DC-Link Capacitor Market Size, Share, Trends, & Industry Analysis Report

By Product Type, By Voltage Range, By Capacitance Range, By Installation Type, By Distribution Channel, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5799

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

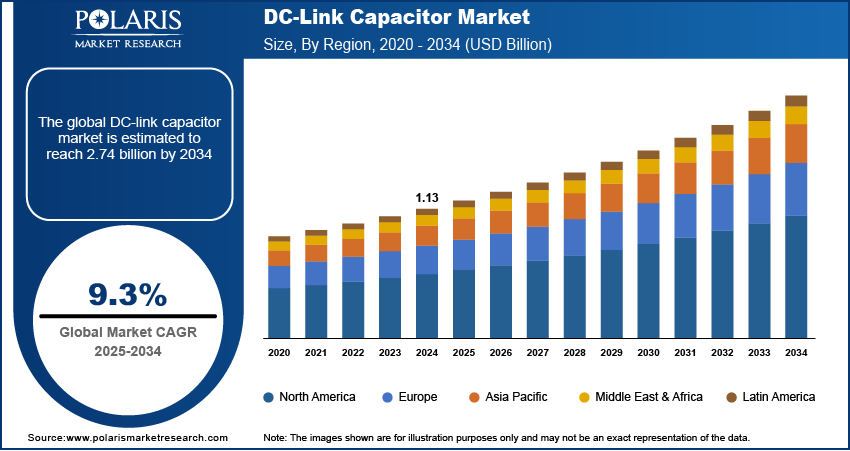

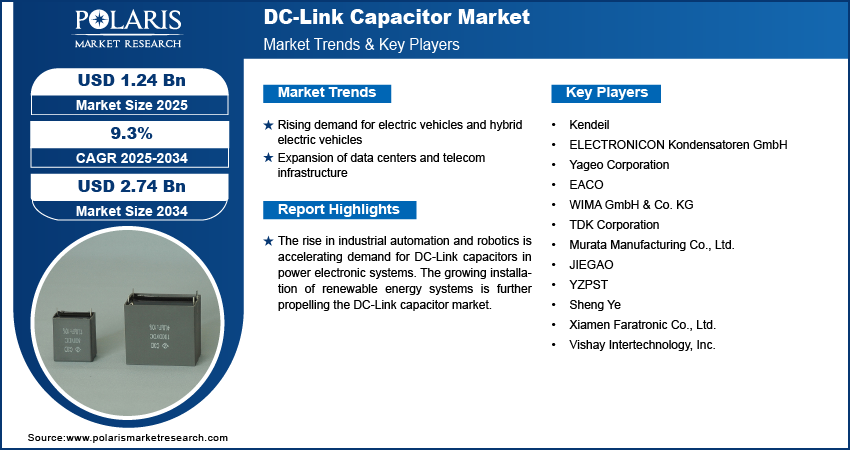

The global DC-link capacitor market size was valued at USD 1.13 billion in 2024, growing at a CAGR of 9.3% during 2025–2034. Rising demand for electric vehicles and hybrid electric vehicles globally are encouraging DC-link capacitor adoption. Expansion of data centers and telecom infrastructure is further boosting dc-link capacitor market.

DC-Link capacitors are key components in power electronic systems, serving as vital energy storage devices that stabilize voltage levels and ensure the smooth transfer of electrical energy between various stages of power conversion. These capacitors are essential for managing DC voltage fluctuations in converters and inverters used in industrial drives, renewable energy systems, electric vehicles, and other high-performance electronic equipment. DC-Link capacitors support improved system reliability, reduced electromagnetic interference, and enhanced operational lifespan of electronic circuits, enabling a stable and efficient energy flow.

The working principle of DC-link capacitors involves storing energy in the intermediate circuit of power converters that allows for the buffering of power surges and voltage stabilization during high-frequency switching operations. Their ability to handle high ripple currents and operate at elevated temperatures makes them suitable for demanding applications where electrical performance, durability, and precision are crucial. Furthermore, advancements in dielectric materials, electrode design, and packaging technology led to more compact, thermally resilient, and energy-dense DC-Link capacitor solutions, which are increasingly adopted across various sectors.

To Understand More About this Research: Request a Free Sample Report

The rise in industrial automation and robotics is accelerating demand for DC-link capacitors in power electronic systems. These capacitors are widely integrated into servo drives, motion control systems, and robotics applications to stabilize voltage, minimize power fluctuations, and ensure smoother operations. According to the International Federation of Robotics, global sales of professional service robots rose by 30% in 2023, with over 205,000 units deployed worldwide. The Asia-Pacific region led with 162,284 units, followed by Europe and the Americas with 33,918 and 8,927 units, respectively. Thus, the surge in robotics adoption is contributing to the increased adoption of high-performance DC-link capacitors in automation-intensive environments.

The growing installation of renewable energy systems is further propelling the DC-link capacitor market. Solar and wind energy infrastructure increasingly relies on power electronics for effective energy conversion and distribution. DC-link capacitors are fundamental to these systems as they help maintain voltage stability in the DC bus and enhance inverter performance. The expanding renewable energy infrastructure, combined with government incentives and climate goals, is increasing the need for advanced DC-link capacitor solutions that offer durability and high energy density for grid integration and off-grid applications.

Industry Dynamics

Rising Demand for Electric Vehicles and Hybrid Electric Vehicles Accelerates DC-Link Capacitor Adoption

The global surge in electric and hybrid vehicle adoption is driving significant demand for DC-link capacitors, that serve a vital function in modern automotive power electronic systems. According to the International Energy Agency, in 2024, approximately 11 million units of battery electric vehicles and 6.5 million units of plug-in hybrid electric vehicles were sold globally marking a 16% rise from the previous year. This growth in adoption is pushing automakers, battery manufacturers, and Tier-1 suppliers to integrate more advanced and reliable DC-Link capacitors to handle higher power densities, withstand wide temperature ranges, and meet evolving design specifications for next-generation vehicles.

DC-link capacitors ensure voltage stability and energy efficiency across a range of EV components, including inverters, onboard chargers, and DC-DC converters. Their ability to reduce voltage ripples, absorb switching transients, and store energy during regenerative braking cycles makes them indispensable for enhancing the performance, safety, and lifespan of EV powertrains. The worldwide push toward carbon neutrality and stricter emissions regulations, the EV and HEV market is witnessing robust growth. This increasing penetration of electric mobility is propelling the expansion of the DC-link capacitor market globally.

Expansion of Data Centers and Telecom Infrastructure Drives Capacitor Deployment

The rising demand for high-speed data transmission, cloud services, and connected devices is increasing investment in data center and telecommunications infrastructure, fueling the demand for DC-Link capacitors. For instance, in April 2024 Google announced a USD 3 billion investment to build and expand its data center campuses in Virginia and Indiana, aiming to accommodate growing cloud service demands. Additionally, in February 2025, Meta revealed plans to invest between USD 60 - 65 billion in capital expenditures mostly dedicated to data centers and servers. These large-scale investments highlight the growing digital infrastructure, creating favorable conditions for capacitor manufacturers.

Data centers rely on energy storage and voltage regulation solutions to maintain stable operations, particularly under massive computing loads and real-time processing demands. The increasing emphasis on power quality is accelerating the integration of high-performance DC-link capacitors into modern systems to enhance reliability and reduce downtime. Capacitors are essential in power supply units, uninterruptible power supplies (UPS), and rectifiers used across data centers and telecom base stations, where they maintain voltage stability, suppress electrical noise, and improve overall energy efficiency.

