Data Center Rack Market Share, Size, Trends, Industry Analysis Report

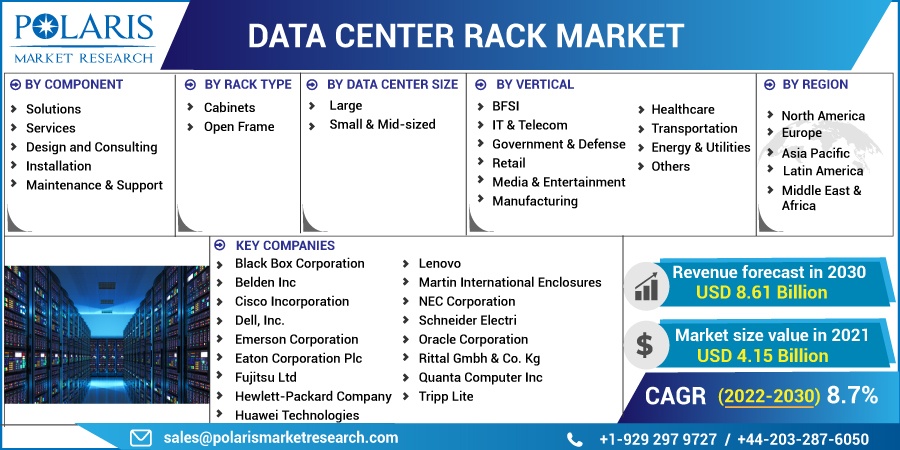

By Component (Solutions, Services); By Data Center Size (Large, Mid-sized); By Rack Type; By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2696

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

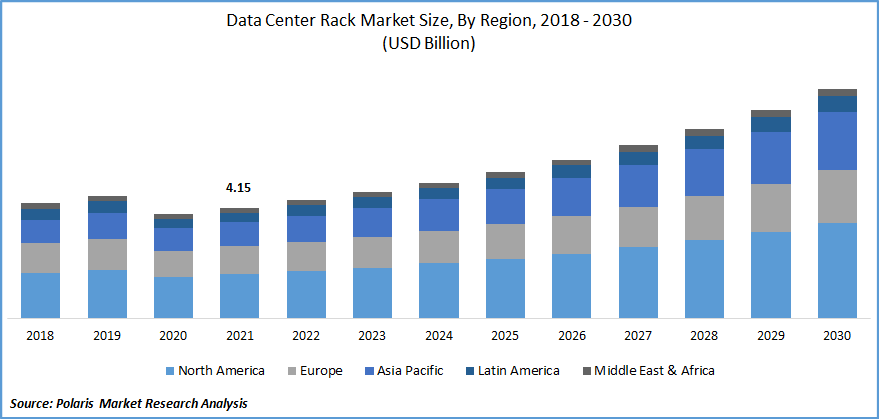

The global data center rack market was valued at USD 4.15 billion in 2021 and is expected to grow at a CAGR of 8.7% during the forecast period. The industry is shifting toward server-based rack data centers, which are expected to play an essential role in facilitating IT teams to address rapidly changing organizational business goals while lowering operational and capital expenses.

Know more about this report: Request for sample pages

High-capital investment data center rack alternatives have a lot of market potential for growth. On the other hand, virtualization, rackmount servers, and centralization pose a threat to the data center rack market's growth. Furthermore, the sector faces high-cost cooling systems, increased workload requirements, limited energy supply, and rising rack density.

A rack is a specific type of physical frame composed of steel and other metals. It stores electronic servers, wires, network equipment, cooling, and other computer equipment in centers. These racks deliver adequate airflow and space for the devices, preventing them from being broken by temperature variations and tangled cords, cables, and other costly components.

Basic-level equipment comprises three or four mounting rails and a structure that holds the rails in position. Enclosures are in charge of storing IT equipment. Although conventional racks do not have as much space for cabling as open-frame racks, more profound or expansive cabinets are available on the data center rack market.

