Data Acquisition (DAQ) System Market Share, Size, Trends, Industry Analysis Report

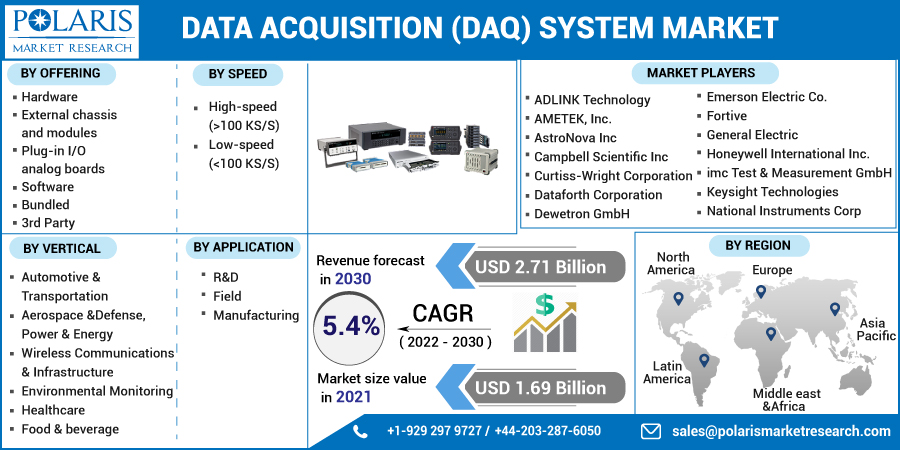

By Offering (Hardware, Software); By Speed (High-speed (>100 KS/S), Low-speed (<100 KS/S)); By Vertical; By Application (R&D, Field, Manufacturing); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 119

- Format: PDF

- Report ID: PM2276

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

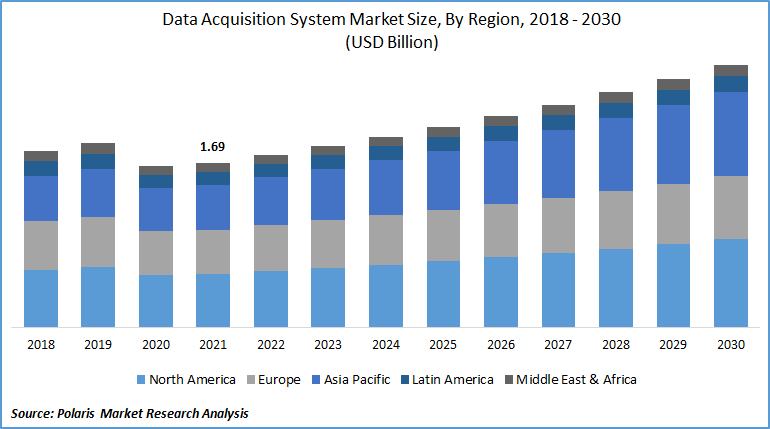

The global data acquisition (DAQ) system market was valued at USD 1.69 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. One of the key factors propelling the data acquisition (DAQ) system market is the potential growth of Ethernet. In recent years, Industrial Ethernet has advanced and exceeded conventional field buses.

Know more about this report: Request for sample pages

The cost-effectiveness, speed, and practically infinite distance possibilities of ethernet-based communication continue to fuel commercial networking and internet growth. This need has been spurred by the growing demand for faster internet connections, the seamless integration of manufacturing installations, the adoption of the Internet of Things, and industrial controls.

Additionally, the information acquisition business is being driven forward by the widespread use of industrial automation and smart manufacturing. These include tracking several structure parameters and monitoring multiple information sources while exchanging data in real-time, including PLCs, databases, maintenance applications, and current information-gathering systems, in order to acquire additional visibility into the machine and floor operations.

Although, In April 2021, Explorium, an automated external data acquisition platform, announced the release of Signal Studio, a DAQ product for advanced analytics and machine learning that enables company and information analysts to quickly search and integrate the most relevant external data signals into their analytics pipeline. Thus, the major players are working to enhance the DAQ systems with advanced analytics to boost the market growth during the forecast period.

However, consumers of DAQ systems are price-conscious and seek low-cost, high-quality information acquisition systems. The cost of a DAQ system, on the other hand, is determined by critical criteria such as sensors, channel counts, and the need to create a DAQ system that can withstand hard-working environments.

DAQ systems are becoming more complex due to technical advancements in the creation and development of this equipment. In order to fulfill the market expectations of specific applications, manufacturers must constantly improve their current equipment and develop higher testing capabilities. The cost of information acquisition DAQ methods is increased by the need for information acquisition system makers to adhere to numerous technical standards.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The data acquisition (DAQ) system market has observed extensive developments in the last few decades, supported by significant players' initiatives, including partnerships, product launches, mergers and acquisitions, and collaborations. For instance, in July 2021, ELIN Motoren GmbH, an Austrian firm, inked a sales contract with Dewesoft. As part of the final inspection method, the company has fully incorporated an obligatory vibration measurement of each produced machine – motor or generator.

Furthermore, Piano, a global customer expertise framework, has partnered with ID5, InfoSum, LiveRamp, and Usercentrics to expand its First-Party Data Acquisition solution in April 2021. This solution combines its information management, identity, and customer experience orchestration capabilities into a single method and view that gathers, unifies, and initiates user data acquisition across the entire digital ecosystem, preventing information leakage and subpar ad performance while improving user experience.

In addition, Concurrent Real-Time, a provider of high-performance real-time computer networks, systems, and software for government and commercial operations, was bought by Spectris in July 2021.

Concurrent Real-RedHawk Time's Linux solutions offer the world's most advanced hardware-in-the-loop and man-in-the-loop simulation, operation control, high-speed data acquisition investment, and low-latency trade processing applications with complex real-time performance. Spectris will be able to deliver sales and support from offices across North America, Europe, and Asia.

Report Segmentation

The market is primarily segmented based on offering, speed, vertical, application, and region.

|

By Offering |

By Speed |

By Vertical |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Offering

Based on the offering segment, the hardware segment is the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. Information collection method hardware is commonly used because of its modular construction and capacity to assemble different combinations to satisfy a wide variety of bespoke experimental settings.

In addition, Ethernet adoption is expanding due to its interoperability and simplicity of integration, driving up demand for DAQ devices. Due to its widespread use in industrial applications such as process and discrete, laboratory/R&D, automotive, and aerospace & military, DAQ hardware is in great demand.

The external chassis and module improve performance and productivity in DAQ and control applications. The ongoing shift is driving the market for external chassis and modules to front-end systems based on USB and Ethernet, providing PC processing power and capabilities at faster adoption rates.

Geographic Overview

In terms of geography, North America had the highest market share in 2021. Due to the significant number of early technology adopters in this region, the data acquisition (DAQ) market in North America has the largest market share and is projected to dominate the market over the forecast period. Over the projection period, it is anticipated that favorable governmental changes, significant industrial automation adoption, and new intelligent manufacturing ventures would increase the European area's market share.

In addition, a high CAGR is expected for the Asia Pacific region in the global market. The utilization of new technologies like artificial intelligence (AI) and the Internet of Things, more production capacity, stronger rules controlling product testing and measurement, and significant government support for manufacturing. The Asia Pacific is the largest automaker in China. The growing presence of multiple auto OEMs and factories in the area is boosting the demand for data acquisition (DAQ) systems.

Competitive Insight

Some of the major players operating in the global data acquisition (DAQ) system market include ADLINK Technology, AMETEK, Inc., AstroNova Inc, Campbell Scientific Inc, Curtiss-Wright Corporation, Dataforth Corporation, Dewetron GmbH, Emerson Electric Co., Fortive, General Electric, Honeywell International Inc., IMC Test & Measurement GmbH, Keysight Technologies, National Instruments Corp, Rockwell Automation Corporation, Schneider Electric, Siemens Digital Industries Software, Spectris PLC, Teledyne Technologies Incorporated, and Yokogawa Electric Corporation.

Data Acquisition (DAQ) System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.69 billion |

|

Revenue forecast in 2030 |

USD 2.71 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Offering, By Speed, By Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ADLINK Technology, AMETEK, Inc., AstroNova Inc, Campbell Scientific Inc , Curtiss-Wright Corporation, Dataforth Corporation, Dewetron GmbH, Emerson Electric Co., Fortive, General Electric, Honeywell International Inc., imc Test & Measurement GmbH, Keysight Technologies, National Instruments Corp, Rockwell Automation Corporation, Schneider Electric, Siemens Digital Industries Software, Spectris PLC, Teledyne Technologies Incorporated, and Yokogawa Electric Corporation. |