Segmental Insights

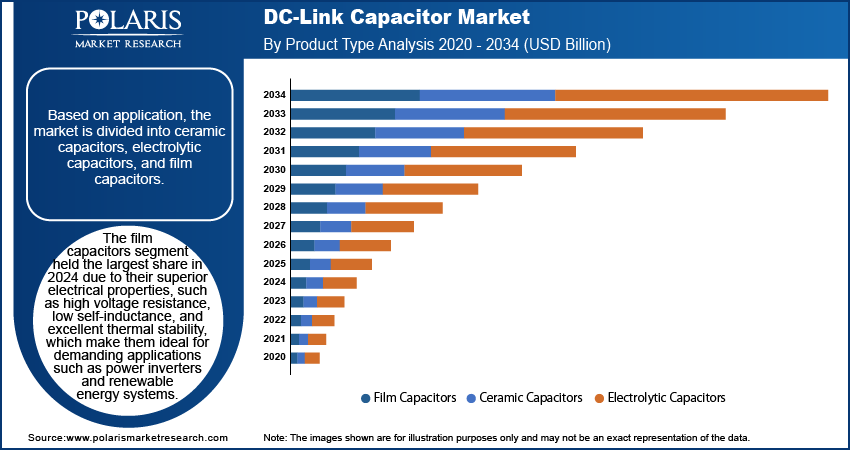

By Product Type Analysis

The global segmentation, based on product type includes, ceramic capacitors, electrolytic capacitors, and film capacitors. The film capacitors segment held the largest share in 2024 due to their superior electrical properties, such as high voltage resistance, low self-inductance, and excellent thermal stability, which make them ideal for demanding applications such as power inverters and renewable energy systems. Their long operational lifespan and self-healing capabilities further enhance their preference across high-frequency switching environments. The growing use of DC-link capacitors in electric vehicles and industrial power supplies is also contributing to the expansion of the film capacitor segment. Additionally, the adoption of film-based capacitor modules in solar inverters and wind turbines accelerated due to the increasing global shift toward clean energy infrastructure.

The ceramic capacitors segment is projected to grow at a steady pace during the forecast period. This growth is driven by rising demand for compact electronic devices and systems requiring high-frequency performance. Ceramic DC-link capacitors are favored for their small size, high capacitance per volume, and ability to operate under high temperatures, making them suitable for automotive powertrains, EV fast chargers, and high-performance consumer electronics. Technological advancements in multilayer ceramic capacitor (MLCC) technology are enhancing product efficiency and driving market growth in compact and high-efficiency power circuits. For instance, in September 2024, Murata unveiled the world’s smallest multilayer ceramic capacitor (MLCC), measuring just 0.16 × 0.08 mm approximately 75% smaller in volume than previous smallest models.

By Voltage Range Analysis

The global segmentation, based on voltage range includes, 0-100V, 101-500V, and above 500V. The above 500V segment accounted for substantial market share in 2024 due to the increasing demand for high-voltage DC-Link capacitors in applications such as HVDC transmission systems, electric vehicle traction inverters, and large-scale renewable energy installations. For instance, in June 2024, TDK Corporation launched a new modular DC-link capacitor specifically for xEV (electric vehicle) traction inverters. The capacitor offers a compact, flexible design and supports high power density, enabling integration into limited spaces while maintaining performance in harsh EV environments. The growing focus of industrial sectors and utility operators on grid efficiency and high-voltage power management is leading to greater integration of high-voltage capacitors within advanced power conversion systems. Thus, the demand for DC-Link capacitors rated above 500V is rising significantly as countries accelerate investments in next-generation grid infrastructure and cross-border power transmission systems.

The 101–500V segment is projected to grow at a strong CAGR over the forecast period, owing to its wide usage in electric vehicle systems, industrial drives, and medium-scale renewable applications. These capacitors are increasingly being deployed in power modules that require consistent voltage support and energy buffering. The moderate voltage range and broad compatibility with power electronics systems offer a reliable solution for manufacturers aiming to balance performance and cost-efficiency in mid-range applications.

By Capacitance Range Analysis

The global segmentation, based on capacitance range includes, 10 μF-100 μF, above 100 μF, and below 10 μF. The above 100 μF segment held substantial share of the market driven by its extensive use in high-energy applications such as power inverters, automotive drivetrains, and industrial automation systems. These capacitors support higher energy storage and discharge functions, making them suitable for systems that require stable voltage under fluctuating loads. The rapid growth of electric vehicles and utility-scale renewable energy projects is significantly boosting the demand for high-capacitance DC-Link capacitors. According to data from the International Energy Agency, investment in solar photovoltaic (PV) technology by the power sector surpassed USD 500 billion in 2024.

The 10 μF–100 μF segment held a notable share in 2024 and is expected to expand steadily over the forecast period. This range is widely used in power electronic devices, motor drives, and onboard chargers where moderate energy buffering is needed. The increasing use of smart appliances and efficient industrial control systems fueled the segment’s growth, as manufacturers continue to look for reliable capacitor solutions that balance size, capacitance, and performance. For example, in April 2025, TDK Corporation expanded its CGA series of automotive multilayer ceramic capacitors (MLCCs) with the addition of a 10 µF, 100 V model in a compact 3225 size (3.2 x 2.5 x 2.5 mm – L x W x H), offering X7R characteristics (Class II dielectric).

By Installation Type Analysis

The global segmentation, based on installation type includes, surface mount and through-hole. The surface mount segment is projected to grow at a significant CAGR during the forecast period attributed to the increasing miniaturization of electronic components across industries such as automotive electronics, consumer devices, and telecom equipment. For instance, in February 2025, Toshiba launched two new photorelay models TLP3414S and TLP3431S in, housed in ultra-compact S‑VSON4T packages (1.45 × 2.0 mm) with turn-on times of just 150 µs 50–62% faster than previous versions and low on-resistance and capacitance. Surface mount DC-Link capacitors offer high packing density, low profile, and superior high-frequency performance, making them suitable for automated assembly lines and space-constrained circuit designs. Additionally, the growing adoption of surface mount DC-Link capacitors in EV power control units and battery management systems is further boosting the market growth.

The through-hole segment is estimated to hold a significant market share in 2034. These capacitors are widely used in high-reliability and high-power applications such as industrial drives, medical equipment, and defense systems due to their mechanical strength and higher current handling capability. The preference for through-hole installations in aerospace and defense applications where rugged performance is a priority is expected to continue propelling the segment’s growth, particularly in custom high-power modules.

By Distribution Channel Analysis

The global segmentation, based on distribution channel includes, offline and online. The offline distribution segment dominated the market in 2024 due to the preference for direct and distributor-based purchasing models in the industrial, automotive, and defense sectors where custom requirements, bulk orders, and technical consultation are critical. Offline channels offer better supply chain management, lead-time assurance, and hands-on support, particularly for large-scale projects involving DC-Link capacitors. Major manufacturers also continue to strengthen their network of authorized distributors and technical resellers to ensure component availability and after-sales service in strategic markets.

The online segment is projected to grow at a robust pace during the forecast period, driven by the expanding digital procurement trend among small and medium-sized enterprises (SMEs) and hobbyist developers. Online platforms offer the advantage of transparent pricing, broad component selection, and faster procurement cycles. The rise of e-commerce platforms dedicated to electronics components, such as Digi-Key, Mouser Electronics, and RS Components, is streamlining access to DC-Link capacitors for a wider customer base. Additionally, the growing integration of e-procurement systems in industrial supply chains are further boosting the increasing preference for online distribution channels.

By Application Analysis

The global segmentation, based on application includes, aerospace & defense, automotive, consumer electronics and industrial. The industrial segment growth is driven due to the rising demand for energy-efficient power systems in manufacturing, automation, and renewable energy sectors. DC-link capacitors are essential in variable frequency drives, industrial inverters, and power conditioning systems that require stable DC voltage under variable loads. Industries adopting digital automation and advancing intelligent factory infrastructures are increasingly relying on DC-Link capacitors to improve power quality and maintain operational reliability. For instance, in May 2025, Foxconn and NVIDIA announced plans to build a massive AI data center in Taiwan, starting with 20 MW and scaling to 100 MW, located in Kaohsiung and other cities. The investment marked a strategic deployment of intelligent factory infrastructure, coupled with robust manufacturing capabilities with NVIDIA’s AI supercomputing technology to power smart city, EV, and robotics ecosystems. Moreover, the global shift toward electrified industrial equipment and sustainable energy solutions is fueling capacitor demand in large-scale industrial installations.

The automotive segment is estimated to grow at a significant CAGR from 2025-2034. This growth is primarily due to the rapid electrification of vehicles and the increasing penetration of hybrid and fully electric powertrains. DC-link capacitors are crucial in inverters, onboard chargers, and DC-DC converters within EVs, supporting voltage stabilization, energy buffering, and thermal resilience. Automakers are actively investing in high-performance capacitors that can operate under elevated temperatures and withstand voltage fluctuations in compact vehicle systems. The ongoing transition toward 800V vehicle architectures and high-speed charging infrastructure is further propelling demand for advanced DC-Link capacitors. Data from the US Department of Energy shows that in Q2 2024, the number of DC fast charging ports saw the highest growth, rising by 7.4%.

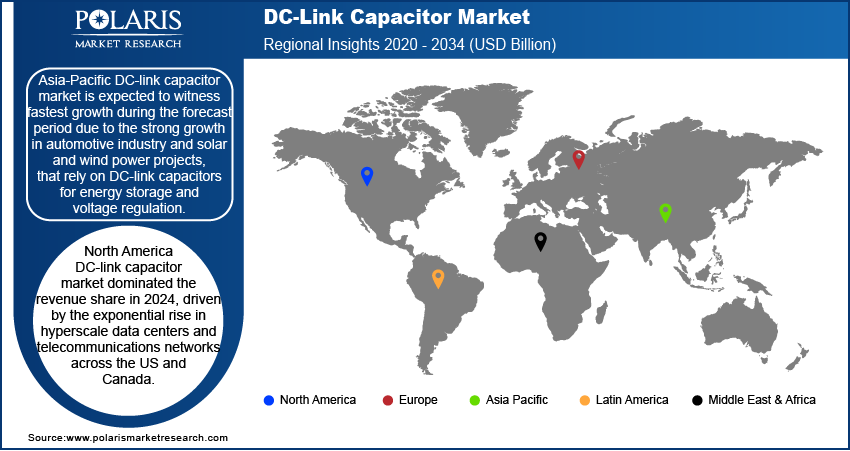

Regional Analysis

Asia-Pacific DC-link capacitor market is expected to witness fastest growth during the forecast period due to the strong growth in automotive industry and solar and wind power projects, that rely on DC-link capacitors for energy storage and voltage regulation. In countries such as China, Japan, and South Korea, the expansion of manufacturing sectors and increasing use of inverters and converters in industrial machinery accelerated the demand for high-reliability DC-link capacitors. In addition, Asia Pacific benefits from a strong component manufacturing ecosystem, supported by favorable production costs and large-scale investments in smart grids and electric mobility. The growing focus on energy-efficient technologies, along with regulatory initiatives for carbon neutrality and grid modernization, is boosting the DC-link capacitors market in the region.

China DC-Link Capacitor Market Insight

China DC-link capacitor market, in particular, is expected to be the fastest growing capturing substantial regional market share due to the country’s growing adoption of robotics and massive investments in industrial automation. According to the International Federation of Robotics, nearly 80% of professional service robots sold globally in 2023 were deployed in Asia Pacific, with China leading the way. Such a large-scale deployment of robotics and motion control systems significantly propelled the need for voltage-smoothing and energy-efficient DC-link capacitors. Moreover, government initiatives such as “Made in China 2025” and the 14th Five-Year Plan, which emphasize energy efficiency, smart manufacturing, and electrification, are driving large-scale capacitor integration in electrical systems, therefore boosting the growth of the DC-Link capacitor market.

Europe DC-Link Capacitor Market

The Europe DC-link capacitor market growth is owing to the increasing integration of renewable energy systems and energy storage technologies. Governments across countries such as Germany, France, and the UK are investing heavily in green infrastructure, EV charging networks, and grid stability solutions, all of which require DC-link capacitors to stabilize voltage and improve energy conversion efficiency. For instance, the European Union’s Green Deal and Fit for 55 packages are prompting industries to transition to sustainable energy solutions, thus increasing the adoption of advanced power electronic components. The emphasis on smart manufacturing, combined with strong regulatory standards for energy performance and environmental compliance, is pushing industries to upgrade their power electronics systems with high-efficiency capacitors. The presence of leading automotive and renewable energy equipment manufacturers in Western Europe is further fueling the market growth.

