Coil Coatings Market Share, Size, Trends, Industry Analysis Report

By Material Type (Polyester, Epoxy, PVC, Plastisols, Acrylic, Polyurethane, PVDF, and Silicone); By Product Type; By Application; By End Use; By Distribution Channel; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4117

- Base Year: 2023

- Historical Data: 2019-2021

Report Outlook

The global coil coatings market was valued at USD 5.52 billion in 2023 and is expected to grow at a CAGR of 4.7% during the forecast period.

The growing demand for coil coatings in the construction sector to be used in applications like metal roofing, wall panels, and others is a result of increasing urbanization and infrastructure development, particularly in developing nations, driving global market growth. In addition, the continuous rise in automobile production worldwide that significantly requires coil coatings for exterior automotive body panels, color and finish, rust prevention, noise reduction, and fuel efficiency, among many others, is further anticipated to boost market growth over the years.

To Understand More About this Research: Request a Free Sample Report

Moreover, the significant increase in investments in research & development activities focused on exploring new potentials for coil coatings, their use in different industries, and the creation of new coatings with enhanced capabilities, along with the presence of stringent environmental regulations promoting the development of low-VOC and sustainable coatings, are likely to generate huge growth potential for the market in the near future.

- For instance, in May 2023, Chemcoaters introduced a thin-film coating named ‘FeGuard,’ which is mainly developed for cold-rolled and hot-rolled pickled and oiled steel.

However, several environmentally stringent regulations towards the use of certain types of chemicals and continuous fluctuations in raw material prices that are being used in the production of coil coatings, such as resins, solvents, and pigments, are likely to restrain global market growth.

Industry Dynamics

Growth Drivers

- Growing global construction sector and rapid rate of industrialization

Coil coatings are being widely used in building and construction applications such as cladding, insulation, and roofing, among many others, due to their numerous advantageous characteristics, including corrosion resistance, durability, energy efficiency, and sustainability. Thus, the continuous expansion of the construction industry all over the world directly influences the demand for coil coatings and boosts its market growth.

Additionally, the rising rate of industrialization, particularly in emerging economies like India, China, and Indonesia, and the exponential growth of their various industrial sectors, such as HVAC, automotive, and appliances, which all require coil-coated materials to be used in their products, is further driving the global coil coatings market growth.

Report Segmentation

The market is primarily segmented based on material type, product type, application, end use, and region.

|

By Material Type |

By Product Type |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type Analysis

- Polyester segment accounted for the largest market share in 2022

The polyester segment accounted for the largest market share. The growth of the segment market is highly attributed to the growing demand for interiors and exteriors of pre-engineered buildings, as they offer numerous benefits such as weather resistance, chemical resistance, and good formability. Apart from this, polyester is also well-known to deliver excellent flow characteristics in various temperatures as compared to other material types, resulting in increased adoption of such materials.

By Product Type Analysis

- Topcoats segment held the significant market share in 2022

The topcoats segment held the majority market revenue share in 2022, which is majorly driven by a constant surge in the number of construction activities globally that boost the demand for coil coatings with topcoats coupled with the growing awareness of environmental concerns and sustainability, fueling the need and demand for coatings that are eco-friendly and have low VOV emissions.

Besides this, topcoats play a very crucial role in protecting metal surfaces from weather-related factors like UV radiation, moisture, and extreme temperatures; thus, growing concerns related to climate change and extreme weather events across the globe could drive the need for durable topcoats.

By Application Analysis

- Steel segment captured the largest market share in 2022

The steel segment captured the largest market share in terms of both revenue and volume in 2022, mainly due to the widespread use of coal-coated steel across different industries, including construction and infrastructure development and automotive, due to its extreme water and weather resistance and greater durability. Increasing consumer preferences for specific finishes, colors, and textures across several applications could also influence the demand for steel-coated coil coatings with particular aesthetic properties.

The aluminum segment is expected to grow at a substantial growth rate over the coming years, mainly accelerated by increasing consumer awareness about its durability and corrosion resistance, which makes it an ideal and highly preferred choice for numerous outdoor applications. Also, aluminum coatings are good conductors of heat, thereby being widely used in applications requiring energy efficiency to improve the energy performance of components.

By End Use Analysis

- Construction segment is projected to witness highest growth

The construction segment is projected to grow at the highest CAGR throughout the study period on account of rising urbanization and drastic growth of global population across several regions of the world that necessitates the development of new commercial buildings and infrastructure development, which in turn, leading to increased demand for coil coatings in construction applications globally.

- For instance, as per a report published by The Hindu, India’s total urban population is estimated to reach 67,54,56,000 by 2035, with a significant increase from 48,30,99,000 in 2022. By 2035, it is expected that the percentage of urban population in India will be around 43.2%.

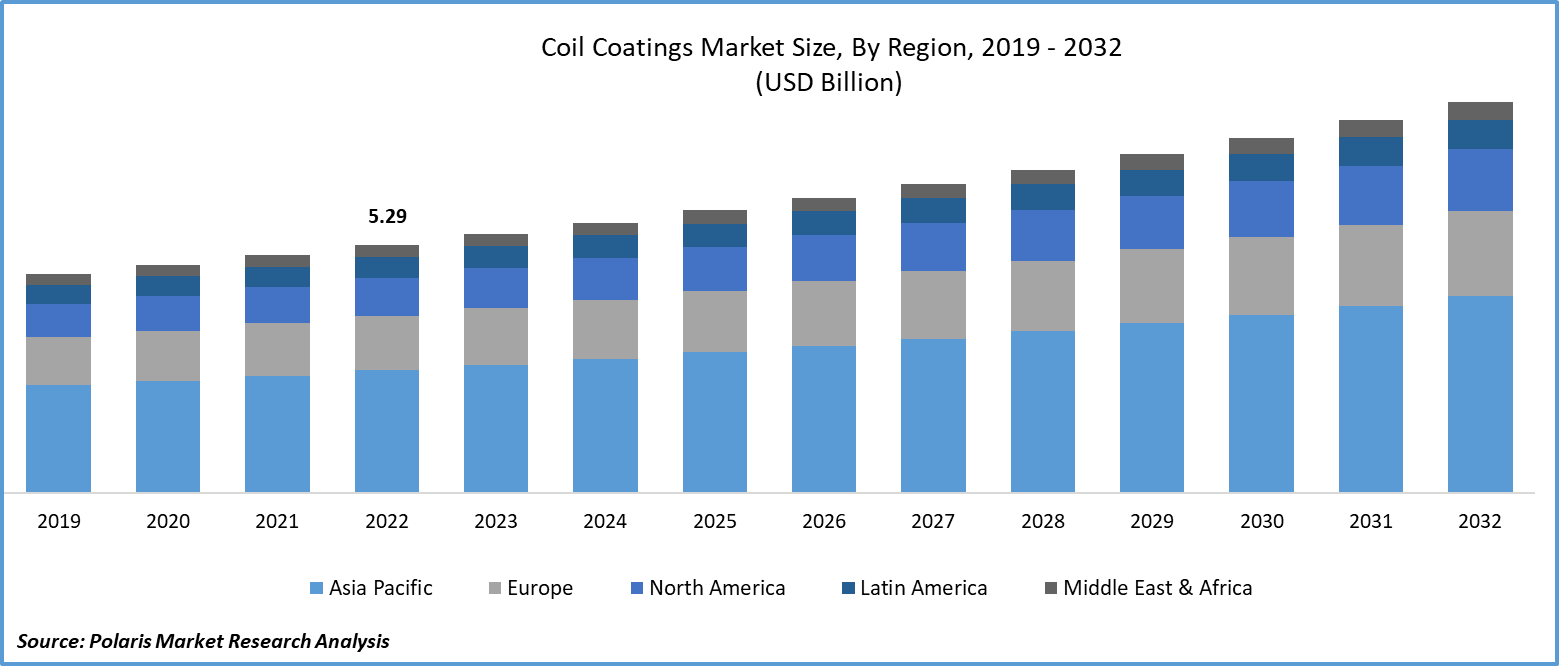

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market. The regional market growth is significantly driven by a surge in the number of construction and renovation activities in developing economies, along with the rapid economic growth across several countries that has boosted the demand for coil coatings across sectors. In addition, government investments in various infrastructure development projects, such as roads, bridges, highways, and public transportation that require coil coatings for corrosion resistance and aesthetic enhancement, have also been driving the region’s growth.

The North America region accounted for the second largest share and is anticipated to witness the highest growth rate during the projected period, owing to increasing emphasis on energy-efficient construction materials and processes that mainly involve the use of coated materials to enhance thermal performance along with the rising focus on R&D in the field of coil coatings that led to the introduction of new and more innovated products.

- For instance, in July 2023, 3A Composites USA announced its new innovative coil coating production line, which is a dedicated aluminum line that boasts innovative technology and advanced automation and will help company products to be more versatile, agile, and ready to respond to the market.

Key Market Players & Competitive Insights

The coil coatings segment is moderately competitive in nature with the presence of several market players competing for market share and consolidating their position. The leading players in the market are focusing on improving their product quality and product differentiation and investing in advancing their manufacturing and processing technologies to cater to emerging or evolving demand of customers.

Some of the major players operating in the global market include:

- Akzo Nobel N.V.

- ALCEA

- Axalta Coating Systems

- Becker Group

- Dura Coat Products Inc.

- Eastman Chemical Corporation

- Henkel AG & Co. KGaA

- Huehoco GmbH

- Jotun Group

- Kansal Paint Co. Ltd.

- Nipsea Group

- Noroo Coil Coatings

- PPG Industries

- The Chemours Company

- The Valspar Corporation

- Titan Coatings Inc.

Recent Developments

- In April 2023, Shrewin-Williams Coil Coatings introduced a new color forecast named “FUSE,” which is specially designed for architectural metal coatings. The new collections are inspired by infrastructure, technology, and empathy and presents 6 colours in every collection.

- In March 2021, AkzoNobel introduced a new PVDF coil coating technology called “TRINAR TC”, which combines 70% PVDF performance with improved durability. It further provides increased scratch, abrasion, and stain resistance across diverse applications.

Coil Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.77 billion |

|

Revenue forecast in 2032 |

USD 8.33 billion |

|

CAGR |

4.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material Type, By Product Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |