Commercial Printing Market Size, Share, Trends, & Industry Analysis Report

By Printing Technology (Digital Printing, Lithography Printing), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM2938

- Base Year: 2024

- Historical Data: 2020-2023

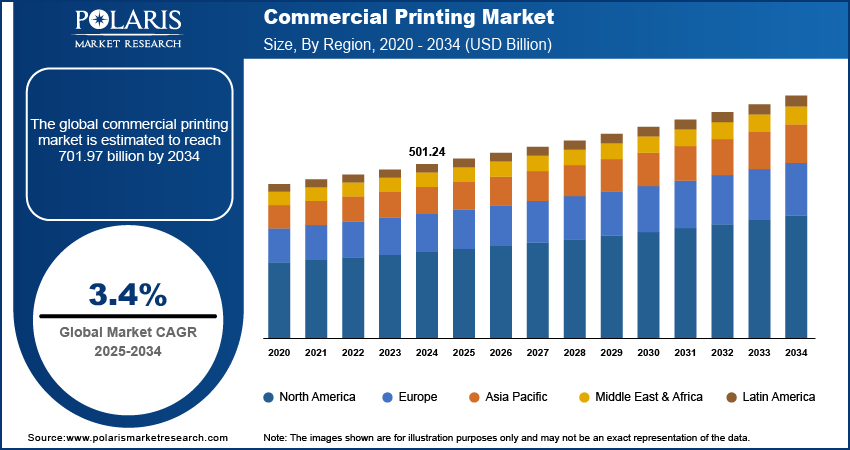

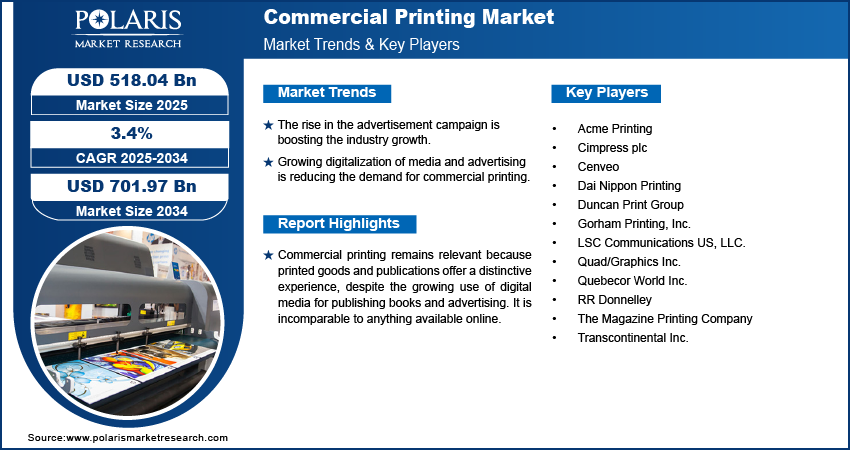

The global commercial printing market was valued at USD 501.24 billion in 2024 and is expected to grow at a CAGR of 3.4% during the forecast period. The growth is driven by rising demand for commercial printing services, as businesses and industries need more promotional materials like brochures and booklets.

Key Insights

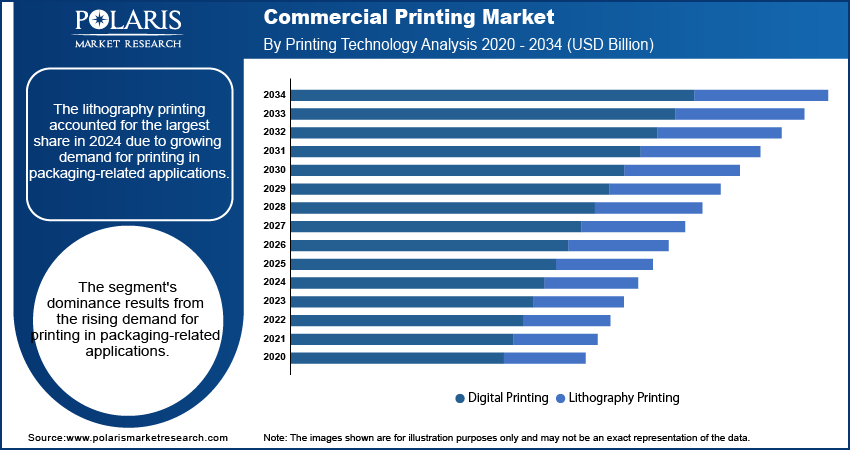

- The lithography printing accounted for the largest share in 2024 due to growing demand for printing in packaging-related applications.

