Concrete Restoration Market Size, Share, Trends, Industry Analysis Report

: By Method (Crack Repair, Shotcrete, Grouting, Overlay, and Patch Repair), Material Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM2652

- Base Year: 2024

- Historical Data: 2020-2023

Concrete Restoration Market Overview

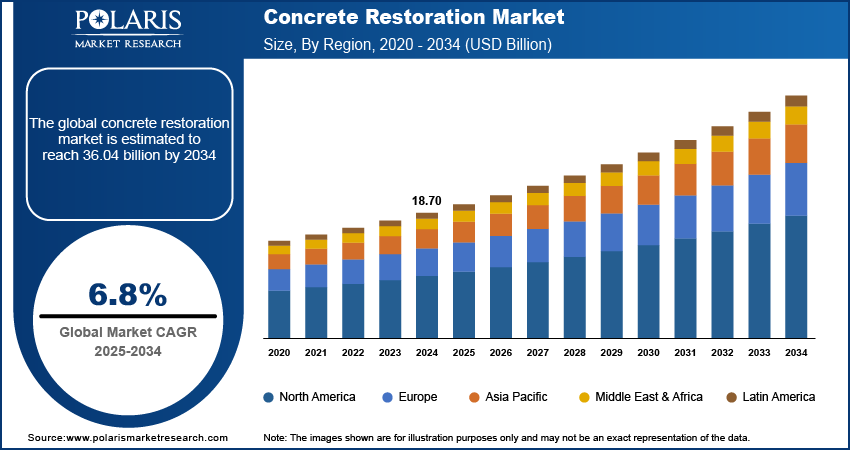

Concrete restoration market size was valued at USD 18.70 billion in 2024. The market is projected to grow from USD 19.94 billion in 2025 to USD 36.04 billion by 2034, exhibiting a CAGR of 6.8% during the forecast period.

The concrete restoration market focuses on rehabilitating and repairing deteriorated concrete structures to extend their service life and maintain structural integrity. This market has gained importance due to aging infrastructure worldwide, particularly in developed nations where bridges, buildings, and highways were constructed during the post-World War II. The market encompasses various repair methods, materials, and techniques designed to address concrete damage caused by environmental factors, structural stress, and chemical exposure. The increasing emphasis on infrastructure sustainability and maintenance is driving the concrete restoration market growth. In 2021, the US Infrastructure Investment and Jobs Act of 2021 allocated substantial funding for infrastructure rehabilitation projects.

The market serves diverse sectors, including commercial, residential, and industrial construction, with solutions ranging from crack repair and surface restoration to complete structural rehabilitation. Growth in urbanization and aging infrastructure has increased the demand for concrete restoration services and products, supported by technological advancements in repair materials and application techniques.

To Understand More About this Research: Request a Free Sample Report

Concrete Restoration Market Dynamics

Aging Infrastructure is Driving Market Growth

American Society of Civil Engineers' 2021 Infrastructure Report Card showcased that 42% of all bridges are at least 50 years old, and 46,154 bridges are considered structurally deficient. In Europe, the European Construction Industry Federation reported that 45% of railway bridges are over 100 years old. This aging infrastructure requires immediate attention due to safety concerns and functional requirements, thereby driving concrete restoration market expansion. The construction deterioration is further accelerated by increasing traffic loads, environmental factors, and deferred maintenance. Government assessments indicate that concrete structures built in the 1960s and 1970s are now reaching critical points in their service lives, necessitating concrete restoration.

Advancements in Repair Technologies

Modern repair techniques, such as self-healing concrete, advanced epoxy injection systems, and fiber-reinforced polymer composites, enhance the durability and lifespan of concrete structures while minimizing downtime during repairs. These technologies cater to increasing sustainability requirements by reducing the need for complete replacements, conserving resources, and lowering carbon footprints. Moreover, improved tools, such as non-destructive testing (NDT) and AI-driven monitoring systems, allow for precise identification of damage, enabling timely interventions that prevent further deterioration. These advancements boost confidence in property owners, engineers, and contractors, encouraging proactive maintenance and repair strategies and ultimately driving up demand in the concrete repair market.

Concrete Restoration Market Segment Analysis

Concrete Restoration Market Assessment by Method Outlook

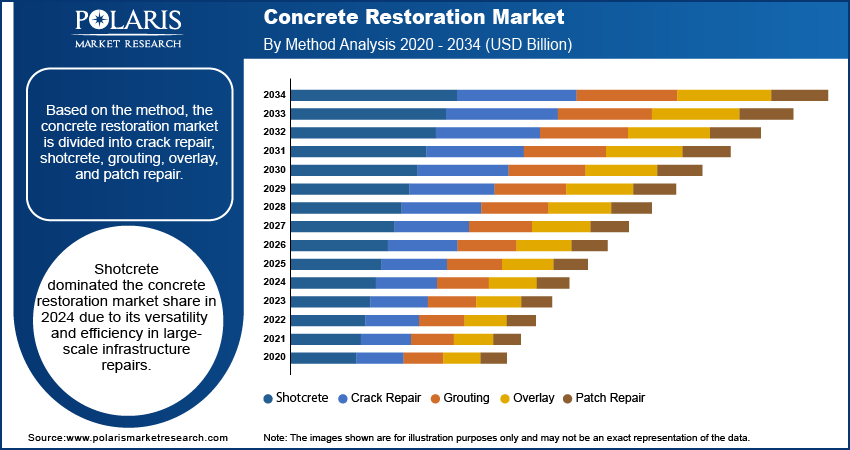

The concrete restoration market segmentation, based on method, includes crack repair, shotcrete, grouting, overlay, and patch repair. The shotcrete segment dominated the market share in 2024. This dominance is attributed to its versatility and efficiency in large-scale infrastructure repairs. The US Department of Transportation reports that shotcrete applications have shown a 40% reduction in repair time compared to traditional methods. The technology's ability to be applied in difficult-to-access areas and its superior bonding properties have made it particularly popular in tunnel and bridge rehabilitation projects, driving its segmental growth in the global concrete restoration market report.

Concrete Restoration Market Evaluation by Material Type Outlook

In terms of material type, the market is divided into cementitious materials, polymer-based materials, steel plate, and fiber composites. The polymer-based materials are expected to record fastest growth during the forecast period. This growth is driven by the material's superior chemical resistance, improved adhesion properties, and longer service life, particularly in harsh environmental conditions. The Federal Highway Administration reports that polymer-modified concrete repairs demonstrate 45% higher durability compared to conventional materials. This, in turn, is driving the growth of the polymer-based materials segment in the concrete restoration market.

Concrete Restoration Market Regional Insights

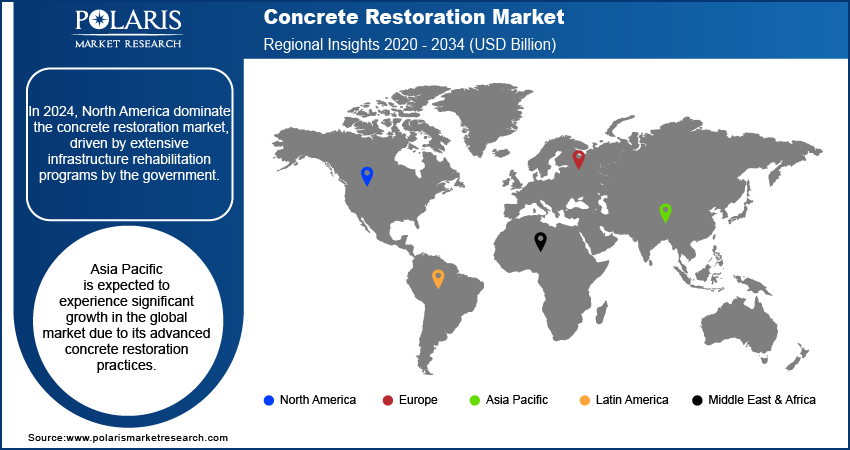

The concrete restoration market, based on region is divided into North America, Asia Pacific, Europe, Middle East and Africa, and Latin America. North America dominated the concrete restoration market in 2024. Extensive infrastructure rehabilitation programs primarily drive this dominance. For instance, according to the American Road & Transportation Builders Association (ARTBA) indicates that approximately 36% of bridges across the US require significant rehabilitative work or complete replacement to meet safety and functional standards. The region's leadership is further strengthened by stringent building codes and maintenance regulations, with states such as California implementing mandatory seismic retrofitting programs affecting over 7,000 structures, driving the demand for concrete restoration in North America.

