth of the CSPM market. Cybercriminals are constantly developing new ways to exploit vulnerabilities, especially in cloud environments where misconfigurations can easily expose sensitive data. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) reported a 62% increase in ransomware incidents against critical infrastructure sectors in 2021 compared to the previous year, with many of these attacks targeting cloud-based systems. This makes robust security measures crucial for organizations seeking to protect their assets.

In addition to direct threats, businesses face stringent data protection and privacy regulations from various governmental bodies. These regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the US for healthcare data or the General Data Protection Regulation (GDPR) in Europe, require organizations to maintain specific security postures.

Segmental Insights

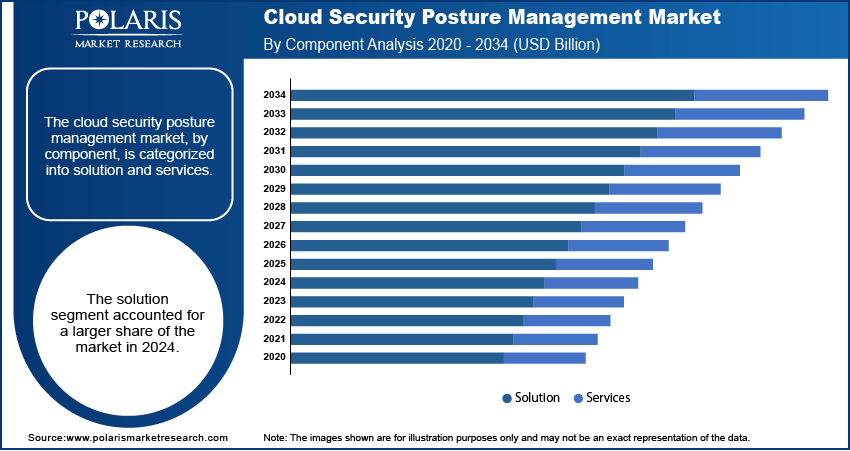

By Component

The solutions segment held the largest share in 2024. This dominance is attributed to the direct need for automated tools and platforms that can continuously monitor, detect, and remediate misconfigurations and compliance issues across diverse cloud environments. Businesses are increasingly seeking comprehensive software that provides real-time visibility and control over their cloud security posture, rather than relying solely on manual processes. For example, the US National Institute of Standards and Technology (NIST) offers various cybersecurity frameworks, and CSPM solutions are instrumental in helping organizations automatically align their cloud configurations with these guidelines.

The services segment is anticipated to register the highest growth rate during the forecast period. While solutions provide the necessary technology, many organizations lack the in-house expertise or resources to effectively implement, manage, and optimize these complex tools. This creates a significant need for specialized services, including consulting, integration, managed CSPM offerings, and ongoing support. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) often emphasizes the importance of skilled cybersecurity professionals, and the scarcity of such talent drives companies to outsource their cloud security management.

By Cloud Service

The software-as-a-service (SaaS) segment held the largest share in 2024 as many organizations widely adopt SaaS applications for critical business functions, often without fully understanding their shared security responsibilities. Even though the SaaS provider handles the infrastructure, the customer is still responsible for securing their data, access controls, and configurations within the application. For instance, the World Health Organization (WHO) provides guidance on securing health data, often used in SaaS environments, emphasizing the importance of proper user access management and data protection.

The infrastructure-as-a-service (IaaS) segment is anticipated to register the highest growth rate during the forecast period. As organizations mature in their cloud journeys, many are leveraging IaaS to build and host their applications and services, providing greater control and flexibility. This increased control, however, also comes with greater responsibility for the underlying infrastructure's security. For example, many US government agencies are actively adopting IaaS solutions to modernize their IT infrastructure, as highlighted by reports from the US Government Accountability Office (GAO).

By Enterprise Size

The large enterprises segment accounted for the largest share in 2024. These organizations often operate vast and complex cloud infrastructures, frequently utilizing multiple cloud providers and services. This inherent complexity, coupled with the immense volume of sensitive data they manage, makes them highly vulnerable to misconfigurations and cyber threats. Therefore, large enterprises are early and major adopters of CSPM solutions to ensure comprehensive visibility, automated remediation, and adherence to various internal and external compliance mandates.

The small and medium enterprises (SMEs) segment is anticipated to register the highest growth rate during the forecast period. While historically lagging in cybersecurity investments due to limited resources, SMEs are increasingly migrating their operations to the cloud for agility and cost efficiency. This digital transformation exposes them to similar cyber risks as larger entities, but often without dedicated security teams or in-depth expertise. The Cybersecurity and Infrastructure Security Agency (CISA) regularly provides guidance for small businesses, emphasizing their vulnerability and the need for basic cybersecurity measures.

