Cottonseed Oil Market Share, Size, Trends, Industry Analysis Report

By Product Type (Processed and Virgin); By End User; By Distribution Channel; By Region; Segment Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM3689

- Base Year: 2024

- Historical Data: 2020-2023

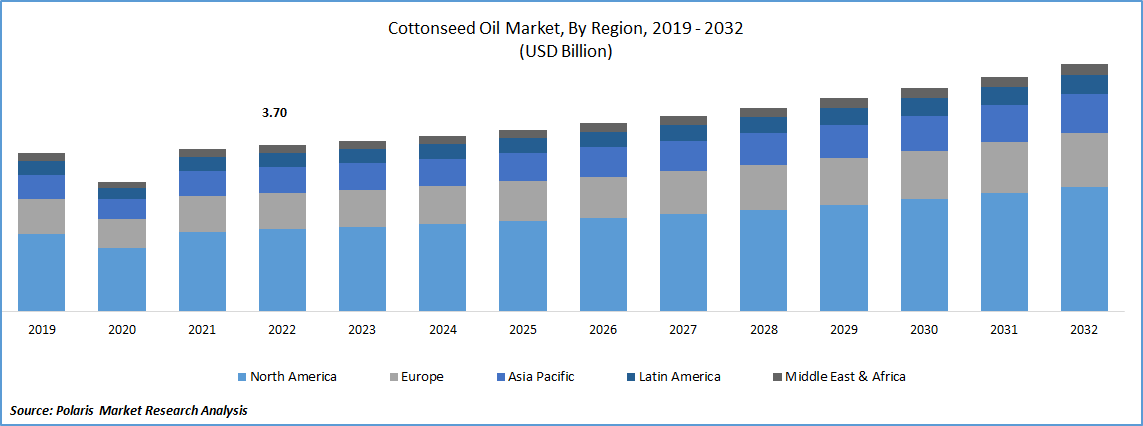

The global cottonseed oil market was valued at USD 3.9 billion in 2024 and is expected to grow at a CAGR of 4.20% during the forecast period. Increasing demand and adoption of cottonseed oil across the world due to its numerous health advantages and prevalence regarding its ability to lower the triglyceride levels, reduce the progression of the atherosclerotic plaque, and lowers the blood pressure, that led to surge in the number of consumers switching to these products, are among the major factors influencing the market at rapid pace.

Key Insights

- The processed segment dominated the market in 2024. This is due to widespread product usage in the food industry and applications.

- The online segment is projected to witness the fastest growth during the anticipated period. This is due to the rapid growth of e-commerce platforms and the increasing trend of digital transformation.

- The Asia Pacific region accounted for the largest global market share in 2024. This growth is attributed to growing consumption of cottonseed oil, rising consumer disposable income, and easy availability of raw materials.

- The North America region is expected to witness rapid growth during the projected period. This is due to the increased number of health-conscious consumers and growing product industrial applications.

Industry Dynamics

- The health consciousness among the consumenrs has accelerated the demand for healthy oils like cottonseed oil which is low in fat and high in polyunsaturated fat.

- Rapid growth of cottonseed oil is due to the automation in oil processing plants which optimize efficiency and ensures consistent quality.

- Its association with cotton farming often involves use of pesticide which creates health problems and consciousness among consumers.

- Promotion of its high vitamin E and neutral flavor creates an opportunity for the food manufacturers and health focused consumers as a stable cooking oil.

Market Statistics

- 2024 Market Size: USD 3.9 billion

- 2034 Projected Market Size: USD 6.0 billion

- CAGR (2025-2034): 4.20%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

It is a cooking oil which is made from the seeds of cotton plants. In addition, the researchers have been investing and exploring the different applications and product potential in several industries like cosmetics, due to its high concentration of vitamin E, fatty acids, and several antioxidants, which is likely to create huge growth potential for the market in the coming years.

For instance, in March 2022, Shree Ram Proteins Limited, announced about its plan to diversify their operations and construction of a new oil refining plant for the new business segment. The company said that, they will be launching the rapeseed oil, cottonseed oil, and groundnut oil by the end of January 2023.

Moreover, the demand for cottonseed oil and other related products is likely to gain huge traction and momentum in the upcoming years, as large number of companies across the globe are focusing on influencing consumer purchasing behavior with the help of various social media platforms, brand promotion, awareness programs, and print media among others.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the cottonseed oil market. The rapid spread of the pandemic brought significant changes in consumer behavior including shifts in food consumption patterns and preferences and boosted the demand for healthier edible oils including cottonseed oil. However, the pandemic also led to huge disruptions in global supply chains as large number of manufacture facilities were temporarily closed.

Industry Dynamics

Growth Drivers

Awareness Amongst the Consumers Regarding the Benefits of Cottonseed Oil is Fueling the Market Growth

Increasing number of consumers across the globe becoming more health-conscious and aware regarding the potential benefits of consuming healthier or sustainable oil products, which leads to an increased demand for healthier cooking oil options and propelling the adoption of cottonseed oil, as these oils have low amount of saturated fats and contains high proportion of polyunsaturated fats, that makes it a healthier choice compared to some other cooking oils, thereby fueling the demand and growth of the global market.

Furthermore, the rapidly growing prevalence for the adoption and integration of automation and control systems in cottonseed oil processing plants in the recent years mainly to optimize production efficiency and ensure consistent product quality have gained significant popularity. Beside this, automated control systems help monitor and regulate various parameters such as temperature, pressure, and flow rates, resulting in improved process control and reduced human error, which in turn, positively influencing the market growth at rapid pace.

Report Segmentation

The market is primarily segmented based on product type, end user, distribution channel, and region.

|

By Product Type |

By End User |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Product Type Analysis

The processed segment held significant share in 2024, mainly attributable to widespread product usage in the food industry and applications in preparation of snacks, baked foods, fried foods, and salad dressings due to its easy availability and cost-effectiveness. Additionally, processed cottonseed oil is considered relatively sustainable compared to some other edible oils available in the market, as it utilizes a byproduct of the cotton industry, thereby growing awareness on sustainability and eco-friendliness the demand for these products also rises.

The virgin segment is projected to grow at highest growth rate over the next coming years, which is largely attributable its wide range of nutritional benefits and are gaining huge popularity across the globe as its in improving heart health, reducing inflammation, and boost the immune system. Moreover, its neutral taste allows it to enhance the flavors of other ingredients without overpowering them which results in making them more appealing to chefs and home cooks, and propelling the demand over the years.

End-User Analysis

The food service segment held the maximum market share in terms of revenue in 2024, which is largely accelerated to significant use of cottonseed oil in the food service industry due to its extensive distinctive value proposition compared to various other vegetable oils and rising number of food chains and restaurants across the globe. Favorable government regulations and standards regarding the use of cottonseed oil in the food service industry and its higher prevalence for meeting specific dietary requirements, are also likely to positively influence the segment market.

The retail segment is likely to exhibit significant growth in the anticipated period, on account of growing availability of cottonseed oil in various retail channels including supermarkets, hypermarkets, convenience stores, and online platforms and surging consumer preferences towards healthier and natural alternatives like cottonseed oil all over the world.

Distribution Channel Analysis

The online segment is projected to witness highest growth during the anticipated period, mainly due to rapid growth of e-commerce platforms and the increasing trend of digital transformation, as increased number of companies are focusing and implementing on establishing their strong online presence to cater wider range of consumers globally and meet their demands in a more effective manner. In addition, with the continuous expansion in the number of people shopping online due to high internet penetration and numerous benefits being provided by these platforms in terms of convenient and accessibility, the segment growth has gained huge traction.

For instance, according to our findings, the number of online shoppers across the India has seen a drastic increase of over 101 million individuals between the period of 2022 to 2022, which nearly accounts for almost 36% of all internet users in the country.

