Colonoscope Market Share, Size, Trends, Industry Analysis Report

By Product Type (Colonoscope, Visualization Systems, Others); By Application; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4609

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

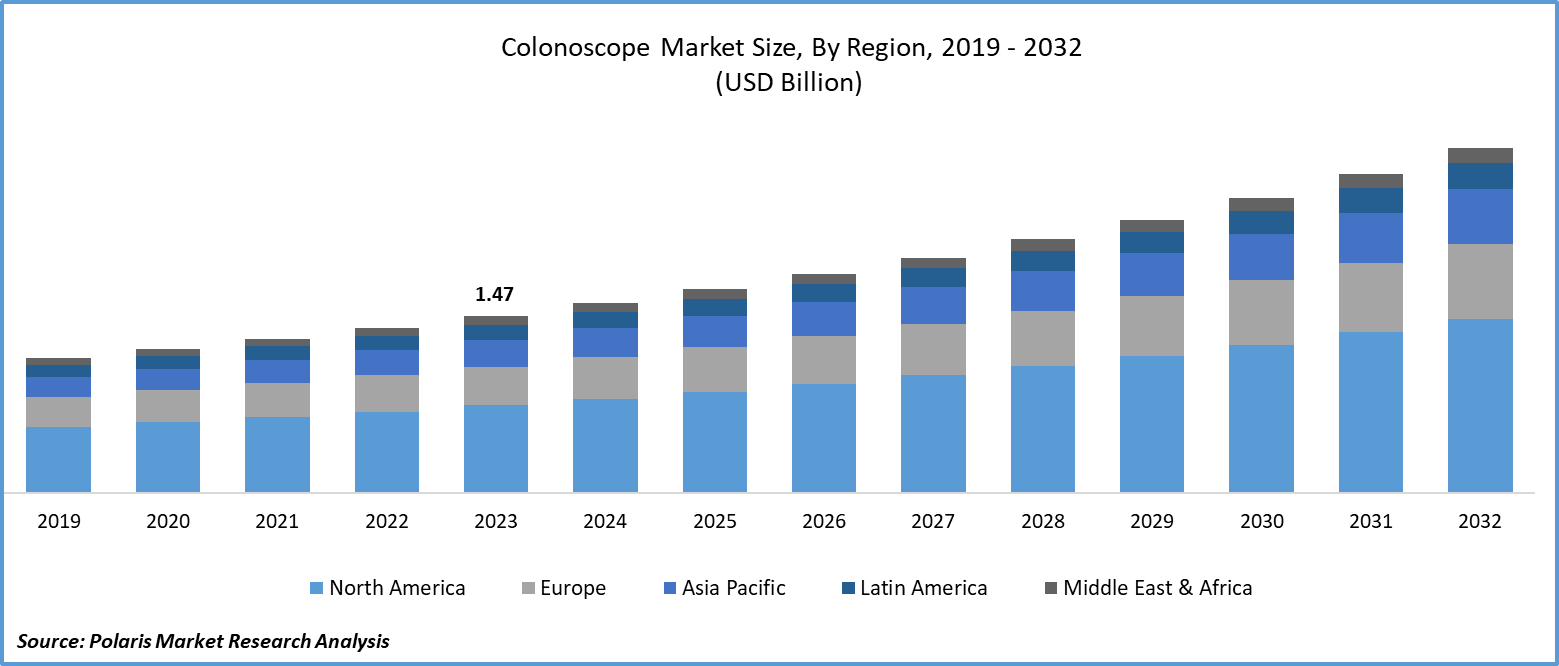

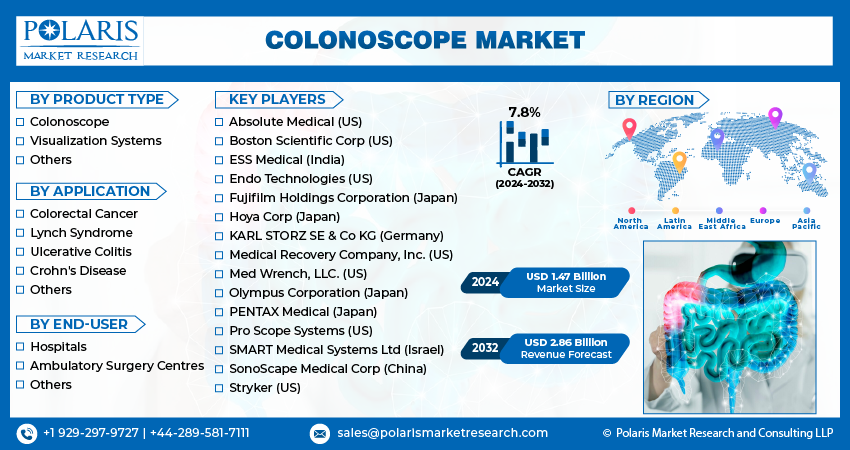

Colonoscope Market size was valued at USD 1.47 billion in 2023. The market is anticipated to grow from USD 1.57 billion in 2024 to USD 2.86 billion by 2032, exhibiting the CAGR of 7.8% during the forecast period.

Market Overview

The increasing prevalence of gastrointestinal diseases, specifically colorectal cancer, ulcerative colitis, and Lynch syndrome, among the individuals is significantly driving n the need for an effective tool with the potential capacity to examine the large intestine in the human body. This is creating the need for colonoscopes. Additionally, doctors are more likely to suggest regular examination of large intestine to the patients as it enables them to monitor the disease condition and prescribe possible medications for early recovery. This trend will boost the demand potential for the colonoscope over the assessment period.

To Understand More About this Research: Request a Free Sample Report

-

Furthermore, technological innovations are anticipated to assist in developing additional features to the colonoscope, enabling doctors to effectively examine, and offer treatment.

- For instance, in December 2023, a study published in Scientific Reports used self-supervised machine learning technology, and pyramid siamese networks, in colonoscopy for colorectal polyp detection and concluded that it is a cost-effective solution for detecting the disease when a small portion of the data is labeled while the other is un-labeled.

Moreover, the growing research activities focusing on designing new surveillance colonoscopies are expected to drive new developments in colonoscopes, contributing to the growth. For instance, in May 2023, Olympus received Food and Drug Administration approval for the EVIS X1 endoscopy system, the GIF-1100 gastrointestinal videoscope, and the CF-HQ1100DL/I colonovideoscope.

Growth Drivers

Rising innovations in the marketplace

Surge in innovations in colonoscopy & adoption of innovative colonoscopes driven by their prominent performance & capability to treat more patients creating lucrative growth opportunities . For instance, in February 2023, the National Health Service (NHS) launched the country's 1st robotic colonoscope machine. Additionally, a 2022 study examined the potential of the colonoscopy in lowering the incidence of the colorectal cancer & following examination it is being found that colonoscopy lowered the risk of colorectal cancer by nearly, 18%. Such studies expected to promote need for colon inspection, boosting demand for the machine soon.