The market is experiencing rapid growth due to the expanding number of service providers, increasing information center interconnection, and the rapid adoption of the centers among end users as global internet traffic grows. According to the World Development Report, worldwide internet activity in 2020 is expected to exceed three zettabytes, or 3,000,000,000,000 gigabytes (GB).

Annual internet traffic is expected to rise by about 50% from 2020 to 2022, attaining 4.8 zettabytes, or 150,000 GB per sec. Furthermore, the number of cellular internet users is predicted to rise from 3.6 billion in 2018 to 5 billion by 2025. IoT interactions are expected to quadruple from 7.5 billion in 2018 to more than 25 billion by 2025.

With the increasing consumption of the information across the globe, the IT infrastructure for data centers will start shifting from small data centers to the much larger cloud as well as hyperscale data centers, requiring greater data center racks capable of handling such large loads and facilitating the system needed for optimal performance among these devices.

Due to government-imposed lockdowns, the coronavirus (COVID-19) pandemic hampered market expansion during the first half of 2020. Because of constraints on logistics services during the lockdown period, there were slowdowns in acquiring raw materials and electrical devices. Lockdowns were eased in the second half of 2020, allowing the operators to carry out their industry expansion plans and new residential projects.

With expanding demand for information traffic management across several industry verticals, the industry will see significant growth. The abrupt adoption of remotely operating and e-learning innovations by corporations and academic institutions will drive demand for high-end data center rack solutions for hardware housing.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increased adoption of data-intensive implementations such as analytics, AI, and machine learning, as well as cloud computing and IoT utilization, have already resulted in market expansion. To maximize efficiency and performance, data centers use rack systems that can encompass more servers for every unit area. Companies on the market also offer customized racks to meet the unique requirements of the companies.

For instance, in August 2022, AMAX, the largest supplier of turnkey rack-scale High-Performance Computing (HPC) alternatives, Deep Learning/AI implementations, and server electronic component manufacturing, announced the launch of AceleMax X-122-Flex server solution, which includes Intel's succeeding GPU Flex Series, and provides the capacity of a graphics processing (GPU) solution managing high density and sophisticated workloads aimed at media delivery, cloud gaming, AWS, and other implementations.

Rapidly rising server and networking applications, including AI and IoT, necessitate a rack transportation system to assist cable management and maintain airflow with maximum flexibility. The industry will benefit from the market's growing global cloud technology and machine learning.

Report Segmentation

The market is primarily segmented based on component, rack type, data center size, vertical, and region.

|

By Component |

By Rack Type |

By Data Center Size |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

BFSI sector segment is expected to witness fastest growth

The market is predicted to expand at a healthy CAGR as digitization spreads throughout the BFSI sector, resulting in the developing of new IT infrastructure and services for data management. The expansion of digital banking enables the BFSI segment to adopt advanced information center infrastructures.

In April 2021, the Unified Payments Interface (UPI), a meaningful payment technology created by the National Payments Corporation of India, captured 2.73 billion transaction records worth USD 67.31 billion. The BFSI sector invests significantly in the infrastructure upgrades while concentrating on cloud-based solutions for expense and agility. This factor will pressure existing IT infrastructure to adopt new and advanced racks and enclosures to meet the needs of the expanding BFSI sector.

The BFSI sector is also moving into new regions and communicating with massive traffic, necessitating a reliable and consistent infrastructure to process payments. The BFSI sector also manages millions of virtual and physical servers. The industry also has several monitoring devices that must address various challenges, such as allocating resources optimization, preparation time reduction, and daily data center operational accountability.

Cabinets segment industry accounted for the highest market share in 2021

The rising demand for the cabinet platform and the adoption of advanced technology are likely to boost segment growth. The major players also focus on the digital infrastructure and cabinet platform launches to promote market growth. For instance, in May 2022, Nexpand, a data centers cabinet platform from Legrand, offered the required adaptability and future-proof structures for digitalization.

