Cold Pain Therapy Market Share, Size, Trends, Industry Analysis Report

By Product (OTC Products and Prescription Products); By Application; By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2798

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

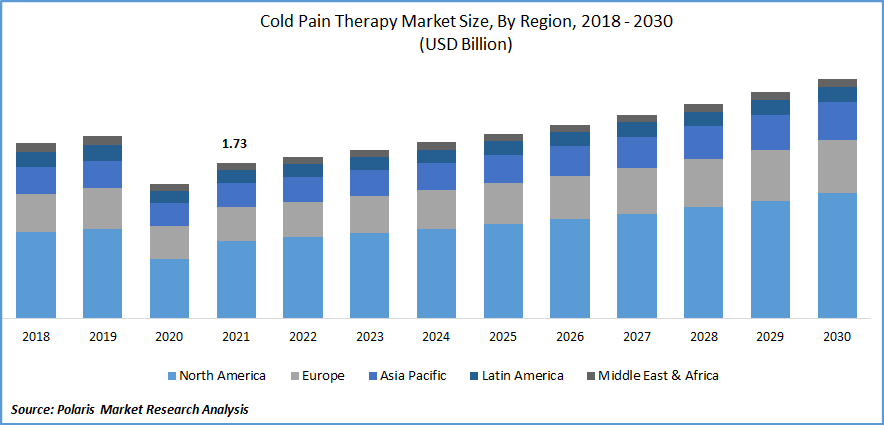

The global cold pain therapy market was valued at USD 1.73 billion in 2021 and is expected to grow at a CAGR of 5.05% during the forecast period.

An increasing number of injuries related to sports activities and the growing prevalence of various orthopedic diseases across the globe are key factors expected to drive the growth. For instance, according to Stanford’s Children’s Health, around one-third of overall injuries incurred by children are those injuries that are related to sports. Moreover, an extensive rise in the geriatric population and the rising number of traumatic injuries resulting from road accidents, falls, and mishaps are a few other factors influencing the global market to grow rapidly.

Know more about this report: Request for sample pages

Furthermore, increasing numbers of introductions to innovated and improved pain relief products by several large market players across the globe are also likely to have a positive impact on the global market demand and adoption of cold relief therapy among consumers. For instance, in June 2021, Hisamitsu Pharmaceutical Co. Inc. announced the launch of Air Salonpas Z, an anti-inflammatory and analgesic spray for various types of muscle pain, bruises, and sprains.

The COVID-19 pandemic has significantly impacted the growth of the cold pain therapy market. The global supply chains had to face several problems and adjust to the ongoing demand and needs for various cold therapy products among people with several pains. Many rehabilitation centers were closed due to the pandemic, which has severally affected access to cold pain therapy products around the world.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

A rise in the popularity of surgeries related to the hip and knee coupled with the changes associated with aging in the musculoskeletal system are major factors projected to drive the growth of the global market over the forecast period. Moreover, increasing adoption of analgesic patches and rising preferences for self-care among global population are other factors likely to boost the growth and adoption of cold pain therapy over the coming years.

In addition, high growth in healthcare infrastructure and technological advancements in cold pain therapy products by both government and private institutions, especially in developing nations such as India, China, and Indonesia, is anticipated to create further growth opportunities for the global market in the near future.

Report Segmentation

The market is primarily segmented based on product, application, distribution channel, and region.

|

By Product |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

OTC products segment held the largest market revenue share in 2021

Easy accessibility and availability in both online and offline stores, along with the high affordability of gels, creams, and various types of sprays, are major factors driving the growth of the segment. Moreover, the introduction of a wide range of OTC products, including gels, sprays, roll-ons, wraps, and pads by various key market companies with attractive packaging and publicity to gain consumer attraction is likely to fuel the demand for these products at a significant rate in the coming years.

Furthermore, prescription products are expected to hold a significant market share over the forecast period owing to a high prevalence of chronic musculoskeletal diseases and rising demand for improved treatment of these types of disorders globally. According to World Health Organization, around 1.71 billion people worldwide are suffering from musculoskeletal conditions, and musculoskeletal conditions are the leading contributor to disabilities around the world.

Orthopedic conditions accounted for the largest market share in 2021

Rising prevalence and cases related to orthopedic diseases, including arthritis, osteoarthritis, joint disorders, and musculoskeletal disorders, are major factors propelling the growth of the segment market. According to the World Health Organization, it is anticipated that nearly 130 million people worldwide are projected to have osteoarthritis by 2050. According to our findings, osteoarthritis is the most common arthritis type found in people globally. Hence, increasing number of patient suffering from these disorders are likely to influence the segment growth over the coming years.

In addition, the sports medicine segment is likely to grow at fastest rate during the forecast period, which is mainly attributed to the growing number of injuries related to sports activities. Major key players in the market are increasingly investing in development of several types of products specially designed for people who are incurred with sports.

E-commerce segment expected to witness fastest growth over the forecast period

The e-commerce segment is witnessing fastest CAGR throughout the forecast period due to the rising popularity of several online platforms including Apollo Pharmacy, NetMeds, and PharmEasy, which offers a wide range of products along with a complete description of products and various other features such as free home delivery and doctor consultation. Additionally, various lucrative offers and discounts that are available on different websites across the globe are further anticipated to drive the growth of the segment at an extensive growth rate in the near future.

However, retail pharmacy held the largest market share in 2021, and is anticipated to retain its position over the study period. The increased number of retail pharmacies in developing and developed regions has resulted in higher growth, and demand for healthcare products from retail stores are key factors estimated to drive the segment growth during the forecast period. In addition, wide availability of topical products in several retail pharmacies across the globe is also likely to contribute significantly to the segment growth over the coming years.

North America dominated the cold pain therapy market in 2021

North America was the leading market in 2021 and is expected to continue its dominance throughout the forecast period. This is attributed to the rising number of various orthopedic diseases and the high adoption of advanced technology devices in the region.

Moreover, the high aging population and large availability of patients with back pain and another type of injuries are also projected to boost the demand for cold pain therapy extensively in the coming years. For instance, as per the Population Reference Bureau’s record, Americans aged over 65 years is likely to double from 52 million in 2018 to 95 million by 2060. This rapid increase in the aging population in the country is likely to impact the market positively.

Furthermore, Asia Pacific region is anticipated to grow at a significant growth rate during the forecast period. Increasing awareness regarding healthcare and rising technological advancements in several emerging countries, including China, India, and Indonesia, are key factors likely to drive the growth and demand of the market in the coming years.

Additionally, according to the World Health Organization, nearly 93% of the total fatalities worldwide due to road accidents occur in medium-low sized economies. These countries hold around 60% of the world’s vehicles. Therefore, an extensive rise in the number of road accidents and the growing popularity of OTC products in the Asia Pacific region is likely to fuel the growth of the market.

Competitive Insight

Some of the major players operating in the global market are Beiersdorf, Hisamitsu Pharmaceutical, Johnson & Johnson, DeRoyal Industries, Romsons Group, DJO Finance, Medline Industries, Polar Products, Hot and Cold Company, Medtronic, 3M Company, ROHTO Pharmaceutical, Bruder Healthcare, Medichill UK, Rapid Aid, and Sanofi.

Recent Developments

In April 2021, Battle Creek introduced cold therapy wraps to improve and treat chronic pain and inflammation. The products are available in four sizes, varying from 12X8 inches to 23X14 inches, and come with a proprietary gel technology, which remains flexible and provides flexibility and effective cold therapy.

In February 2021, Breg entered a partnership with Club Warehouse for the expansion of the delivery of its premium orthopedic products in Australia. The company is expected to distribute its sports organization and orthopedic practices across the region.

Cold Pain Therapy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.80 billion |

|

Revenue forecast in 2030 |

USD 2.67 billion |

|

CAGR |

5.05% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Beiersdorf, Hisamitsu Pharmaceutical Co. Inc., Johnson & Johnson, DeRoyal Industries Inc., Romsons Group of Industries, DJO Finance LLC, Medline Industries Inc., Polar Products Inc., Hot and Cold Company, Medtronic, 3M Company, ROHTO Pharmaceutical Co. Ltd., Bruder Healthcare, Medichill UK, Rapid Aid, and Sanofi |