Debt Collection Software Market Share, Size, Trends, Industry Analysis Report

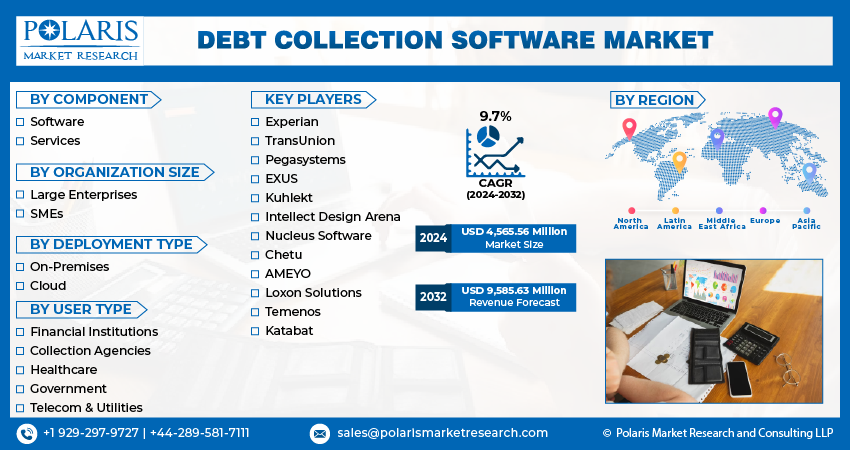

By Component (Software, Services); By Organization Size; By Deployment Type, By User Type; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3050

- Base Year: 2023

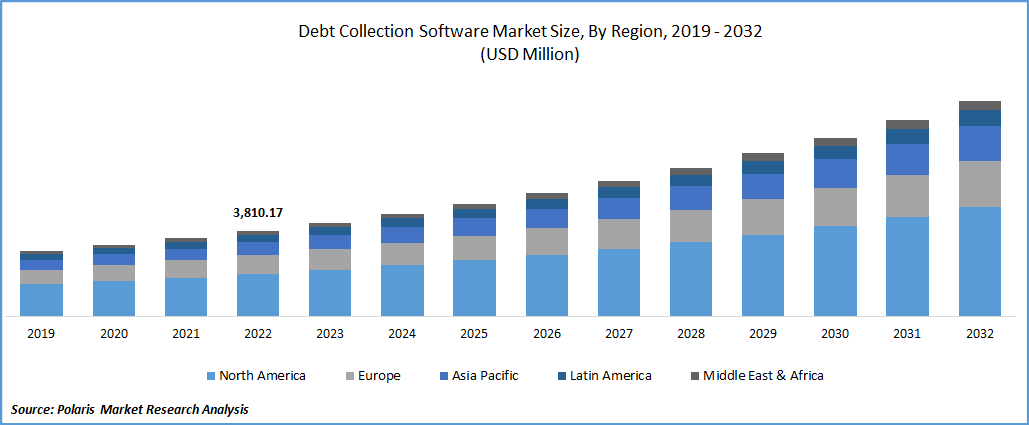

- Historical Data: 2019-2022

Report Outlook

The global debt collection software market was valued at USD 4,169.85 million in 2023 and is expected to grow at a CAGR of 9.7% during the forecast period. BNPL (Buy Now Pay Later) plans are becoming more popular, consumers are taking more debt, and some may need help to make payments on time. This increases the need for debt collection services and software. According to FIS, BNPL is India's fastest-growing online payment option, and it will expand from 3 percent in 2021 to 8.6 percent of the market value of e-commerce by 2025. Additionally, some BNPL companies work with debt collection software providers to manage the collections process when payments are not made on time. This collaboration between BNPL companies and debt collection software providers helps to streamline the collections process and make it more efficient.

Know more about this report: Request for sample pages

The growing e-commerce sector is fueling the growth of the market as more consumers shop online, they are more likely to take on debt through installment payment options, which drive the need for debt collection services and software. By 2034, the Indian e-commerce market, which has been growing quickly, is expected to surpass that of the United States and become the second-largest e-commerce market in the world. However, considering the tremendous digital push, the growing smartphone usage, and the enhanced connection outside of tier 1 cities are driving the debt collection software market.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising consumer and commercial debt trend, including credit card debt, student loans, and medical bills, has created a growing need for debt collection services and software. The debt collection industry has evolved with technological advancements such as artificial intelligence, machine learning, and automation. Debt collection software providers are leveraging these technologies to develop more advanced and specialized solutions. The growth of e-commerce has led to an increase in online transactions and payment plans, which creates a need for efficient and effective debt-collection software solutions.

Debt collection software providers are expanding their reach globally as more companies operate in multiple countries and require software solutions that handle various languages, currencies, and payment methods. Debt collection software providers are developing solutions that prioritize the customer experience and improve communication, transparency, and convenience for debtors. Increasing focus on consumer experience is fueling the market's growth in upcoming years.