North America DC-Link Capacitor Market Overview

North America DC-link capacitor market dominated the revenue share in 2024, driven by the exponential rise in hyperscale data centers and telecommunications networks across the US and Canada. In May 2025, NTT DATA acquired 174 acres in Mesa, Arizona, to develop a new multi-data center campus comprising seven planned facilities with an anticipated total capacity of 324 MW. The first facility is expected to be operational by fiscal year 2028. This new site complements NTT DATA’s existing 102-acre Phoenix campus, which supports 240 MW of capacity, bringing the combined total planned data center capacity in the region to nearly 600 MW. As cloud computing, 5G deployment, and AI-driven applications expand rapidly, data center operators are investing heavily in power infrastructure to ensure uninterrupted operations and voltage stability. This surge in high-performance computing environments has significantly increased the demand for reliable DC-link capacitors, which are crucial for power conversion and energy buffering in server power supplies and telecom base stations. The growing need for high-efficiency power delivery in mission-critical IT infrastructure is emphasizing the role of DC-Link capacitors as essential components in modern digital ecosystems across the region.

Key Players & Competitive Analysis Report

The DC-link capacitor industry is highly competitive, marked by strong rivalry among leading manufacturers focused on expanding their component offerings, improving production efficiencies, forging strategic collaborations, and executing mergers and acquisitions (M&A) to solidify their positions in global and regional markets. Key players are consistently investing in broadening their product portfolios to meet the rising demand across sectors such as electric vehicles, renewable energy systems, industrial automation and control systems, and data centers. These capacitors are essential components in high-performance power conversion and voltage regulation systems, making technological innovation a central strategy for differentiation among competitors.

Prominent companies in the DC-link capacitor market include Kendeil, ELECTRONICON Kondensatoren GmbH, Yageo Corporation, EACO, WIMA GmbH & Co. KG, TDK Corporation, Murata Manufacturing Co., Ltd., JIEGAO, YZPST, Sheng Ye, Xiamen Faratronic Co., Ltd., and Vishay Intertechnology, Inc.

Key Players

- Kendeil

- ELECTRONICON Kondensatoren GmbH

- Yageo Corporation

- EACO

- WIMA GmbH & Co. KG

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- JIEGAO

- YZPST

- Sheng Ye

- Xiamen Faratronic Co., Ltd.

- Vishay Intertechnology, Inc.

Industry Developments

October 2024: TDK launched the xEVCap modular DC-link capacitor, featuring scalable capacitance (60–270 µF), rated voltages (500–920 V), high ripple current support, and compliance with automotive standards AEC‑Q200 and IEC TS 63337:2024.

April 2024: TDK launched a new series of EPCOS power capacitors (codes B25695E) for DC-link applications. They supported 700–1300 V DC, operated up to +105 °C, handled peak currents to 15.8 kA, and offered 120,000 h service life.

June 2022: Vishay introduced MKP1848H series of AEC‑Q200-qualified DC-link film capacitors, featuring capacitance from 1–80 µF, low ESR (down to 3 mΩ), high ripple current (up to 25 A), and THB endurance (85 °C/85 % RH for 1,000 h).

DC-Link Capacitor Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Ceramic Capacitors

- Electrolytic Capacitors

- Film Capacitors

By Voltage Range Outlook (Revenue, USD Billion, 2020–2034)

- 0-100V

- 101-500V

- Above 500V

By Capacitance Range Outlook (Revenue, USD Billion, 2020–2034)

- 10 μF-100 μF

- Above 100 μF

- Below 10 μF

By Installation Type Outlook (Revenue, USD Billion, 2020–2034)

- Surface Mount

- Through-Hole

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Application Type Outlook (Revenue, USD Billion, 2020–2034)

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DC-Link Capacitor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.13 Billion |

|

Market Size in 2025 |

USD 1.24 Billion |

|

Revenue Forecast by 2034 |

USD 2.74 Billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.13 billion in 2024 and is projected to grow to USD 2.74 billion by 2034.

The global market is projected to register a CAGR of 9.3% during the forecast period.

Asia-Pacific dominated the market share in 2024.

A few of the key players in the market are Kendeil, ELECTRONICON Kondensatoren GmbH, Yageo Corporation, EACO, WIMA GmbH & Co. KG, and TDK Corporation.

The film capacitors segment dominated the market share in 2024.

The above 100 ?F segment held substantial share of the market during the forecast period.