The flexible, strong, and safeguard offering from the electric and digital infrastructure building professional is intended to house devices. In addition to assisting with expanding online transitions, the new system also aids in the Internet of Things integration, 5G assistance, cloud technologies, and AI applications.

Manufacturing sector is expected to hold the significant revenue share

The market was propelled by the increasing penetration of technologies such as Artificial intelligence, IoT, and robotics in manufacturing plants. Large automakers such as BMW and Mercedes-Benz use robotics and machine learning at their production facilities. This factor involves the demand for advanced data center racks capable of organizing an extensive IT infrastructure to handle increasing data volumes.

Automotive manufacturing plants require continuous and efficient data management to make critical decisions based on anticipatory analysis. The growing demand for IT components housed in expansive yet compact racks that provide optimal airflow monitoring and cooling solutions will drive market revenue.

The demand in North America data center rack market is expected to witness significant growth

North America is anticipated to have the largest market size during the forecast period owing to the presence of a significant number of data centers and the availability of sophisticated infrastructure in the region. The demand for the racks is expected to rise due to increased demand for optimal space utilization and an unavoidable need for improved performance.

A favorable financial landscape, massive IT budgets, highly technological assimilation, and adoption of emerging technologies such as edge devices, HPC, big data analytics, and AI are expected to propel the need for information center products and services across North American businesses.

Furthermore, the Asia Pacific region is seeing an increase in process digitization, as evidenced by Digital India, Make in India, Smart Cities, and other initiatives in India. In addition, increasing investments in cloud from countries such as China, India, Singapore, and others are expected to contribute significantly to the region's market growth.

In May 2022, NTT Ltd. declared the inauguration of its new hyper-scale data storage premises in Navi Mumbai, India, commencing with the NAV1A data center. The NAV1A data center would be 400,000 square feet, capable of accommodating 5,000 racks and supporting more than 30MW of IT load.

Also, in November 2021, Chayora is thrilled to announce the opening its Shanghai campus, which will serve hyper-scale excellent performance clients with up to 54MW of IT load. This is Chayora's 2nd campus. Once its established Tianjin campuses are sufficiently matured, they will provide customers with more than 200MW of IT load-bearing capacity and more than 35,000 racks. Therefore, these factors are boosting the market growth over the forecast period.

Competitive Insight

Some of the major players operating in the global data center rack market include Black Box Corporation, Belden Inc., Cisco Incorporation, Dell, Inc., Emerson Corporation, Eaton Corporation Plc, Fujitsu Ltd, Hewlett-Packard Company, Huawei Technologies, Lenovo, Martin International Enclosures, NEC Corporation, Schneider Electric, Oracle Corporation, Rittal Gmbh & Co. Kg, Quanta Computer Inc, and Tripp Lite.

Recent Developments

- In September 2022, Vertiv debuted Vertiv prefabricated modular data center infrastructure offerings in India. The integrated solutions are flexible platforms that are optimized for IT asset implementation and provide a simple method for adding capacity in less time.

- In May 2022, Genetec introduced a new enclosed management system that will allow data centers to remotely protect, monitor, and maintain access to racks and cabinets. The new light-architecture operating system sets provide further possibilities for those operating in scalable data center environments by leveraging industry-specific NEMA TS2 compliant hardware via Cloud Link Roadrunner technology.

Data Center Rack Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.42 billion |

|

Revenue forecast in 2030 |

USD 8.61 billion |

|

CAGR |

8.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Rack Type, By Data Center Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Black Box Corporation, Belden Inc., Cisco Incorporation, Dell, Inc., Emerson Corporation, Eaton Corporation Plc, Fujitsu Ltd, Hewlett-Packard Company, Huawei Technologies, Lenovo, Martin International Enclosures, NEC Corporation, Schneider Electric, Oracle Corporation, Rittal Gmbh & Co. Kg, Quanta Computer Inc, and Tripp Lite |