- The advertising segment is expected to witness significant growth due to legal requirement for packaging printing on goods.

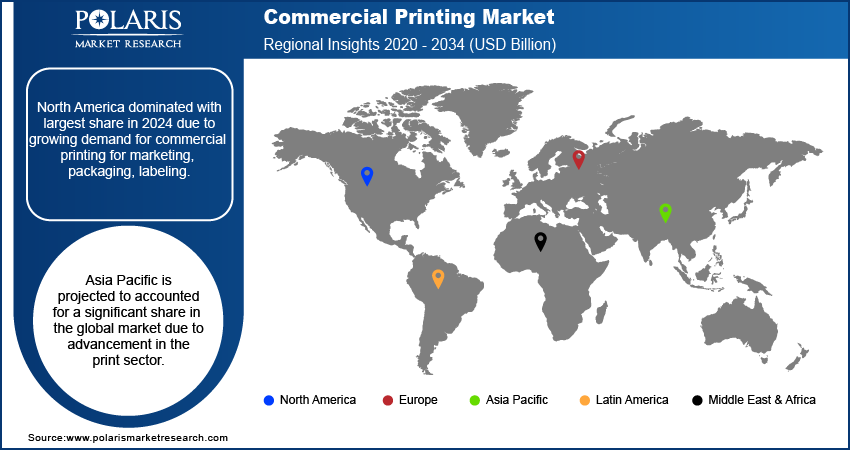

- North America dominated with largest share in 2024 due to growing demand for commercial printing for marketing, packaging, labeling.

- Asia Pacific is projected to accounted for a significant share in the global market due to advancement in the print sector.

Industry Dynamics

- The growth of e-commerce is boosting the need for commercial printing and labeling of package, thereby fueling the growth.

- The rise in the advertisement campaign is boosting the industry growth.

- Technological advancement is driving the growth.

- Growing digitalization of media and advertising is reducing the demand for commercial printing.

Market Statistics

- 2024 Market Size: USD 501.24 Billion

- 2034 Projected Market Size: USD 701.97 Billion

- CAGR (2025-2034): 3.4%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

The e-commerce industry is expanding worldwide due to rise in the smart penetration and internet access in urban as well as rural areas. According to the U.S. Census Bureau, in U.S. alone the retail e-commerce sales was worth USD 304.2 billion in second quarter of 2025, which is increase of 1.4% from the first quarter. This growth in the e-commerce sale is fueling the demand for the printing packaging and labelling, which in turn is fueling the demand for the commercial printings. Furthermore, expanding quick commerce sector in countries such as India is further fueling the demand for creative packaging, which is driving the demand for commercial printing, thereby driving the industry growth.

Commercial printing remains relevant because printed goods and publications offer a distinctive experience, despite the growing use of digital media for publishing books and advertising. It is incomparable to anything available online. Regular book and magazine readers prefer printed publications over online ones because actual books improve the experience. Users also benefit from printed books, such as easier reading.

Industry Dynamics

Growth Drivers

The demand for prints in the developing regions such as Asia Pacific, Latin America is rising. This rise in the demand if fuel by rising urbanization and literacy rate. This rise in the urbanization and literacy rate is boosting the demand for the brochure, manuals, catalogs, and commercial publications, which in turn is fueling the demand for the commercial printings. Moreover, expansion of the urban infrastructure in the developing countries such as India, Mexico, and Vietnam is boosting the number of showrooms and shopping malls. This rise in the showrooms and shopping malls is further driving the demand for the catalogs and advertisement boards. Consequently, boosting the demand for the commercial printing and thereby driving the industry growth.