By Cloud

The public segment held the largest share in 2024, due to the widespread adoption of public cloud services by a vast array of businesses for their scalability, flexibility, and cost-effectiveness. As more organizations move their workloads and data to public cloud platforms, the complexity of managing and securing these shared environments increases significantly. The need to continuously monitor public cloud configurations for misconfigurations and compliance issues is critical.

The hybrid segment is anticipated to register the highest growth rate during the forecast period. Many organizations are opting for hybrid cloud models, combining their on-premises infrastructure with public cloud resources to balance control, cost, and flexibility. This approach, however, introduces a new layer of complexity in security management, as businesses need consistent visibility and policy enforcement across both environments. For example, a 2024 survey involving public sector organizations indicated that 45% currently use a hybrid cloud operating model, with a significant pivot expected toward hybrid multicloud.

By Industry Vertical

The IT & telecom segment held the largest share in 2024. This sector has been an early and extensive adopter of cloud technologies due to its inherent digital nature and continuous need for scalable and agile infrastructure. The sheer volume of data processed in IT cloud, the complex network environments, and the increasing sophistication of cyber threats targeting telecommunications infrastructure make robust CSPM solutions essential. For example, the Indian Ministry of Communications, in a press release dated February 6, 2025, highlighted various measures taken to combat telecom-related frauds and ensure the security of telecommunication infrastructure, demonstrating the ongoing high-level focus on cybersecurity in this sector.

The healthcare segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by the accelerated digital transformation within healthcare, including the widespread adoption of electronic health records (EHRs), telehealth services, and cloud-based data analytics. Healthcare organizations handle highly sensitive patient data, which is a prime target for cybercriminals, and they face stringent regulatory requirements like HIPAA in the US. A HIMSS Analytics Survey revealed that over 83% of healthcare organizations were already using cloud services, underscoring the growing attack surface.

Regional Analysis

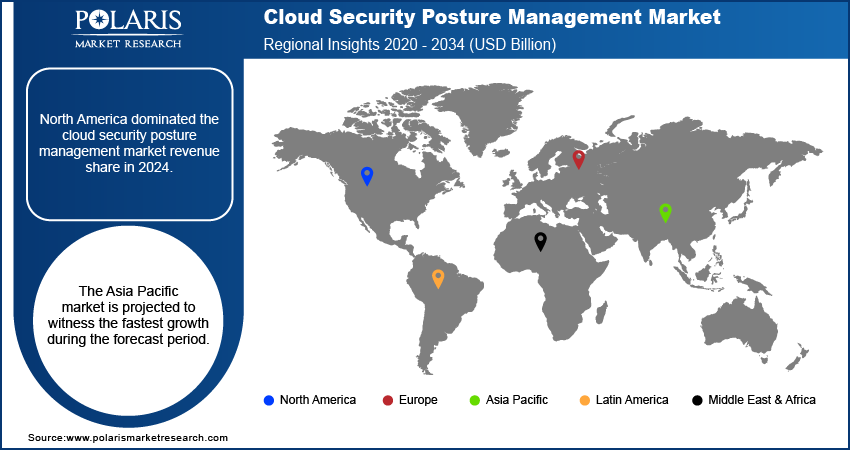

The North America cloud security posture management market held a dominant position across the world in 2024, primarily due to the region's highly developed technological infrastructure, significant early adoption of cloud services across various industries, and the presence of stringent cybersecurity frameworks. Businesses in North America, including those in finance, healthcare, and technology, have rapidly shifted critical workloads to the cloud, intensifying the demand for robust CSPM solutions that emphasize security, compliance, and risk management. The region also benefits from being home to many leading CSPM solution providers, fostering innovation and widespread implementation of advanced cloud security practices.

US Cloud Security Posture Management Market Insight

The US is a key contributor to North America's leading position in the global CSPM market. The country has a robust cloud infrastructure and a strong focus on digital transformation across both the private and public sectors. With a significant number of organizations leveraging various cloud platforms, the need for continuous security monitoring and compliance validation is increasing. The increasing threat of cyberattacks, coupled with evolving regulations, drives continuous investments in CSPM tools. For instance, federal agencies in the US have increasingly adopted cloud services, creating a significant demand for solutions that can secure these complex environments and ensure compliance with government cybersecurity mandates.