Adoption of technologies in the colonoscopy design process

Use of artificial intelligence, via machine learning & deep learning, in the design of the colonoscopes to identify the potential abnormalities in the colon & to assist gastro-intestinologist to not miss any mis-leadings during screening process has fueled the adoption of advanced colonoscopes . For instance, a 2023 study it is found AI based colonoscopes have significantly improved diagnosis rate by lowering missing rates and thereby, causing

Restraining Factors

Higher costs of colonoscope installation

The resistance to higher-cost healthcare infrastructure installation by hospitals, ambulatory surgery centers, and others is expected to lower the demand for the colonoscope. The rising patients' concerns about the risks associated with the colonoscopy diagnosis, such as infection and bleeding, are likely to hinder its adoption in the marketplace. Additionally, the evolution of the cost-effective testing solutions is will lower their demand. For instance, in March 2024, a study published in New England Journal of Medicine (NEJM) found that effectiveness of the blood test in detecting the presence of colorectal cancer with, nearly83% accuracy rate.

Report Segmentation

The market is primarily segmented based on product type, application, end-user and region.

|

By Product Type |

By Application |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Visualization Systems segment is expected to witness the highest growth during the forecast period

The visualization systems segment is anticipated to exhibit a prominent share with a higher CAGR during the projected period, mainly driven by its stupendous potential in detecting abnormal activities in the large intestine. The increasing use of technologies in the automatic detection of gastrointestinal issues through colonoscopy has been made possible by the presence of superior visualization systems.

The rising companies' initiatives to promote colonoscope visualization systems are driving the innovation of eminent colonoscope visualization systems. For instance, in January 2024, Motus GI Holdings announced the positive results of its Second Generation Pure-Vu System in a study on improving visualization among inadequate bowel preparation patients.

By Application Analysis

Colorectal cancer segment acquired the largest market share in 2023

Colorectal cancer segment garnered the largest share. The rising prevalence of colorectal cancer is positively influencing the demand for colonoscopy in the global market. According to the World Health Organization, colorectal cancer is the 2nd major factor leading to cancer-based mortality & 3rd most prevalent cancer across the globe . This is expected to be prevented by regular screening tests, via colonoscope.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region dominated the global market. Region’s growth is attributed to the surge in the incidence of colorectal cancer. Based on the American Cancer Society’s Colorectal Cancer Report 2023, from 2000-2019, the number of people taking treatment for advanced-stage colorectal cancer has grown by, around 8%.

In addition, a greater number of people with below 50 years of age are having colorectal cancer, making 4th cause of cancer deaths in the United States. Around 106,590 new colorectal cancer cases are expected to register in 2024, as per American Cancer Society. This tends to necessitate the need for colonoscope in the region.

Furthermore, the prevalence of preventive measures taken by governments is anticipated to propel the need for colonoscopy. For instance, the U.S. Preventive Services Task Force suggested that people over the age of 40 have a colonoscopy examination every ten years. This can drive the establishment of ambulatory surgery clinics offering gastrointestinal screening tests, contributing to the expansion of the colonoscopy market.

The Asia Pacific region is expected to be the fastest-growing region with an iconic CAGR during the projected period, owing to the growing number of countries investing in healthcare advancements to improve the accessibility, safety, and efficacy of hospitals with technological advancements. For instance, in December 2022, Bharti Airtel & Apollo Hospitals, in collaboration with the HealthNet Global, Amazon Web Services (AWS), & Avesha, conducted the initial AI based colonoscopy 5G trials.

Moreover, the increasing incidence of colorectal cancer among the younger population is expected to stimulate the adoption of colonoscopy in hospitals. As per 2023 study conducted by the Delhi State Cancer Institute, the colorectal cancer shifting its prevalence from more than 50 years people to the age group of 31 to 40. As more people suffer from the intestine-based diseases, there will be a significant need for large intestine screening, thereby fueling its use in the next few years.

Key Market Players & Competitive Insights

Partnerships are anticipated to boost the competition

The colonoscope market is characterized by a mix of fragmentation and consolidation, with the ongoing development of collaborative frameworks by most players. The key market players are emphasizing the adoption of artificial intelligence technologies to promote accurate detection of colorectal cancer, ulcer colitis, and others in a shorter span of time. For instance, in December 2023, Medtronic announced the doubling of its endoscopy artificial intelligence partnership with the Cosmos Pharmaceutical with a deal of USD 200 million.

Some of the major players operating in the global market include:

- Absolute Medical (US)

- Boston Scientific Corp (US)

- ESS Medical (India)

- Endo Technologies (US)

- Fujifilm Holdings Corporation (Japan)

- Hoya Corp (Japan)

- KARL STORZ SE & Co KG (Germany)

- Medical Recovery Company, Inc. (US)

- Med Wrench, LLC. (US)

- Olympus Corporation (Japan)

- PENTAX Medical (Japan)

- Pro Scope Systems (US)

- SMART Medical Systems Ltd (Israel)

- SonoScape Medical Corp (China)

- Stryker (US)

Recent Developments in the Industry

- In August 2023, Motus GI, received approval from the Health Ministry of Israel to start commercial sales of its Pure-Vu EVS system in the country. This is used to promote the visualization quality of colonoscopes.

- In April 2023, Medical Specialists of the Palm Beaches acquired Palm Beach Digestive Associates, a colonoscopy & gastroenterology clinic, to expand its offerings.

Report Coverage

The colonoscope market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, application, end-user and their futuristic growth opportunities.

Colonoscope Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.57 billion |

|

Revenue forecast in 2032 |

USD 2.86 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

The analysis of colonoscope market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

FAQ's

The Colonoscope Market report covering key segments are product type, application, end-user and region.

Colonoscope Market Size Worth $2.86 Billion By 2032

Colonoscope Market exhibiting the CAGR of 7.8% during the forecast period.

North America is leading the global market

key driving factors in Colonoscope Market are Rising innovations in the marketplace