Cumene Market Share, Size, Trends, Industry Analysis Report

By Type (Zeolite, Solid Phosphoric Acid, and Aluminum Chloride); By Application; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4102

- Base Year: 2023

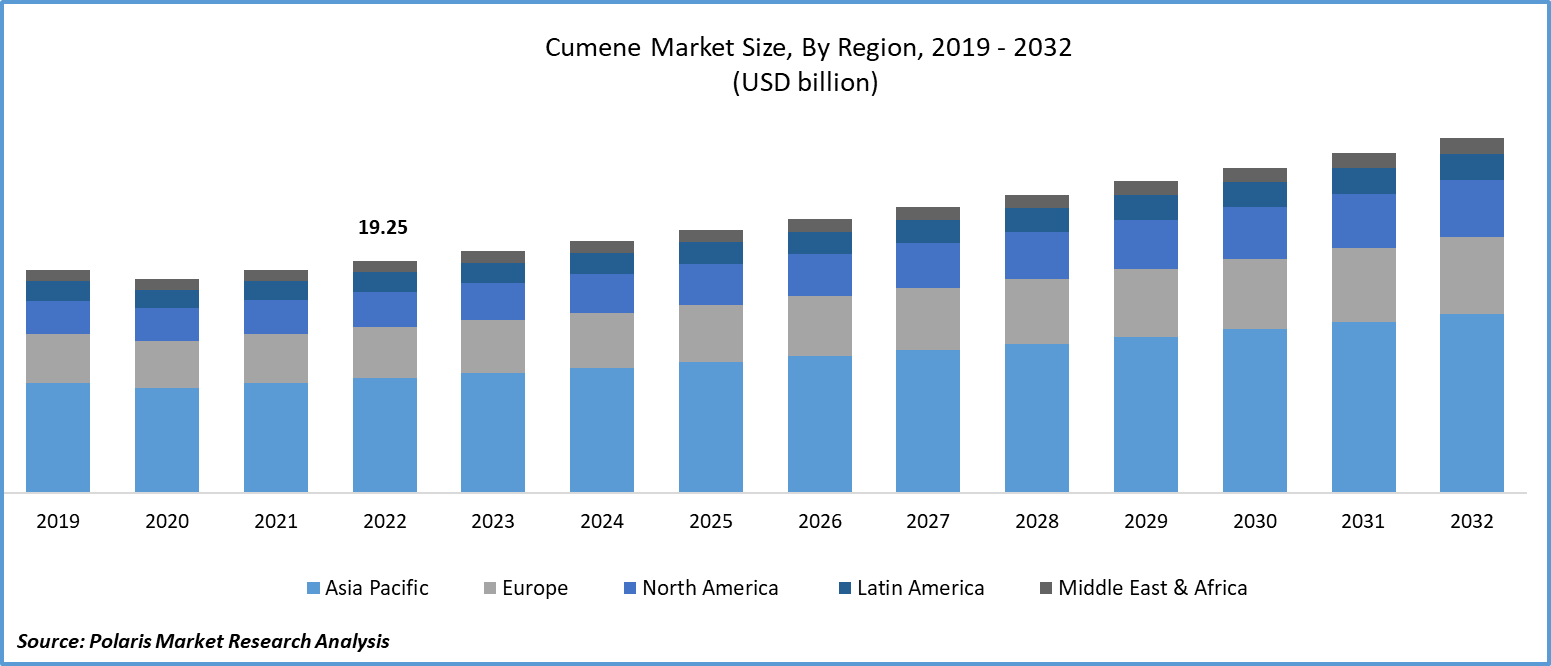

- Historical Data: 2019-2022

Report Outlook

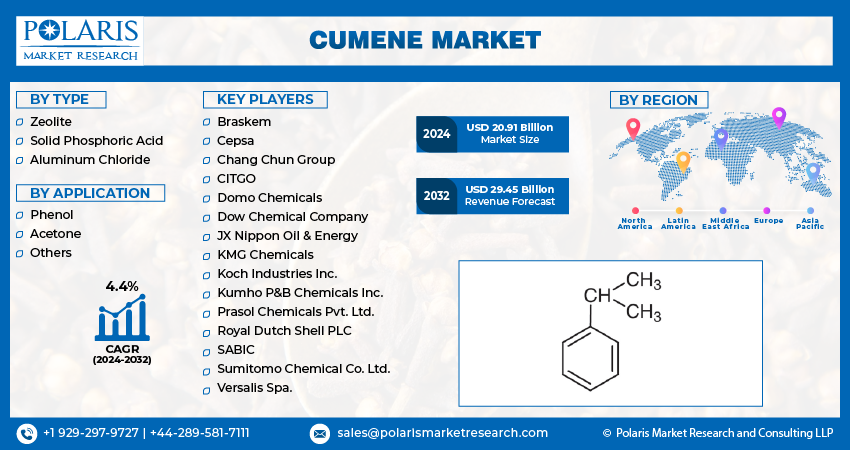

The global cumene market was valued at USD 20.06 billion in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period.

The rapid increase in product utilization for wide range of applications across industries including adhesives and chemicals and rising consumer preferences for high octane production, are among the leading factors influencing the market growth globally. Additionally, there are numerous other factors including increasing consumer demand for high-octane cumene derivatives, high rate of industrialization, development of new cumene products, and exponential growth in various end-use industries, which are likely to spur the product demand at significant pace over the coming years.

To Understand More About this Research: Request a Free Sample Report

For instance, in July 2023, Eastman, introduced new adhesion promoters that is mainly designed to mitigate materials of concern and keep paint & coatings users in compliant with regulatory changes. These new solutions include materials like cumene that offers a simple alternative to help companies customers remain complaint.

Moreover, rising innovations in the cumene which may include the development of more environmentally friendly and sustainable production methods and use of catalysts or processes that help reduce the environmental impact of cumene production such as lowering energy consumption or minimizing waste generation, are further likely to bode well for the global market during the study period.

The adoption and integration of digital technologies, data analytics, and automation has been becoming more prevalent in the chemical industry including cumene production, which could lead to improved process control, predictive maintenance, and cost optimization, and can help companies generate higher revenues.