Report Segmentation

The market is primarily segmented based on component, organization size, deployment type, user type, and region.

|

By Component |

By Organization Size |

By Deployment Type |

By User Type |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Software Segment is Expected to Witness the Fastest Growth

The software segment is expected to have a higher growth rate in the future. Debt collection software providers are developing advanced solutions that leverage cutting-edge technologies like artificial intelligence (AI) and machine learning (ML), which can improve the efficiency, accuracy, and scalability of debt collection operations. Moreover, the debt collection market software segment offers several specialized solutions tailored to specific industries and requirements. Debt collection software providers offer solutions designed for healthcare, finance, education, and other sectors with unique regulatory requirements and payment processing methods. This customization helps businesses to streamline the collections process while adhering to industry-specific regulations and requirements.

The Large Enterprises Segment is Expected to Witness Fastest Growth

The large Enterprises segment is expected to have a significant growth rate. Compared to small and medium-sized businesses, large businesses use debt collection more frequently (SMEs) due to affordability and economies of scale, which allow huge firms to profit from debt collecting. There is a growing utilization of this service. The expansion of debt collection software is likely fueled by the need for multichannel communication to contact debtors and enhance the collection process through automation.

Cloud Segment Projected to have Largest Market Share in Coming Years

The cloud segment is expected to have the largest market share in 2022. During the forecast period, the cloud sector is expected to grow quickly and drive the market for debt-collection software. This software provides several benefits over traditional on-premise software, such as accessibility from anywhere with an internet connection, easy deployment, and lower upfront costs. Moreover, the growing demand for digital transformation and automation of debt collection processes is also contributing to the growth of the debt collection software market.

Healthcare Segment is Expected to Hold the Significant Revenue Share

The healthcare segment is expected to witness a higher growth rate throughout the forecast period. The growth of healthcare has been impeded by bad debt. Due to a shortage of money, bad debt might impede company and service flow, which could impact industry revenue growth. The healthcare industry has adopted software for debt collection to speed up payment procedures.

Medical debt collection is obtaining unpaid medical bills and bad debts from former or current patients in the healthcare industry. The use of debt collection tools will rise as patient cost sharing and bad debt in healthcare expand. Debt collection software can help healthcare providers comply with regulations such as the Fair Debt Collection Practices Act (FDCPA) and the Health Insurance Portability and Accountability Act (HIPAA), particularly relevant in the healthcare industry. As the demand for more efficient and compliant debt collection solutions continues to grow in the healthcare industry, the debt collection software market will likely continue expansion during the forecast period.

The Demand in North America is Expected to Witness the Highest Growth Rate

North America is projected to witness a higher growth rate in the coming years. This region has traditionally been the largest revenue contributor to the debt collection software market due to the region's many debt collection agencies, financial institutions, and healthcare providers. The well-established regulatory environment in North America, which mandates fair debt collection practices and consumer protection, has also contributed to the growth of the debt collection software market in the region. Growing debts in this region are fuelling the market's growth, for instance, in the US. According to a study by NerdWallet, in 2023, average households have more than $165000 in debt. This will further fuel the growth of the market in the future.

Asia Pacific is expected to have the largest revenue share in upcoming years. The region's market is driven by rising consumer debt, increasing urbanization, and the growing adoption of digital payment systems. The area is expected to see significant growth in the coming years as more regional businesses adopt debt-collection software to manage their collections processes. Emerging nations are influencing the development of the market in this region.

Competitive Insight

Some of the major players operating in the global market include Experian, TransUnion, Pegasystems, EXUS, Kuhlekt, Intellect Design Arena, Nucleus Software, Chetu, AMEYO, Loxon Solutions, Temenos, & Katabat.

Recent Developments

- In January 2023, FPG Technologies and global analytics software supplier FICO partnered to offer decision management & analytics capabilities to businesses in West Africa.

- In August 2022, ANZ Bank New Zealand chose FIS, a pioneer in financial technology, to upgrade its fundamental banking capabilities. Through a cloud-native architecture, FIS' Modern Banking Platform makes it possible for digital banking services to be simple and convenient.

Debt Collection Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4,565.56 million |

|

Revenue forecast in 2032 |

USD 9,585.63 million |

|

CAGR |

9.7% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019- 2022 |

|

Forecast period |

2024- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Organization Size, By Deployment Type, By User Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

FIS, FICO, Experian, CGI, TransUnion, Pegasystems, Temenos, Intellect Design Arena, Nucleus Software, Chetu, AMEYO, Loxon Solutions, EXUS, Kuhlekt and Katabat. |

FAQ's

The debt collection software market report covering key segments are component, organization size, deployment type, user type and region.

Debt Collection Software Market Size Worth $9,585.63 Million By 2032.

The global debt collection software market expected to grow at a CAGR of 9.7% during the forecast period.

North America is leading the global market.

Key driving factors in debt collection software market are government regulations regarding data security and growing e-commerce sector