Regional Analysis

Asia Pacific Cottonseed Oil Market Assessment

The Asia Pacific region dominated the global market with substantial revenue share in 2024, and is projected to maintain its dominance throughout the anticipated period. The regional market growth can be mainly attributed to growing consumption of cottonseed oil, rising consumer disposable income, and easy availability for raw materials particularly in countries like China, India, and Japan, and Indonesia. The presence of favorable government initiatives promoting domestic agricultural production and reducing reliance on imports has been supporting the cultivation of cotton and the production of cottonseed oil in the region.

North America Cottonseed Oil Market Insights

The North America region expected to grow during the projected period, owing to increased number of health-conscious consumers, growing product industrial applications like in cosmetics, personal care products, biofuels, and pharmaceuticals coupled with the surging consumer preference for sustainably sourced and non-genetically modified organisms mainly in developed countries like United States & Canada.

Key Market Players & Competitive Insights

The cottonseed oil market is witnessing competitive pressure from traditional options, such as soybean and palm oil. A comprehensive review of competition and strategy shows that revenue opportunity lies in targeting developing market segments, like health-oriented consumers, by advocating its Vitamin E properties. Future directions for development must factor in substantial disruptions in the supplier chain, and respond to economic and geopolitical shifts that will impact raw material costs, such as global food prices, tariffs, and labor considerations. There is opportunity to develop a line of more specialized, or perhaps, non-GMO, organic products, creating value with sustainable supply chains for small and medium businesses. In the expert's opinion, future growth is dependent on sustained investment in processing technology that will improve oil stability and color, improving its marketability relative to competitor offerings. Navigating these industry changes is essential for best positioning vendors for growth and enhancing competitiveness.

The cottonseed oil market is fragmented and is anticipated to witness competition due to several players' presence. Key players in the market are constantly launching new verities to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Key players include:

- Adams Group

- American Vegetables

- Alice Cottonseed

- Archer Daniels

- Asha Cotton Industries

- Bunge

- Borges International Adani Wilmar

- Cargill

- FEDIOL

- Gelivi Group

- Marico Limited, and.

- Matangi Cotton Industries

- Maharashtra Solvent Extraction

- Pyco Industries

- Ruchi Soya

- Swarna Industries

Industry Developments

- In July 2022, Eni, inaugurated its oil-seed collection & pressing plant in the Kenya announced to produce 1st vegetable oil for bio-refineries. The newly constructed facility has a total installed facility of around 15,000 tons with an estimated production capacity of around 2,500 tons.

- In February 2021, Bunge Loders, announced the expansion of its organic portfolio across the Europe region, through offering an enhanced and steady supply chain of organic oils and fats including sunflower, cottonseed, rapeseed, soy, palm, and coconut among others.

Cottonseed Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.9 billion |

| Market size value in 2025 | USD 4.1 billion |

|

Revenue forecast in 2034 |

USD 6.0 billion |

|

CAGR |

4.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By End User, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Archer Daniels Midland Company, Louis Dreyfus, Matangi Cotton Industries, Swarna Industries Limited, Adani Wilmar, Pyco Industries, Cargill Incorporated, Maharashtra Solvent Extraction Ltd., Alice Cottonseed Oil Mill, FEDIOL, Gelivi Group of Industries, Asha Cotton Industries, Bunge Limited, Adams Group, American Vegetables, Borges International, Marico Limited, and Ruchi Soya Industries. |

FAQ's

The cottonseed oil market report covering key segments are product type, end user, distribution channel, and region.

Cottonseed Oil Market Size Worth USD 6.0 Billion By 2034.

The global cottonseed oil market is expected to grow at a CAGR of 4.20% during the forecast period.

Asia Pacific is leading the global market in 2024.

key driving factors in cottonseed oil market are awareness amongst the consumers regarding the benefits of cottonseed oil.