However, the continuous fluctuation in raw material prices required for the production of cumene, growing environmental regulations related to water and air emissions, and drastic shift towards several renewable feedstocks, are among the factors expected to hinder the market growth.

Industry Dynamics

Growth Drivers

Growing Usage of Cumene in Adhesives and Sealant Chemicals and Demand for Phenolic Resins Driving the Market Growth

There has been an exponential rise in the usage of cumene in adhesives & sealant chemicals all over the world due to its ability to provide high heat resistance, chemical resistance, better electrical insulation, and low smoke emissions, among others, which are among the primary factors driving the demand and growth of the cumene market. Beside this, growing proliferation towards the product innovations like the development of food-grade cumene for the poly-carbonate plastic-based containers, will further create lucrative growth opportunities for the market.

For instance, according to a report published by Kaia, the total output of China’s adhesive industry was stood at around 7,090,000 tons, with a total sales value of approx. 100.64 billion RMB an increase of 4.4% and 3.6% respectively compared to 2019.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Zeolite Segment Accounted for the Noteworthy Market Share in 2022

The zeolite segment accounted for the noteworthy market share. The growth of the segment market is highly attributed to growing use as a catalyst among various industrial processes for the manufacturing of cumene due to its numerous advantages over aluminum chloride. Beside this, with the growing importance of zeolite catalyst in cumene production process because of its ability to facilitate the alkylation of benzene and propylene and significant advancement in zeolite technology that have enhanced the selectivity and efficiency of process, the demand and adoption of this cumene production is growing rapidly.