Asia Pacific is projected to experience the fastest growth during the forecast period, with China, Japan, and India leading the expansion due to its advanced concrete restoration practices. The Japanese Ministry of Land, Infrastructure, Transport, and Tourism reports that 42% of the country's bridges will be over 50 years old by 2025, driving increased restoration activity. Additionally, the country has implemented a comprehensive infrastructure maintenance program, investing in advanced restoration technologies and preventive maintenance strategies. Consequently, driving the growth of the concrete restoration market in Asia Pacific.

Concrete Restoration Market Players & Competitive Analysis Report

Companies in the market collectively dominate through extensive product portfolios, strong distribution networks, and significant R&D investments. The market structure is oligopolistic, with the top five players holding approximately the majority of the market share. Competition centers around product innovation, technical expertise, and geographic presence. Major players have established strong regional manufacturing facilities and technical support centers to maintain market position and respond quickly to local market needs.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, surface technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The nutrition and care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the agricultural solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Pidilite Industries Limited, founded in 1959 and based in Mumbai, India, is a manufacturer of adhesives, sealants, and specialty chemicals. The company operates through two main business segments, which include branded consumer & bazaar and business-to-business (B2B). The branded consumer segment includes products such as Fevicol, Dr. Fixit, and M-seal, which are used in household and craft applications. The B2B segment focuses on industrial applications, particularly construction chemicals and industrial adhesives. Pidilite's product range is diverse. Adhesives and sealants account for about 53% of the company's sales, while construction and paint chemicals contribute approximately 19%. Art and craft materials make up about 12% of sales, with industrial products representing roughly 10% of total revenue. This variety allows Pidilite to serve different market needs across various sectors. The company has a notable international presence, with manufacturing facilities located in countries such as the USA, Brazil, Thailand, Egypt, and Bangladesh. Pidilite exports its products to over 60 countries globally, with significant revenue derived from the USA (42% of international revenue) and Brazil (17%). This international footprint enables Pidilite to address diverse market demands effectively.

Key Companies in Concrete Restoration Market

- Sika AG

- BASF SE

- Mapei S.p.A

- Saint-Gobain Weber

- Fosroc International

- Master Builders Solutions

- Pidilite Industries

- RPM International Inc.

- Adhesives Technology Corporation

- The Euclid Chemical Company

- GCP Applied Technologies

- Rust-Oleum

- W. R. Meadows, Inc.

- Concrete Restoration, Inc.

- Simpson Strong-Tie Company Inc.

Concrete Restoration Market Developments

October 2022: Master Builders Solutions, a global company that manufactures and sells chemical solutions for the construction industry, introduced a customizable, environmentally friendly concrete repair system, MasterEmaco OneMix, designed to increase versatility, efficiency, and ease of use on job sites.

June 2022: Cortec, a company that develops and manufactures products to control corrosion, launches new, improved MCI-2039 horizontal concrete repair mortar to repair concrete with migrating corrosion inhibitors.

August 2021: Hawk, a company that manufactures and sells refinishing coatings and accessories, announced the launch of a new CreteFx, a concrete resurfacing system for filling in concrete holes and cracks.

Concrete Restoration Market Segmentation

By Method Outlook (Revenue, USD Billion, 2020 - 2034)

- Crack Repair

- Shotcrete

- Grouting

- Overlay

- Patch Repair

By Material Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Cementitious Materials

- Polymer-Based Materials

- Steel Plate

- Fiber Composites

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Infrastructure

- Commercial Buildings

- Industrial Structures

- Residential Buildings

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Concrete Restoration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.70 billion |

|

Market Size Value in 2025 |

USD 19.94 billion |

|

Revenue Forecast in 2034 |

USD 36.04 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global concrete restoration market size was valued at USD 18.70 billion in 2024 and is projected to grow to USD 36.04 billion by 2034.

The global market is projected to grow at a CAGR of 6.8% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Sika AG; BASF SE; Mapei S.p.A; Saint-Gobain Weber; Fosroc International; Master Builders Solutions; Pidilite Industries; RPM International Inc.; Adhesives Technology Corporation; The Euclid Chemical Company; GCP Applied Technologies; Rust-Oleum; W.R. Meadows, Inc.; Concrete Restoration, Inc.; and Simpson Strong-Tie Company Inc.

The shotcrete segment dominated the concrete restoration market share in 2024 due to its versatility and efficiency in large-scale infrastructure repairs.