Construction Estimating Software Market Share, Size, Trends, Industry Analysis Report

By Deployment (Cloud and On-premises); By Software License; By Enterprise Size; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2932

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

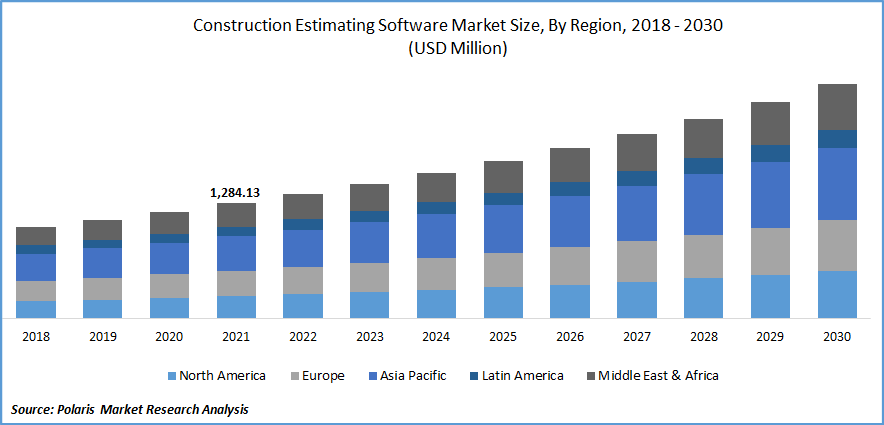

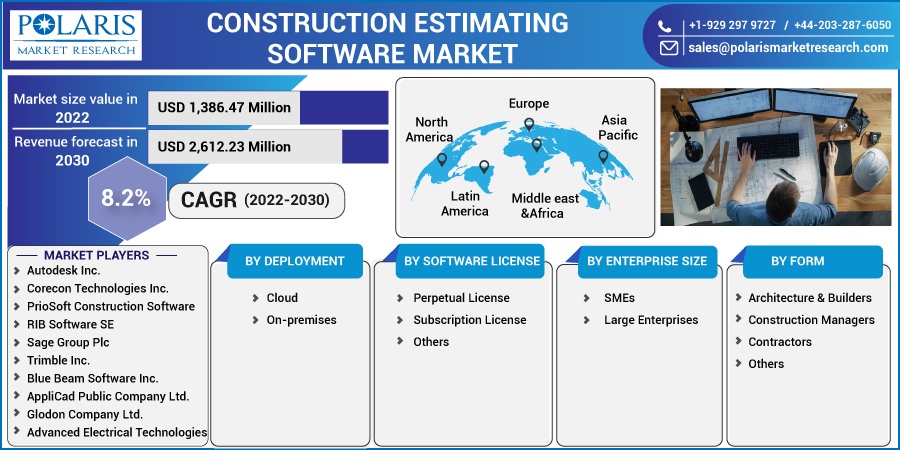

The global construction estimating software market was valued at USD 1,284.13 million in 2021 and is expected to grow at a CAGR of 8.2% during the forecast period.

An extensive rise in the number of construction projects and the growing need to enhance and improve construction productivity across the globe coupled with the rising government favorable initiatives on the development of infrastructure are major factors driving the growth of the global market.

Know more about this report: Request for sample pages

Moreover, the technological innovation and high advancements for the improvement of product performance, which enables it to acquire a wider range of construction applications in the downstream market are further anticipated to propel the construction estimating software market growth over the coming years.

Furthermore, major industry players are highly focusing on improving their client network and global market presence by partnering with various construction design companies to cater to the growing demand for innovative construction estimation software is forcing vendors to adopt several new marketing strategies to increase their operating revenue and sales worldwide.

For instance, in June 2022, the Public Works Department of India launched construction and project estimator software for calculating the funds, which requires strengthening the transparency in the system to commence the project. The department also put its efforts to make the software easily compatible with various other construction software including asset monitoring, tracking, and quality-checking tools.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapidly growing population around the world and the introduction of various infrastructure development initiatives such as smart cities and high-speed transportation, which has significantly increased the need for the construction of buildings, malls, and workplaces are major key factors expected to drive the growth of the global market during the forecast period. Aggressive growth in global construction activities and increasing focus on the optimization of the cost of the project is likely to augment the market growth in the coming years.

Furthermore, the high utilization of constructing estimating software to increase the accuracy and speed of a project’s overall estimation process along with the high technological developments and rising urbanization especially in developing economies such as India, China, and Indonesia are likely to fuel the demand and growth of the market extensively in the next coming years.

For instance, in November 2022, Foundation Software announced that it has now fully integrated with Estimating’s Edge’s Platform of estimating and takeoff products. Earlier in the year Foundation Software acquired Estimating Edge for the purpose to provide their clients with an even better and improved solution for their office and field needs.

Report Segmentation

The market is primarily segmented based on deployment, software license, enterprise size, end use, and region.

|

By Deployment |

By Software License |

By Enterprise Size |

By End Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Cloud Deployment Segment Accounted for the Highest Market Share

The cloud segment accounted for a considerable market share, in 2021, owing to the high adoption of cloud computing within the industry as the construction companies consider cloud deployments, as the most preferred way of deploying software. This type of deployment helps to ensure cost-efficiency and increase productivity by allowing the effective use of data for the streamlining process.

Furthermore, the on-premises segment is anticipated to grow at the fastest CAGR during the projected period. Large upfront capital investments and the increasing complexity of real-time collaboration among various project stakeholders across the world to efficiently manage and purchase the software along with other facilities are key factors expected to drive the growth of the segment market. On-premises solutions are known to provide high security of data for construction projects through facilitating various functionalities such as estimating, job costing, project management, scheduling, and product design, which is likely to result in high growth opportunities for the market.

Subscription License Segment Held the Significant Market Revenue Share

The subscription segment held the largest market share in 2021 and is likely to maintain its position throughout the forecast period. The growth of the segment can be attributed to the rising preference for subscription-based business models and strong customer retention emphasis coupled with reducing subscriber churn and ensuring regulatory compliance on various types of projects.

Moreover, it allows and enables construction companies to increase their customer engagement and subsequently expected to increase their sales by enhancing their consumer experience to their customers.

Furthermore, the perpetual license segment is projected to witness significant growth at a CAGR over the anticipated period. A high level of customization and integration in line with the customer’s requirement, which gives more control over security and insight are key factors influencing the segment growth all over the world.

Large Enterprises Segment Dominated the Market in 2021

The large enterprise segment dominated the market in 2021 and has a holding of significant market share. It is driven by the high adoption of advanced and innovative software by key market players such as DPR Construction, & Eckardt Group. Large companies in the construction industry are also using such software for the efficient tracking of costs and managing the overall budget of the projects.

Moreover, the small & medium enterprises segment is likely to register the fastest growth, over the study period, with the high deployment of cloud-based solutions & rapid advances in cloud computing & the increased profitability associated with the adoption of these advanced solutions.

Architecture & Builders Segment Held the Highest Market Revenue Share

The architecture & builders segment lead the global market in 2021 and is expected to grow at a considerable growth rate over the forecast period. High advances in virtual reality and augmented reality technologies along with the continuous integration of these technologies into consulting software, engineering, and architecture services around the world are major reasons propelling the growth of the segment market in the last few years.

The contractor segment is anticipated to register the fastest growth in the next coming years. By using such software, various contractors & sub-contractors operating across the globe enhance project efficiency & accountability with the help of streamlining project communication and documentation, which is likely to augment the segment market growth.

The Demand in Asia Pacific is Expected to Witness Significant Growth

Asia Pacific region is expected to expand at the highest CAGR throughout the projected period on account of the increasing number of government favorable initiatives towards commercialization, growing infrastructure development, and heavily investing in advanced technologies. In addition, a rapid surge in lean management applications in many construction-related operations has significantly fueled the growth of the market.

However, the North America region dominated the construction estimating software market in 2021 and is anticipated to maintain its dominance over the study period, the growth of the regional market can be attributed to the rapid adoption of digital technologies such as cloud computing and the Internet of Things by several architects, engineers, and builders and wide presence of prominent market players in the region.

Competitive Insight

Some of the major players operating in the global market include Autodesk Inc., Corecon Technologies Inc., PrioSoft Construction Software, RIB Software SE, Sage Group Plc, Trimble Inc., Blue Beam Software Inc., AppliCad Public Company Ltd., Glodon Company Ltd., Advanced Electrical Technologies, QuoteSoft, Takeoff Live, Microsoft Corporation, UDA Technologies, and SAP SE.

Recent Developments

In January 2022, Corecon Technology announced its integration with the DocuSign eSignature for use in its cloud-based software & job cost over-run software & services. This feature allows the subscribers of Corecon to easily & securely obtain & track their electronic signatures on the construction documents.

Furthermore, in April 2022, Procore Technologies announced a new integration of building transparency with its mission to enable broad and swift action for addressing climate change in the construction industry. The latest integration enables the users of the company to leverage the Embodied Carbon into Construction Calculator across the global industry of construction.

Construction Estimating Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1,386.47 million |

|

Revenue forecast in 2030 |

USD 2,612.23 million |

|

CAGR |

8.2% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Deployment, By Software License, By Enterprise Size, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Autodesk Inc., Corecon Technologies Inc., PrioSoft Construction Software, RIB Software SE, Sage Group Plc, Trimble Inc., Blue Beam Software Inc., AppliCad Public Company Ltd., Glodon Company Ltd., Advanced Electrical Technologies, QuoteSoft, Takeoff Live, Microsoft Corporation, UDA Technologies, and SAP SE. |