The aluminum chloride segment also expected to hold substantial market share during the forecasted period, due to its widespread availability and cost-effectiveness as compared to some other catalysts available in the market. Apart from this, numerous benefits of using aluminum chloride to produce cumene such as high purity, consistent product quality, controlled reaction, regeneration and recyclability, and high selectivity, could also influence the growth of the segment market.

By Application Analysis

Phenol Segment Held the Significant Market Share in 2022

The phenol segment held the majority market share in terms of both revenue and volume in 2022, that is largely attributed to its rapidly increasing use as a solvent across numerous industries including automotive, paints & coatings, cosmetics, and electrical & electronics, among others. As, phenol is closely tied to petrochemical industry and is being produced from petrochemical derivatives, thus, growth and developments in petrochemical sector directly impact the market for phenol.

With the growing consumer awareness and proliferation towards environmental and sustainability issues and growing number of environmental regulations and initiatives influencing the choice of chemicals being used in different applications, the demand for products that are made using environment friendly and sustainable processes including phenol is drastically increasing.

The acetone segment is projected to exhibit highest growth rate over the course of study period, mainly due to its continuously increasing demand from paints and solvent industries and utilization in the chemical industry as a crucial and important intermediate in the production several resins and chemicals along with the use in various industrial processes including the production of methyl methacrylate.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market, which is mainly attributable region’s greater production of cumene to meet demand from various end-use industries including automotive, pharmaceuticals, and paints & coatings, among others along with the continuous infrastructure development including construction activities that heavily relies on products manufactured with the help of cumene-derived chemicals.

For instance, in September 2021, Formosa Chemicals, announced to expand cumene & phenol plant in China with the help of the Lummus technology license & engineering design. The expansion will increase the current’s plant capacity from 450 kMTA cumene & 300 kMTA phenol to 600 kMTA cumene & 400 kMTA phenol.

The North America region will grow at rapid pace, on account of growing innovations and technological advancements in cumene production processes that could lead to increased efficiency and reduced costs and presence of favorable economic conditions for the usage and adoption of cumene-related products across the region. Additionally, the surge in the sales of automobiles and higher demand for electronic devices across the region, are likely to positively influence the demand for cumene, as they are widely utilized in these industries.

For instance, as per a recent report, the US vehicle sales in September 2023 was accounted for 15.4 million units with an increase of 2.2% month-on-month basis. Also, the adjusted sales volumes of vehicles rose by 1.33 million units or 18.5% over year-ago levels.

Key Market Players & Competitive Insights

The cumene market is highly competitive in nature with the large number of global market players operating across the globe including Cepsa, INEOS, Kumho P&B Chemicals, and Koch Industries. These market players are heavily investing on various business expansion and development strategies such as collaboration with local players, partnerships, acquisitions, and new product launches, that allow them to expand their market into new and untapped markets.

Some of the major players operating in the global market include:

- Braskem

- Cepsa

- Chang Chun Group

- CITGO

- Domo Chemicals

- Dow Chemical Company

- JX Nippon Oil & Energy

- KMG Chemicals

- Koch Industries Inc.

- Kumho P&B Chemicals Inc.

- Prasol Chemicals Pvt. Ltd.

- Royal Dutch Shell PLC

- SABIC

- Sumitomo Chemical Co. Ltd.

- Versalis Spa.

Recent Developments

- In June 2022, INEOS Phenol, announced new product line named “INVIRDIS” for their acetone, phenol, and alpha-methylstyrene business. The newly developed product line is made using bio-attributed cumene to replace fossil fuels and are certified by the ISCC Plus & RSB.

- In March 2022, INEOS Styrolution, introduced its new NAS ECO & Luran ECO sustainable products. The products are mainly based on the production from various renewable feedstocks and will likely to reduce the carbon footprint by 77% to 99% compared to petrochemicals.

Cumene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 20.91 billion |

|

Revenue forecast in 2032 |

USD 29.45 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |