Industrial Automation and Control Systems Market Size, Share, Trends, Industry Analysis Report

By Component (Industrial Robots, Sensors, Control Valves, Others), By Control System, By End Use, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2945

- Base Year: 2024

- Historical Data: 2020-2023

Overview

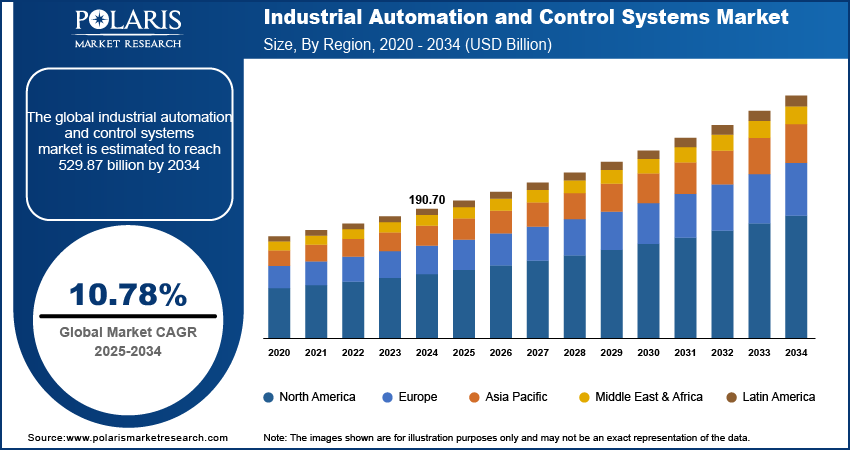

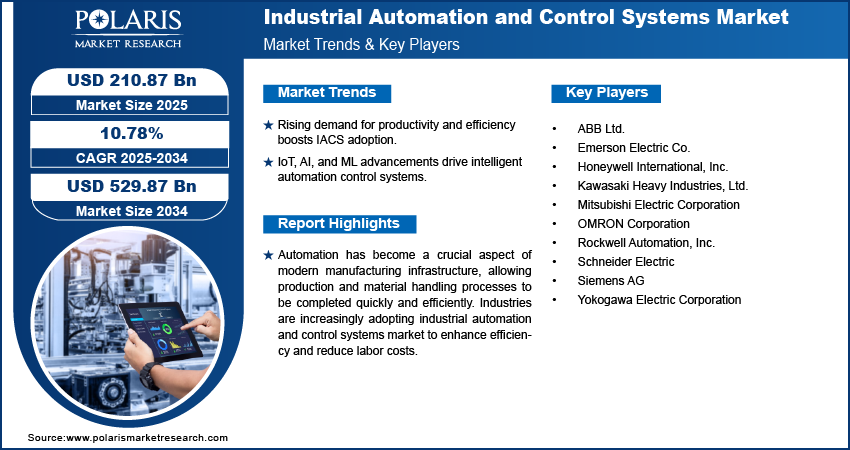

The global industrial automation and control systems market size was valued at USD 190.70 billion in 2024. The market is projected to grow at a CAGR of 10.78% during 2025 to 2034. Key factors driving demand for industrial automation and control systems include a global shift towards Industry 4.0 and smart manufacturing, and the need for increased operational efficiency and productivity.

Key Insights

- The sensors segment dominated the market in 2024 due to their vital role in automation and control systems.

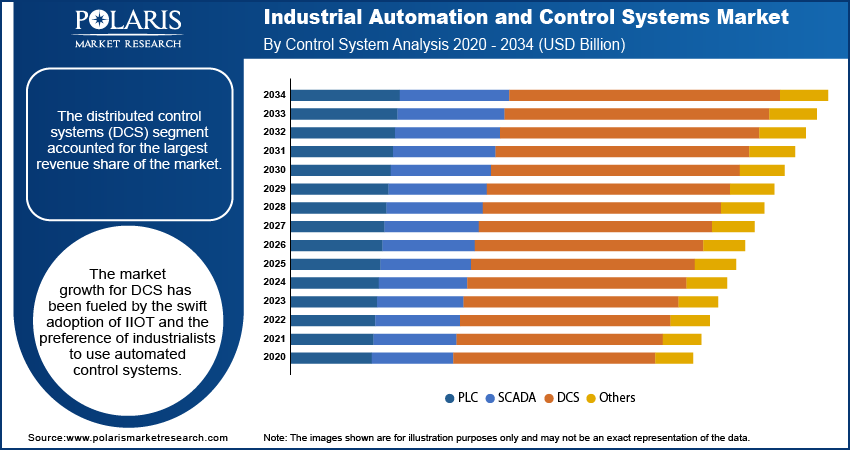

- The distributed control systems (DCS) segment accounted for the largest revenue share of the market in 2024, due to the swift adoption of IIOT and the preference of industrialists to use automated control systems.