Report Segmentation

The market is primarily segmented based on printing technology, application, and region.

|

By Printing Technology |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The Lithography Printing Segment Dominated the Market

The segment's dominance results from the rising demand for printing in packaging-related applications. Lithography technology has a number of benefits, such as constant and excellent image quality, which encourages more usage. Lithographic printing is perfect for high-volume static mailings, such as directories and product advertising. One of the most popular technologies is flexographic technology.

The digital printing segment is anticipated to record fastest CAGR. Due to the cost-effectiveness and flexibility of the technology, inkjet and laser printing solutions have been quickly adopted by the paper and package printing industry. The category is also predicted to be pushed by the uptake of Internet of Things (IoT) and artificial intelligence (AI) based technologies. Because digital printing offers lower prices for color prints and a better rate of return on investment, it is frequently used in printing operations.

The Advertising Segment is Expected to Witness Significant rowth

The advertising segment is expected to witness significant growth during the forecast period due to rising demand for the attractive brand promotions. Companies globally are focusing on creative brand campaign to attract younger population. This creative brand campaign is increasing the packaging and promotion board needs that align with the brand campaigns, which is driving the demand for the commercial printing in advertising applications. Moreover, advancement in the digital printing is making advertisement printing more efficient and cost effective. This cost effectiveness is fueling the adoption, thereby driving the segment growth.

The Demand in Asia-Pacific is Expected to Witness Significant Growth

Asia Pacific is anticipated to develop at the highest CAGR over the forecast period. Advancements in the print sector, such as digital technologies, notably in China and India, are driving the regional expansion. Due to these advancements' high-speed capabilities, conventional printers have been supplanted with high-tech commercial printers. Along with supporting the target market, the region's e-commerce explosion and retail sector organization offer tremendous possibilities for packaging expansion, which further drives the demand for the commercial printing in the region.

In 2024, North America dominated the market share. The rising demand for commercial printing for marketing, packaging, labeling, and advertising is fueling regional boom. Additionally, it is projected that the presence of essential firms in the area, like Quad/Graphics Inc., Acme Printing, Cenevo, and RR Donnelley, will further spur the industry's expansion. Furthermore, presence of major e-commerce players such as Amazon, Walmart, and Ebay is further fueling the demand for the creative packaging, thereby boosting the demand for the commercial printing in the region.

Competitive Insight

Some of the major players operating in the global market include Quad/Graphics Inc., Acme Printing, Cenveo, RR Donnelley, Transcontinental Inc., LSC Communications US, LLC., Gorham Printing, Inc., Dai Nippon Printing, The Magazine Printing Company, Cimpress plc, Quebecor World Inc., and Duncan Print Group.

Recent Developments

- Helium gives professionals access to specialist copywriting, content optimization, and project management was introduced by R.R. Donnelley (RRD) in May 2022. Through this service, brands may have a single-entry point to hundreds of subject matter experts who can provide content.

- LSC Communications US, LLC acquired Quad/Graphics, announced in October 2018. With the acquisition’s help, Quad could concentrate on the 3.0 strategy of the business and increase its capabilities.

Commercial Printing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 501.24 billion |

| Market size value in 2025 | USD 518.04 billion |

|

Revenue forecast in 2034 |

USD 701.97 billion |

|

CAGR |

3.4% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020- 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Printing Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Quad/Graphics Inc., Acme Printing, Cenveo, RR Donnelley, Transcontinental Inc., LSC Communications US, LLC., Gorham Printing, Inc., Dai Nippon Printing, The Magazine Printing Company, Cimpress plc, Quebecor World Inc., and Duncan Print Group. |

FAQ's

• The market size was valued at USD 501.24 Billion in 2024 and is projected to grow to USD 701.97 Billion by 2034.

• The market is projected to register a CAGR of 3.4% during the forecast period.

• A few of the key players in the market are Quad/Graphics Inc., Acme Printing, Cenveo, RR Donnelley, Transcontinental Inc., LSC Communications US, LLC., Gorham Printing, Inc., Dai Nippon Printing, The Magazine Printing Company, Cimpress plc, Quebecor World Inc., and Duncan Print Group.

• The lithography printing accounted for the largest market share in 2024.

• The advertising segment is expected to record significant growth.