Europe Cloud Security Posture Management Market

Europe represents a substantial and growing region in the CSPM market, driven by its strong regulatory environment and increasing cloud adoption. European organizations are highly focused on data protection and privacy, largely due to strict regulations such as the General Data Protection Regulation (GDPR). This regulatory pressure mandates robust security measures for cloud environments, making CSPM solutions vital for compliance. Many businesses are also accelerating their cloud migration, leading to a rising need for tools that can identify and fix misconfigurations across their cloud infrastructure. The Germany cloud security posture management market plays a major role in Europe. As a country with a strong economy and a significant digital footprint, German businesses are increasingly utilizing cloud services for various operations. The German government and its industries prioritize data security and adherence to European and national data protection laws. This emphasis on regulatory compliance, combined with a sophisticated IT landscape, drives the demand for comprehensive CSPM solutions that help organizations maintain a strong security posture and mitigate risks associated with cloud adoption.

Asia Pacific Cloud Security Posture Management Market Overview

The Asia Pacific market is experiencing rapid growth and is one of the fastest-growing regions globally. This expansion is fueled by accelerated digital transformation initiatives, increasing cloud adoption rates across diverse industries, and a growing awareness of cybersecurity risks. As businesses in countries such as China and India move more operations to the cloud, they are encountering complex security challenges, including misconfigurations and compliance issues. This is leading to a heightened demand for CSPM solutions that can provide visibility and automation. The China cloud security posture management market contributes major share in Asia Pacific. With its rapidly expanding digital economy and massive adoption of cloud computing, Chinese organizations are keenly focused on securing their cloud environments. The rising number of cyber threats and the increasing importance of data security and local regulations are propelling the demand for cloud security solutions. As more businesses in China adopt multi-cloud and hybrid cloud strategies, CSPM tools become essential for managing security across these complex deployments and ensuring compliance with national cybersecurity policies.

Key Players and Competitive Insights

The cloud security posture management market is highly competitive, featuring a mix of established cybersecurity vendors and specialized cloud-native security companies. Competition primarily revolves around offering comprehensive coverage across various cloud environments, advanced automation capabilities for detection and remediation, and strong integration with existing security and DevOps tools.

A few prominent companies in the industry include Zscaler, Palo Alto Networks, CrowdStrike, Wiz, Orca Security, Check Point Software Technologies Ltd., Tenable, Rapid7, Aqua Security, Fortinet, Microsoft (Microsoft Azure Security Center), Google (Alphabet Inc.), and Amazon Web Services.

Key Players

- Aqua Security

- Check Point Software Technologies Ltd.

- CrowdStrike

- Fortinet

- Google (Alphabet Inc.)

- Microsoft (Microsoft Corporation)

- Orca Security

- Palo Alto Networks

- Rapid7

- Tenable

- Wiz

- Zscaler

Industry Developments

August 2024: SentinelOne and Google Cloud enhanced their partnership to provide advanced enterprise cyber defense. The integration of AI-driven endpoint protection with Google Cloud’s threat intelligence strengthens organizational security posture.

February 2025: Check Point Software Technologies Ltd. partnered with Wiz to help businesses deal with the increasing security issues in hybrid cloud setups.

October 2024: Cognizant partnered with Palo Alto Networks to offer cybersecurity solutions and services to companies in many different industries.

Cloud Security Posture Management Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Services

By Cloud Service Outlook (Revenue – USD Billion, 2020–2034)

- SaaS

- IaaS

- PaaS

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Cloud Outlook (Revenue – USD Billion, 2020–2034)

- Public

- Private

- Hybrid

By Industry Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Retail

- Healthcare

- IT & Telecom

- BFSI

- Defense/Government

- Manufacturing

- Energy

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud Security Posture Management Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.17 billion |

|

Market Size in 2025 |

USD 5.70 billion |

|

Revenue Forecast by 2034 |

USD 14.12 billion |

|

CAGR |

10.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.17 billion in 2024 and is projected to grow to USD 14.12 billion by 2034.

The global market is projected to register a CAGR of 10.6% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Zscaler, Palo Alto Networks, CrowdStrike, Wiz, Orca Security, Check Point Software Technologies Ltd., Tenable, Rapid7, Aqua Security, Fortinet, Microsoft (Microsoft Azure Security Center), Google (Alphabet Inc. - Google Cloud Security Command Center), and Amazon Web Services (Amazon.com Inc. - AWS Security Hub).

The solution segment accounted for the largest share of the market in 2024.

The service segment is expected to witness the fastest growth during the forecast period.