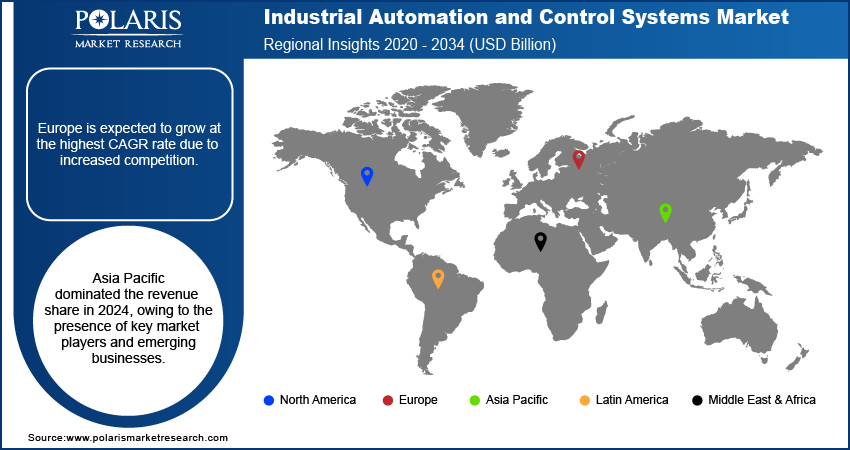

- Europe is expected to grow at the highest CAGR rate due to increased competition.

- Asia Pacific dominated the revenue share in 2024, owing to the presence of key market players and emerging businesses.

Industry Dynamics

- The need for increased productivity and efficiency in manufacturing processes has become a crucial driver for IACS adoption.

- Technological advances such as IoT, AI, and ML drive the adoption of IACS.

- The increasing focus on safety and environmental regulations is creating a lucrative market opportunity.

- High initial investment costs for equipment, software, and installation may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 190.70 Billion

- 2034 Projected Market Size: USD 529.87 Billion

- CAGR (2025-2034): 10.78%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Industrial Automation and Control Systems Market

- AI helps in reducing unplanned downtime and maintenance costs.

- AI integration increases operational flexibility.

- AI in IACS leads to consistent product quality and reduced waste.

Automation has become a crucial aspect of modern manufacturing infrastructure, allowing production and material handling processes to be completed quickly and efficiently. Industries are increasingly adopting industrial automation and control systems market to enhance efficiency and reduce labor costs. The adoption of new technologies and networking architectures, specifically Industry 4.0, has been a significant contributor to the growth of the industrial sector. Industry 4.0 has revolutionized manufacturing by introducing smart factories, where machines are connected, and data is utilized to optimize production and supply chain processes.

Technological advancements, expanding infrastructure opportunities, and the need for increased operational efficiency are driving the adoption of factory automation. This approach is expected to foster economic growth for nations and businesses by ushering in a new era of prosperity.

Furthermore, the automation systems in modern manufacturing facilities consist of small standalone units or several interconnected work cells spread throughout the manufacturing floor. Each system is designed to fulfill specific tasks, resulting in reduced costs, enhanced quality, improved operator safety, and increased production output. Employing technologies like analytics, cloud computing, and mobility helps businesses achieve their objectives more effectively. Furthermore, the smart manufacturing trend, which leverages the advantages of Internet connectivity, is expanding due to the proliferation of the Internet of Things (IoT) in factory automation.

The industrial automation and control systems market has been impacted by the COVID-19 pandemic in both positive and negative ways. While supply chain disruptions, labor shortages, and reduced demand have affected the industry's growth prospects, the pandemic has also accelerated the adoption of automation technologies. The pandemic has also driven the development of new automation solutions and technologies like robots and autonomous vehicles that can perform tasks without human intervention. The long-term outlook for the market remains positive, as automation improves efficiency, reduces costs, and enhances worker safety.

Industry Dynamics

Growth Drivers

Several factors drive the Industrial Automation and Control Systems (IACS) market. The need for increased productivity and efficiency in manufacturing processes has become a crucial driver for IACS adoption. Automation technologies streamline operations, reduce manual labor, and improve overall efficiency, increasing productivity. In addition, technological advances such as IoT, AI, and ML drive the adoption of IACS. These technologies provide enhanced capabilities for monitoring and control, allowing for better decision-making and increased efficiency. IACS can leverage the power of these technologies to enable predictive maintenance, real-time monitoring, and remote access, leading to better outcomes.

Furthermore, the increasing focus on safety and environmental regulations drives the adoption of IACS. Safety is critical in many industries, particularly those involving hazardous materials or processes. IACS can help improve safety by providing real-time monitoring and control, reducing the risk of accidents. Additionally, IACS can help achieve energy efficiency by optimizing energy usage and reducing waste, a growing concern due to environmental regulations. With the increasing adoption of remote work and the need for social distancing, there is a growing demand for remote monitoring and control capabilities. IACS can provide these capabilities, enabling operators to monitor and control systems from anywhere in the world.

Report Segmentation

The market is primarily segmented based on component, control system, end-use, and region.

|

By Component |

By Control System |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Sensors Segment Dominated the Market in 2024

The sensors segment dominated the market in 2024 due to their vital role in automation and control systems. With their compact size and ability to provide real-time, accurate data, sensors play a crucial role in making industrial automation and production processes intelligent and automated, emphasizing precision, consistency, and reliability.

The industrial robot’s segment is also expected to experience significant growth and dominate the industry. Manufacturing companies increasingly utilize advanced equipment and industrial robots to enhance their processes, enabling them to achieve greater speed, durability, and accuracy. Industrial robotic automation also helps to reduce labor costs and energy consumption and minimize waste of raw materials while ensuring an efficient and uninterrupted workflow throughout the manufacturing process.

DSC Segment Accounted for the Largest Revenue Share of the Market in 2024

The distributed control systems (DCS) segment accounted for the largest revenue share of the market. The market growth for DCS has been fueled by the swift adoption of IIOT and the preference of industrialists to use automated control systems. The integration of IoT and DCS is expected to receive a further boost from adopting 5G technology in the power generation sector, resulting in improved output efficiency.

Healthcare Segment Accounted for the Largest Revenue Share in 2024

The healthcare segment accounted for the largest revenue share in 2024 and is expected to dominate the market due to providing services and consultations for treating various health issues such as curative, rehabilitative, palliative, and preventive care. Integrating automation and control systems has led to improvements in operational costs and reduced supply chain errors, which ultimately translates into better patient care and treatment outcomes. Automation has also facilitated remote surgeries and minimized human intervention, enhancing safety and precision, thus contributing to the continued growth of this sector.

Manufacturing has gained a significant market share due to the increasing adoption of automated processes and systems in factories and industries. Automation technology and software enable minimal human intervention, reducing error rates and process time. This shift towards automation is projected to drive the growth of the manufacturing segment in the foreseeable future.

Asia Pacific Dominated the Global Market in 2024

The Asia Pacific region dominated the market in 2024. This is due to the presence of key market players and emerging businesses. The increasing need for improved industrial plant management systems in countries such as China and India fueled the market growth in the region. There is also a growing trend of traditional manufacturing facilities being transformed into smart factories, which helped to increase public acceptance of industrial automation, thereby contributed to the regional dominance.

Europe is expected to grow at a highest CAGR rate due to increased competition and demand from end-users. Manufacturing facilities in the region are adopting the latest technological advancements and digital transformation skills to streamline their operations, resulting in considerable expansion. This has been particularly noticeable in the automotive sector, where companies quickly adapt to market demands, reduce manufacturing downtime, increase supply chain efficiency, and improve productivity. Industrial automation products are being marketed by major corporations and used across various regional sectors, including healthcare, manufacturing, and others.

Competitive Insight

Some of the major players operating in the global market include ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens AG, Yokogawa Electric Corporation.

Recent Developments

- In March 2021: Suez and Schneider Electric announced the creation of a joint to provide cutting-edge digital solutions for water cycle management. The new venture is anticipated to bring together EcoStruxure and SUEZ's technical know-how in the water business.

Industrial Automation and Control Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 190.70 Billion |

| Market size value in 2025 |

USD 210.87 Billion |

|

Revenue forecast in 2034 |

USD 529.87 Billion |

|

CAGR |

10.78% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2034 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Key Companies |

ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens AG, Yokogawa Electric Corporation. |

FAQ's

The Industrial Automation and Control Systems Market report covering key segments are component, control system, end use, and region

Industrial Automation and Control Systems Market Size Worth $ 529.87 Billion By 2034.

The global industrial automation and control systems market expected to grow at a CAGR of 10.78% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in Industrial Automation and Control Systems Market are Rise in demand for industrial automation in manufacturing.